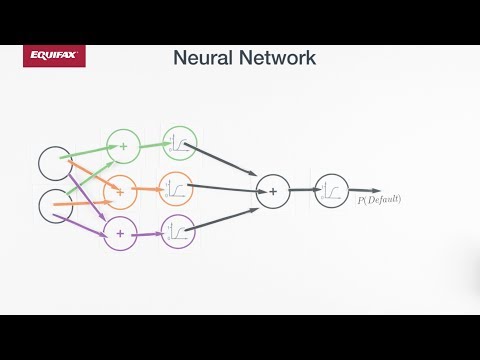

ATLANTA, Aug. 22, 2018 /PRNewswire/ -- Equifax, a global information solutions company, is revolutionizing the way data scientists build and deploy predictive models with its new AI-enabled Advanced Model Engine. The tool is a modular model development and deployment library which uses big data and distributed computing to quickly and efficiently create models that can be seamlessly deployed with applications across industries and use cases. Advanced Model Engine includes Equifax NeuroDecision® Technology, a patent-pending machine learning technology for regulatory-compliant, advanced neural network modeling in credit scoring. The end result is faster model implementation due to reduced friction and more predictive risk models for businesses of all sizes.

"Currently, data scientists could spend months building models on limited sample sizes due to computational constraints. The Advanced Model Engine gives clients the ability to create AI-enabled models and scores on larger samples at a faster pace and with less friction and provides access to innovative technology like NeuroDecision," said Prasanna Dhore, Chief Data & Analytics Officer, Equifax. "Our customers can now take advantage of our big data capabilities to build and deploy their own explainable AI solutions. More importantly, we have taken traditional neural network technology and turned it into something that satisfies the rules and regulations required for credit scoring systems, which is critical for compliance."

"NeuroDecision® Technology provides users the ability to give consumers logical, actionable explanations for the key factors that impacted their credit scores, ensuring that consumers know what actions or behaviors will improve their scores," said Kim Oliver, Chief Compliance Officer, Equifax. "Our solution was crafted to ensure, consumer-specific explanations that do not depend on potentially non-compliant proxy explanations or average population explanations."

Advanced Model Engine increases model performance through use case configuration, application of machine learning techniques, the use of alternative and trended data, and processing power to test more model configurations.

Using industry standard techniques and software, a model developed by selecting the best configuration from all combinations of three data assets, 20 segmentation schemes, and two different modeling techniques, totaling 120 configurations, took nearly one month to complete. When using the AI-enabled Advanced Model Engine, the same development process took on average three to four days.

Advanced Model Engine is now available through Equifax IgniteTM , a portfolio of premier data and advanced analytic solutions, that securely and comprehensively supports the full analytical lifecycle – from data access and transparency to visualization and deployment – using a single, connected suite of advanced analytical processes, technology and tools.

Please visit our Insights blog and follow us on LinkedIn.

About Equifax Equifax is a global information solutions company that uses trusted unique data, innovative analytics, technology and industry expertise to power organizations and individuals around the world by transforming knowledge into insights that help make more informed business and personal decisions.

Headquartered in Atlanta, Ga., Equifax operates or has investments in 24 countries in North America, Central and South America, Europe and the Asia Pacific region. It is a member of Standard & Poor's (S&P) 500® Index, and its common stock is traded on the New York Stock Exchange (NYSE) under the symbol EFX. Equifax employs approximately 10,800 employees worldwide.

FOR MORE INFORMATION

Wyatt Jefferies

Sr. Director, Public Relations

404-617-8197

[email protected]

SOURCE Equifax Inc.

Share this article