Zelle(SM) Now Live! In Mobile Banking Apps Today, a New Way to Pay

Zelle Changes the Way Money Moves - Makes Sending Money Digitally to Friends and Family Fast, Safe and Easy for More than 86-Million Mobile Banking Consumers

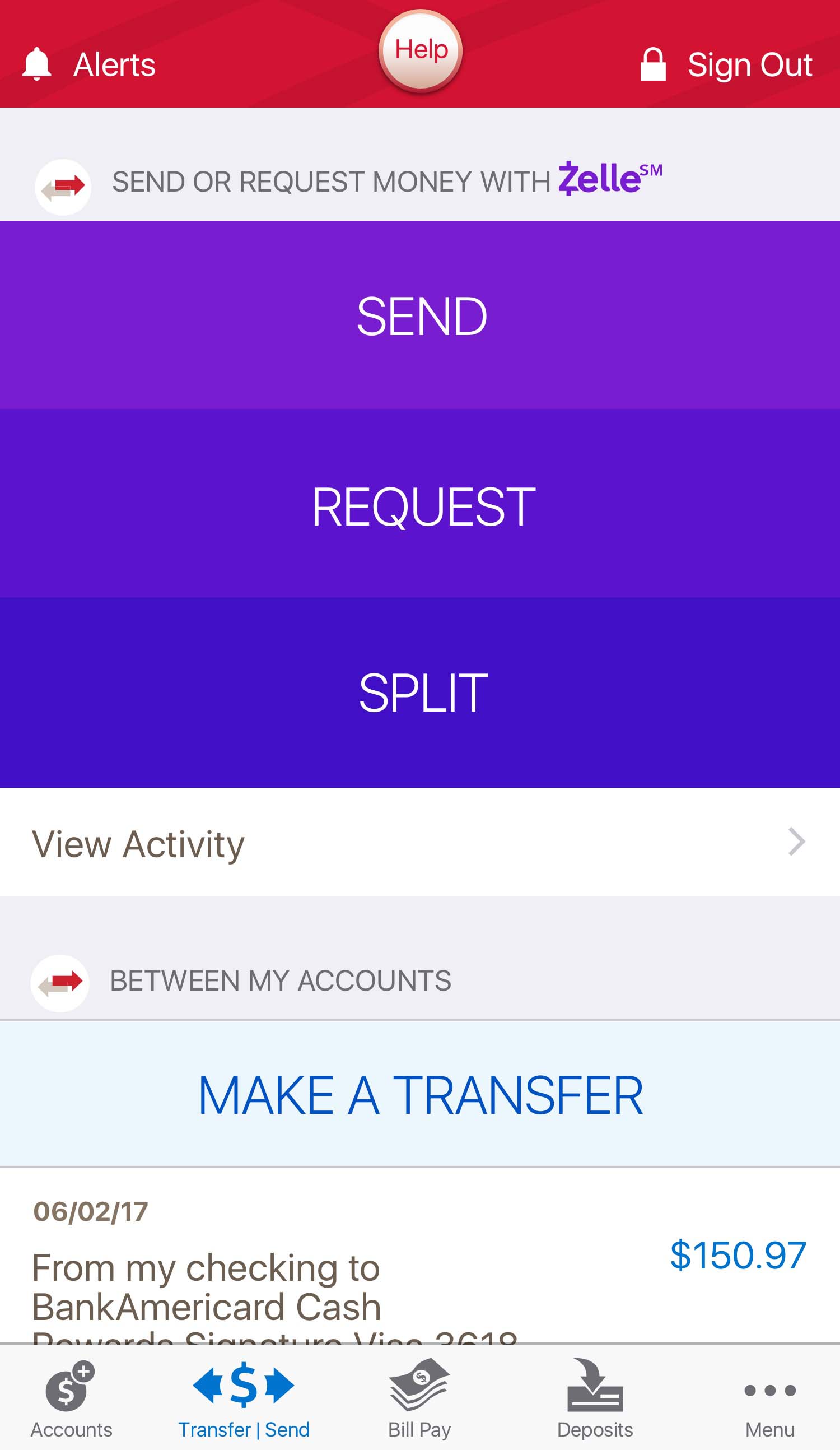

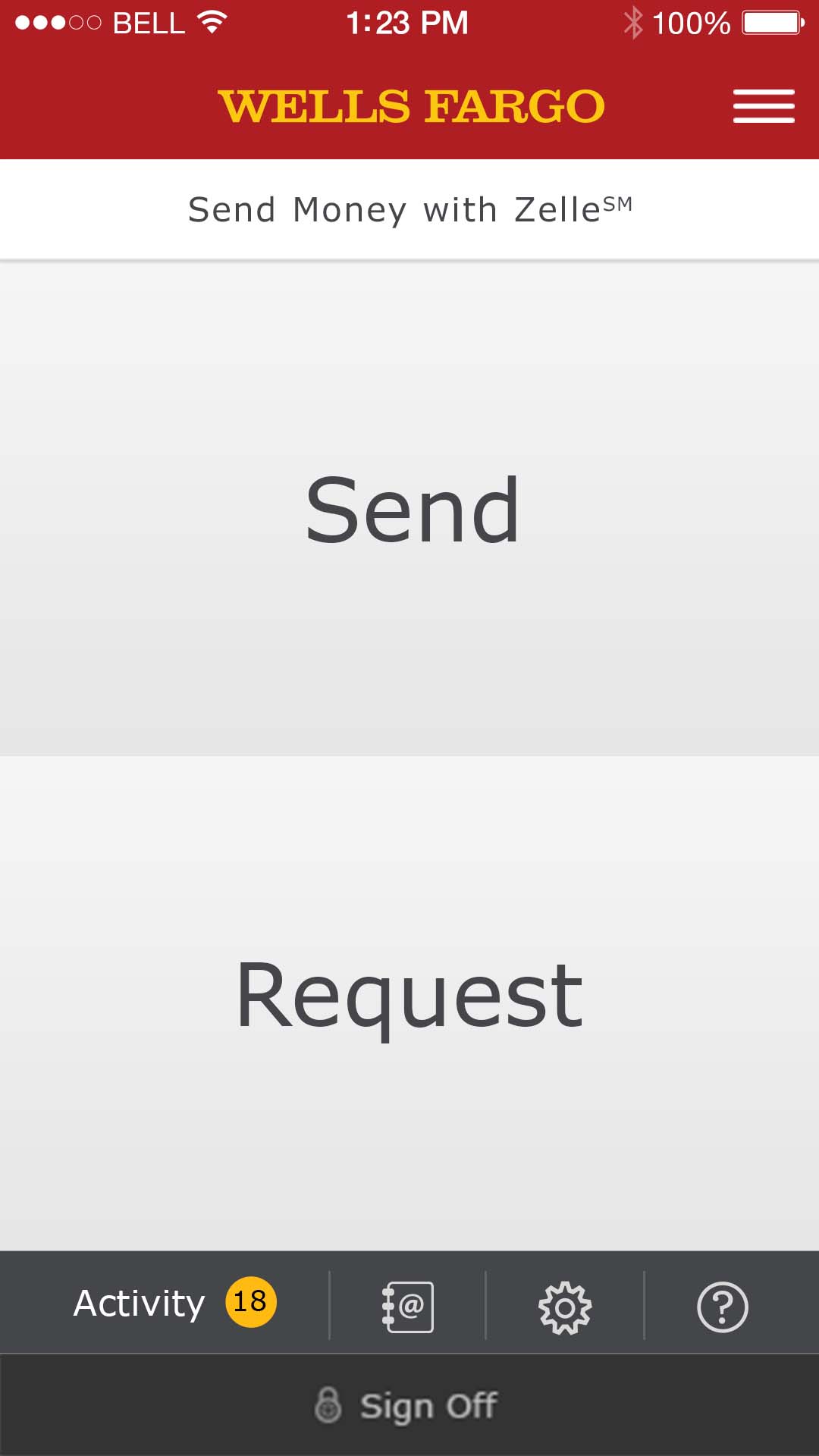

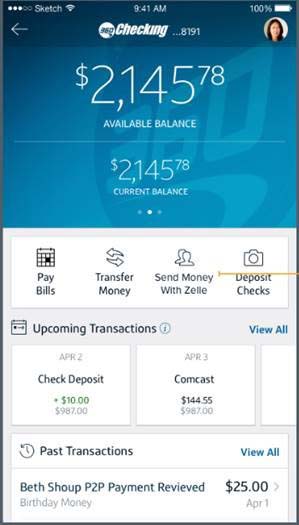

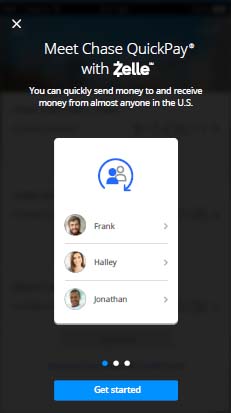

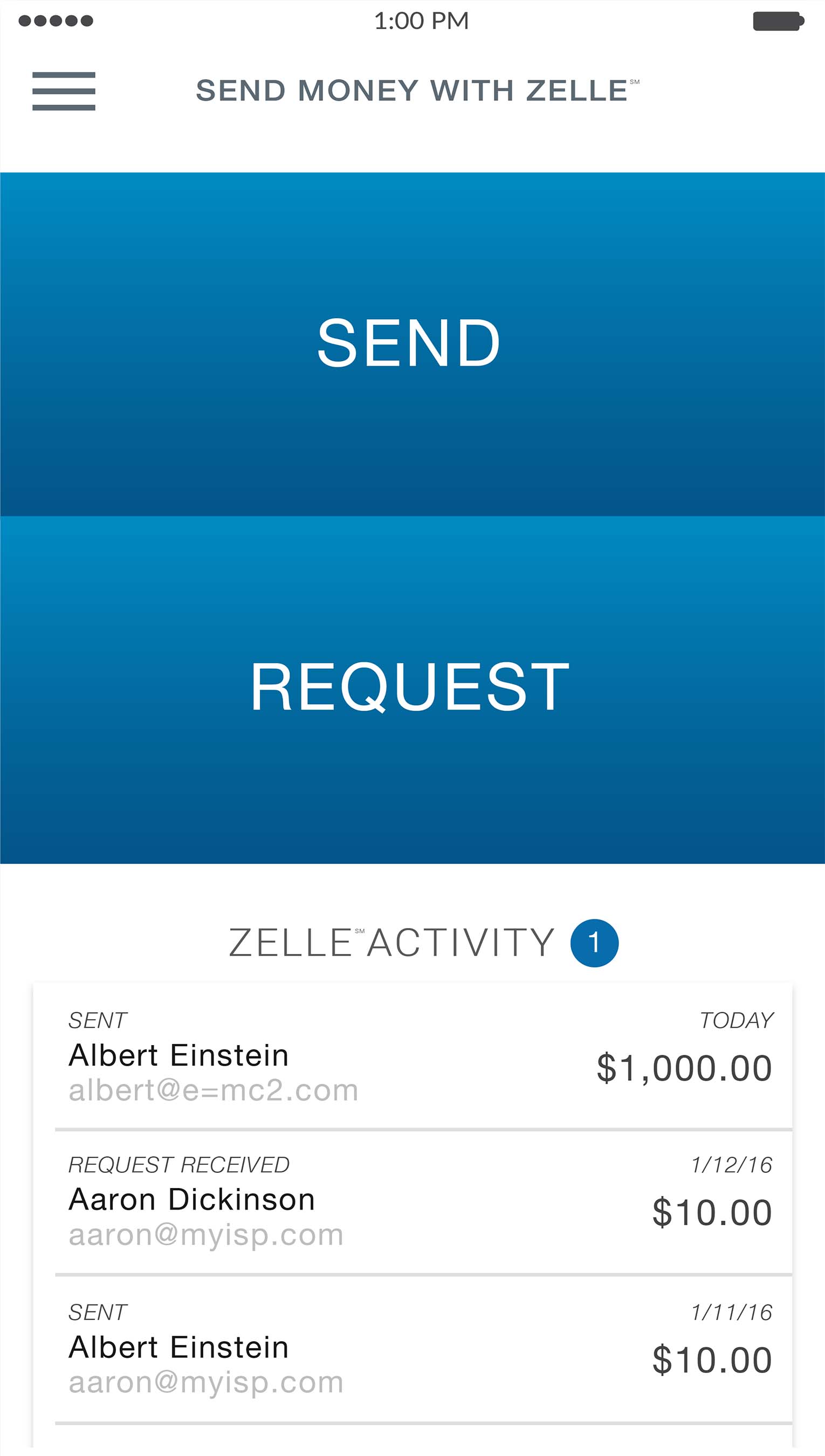

SCOTTSDALE, Ariz., June 12, 2017 /PRNewswire/ -- Beginning this month, more than 86-million U.S. mobile banking consumers will be able to send and receive money through Zelle – a new person-to-person (P2P) payments network from bank-owned Early Warning Services. Changing the way money moves, Zelle allows for funds to be sent from one bank account to another in minutes, using only a recipient's email address or mobile number. "Send Money with Zelle" is conveniently available within the mobile banking apps of Zelle Network℠ participants – a network, which includes banks and credit unions of all sizes. With no additional app to download, Zelle will make digital payments a fast, safe and easy alternative to checks and cash.

Experience the interactive Multichannel News Release here: https://www.multivu.com/players/English/8113351-zelle-send-money-app-mobile-banking/

Beginning this week, and continuing on a rolling basis over the next 12 months, Zelle will become available in the mobile banking apps of more than 30 participating financial institutions, including (listed alphabetically); Ally Bank, Bank of America, Bank of Hawaii, Bank of the West, BB&T, BECU, Capital One, Citi, Citizens Bank, Comerica Bank, ConnectOne Bank, Dollar Bank, Fifth Third Bank, FirstBank, First Tech Federal Credit Union, First Tennessee Bank, First National Bank, Frederick County Bank, Frost Bank, HomeStreet Bank, JP Morgan Chase, KeyBank, M&T Bank, MB Financial Bank, Morgan Stanley, PNC Bank, SchoolsFirst Federal Credit Union, Star One Credit Union, SunTrust Bank, TD Bank, USAA, U.S. Bank, and Wells Fargo.

In addition to working directly with financial institutions, Early Warning has established strategic partnerships with some of the leading payment processors –– CO-OP Financial Services , FIS, Fiserv, and Jack Henry and Associates. These relationships will allow millions more to experience Zelle through community banks and credit unions.

"Fragmentation has been frustrating for consumers. Inconsistent experiences, have made it difficult to send and receive money between banks," said Paul Finch, Chief Executive Officer, Early Warning Services. "Zelle unites the financial community behind a single, real-time P2P payments experience for millions of consumers. Together, we are removing friction from finance, allowing money to move seamlessly between accounts in minutes. This revolution in money movement will create for consumers a viable alternative to checks and cash."

Moving P2P Payments from Millennials to Mainstream

In May 2017, Javelin Strategy & Research reported explosive growth in digital (PC/laptop or mobile) P2P payment usage from 62 million consumers in 2013 to 84 million in 2016. An estimated 129 million consumers will use P2P services in 2021 (Moeser, Michael, Making Payments Faster: The $20 Trillion Opportunity, May 2017). As consumers get increasingly comfortable with using digital channels as a cash and check alternative in daily commerce, Zelle is well positioned to drive P2P payments to the mainstream.

"The consumer P2P market is experiencing rapid growth and financial institutions have a critical role to play," said Michael Moeser, Director of Payments, Javelin Strategy & Research. "There is a market opportunity to offer a secure and trusted experience, as well as have greater P2P availability in financial institutions' digital banking, mobile wallets and voice-driven P2P services."

In Q1 2017, more than 51 million transactions flowed through the Zelle Network, totaling more than $16 billion. The Zelle Network, built on the foundation of the clearXchange® Network, experienced 39% year-over-year growth in transaction volume. In 2016, a staggering $55 billion in P2P payment transactions were processed by financial institutions participating in the Zelle Network.

Millions more consumers, including individuals at non-participating banks, can experience Zelle through a standalone Zelle app in the coming months. Through partnerships with MasterCard and Visa the Zelle app will enable the customers of participating financial institutions to send money to, and receive money from, nearly anyone with a U.S. based debit card.

About Zelle

Brought to you by Early Warning, an innovator in payment and risk management solutions, Zelle℠ makes it easy, fast and safe for money to move. The Zelle Network℠ connects the nation's leading financial institutions,enabling consumers to send faster person-to-person payments to nearly anyone with a U.S. bank account. Funds are available directly in consumer bank accounts generally within minutes. To learn more about Zelle and its participating financial institutions, visit http://www.zellepay.com.

About Early Warning Services

Creating the Future of Payments™ - Early Warning delivers innovative payment and risk solutions to financial institutions nationwide. For over 25 years, Early Warning has been a leader in technology that helps money move easy, fast and safer. Learn more at earlywarning.com.

Zelle and the Zelle related marks and logos are property of Early Warning Services, LLC.

Quotes

"Use of our person-to-person transfer services increased significantly after we incorporated features of Zelle in our mobile app earlier this year. Zelle delivers a fast, safe and convenient way for people to pay friends and family -- another example of how we're making it easier for customers to better manage their financial lives."

Mark Monaco, Head of Enterprise Payments, Bank of America

"We're excited to offer Zelle as a simple and secure way for our clients to transfer money in real-time. Backed by the strongest banks in our country, our clients can depend on Zelle to easily pay or receive funds with other clients as well as friends and family who bank at other financial institutions. And best of all, it's embedded right into our digital banking platform, so there's no hassle and no extra apps to manage."

Bennett Bradley, Senior Executive Vice President and Chief Digital Officer, BB&T Corporation

"We're proud to connect our Capital One customers with more than 86 million other banking consumers within the Zelle Network. Banking should be just an extension of our everyday lives. It needs to be convenient, fast and easy. Whether it's paying a friend or requesting money, Zelle is saving our customers time and making their financial lives easier."

Kleber Santos, President, Retail and Direct Banking, Capital One

"By coming together to offer Zelle, we are providing a large majority of Americans with a safe, fast, and easy way to move money. It will provide a better payment experience that will change how people pay each other."

Bill Wallace, Head of Digital Banking, JP Morgan Chase

"Zelle will be embedded directly into our mobile banking experience and that means no downloads and no hassle. Zelle will be easy to access and navigate with an intuitive and consistent user experience, and the ability to quickly move money is only a few taps away. Payments can be sent using either a registered email address or mobile number so customers never have to give out their bank account information."

Karen Larrimer, Head of Retail Banking and Chief Customer Officer, PNC Bank

"Zelle brings person-to-person digital payments to the mainstream. Moving money faster, safer and more conveniently is important to a broad range of customers, not just millennials. For the growing number of people who are embracing digital banking and mobile usage, Zelle is for them."

Gareth Gaston, Executive Vice President and Head of Omnichannel Banking, U.S. Bank

"At Wells Fargo, we're so excited to bring the Zelle brand to our 20 million mobile customers because it represents an advance in speed, connectivity and security in payments, and because we've already seen that our customers love using the service behind it. What truly makes Zelle a game-changer for our customers is the number of banks and customers it connects, and the speed at which funds are available to spend, withdraw or transfer, all within the same, familiar banking experience. We're thrilled to be a part of this payments revolution, and we will be announcing more specifics around our rollout of the Zelle brand in the coming days."

Brett Pitts, Head of Digital for Wells Fargo virtual channels, Wells Fargo

| Contact |

|

| Jeremiah Glodoveza |

Kate Burgess |

| Early Warning Services |

Porter Novelli |

| +1.415.862.6131 |

+1.516.662.3383 |

SOURCE Early Warning Services

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article