Luminary Platforms, Inc. has closed convertible note financing led by existing investors 8VC, Focus Financial Partners and Rockefeller Asset Management.

Additionally, after making a personal investment, Rudy Adolf, founder and former CEO of Focus Financial Partners, will join Luminary's board as an advisor.

NEW YORK, April 4, 2024 /PRNewswire/ -- Luminary Platforms, Inc. today announced closing of convertible note proceeds at full capacity. The financing was led by existing investors 8VC, Focus Financial Partners and Rockefeller Asset Management's Fintech Innovation Fund. Ruediger "Rudy" Adolf, founder and former CEO of Focus Financial Partners, participating personally, was also a leader among the investor group and will join the board as an advisor. Luminary received investments at the note's capacity limit from other new investors, including family offices and strategic partners.

With these funds, Luminary bolsters an already strong capital position and will add additional resources to the execution of its commercial strategy. Luminary is a data and collaboration software platform purpose-built for the delivery of trust & estate planning services. The company was founded in 2021 by David Barnard, former Head of Wealth Management at AllianceBernstein, and Joe Lonsdale, managing partner at 8VC and founder of several successful software companies including Addepar, Palantir, and OpenGov among others.

"After focusing our efforts over the last two years on product development, we're now in a position to really accelerate our growth strategy and customer success. Response in the market to what we've built has been phenomenal, and this investment will help us meet demand while continuing to execute our product roadmap," said David Barnard, CEO of Luminary.

He added, "A big part of our success to date has been the strategic support of our major investors, and I'm thrilled to add Rudy to that group. Over the last 20 years he built the largest independent partnership of RIAs in the industry. His insights into the needs of the wealth management industry, and where it's going, are second to none."

"I've known David and Joe for years and share their vision for the role of technology to transform how advisors will serve their clients. The wealth management industry is at a crossroads of consolidation, generational wealth transfer, and shift to emphasize more personalized, tax related value creation. And AI will only accelerate these trends." said Rudy Adolf, founder and co-CEO of E-3 Tech.

He added, "Luminary is perfectly positioned to lead the way with tools that enable advisors to help clients better understand how their legacy plans work, and to track the tangible value created by them. Family offices have always performed this service manually for the ultra-wealthy, and Luminary is unlocking it as a core capability for the industry. This is the future."

ABOUT LUMINARY

Luminary is a data and collaboration platform purpose-built for the delivery of trust & estate services. Customers include family offices, RIAs and wealth management firms of all types, as well as professional practices in the legal and tax industries, and major insurance companies.

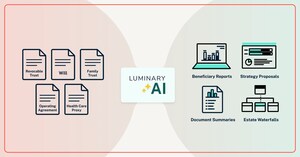

The company's unique open-architecture collaboration technology enables multiple parties to work seamlessly together in service of a shared client. It uses human-in-the-loop AI assistance to digitize information that otherwise lives in original documents, and connects it to applications that enable users to create rich visualizations, perform forward looking scenario analysis, and incorporate what-if strategy modeling.

Luminary is based in New York City, SOC2 Type II certified, and backed by leading venture capital investors, prominent wealth management firms, as well as several family offices.

Learn more at www.withluminary.com

The offer and sale of the Convertible Notes, and any shares of the Luminary's stock issuable upon conversion of the Convertible Notes, have not been and will not be registered under the Securities Act of 1933, as amended (the "Securities Act"), or any state securities laws, and neither the Convertible Notes nor any shares of the Luminary's stock issuable upon conversion of the Convertible Notes may be offered or sold in the United States absent registration or an applicable exemption from registration under the Securities Act and any applicable state securities laws. This press release shall not constitute an offer to sell or a solicitation of an offer to buy any securities, including the Convertible Notes or Luminary's stock. Statements in this press release that are not historical are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

For more information contact:

SOURCE Luminary Platforms, Inc.

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article