CHARLOTTE, N.C., June 14, 2017 /PRNewswire/ -- LendingTree®, the nation's leading online loan marketplace, today announced the launch of its new home valuation feature within the My LendingTree platform, which now has more than 5 million users. Launched in June 2014, My LendingTree is LendingTree's financial intelligence platform, and has continually rolled out new features to keep consumers up-to-date on financial health and identify savings opportunities through real-time data.

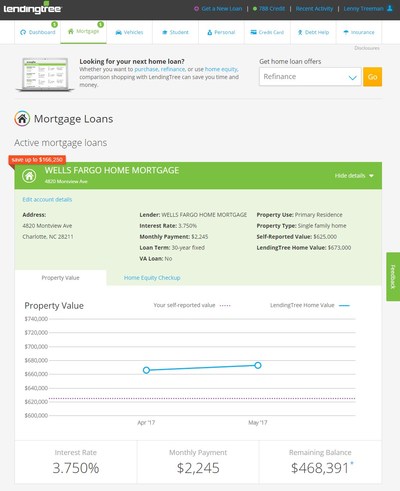

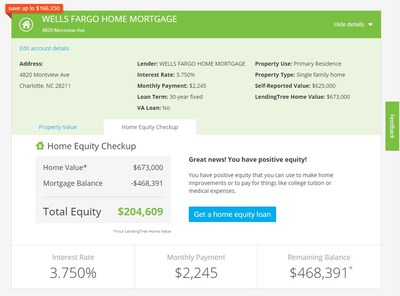

The home valuation tool leverages a proprietary home valuation model that estimates home value by accessing third party data and tracking it to visualize the user's home value data trends over time. Additionally, My LendingTree utilizes existing mortgage balance information to estimate the user's home equity, and through real-time marketplace data, informs users when there's an actionable opportunity to tap into home equity.

My LendingTree users with an existing mortgage balance have an average home value of $310,000 and an average mortgage balance of roughly $178,000. This translates into roughly $132,000 of untapped home equity on average.

LendingTree's financial intelligence platform allows users to monitor their credit health and save money on existing loans. The platform provides users with completely free credit scores, an analysis of their credit report that highlights important changes, and grades for the six primary factors that influence their score. The platform also conveniently displays information on existing financial accounts and loans, including credit card accounts, mortgages, home equity loans, auto loans, personal loans, and student loans. My LendingTree alerts users when an opportunity emerges to save money, based on real-time marketplace data on the LendingTree network.

"We're continuing to evolve the My LendingTree platform to bring consumers valuable information they need to make smarter financial decisions," said Nikul Patel, LendingTree's Chief Product and Strategy Officer. "Our home valuation feature allows borrowers to see an estimate of their home value and untapped equity that can be accessed for home improvement projects, debt consolidation, education costs and more."

My LendingTree has added a variety of new features since the platform was launched in 2014, and My LendingTree mobile apps continue to gain traction with positive user feedback.

Home Equity Checkup

Using home valuation data and mortgage balance data from a user's credit report, My LendingTree calculates how much equity users have in their homes so they can immediately see their home value and available equity in one convenient location.

Savings Brain

The platform uses a "brain" to identify savings across multiple loan categories for users. The brain is a proprietary, intelligent savings and recommendation engine that provides users with recommendations to improve their financial lives.

Free Credit Score, Credit Analysis and Credit Advice

In addition to free credit scores, users receive alerts of noteworthy changes that have occurred since their previous credit report so they can track what's changing and how those changes impact their score.

The credit analysis feature dives deeper into the user's credit score and provides details and a factor "grade" for each of the six primary credit factors so that users can see how they're doing across each factor.

The credit advice feature provides recommendations to users on how they should focus their efforts to improve their credit scores and alerts them when opportunities arise to improve their credit. For example, the tool notifies users if they have recently missed a payment or if their credit utilization has increased, both of which could have a negative impact on their score.

Custom Credit Card Recommendations

Using a proprietary recommendation engine, the tool serves up credit card recommendations for each user based on the probability of the user being approved for a given credit card.

Mobile Apps:

My LendingTree has apps available for both Apple's iPhone/iOS and Google's Android operating systems, providing meaningful information at users' fingertips. It also notifies customers when their new credit file is available. The My LendingTree app makes it easy to comparison shop mortgages, personal loans and credit cards.

For more information or to discover savings, visit www.MyLendingTree.com.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation's leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

MEDIA CONTACT:

Megan Greuling

704-943-8208

[email protected]

SOURCE LendingTree

Share this article