Wealthfront Launches Highly Anticipated Automated Bond Portfolio With A 5.48% Blended 30-Day SEC Yield

The latest addition to the company's product suite brings much-needed innovation and ease of use to bonds.

PALO ALTO, Calif., June 7, 2023 /PRNewswire/ -- Wealthfront, a leading consumer fintech and pioneer of the robo-advisor industry, today announced a highly anticipated addition to the company's growing product suite with the launch of the Automated Bond Portfolio. Currently featuring a 5.48% blended 30-day SEC yield* net of fees, it is designed to provide a higher yield and more liquidity than a variety of popular fixed-income products including CDs, I-bonds and Treasury bills.

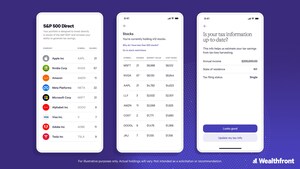

A first of its kind, the Automated Bond Portfolio uses a diversified mix of Treasury and corporate bond ETFs to provide a higher yield than savings accounts with less risk than investing in equities. Clients are particularly excited that Wealthfront will automatically build a personalized portfolio designed to maximize after-tax yield by recommending a tax-optimized allocation of bond ETFs based on an individual's income, state of residence, and tax filing status. It's an ideal place to save for near-term financial goals like a down payment on a house, an upcoming wedding or vacation, or a home renovation.

"Clients have been requesting an easier entry into bonds that helps them take advantage of the higher yields and lower risk without having to navigate a clunky interface or sacrifice liquidity," said Dave Myszewski, Wealthfront's Vice President of Product. "We're excited to solve those pain points for our clients and expand our product suite to meet even more of our clients' saving and investing needs."

Bonds are growing in popularity amid rising interest rates, and many young savers witnessing their first attractive bond market are eager to take advantage. Approximately $200 billion flowed into bond ETFs in 2022, and the funds brought in over $28 billion in March alone. Wealthfront clients followed a similar trend: fixed-income purchases accounted for nearly half of the top 25 securities purchased in clients' external brokerage accounts in Q1 2023, an increase of 130% over Q4 2022.

As Nitin Kumar, a Wealthfront client who beta-tested the Automated Bond Portfolio, said: "I knew bonds were becoming more attractive in today's market environment, but I wasn't sure how to get started. When I heard about Wealthfront's Automated Bond Portfolio, I knew I had found the answer. The combination of higher yield and lower risk makes it the Goldilocks account I was looking for."

Wealthfront continues transforming the financial landscape by broadening its offerings and delivering exceptional value to clients. With today's launch, the company further cements its commitment to innovation and client satisfaction. This approach has fueled Wealthfront's impressive growth, propelling the firm to manage over $43 billion in assets.

"The Automated Bond Portfolio is a perfect example of how Wealthfront uses software to rethink consumer finance and develop products that help our clients achieve better financial outcomes. This philosophy has set Wealthfront apart from the beginning and is why we've been able to build a profitable business that remains resilient through all market conditions," said David Fortunato, Chief Executive Officer at Wealthfront.

Wealthfront has expanded its offering dramatically from its pioneering automated investing products to a Cash Account offering 4.55% APY and up to $5M FDIC insurance through partner banks, commission-free stock investing, and now the Automated Bond Portfolio. By continuously expanding its suite of products and services, the company not only addresses the diverse financial needs of its clients but also reinforces its position as a dominant player in the fintech space. As the company looks ahead, it remains dedicated to empowering young professionals to achieve their financial goals and shaping the future of personal finance.

To learn more about Wealthfront's Automated Bond Portfolio and to sign up, please visit: www.wealthfront.com/automated-bond-portfolio

About Wealthfront

Wealthfront integrates investing and saving products to help young professionals build long-term wealth in any market condition. Through software, the company delivers high-yield saving, diversified ETF and bond investing, zero-commission stock investing, and low-cost loans to help both sophisticated and new investors learn, lower costs, and grow wealth. Wealthfront is one of the highest rated financial apps in the Apple App Store and has been named Best Automated Investment App, Best Overall Robo-Advisor, and Best Robo-Advisor for Goal Planning by Investopedia (2022), Best Cash Management Account and Best Investing App by Bankrate (2023), Best Robo-Advisor for Portfolio Options by NerdWallet (2023), and Best Robo-Advisor for DIY Financial Planning by Forbes (2023). The company currently oversees more than $43 billion for over 600,000 clients in the US. To learn more please visit www.wealthfront.com or download the app on the App Store or Google Play.

Disclosures

*The blended 30-day SEC yield is as of May 31, 2023. Wealthfront created the blended 30-day SEC yield by taking a weighted average of the 30-day SEC yields for each ETF in the portfolio, after deducting Wealthfront's 0.25% annual advisory fee. Please note that the 30-day SEC yield is not an indicator of the portfolio's overall performance or future returns. The yield simply provides a snapshot of the income generated by the ETFs in the past 30 days, and it is subject to change.

The testimonial provided above was made by a current Wealthfront Adviser client.

Nerdwallet, Investopedia, and Forbes (the "Endorsers") receive cash compensation for referring potential clients to Wealthfront via advertisements placed on their respective websites. The Endorsers and Wealthfront are not associated with one another and have no formal relationship outside of this arrangement.

Bankrate's endorsement was voluntarily given and Wealthfront has no formal relationship with Bankrate.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation or offer, or recommendation, to buy or sell any security.

Investors should carefully consider the risks associated with bond ETF investments, which include tracking errors, management fees, interest rate risk, credit risk, counterparty risk, call risk, and liquidity constraints. Bond ETFs may not precisely mirror their underlying index and lack fixed maturity dates or guaranteed principal repayment, potentially leading to capital losses and unexpected tax liabilities. Savings or deposit accounts may provide stability and accessibility despite lower yields. Before investing, individuals should weigh these risks against their risk tolerance, time horizon, and financial goals. Past performance does not guarantee future results.

The 529 Plan is administered by the Board of Trustees of the College Savings Plans of Nevada, chaired by the Nevada State Treasurer. Ascensus Broker Dealer Services, Inc. serves as the Program Manager. Wealthfront Advisers LLC, an SEC-registered investment adviser, serves as the investment adviser to the Plan. Wealthfront Brokerage LLC, a Member of FINRA/SIPC, serves as the distributor and the underwriter of the Plan.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Cash Account is offered by Wealthfront Brokerage LLC ("Wealthfront Brokerage"), a Member of FINRA/SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. We convey funds to partner banks who accept and maintain deposits, provide the interest rate, and provide FDIC insurance. Rate is subject to change. Investment management and advisory services--which are not FDIC insured--are provided by Wealthfront Advisers LLC ("Wealthfront Advisers"), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC ("Wealthfront"). The Stock Investing Account is a limited-discretion investment product offered by Wealthfront Advisers LLC.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2023 Wealthfront Corporation. All rights reserved.

Contact:

[email protected]

SOURCE Wealthfront

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article