Marcato Sends Letter To Deckers Stockholders Highlighting Board Failures

Urges Stockholders to Vote the GOLD Proxy Card "FOR" Marcato's Nine Nominees

SAN FRANCISCO, Nov. 30, 2017 /PRNewswire/ -- Marcato Capital Management LP ("Marcato"), a San Francisco-based investment manager which manages funds that beneficially own approximately 8.4% of the outstanding common shares of Deckers Outdoor Corporation (NYSE: DECK) ("Deckers" or the "Company"), is today sending a letter to Deckers' stockholders urging them to hold Deckers' Board of Directors (the "Board") accountable for their lack of transparency and oversight, and Deckers' chronic underperformance by voting GOLD "FOR" Marcato's nine highly-qualified nominees in connection with Deckers' Annual Meeting of Stockholders to be held December 14, 2017.

The full text of the letter is below.

November 30, 2017

Dear Fellow Deckers Stockholder,

Deckers Outdoor Corporation's ("Deckers" or the "Company") December 14th Annual Meeting is two weeks away, and we are seeking your vote in this critical election.

Despite the many press releases and presentation materials you've no doubt received from the Company in recent weeks, Deckers' Board of Directors (the "Board") and management have been unable to address the basic facts that stockholders have endured for several years: the Company has fallen further away from its own stated long-term margin goals; repeatedly missed annual earnings targets; wasted hundreds of millions of dollars of stockholders' capital through unwise capital-intensive retail expansion, overpriced acquisitions and excessive corporate SG&A and overhead costs; and seen its shares drastically underperform those of its peers.

As one of Deckers' largest stockholders with approximately 8.4% of the Company's common stock, we are asking for your support by voting GOLD in favor of Marcato's NINE highly-qualified nominees. Marcato's nominees have fashion, apparel, retail, marketing and finance expertise and will provide the proper oversight required to put Deckers back on a path to success.

Simply put, the Board and management team have demonstrated time and again that they cannot deliver on their goals. As stockholders, we deserve better. We deserve directors who can design and execute a long-term business strategy that delivers growth in earnings per share and total stockholder return and will hold management accountable for achieving these goals.

Your support in this election is essential. VOTE GOLD TODAY.

SERIOUS QUESTIONS DECKERS' BOARD HAS FAILED TO ADDRESS

As stockholders, we place our trust in the Board to be the stewards of our capital. The reality is that we believe the Board has failed to honor this trust. Accordingly, we believe stockholders DESERVE answers.

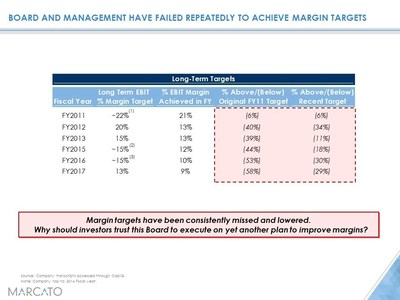

- Why has the Company struggled to meet any of its long-term margin targets?

- Why was the FY2011 margin goal of 22% lowered to a long-term margin goal of 15% in FY2016? And why does the Company now believe it can only achieve 13% by FY2020?

- How does the Company explain its current operating margin of 9% – the Company's LOWEST MARGINS EVER?

- Why has the Company still been UNABLE TO ACHIEVE its FY2012 EPS goal of $5.07 per share over the past five years and after spending over $500 million?

- Why should stockholders trust the Company after its ATTEMPT TO HIDE DETERIORATING PERFORMANCE of its brick-and-mortar retail stores by consolidating that segment's financials with the faster growing, higher margin e-commerce segment?

- Why have SG&A and corporate overhead EXPENSES GROWN FASTER THAN REVENUE for six years in a row?

- Why, amid a proxy contest, is the Board only now talking about returning capital to stockholders through buybacks after overseeing an INEFFICIENT net-cash capital structure for over 10 years?

- How does the Board explain a commitment to a leverage target of 1.0X debt / EBITDA but a two-year financial plan that still results in a balance sheet with 1.0X of NET CASH?

- Why hasn't the Company ever explained what went wrong with Sanuk that forced Deckers to WRITE DOWN its investment by 60% only a few years after buying the brand?

- Why does Deckers FALSELY claim that its business transformation is "new" when it has been making the same statements about its "ongoing business transformation" since FQ4 2013?

- How can the Board defend its decision to allow Angel Martinez to remain Chairman during the strategic alternatives process while simultaneously launching a time-intensive, and ultimately unsuccessful, CAMPAIGN FOR MAYOR of Santa Barbara?

- Why did Mr. Martinez SELL approximately 50% of his investment in the Company in only two trading days after recently stepping off the Board?

- How do the incumbent Board members, whose primary professional experiences are in the telecommunications, recorded music, and semiconductor industries, add meaningful value without relevant retail, apparel and e-commerce expertise?

- Why haven't these same Board members purchased A SINGLE SHARE OF DECKERS STOCK on the open market during the past five years?

- Why has the Board seemingly taken action only in response to stockholder pressure, and not proactively? For example:

- Why did the Board agree to approve Marcato's nominees as "continuing directors," thus saving the Company millions of dollars in potential payments to insiders and a potential default under its credit facility, only after Marcato filed a LAWSUIT to force it to do so?

- Why did the Board agree to run a sale process only following pressure from Marcato and other stockholders to do so?

- Why would the Board wait until right before its annual meeting to announce that it intends to "refresh" the Board NEXT YEAR with just two new candidates OF ITS CHOOSING, only after Marcato has sought to replace the entire Board?

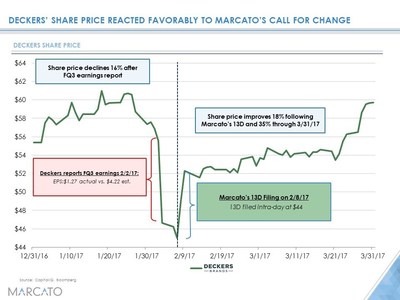

Undoubtedly, Deckers' strategic business and operational errors have led to SIGNIFICANT share price underperformance as compared to proxy peers and broad industry benchmarks. But don't just take our word for it. The market has spoken. Since first disclosing our investment in a Schedule 13D filing on February 8, 2017, Deckers' stock price immediately jumped 18%, and another 35% over the subsequent seven weeks.

It is clear: investors recognize that change is desperately needed at Deckers.

DECKERS' BOARD MUST BE HELD ACCOUNTABLE FOR

CHRONIC UNDERPERFORMANCE

Since Marcato disclosed its stake in February 2017, Deckers has inundated stockholders with falsities regarding its "measurable progress" and "business transformation." The truth is that over the last five years, the Company's underwhelming performance supports our view that the incumbent directors have ACTED WITHOUT URGENCY, and while presiding over a company that has FAILED to meet nearly every strategic priority it set.

Here are the facts. Deckers has:

- Underperformed proxy peers by 85% over the five-year period prior to Marcato's Schedule 13D;

- Missed and decreased long-term margin targets six times in six years;

- Missed annual EPS targets in three of the past five years and each of the last two years;

- Seen a 55% deterioration in EBIT margin from 2011 to 2017;

- Increased SG&A by 70% since 2011;

- Increased corporate expense by 32% since 2011;

- Allocated considerable capital to unprofitable and low-return retail stores;

- Undertaken unprofitable acquisitions; and

- Taken large write-downs including with respect to the Sanuk acquisition.

DECKERS' BOARD HAS DEMONSTRATED A LACK OF TRANSPARENCY, OVERSIGHT

AND OWNERSHIP; ITS INTERESTS ARE NOT ALIGNED WITH

THOSE OF STOCKHOLDERS

After four consecutive quarters of same store sales' negative results, Deckers consolidated its retail and e-commerce segments to form a single Direct-to-Consumer segment: we believe that this constitutes a DESPERATE attempt to CAMOUFLAGE its EVEN WEAKER standalone retail performance. We can only assume that Deckers took such steps to mask the deterioration of its retail store network – results the Board and management would undoubtedly prefer not to highlight.

But don't just take our word for it: take the word of an independent third party. In its February 5, 2016 report, Sterne Agee noted: "Do not own this stock. DECK is changing its reporting segments from 4 to 2, and is no longer providing supplemental commentary. The aforementioned actions demonstrate an unconscionable lack of transparency."

Additionally, despite Deckers' promises to "enhance value at Deckers for all stockholders," the actions taken by the Board prove quite the contrary. Case in point: the Board's poor compensation plan. Despite the Company's missed EPS guidance metrics and stock price decline in three out of the last six years, the Board has handsomely rewarded Deckers' CEO with an elevated compensation package regardless of execution and stock price performance. Rather than hold management accountable for poor performance, the Board has rewarded it.

Finally, despite their stated optimism to implement a transformation plan, NOT A SINGLE MEMBER OF THE BOARD OWNS ANY MEANINGFUL AMOUNT OF DECKERS STOCK AND NOT ONE INCUMBENT DIRECTOR HAS MADE ANY OPEN MARKET PURCHASE IN THE LAST FIVE YEARS.

In fact, Angel Martinez, Deckers' former Chairman and CEO, SOLD ALMOST HALF OF HIS SHARES ONLY TWO WEEKS AFTER STEPPING OFF THE BOARD THIS PAST OCTOBER. If the leaders of Deckers' are not conveying confidence in this Board and their strategy, why should stockholders?

As stockholders we deserve a Board that believes in the future success of the Company – a Board that is transparent, provides proper oversight of management and whose interests are aligned with those of stockholders.

MARCATO HAS THE PLAN AND NOMINEES REQUIRED TO CREATE MEANINGFUL

STOCKHOLDER VALUE AT DECKERS

Marcato's plan is simple. We believe that with the right directors in the boardroom, there is an opportunity to create substantial value at Deckers by:

- Focusing on profitable growth of the core UGG Brand;

- Selling or spinning off non-core brands;

- Targeting more aggressive closure of physical retail stores;

- Reducing excessive SG&A;

- Recapitalizing the balance sheet; and

- Aligning management compensation with margins, profitable growth and total stockholder return.

If elected to the Board, our nine highly-qualified nominees will bring the retail, apparel, marketing and finance experience and expertise that the incumbent directors sorely lack. It is clear to us that the incumbent directors' experiences in the telecom, semiconductor, and music industries DO NOT TRANSLATE into success at a branded footwear business such as Deckers. Accordingly, we urge stockholders to protect the value of your investment by voting GOLD today in support of Marcato's nominees who have the industry expertise desperately needed to create long-term stockholder value.

Please vote your GOLD proxy card TODAY.

You can vote by Internet, telephone or by signing and dating the enclosed GOLD proxy card or GOLD voting instruction form and mailing it in the postage paid envelope provided. We urge you NOT to vote using any white proxy card or voting instruction form you receive from Deckers. Please discard the white proxy card.

If you have any questions about how to vote your shares, please contact our proxy solicitor, D.F. King & Co., Inc., at (800) 761-6521.

Sincerely,

Mick McGuire

Managing Partner

Marcato Capital Management LP

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information herein contains "forward-looking statements." Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as "may," "will," "expects," "believes," "anticipates," "plans," "estimates," "projects," "targets," "forecasts," "seeks," "could," "should" or the negative of such terms or other variations on such terms or comparable terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if Marcato's underlying assumptions prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation by Marcato that the future plans, estimates or expectations contemplated will ever be achieved.

Certain statements and information included herein have been sourced from third parties. Marcato does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as may be expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed herein.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Marcato International Master Fund, Ltd. ("Marcato International"), Marcato Capital Management LP ("Marcato") and the other Participants (as defined below) have filed a definitive proxy statement and accompanying GOLD proxy card with the Securities and Exchange Commission (the "SEC") to be used to solicit (the "Solicitation") proxies for, among other matters, the election of its slate of director nominees at the 2017 annual stockholders meeting (the "Annual Meeting") of Deckers Outdoor Corporation ("Deckers" or the "Company"). Stockholders are advised to read the definitive proxy statement and any other documents related to the Solicitation because they contain important information, including information relating to the Participants in the Solicitation. These materials and other materials filed by Marcato with the SEC in connection with the Solicitation are available at no charge on the SEC's website at http://www.sec.gov. The definitive proxy statement and other relevant documents filed by Marcato with the SEC are also available, without charge, by directing a request to Marcato's proxy solicitor, D.F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, New York 10005 (Call Collect: (212) 269-5550, Call Toll Free: (800) 761-6521 or Email: [email protected]).

The participants in the proxy solicitation are Marcato International, Marcato, MCM Encore IM LLC ("Marcato Encore LLC"), Marcato Encore Master Fund, Ltd. ("Marcato Encore Fund"), Richard T. McGuire III, Deborah M. Derby, Kirsten J. Feldman, Steve Fuller, Matthew P. Hepler, Robert D. Huth, Jan Rogers Kniffen, Mitchell A. Kosh, Nathaniel J. Lipman and Anne Waterman (collectively, the "Participants"). As of the date hereof, Mr. McGuire, Marcato, Marcato International, Marcato Encore LLC and Marcato Encore Fund may be deemed to beneficially own the equity securities of the Company as described in Marcato's statement on Schedule 13D in respect of the Company initially filed with the SEC on February 8, 2017 (the "Schedule 13D"), as it may be amended from time to time.

SOURCE Marcato Capital Management LP

Share this article