- Global investment firm KKR leading Series F funding round, with participation from Inovia Capital

- Investment to drive continued global expansion through both acquisitions and organic growth, including broadening the enterprise-level offering to accommodate medium-term rentals, corporate housing, and fully-serviced stays

NEW YORK, April 10, 2024 /PRNewswire/ -- Guesty, the leading property management software platform for the short-term rental ("STR") and hospitality industry, today announced a $130M Series F funding round led by leading global investment firm KKR. Inovia Capital, together with existing investors Apax Funds, BDT & MSD Partners and Sixth Street, also joined the round, extending their support following Guesty's significant expansion and sustained growth. This new round of funding will support continued development of Guesty's best-in-class enterprise-level platform for property managers and drive market consolidation to grow the company's global footprint. Stephen Shanley, Partner at KKR and Head of Tech Growth in Europe; Lauriane Requena, Principal at KKR Tech Growth, and Dennis Kavelman, Inovia Capital Partner, join Guesty's Board of Directors following this investment.

The STR industry is growing rapidly and is currently valued at $277B. The significant shift in the way customers choose to live, work, socialize and travel, has led to growth in demand for STRs outpacing hotels in every quarter since 2022. To meet these consumer demands and the growth and complexity in the number of properties offered as short-term rentals, property managers increasingly utilize end-to-end property management systems, like Guesty.

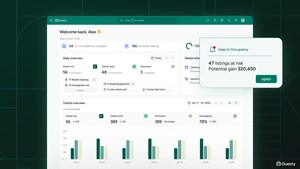

Operating in over 80 countries, Guesty is the most comprehensive and easy-to-use platform on the market today. Guesty's platform provides both enterprise and SMB property managers as well as individual hosts with the necessary tools to manage the entire rental journey, solving some of their biggest pain points. The company's best-in-class software platform helps property managers advertise and manage their vacation or short-term rental properties, delivering unrivaled guest experiences through a highly intuitive user experience and open API capabilities.

Guesty's new funding will be used for expansion across the US, enhancing vacation rental offerings with innovative features. Jonah Mandel joins as VP of Sales to lead the expansion. Additionally, Guesty will invest in catering to the European market, focusing on France, Germany, and Spain, while reinforcing its presence in Australia with customer tailored developments.

"Guesty is a best-in-class operator and one of the clear leaders in the property management sector. There has been a significant shift towards the short- term rental market and this investment will support the company as it continues to meet that growing customer need," said Stephen Shanley, Partner and Head of Europe Tech Growth at KKR. Lauriane Requena, Principal with KKR Tech Growth added. "Guesty's product is unique in its ability to offer the tools customers require throughout the management process, giving them an incredible platform to continue to expand. We're pleased to have invested in the business to support this next phase of growth, as they look to the significant opportunity to grow the business internationally.

'We have been thoroughly impressed with Guesty's track record in consolidating the STR segment,'' says Inovia Partner Dennis Kavelman. ''We are excited to further invest in this category as its importance in the travel sector continues to grow, and we are confident in Guesty's position as one of the clear software leaders in this area.''

"Guesty has enjoyed astonishing five-fold growth during the last three years. We're delighted that this has been recognized by top-tier investors KKR and Inovia, and we're excited to have them onboard alongside our other investors as we enter our next growth period," says Amiad Soto, Guesty's CEO & Co-Founder. "The surge in those seeking short-term rentals continues and our platform remains at the vanguard of the industry. As we embark on creating the industry's first intelligent property management platform, we'll continue to develop its functionality and AI capabilities to deliver first-to-market features and best-in-class support for our customers."

KKR is making the investment in Guesty primarily through its Next Generation Technology Growth Fund III, a fund dedicated to growth equity investment opportunities in the technology space. KKR has established a proven track record of supporting technology-focused growth companies, having invested over $21.6 billion in related investments since 2014 and built a dedicated global team of more than 35 investment professionals with deep technology growth equity expertise. The firm has executed several transactions as part of its tech growth strategy, including DarkTrace, KnowBe4, o9 Solutions, Onestream, OutSystems, NetSPI and Restaurant365.

About Guesty

Guesty is the all-in-one platform for short-term rental businesses to automate and optimize every aspect of their operations. With purpose-built technology, industry-wide expertise, and an R&D team of 250+ engineers, Guesty ensures that hospitality businesses can streamline and achieve growth while delivering the best value to guests. With a complete suite of features and 200+ industry partners, including major booking OTAs like Airbnb, Vrbo, booking.com, Tripadvisor, Expedia, Hopper, Google Travel, Home & Villas by Marriot, and many more, Guesty is transforming the short-term rental industry with innovative solutions. Today, Guesty has 15 offices and 750+ team members across the globe. For more information, visit guesty.com.

About KKR

KKR is a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions. KKR aims to generate attractive investment returns by following a patient and disciplined investment approach, employing world-class people, and supporting growth in its portfolio companies and communities. KKR sponsors investment funds that invest in private equity, credit and real assets and has strategic partners that manage hedge funds. KKR's insurance subsidiaries offer retirement, life and reinsurance products under the management of Global Atlantic Financial Group. References to KKR's investments may include the activities of its sponsored funds and insurance subsidiaries. For additional information about KKR & Co. Inc. (NYSE: KKR), please visit KKR's website at www.kkr.com. For additional information about Global Atlantic Financial Group, please visit Global Atlantic Financial Group's website at www.globalatlantic.com.

About Inovia Capital

Inovia Capital is a venture capital firm that partners with founders to build impactful and enduring global companies. The team leverages an operator-led mindset to provide founders with multi-stage support, mentorship, and access to a worldwide network. Inovia manages over US$2.2B with operations in Montreal, Toronto, Calgary, Bay Area, and London. For more information, visit inovia.vc.

Media Contact:

Diane McKaye, Si14 Global Communications

[email protected]

KKR

FGS Global

Alastair Elwen/ Jack Shelley

[email protected]

SOURCE Guesty

Share this article