CHARLOTTE, N.C., Nov. 8, 2017 /PRNewswire/ -- LendingTree®, the nation's leading online loan marketplace, has released the findings of its study on which places have the most consumers with signs of being maxed-out with their credit cards.

Credit card balances in the U.S. are now almost $800 billion, the highest since 2009, according to Federal Reserve data. While not all of those balances represent debt that won't be paid off each month, many consumers struggle with credit card debt. One clear signal that a consumer might be in trouble with credit is having at least one card that is "maxed-out," with a balance that is equal to the total credit limit allotted on the account.

LendingTree analyzed a sample of more than a million anonymized My LendingTree users in 50 of the largest metropolitan areas to create a "Maxed-Out Score" between 0 to 100 for each metro, with 100 signaling metros where consumers are most maxed-out on their credit.

The score includes:

- Rate of consumers with at least one maxed-out card to get a sense of how widespread the trend of being maxed-out is in the metro area.

- Revolving credit utilization to see how deep people are dipping into their overall credit and how likely they are to carry a balance.

The Most Maxed-Out Places

#1 San Diego, California

Maxed-out score: 98

San Diego residents carry $6,629 in credit card balances on average. Nearly one in five (18 percent) have at least one card maxed-out. That's second only to Oklahoma City, where 18.5 percent of residents have a maxed-out card. San Diego residents also use more of their credit lines overall, with 32.8 percent utilization. That combination makes San Diego the highest-ranking metro.

#2 Los Angeles, California

Maxed-out score: 93

Los Angeles residents also push their credit further than most, with 17.5 percent of residents having at least one maxed-out card. Those that do have a maxed-out card have 1.33 maxed-out cards on average. Balances average $6,472, a touch lower than their neighbors to the South in San Diego, helping utilization come in at 32.0 percent versus San Diego's 32.8 percent.

#3 San Antonio, Texas

Maxed-out score: 92

San Antonio residents don't face the same high cost of living that Southern Californians deal with, but they share an affinity for using their credit cards. The study findings revealed that 17.2 percent of San Antonio residents have a maxed-out credit card, and their total credit card balances average $6,474, similar to those among Southern Californians.

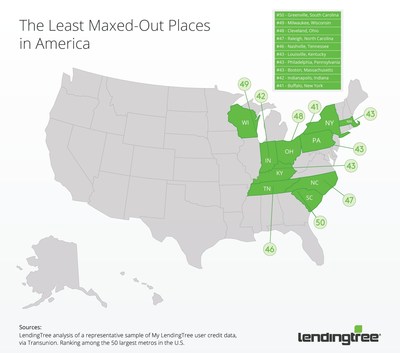

The Least Maxed-Out Places

#50 Greenville, South Carolina

Maxed-out score: 10

The least maxed-out place in the ranking was Greenville. Just 15.1 percent of residents have a maxed-out card account in their credit file. While that's not as low as Milwaukee, with its 14.2 percent, utilization in Greenville is lower. Residents have an average utilization rate of 27.6 percent, versus 28.4 percent for Milwaukee.

Average credit card balances in Greenville are $4,672 — roughly 30 percent lower than those in the most maxed-out metro, San Diego.

#49 Milwaukee, Wisconsin

Maxed-out score: 11

Milwaukee is a close second among least maxed-out cities. As mentioned above, at 14.2 percent, it actually has a slightly lower percentage of residents with at least one maxed-out card than Greenville, but has a slightly higher utilization rate of 28.4 percent.

#48 Cleveland, Ohio

Maxed-out score: 14

Another Great Lakes city, Cleveland, is also among the least maxed-out cities. Only 14.5 percent of residents have one or more maxed-out credit cards, and the utilization rate is just 28.9 percent.

"With the holidays around the corner, the lure of minimum payments can let debt linger for much longer than necessary, with interest accruing along the way," said Brian Karimzad, VP of Research at LendingTree. "The debt snowball and debt avalanche methods are both popular ways to tackle credit card debt. Moving your debt to a lower rate card or using a personal loan to pay off existing credit debt can make a lot of sense if you're committed to a payoff plan. Not only can you potentially reduce the amount you're paying in interest (if you are able to qualify for a card with a lower APR or 0 percent APR promo offer), but less money spent on interest means more money going to the principal balance and a much faster payoff."

For more information on the study, visit https://www.lendingtree.com/debt-consolidation/credit-card/maxed-out-places/.

Methodology:

LendingTree used a statistically relevant sampling (over one million) of anonymized My LendingTree user data. The rank of percentage of users in each metro with at least one maxed-out card was weighted evenly with the rank of the average utilization of revolving credit in each metro, creating a maxed-out score from 0 to 100.

My LendingTree user credit information is provided by TransUnion.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation's leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

MEDIA CONTACT:

Megan Greuling

704-943-8208

[email protected]

SOURCE LendingTree

Share this article