General Dynamics Reports Fourth-quarter, Full-year 2013 Financial Results

- 2013 operating margin of 11.8 percent reflects focus on performance improvement

- Cash generation is exceptional

- Full-year diluted EPS from continuing operations is $7.03

FALLS CHURCH, Va., Jan. 22, 2014 /PRNewswire/ -- General Dynamics (NYSE: GD) today reported 2013 fourth-quarter earnings from continuing operations of $624 million, or $1.76 per share on a fully diluted basis; revenues for the quarter were $8.1 billion. For the full year of 2013, earnings from continuing operations were $2.5 billion, or $7.03 per share fully diluted, on revenues of $31.2 billion.

Net earnings for fourth-quarter 2013 were $495 million, or $1.40 fully diluted, including a $129 million loss in discontinued operations related to the pending settlement of the long-standing A-12 litigation. Net earnings for the full year were $2.4 billion, or $6.67 per share fully diluted.

Margins

Company-wide operating margins in 2013 were 11.4 percent for the fourth quarter and 11.8 percent for the full year, increasing over 2012 margins calculated on a non-GAAP basis for the same periods. Aerospace and Combat Systems achieved significant margin expansion in 2013 and Marine Systems and IS&T margins were consistent with the company's expectations.

Cash

Net cash provided by operating activities totaled $1.6 billion in the fourth quarter of 2013 and $3.1 billion for the full year. Free cash flow from operations, defined as net cash provided by operating activities less capital expenditures, was $1.4 billion in the quarter (222 percent of earnings from continuing operations) and $2.7 billion for the year (107 percent).

Backlog

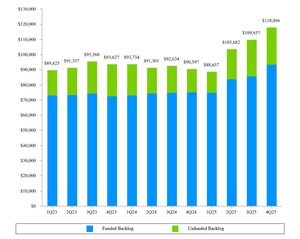

The company's total backlog was $46 billion at the end of the year. In the fourth quarter, orders were strong in the Aerospace group across the Gulfstream fleet. Significant orders were also received for production of additional double-V-hulled Stryker combat vehicles and engineering development of the next Stryker upgrade program; for long-lead material for Virginia-class Block IV submarines and design work on the next-generation ballistic-missile submarine; and for weapons-systems development, information technology services and tactical network components and radios.

Estimated potential contract value, representing management's estimate of the value of unfunded indefinite delivery, indefinite quantity (IDIQ) contracts and unexercised contract options, increased to $27.6 billion at year-end 2013. Total potential contract value, the sum of all backlog components, was $73.6 billion at the end of the year.

"General Dynamics performed well in 2013, reflecting our continued focus on operations, cost management, cash generation and our commitment to meeting our customers' requirements," said Phebe N. Novakovic, chairman and chief executive officer. "As promised, we managed our company prudently, adjusting our business to reflect the realities of the current defense spending environment and retiring risk throughout the organization."

General Dynamics, headquartered in Falls Church, Virginia, employs approximately 96,000 people worldwide. The company is a market leader in business aviation; land and expeditionary combat systems, armaments and munitions; shipbuilding and marine systems; and information systems and technologies. More information about the company is available on the Internet at www.generaldynamics.com.

Certain statements made in this press release, including any statements as to future results of operations and financial projections, may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are based on management's expectations, estimates, projections and assumptions. These statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors. Additional information regarding these factors is contained in the company's filings with the Securities and Exchange Commission, including, without limitation, its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q.

All forward-looking statements speak only as of the date they were made. The company does not undertake any obligation to update or publicly release any revisions to any forward-looking statements to reflect events, circumstances or changes in expectations after the date of this press release.

WEBCAST INFORMATION: General Dynamics will webcast its fourth-quarter securities-analyst conference call at 11:30 a.m. EST on Wednesday, January 22, 2014. The webcast will be a listen-only audio event, available at www.generaldynamics.com. An on-demand replay of the webcast will be available shortly after the conclusion of the call on January 22 and will continue for 12 months. To hear a recording of the conference call by telephone, please call 888-286-8010 (international: 617-801-6888); passcode 39157916. The phone replay will be available shortly after the conclusion of the call on January 22 through January 29, 2014.

| EXHIBIT A |

|||||||||

| CONSOLIDATED STATEMENTS OF EARNINGS - (UNAUDITED) |

|||||||||

| DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS |

|||||||||

| Fourth Quarter |

Variance |

||||||||

| 2012 |

2013 |

$ |

% |

||||||

| Revenues |

$ 8,078 |

$ 8,107 |

$ 29 |

0.4 % |

|||||

| Operating costs and expenses |

9,980 |

7,186 |

2,794 |

||||||

| Operating earnings (loss) |

(1,902) |

921 |

2,823 |

148.4 % |

|||||

| Interest, net |

(41) |

(23) |

18 |

||||||

| Other, net |

(128) |

2 |

130 |

||||||

| Earnings (loss) from continuing operations before income taxes |

(2,071) |

900 |

2,971 |

143.5 % |

|||||

| Provision for income taxes |

59 |

276 |

(217) |

||||||

| Earnings (loss) from continuing operations |

$ (2,130) |

$ 624 |

$ 2,754 |

129.3 % |

|||||

| Discontinued operations, net of tax |

- |

(129) |

(129) |

||||||

| Net earnings (loss) |

$ (2,130) |

$ 495 |

$ 2,625 |

123.2 % |

|||||

| Earnings (loss) per share - basic |

|||||||||

| Continuing operations |

$ (6.07) |

$ 1.78 |

$ 7.85 |

129.3 % |

|||||

| Discontinued operations |

$ - |

$ (0.37) |

$ (0.37) |

||||||

| Net earnings (loss) |

$ (6.07) |

$ 1.41 |

$ 7.48 |

123.2 % |

|||||

| Basic weighted average shares outstanding |

350.9 |

350.5 |

|||||||

| Earnings (loss) per share - diluted |

|||||||||

| Continuing operations |

$ (6.07) |

* |

$ 1.76 |

$ 7.83 |

129.0 % |

||||

| Discontinued operations |

$ - |

$ (0.36) |

$ (0.36) |

||||||

| Net earnings (loss) |

$ (6.07) |

* |

$ 1.40 |

$ 7.47 |

123.1 % |

||||

| Diluted weighted average shares outstanding |

350.9 |

* |

354.6 |

||||||

| * Fourth quarter 2012 amounts exclude dilutive effect of stock options and restricted stock as it would be antidilutive. |

|||||||||

| EXHIBIT B |

|||||||||

| CONSOLIDATED STATEMENTS OF EARNINGS - (UNAUDITED) |

|||||||||

| DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS |

|||||||||

| Twelve Months |

Variance |

||||||||

| 2012 |

2013 |

$ |

% |

||||||

| Revenues |

$ 31,513 |

$ 31,218 |

$ (295) |

(0.9)% |

|||||

| Operating costs and expenses |

30,680 |

27,533 |

3,147 |

||||||

| Operating earnings |

833 |

3,685 |

2,852 |

342.4 % |

|||||

| Interest, net |

(156) |

(86) |

70 |

||||||

| Other, net |

(136) |

8 |

144 |

||||||

| Earnings from continuing operations before income taxes |

541 |

3,607 |

3,066 |

566.7 % |

|||||

| Provision for income taxes |

873 |

1,121 |

(248) |

||||||

| Earnings (loss) from continuing operations |

$ (332) |

$ 2,486 |

$ 2,818 |

848.8 % |

|||||

| Discontinued operations, net of tax |

- |

(129) |

(129) |

||||||

| Net earnings (loss) |

$ (332) |

$ 2,357 |

$ 2,689 |

809.9 % |

|||||

| Earnings (loss) per share - basic |

|||||||||

| Continuing operations |

$ (0.94) |

$ 7.09 |

$ 8.03 |

854.3 % |

|||||

| Discontinued operations |

$ - |

$ (0.37) |

$ (0.37) |

||||||

| Net earnings (loss) |

$ (0.94) |

$ 6.72 |

$ 7.66 |

814.9 % |

|||||

| Basic weighted average shares outstanding |

353.3 |

350.7 |

|||||||

| Earnings (loss) per share - diluted |

|||||||||

| Continuing operations |

$ (0.94) |

* |

$ 7.03 |

$ 7.97 |

847.9 % |

||||

| Discontinued operations |

$ - |

$ (0.36) |

$ (0.36) |

||||||

| Net earnings (loss) |

$ (0.94) |

* |

$ 6.67 |

$ 7.61 |

809.6 % |

||||

| Diluted weighted average shares outstanding |

353.3 |

* |

353.5 |

||||||

| * 2012 amounts exclude dilutive effect of stock options and restricted stock as it would be antidilutive. |

|||||||||

| EXHIBIT C |

|||||||||

| REVENUES AND OPERATING EARNINGS BY SEGMENT - (UNAUDITED) |

|||||||||

| DOLLARS IN MILLIONS |

|||||||||

| Fourth Quarter |

Variance |

||||||||

| 2012 |

2013 |

$ |

% |

||||||

| Revenues: |

|||||||||

| Aerospace |

$ 1,861 |

$ 2,135 |

$ 274 |

14.7 % |

|||||

| Combat Systems |

1,976 |

1,651 |

(325) |

(16.4)% |

|||||

| Marine Systems |

1,664 |

1,630 |

(34) |

(2.0)% |

|||||

| Information Systems and Technology |

2,577 |

2,691 |

114 |

4.4 % |

|||||

| Total |

$ 8,078 |

$ 8,107 |

$ 29 |

0.4 % |

|||||

| Operating earnings (loss): |

|||||||||

| Aerospace |

$ 69 |

$ 348 |

$ 279 |

404.3 % |

|||||

| Combat Systems |

(136) |

247 |

383 |

281.6 % |

|||||

| Marine Systems |

196 |

159 |

(37) |

(18.9)% |

|||||

| Information Systems and Technology |

(2,014) |

196 |

2,210 |

109.7 % |

|||||

| Corporate |

(17) |

(29) |

(12) |

(70.6)% |

|||||

| Total |

$ (1,902) |

$ 921 |

$ 2,823 |

148.4 % |

|||||

| Operating margins: |

|||||||||

| Aerospace |

3.7 % |

16.3 % |

|||||||

| Combat Systems |

(6.9)% |

15.0 % |

|||||||

| Marine Systems |

11.8 % |

9.8 % |

|||||||

| Information Systems and Technology |

(78.2)% |

7.3 % |

|||||||

| Total |

(23.5)% |

11.4 % |

|||||||

| EXHIBIT D |

|||||||||

| REVENUES AND OPERATING EARNINGS BY SEGMENT - (UNAUDITED) |

|||||||||

| DOLLARS IN MILLIONS |

|||||||||

| Twelve Months |

Variance |

||||||||

| 2012 |

2013 |

$ |

% |

||||||

| Revenues: |

|||||||||

| Aerospace |

$ 6,912 |

$ 8,118 |

$ 1,206 |

17.4 % |

|||||

| Combat Systems |

7,992 |

6,120 |

(1,872) |

(23.4)% |

|||||

| Marine Systems |

6,592 |

6,712 |

120 |

1.8 % |

|||||

| Information Systems and Technology |

10,017 |

10,268 |

251 |

2.5 % |

|||||

| Total |

$ 31,513 |

$ 31,218 |

$ (295) |

(0.9)% |

|||||

| Operating earnings (loss): |

|||||||||

| Aerospace |

$ 858 |

$ 1,416 |

$ 558 |

65.0 % |

|||||

| Combat Systems |

663 |

904 |

241 |

36.3 % |

|||||

| Marine Systems |

750 |

666 |

(84) |

(11.2)% |

|||||

| Information Systems and Technology |

(1,369) |

795 |

2,164 |

158.1 % |

|||||

| Corporate |

(69) |

(96) |

(27) |

(39.1)% |

|||||

| Total |

$ 833 |

$ 3,685 |

$ 2,852 |

342.4 % |

|||||

| Operating margins: |

|||||||||

| Aerospace |

12.4 % |

17.4 % |

|||||||

| Combat Systems |

8.3 % |

14.8 % |

|||||||

| Marine Systems |

11.4 % |

9.9 % |

|||||||

| Information Systems and Technology |

(13.7)% |

7.7 % |

|||||||

| Total |

2.6 % |

11.8 % |

|||||||

| EXHIBIT E |

|||||

| PRELIMINARY CONSOLIDATED BALANCE SHEETS |

|||||

| DOLLARS IN MILLIONS |

|||||

| (Unaudited) |

|||||

| December 31, 2012 |

December 31, 2013 |

||||

| ASSETS |

|||||

| Current assets: |

|||||

| Cash and equivalents |

$ 3,296 |

$ 5,301 |

|||

| Accounts receivable |

4,204 |

4,402 |

|||

| Contracts in process |

4,964 |

4,780 |

|||

| Inventories |

2,776 |

2,968 |

|||

| Other current assets |

504 |

435 |

|||

| Total current assets |

15,744 |

17,886 |

|||

| Noncurrent assets: |

|||||

| Property, plant and equipment, net |

3,403 |

3,415 |

|||

| Intangible assets, net |

1,383 |

1,217 |

|||

| Goodwill |

12,048 |

11,977 |

|||

| Other assets |

1,731 |

953 |

|||

| Total noncurrent assets |

18,565 |

17,562 |

|||

| Total assets |

$ 34,309 |

$ 35,448 |

|||

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|||||

| Current liabilities: |

|||||

| Accounts payable |

$ 2,469 |

$ 2,248 |

|||

| Customer advances and deposits |

6,042 |

6,584 |

|||

| Other current liabilities |

3,109 |

3,362 |

|||

| Total current liabilities |

11,620 |

12,194 |

|||

| Noncurrent liabilities: |

|||||

| Long-term debt |

3,908 |

3,908 |

|||

| Other liabilities |

7,391 |

4,845 |

|||

| Total noncurrent liabilities |

11,299 |

8,753 |

|||

| Shareholders' equity: |

|||||

| Common stock |

482 |

482 |

|||

| Surplus |

1,988 |

2,226 |

|||

| Retained earnings |

17,860 |

19,428 |

|||

| Treasury stock |

(6,165) |

(6,450) |

|||

| Accumulated other comprehensive loss (AOCL) |

(2,775) |

(1,185) |

|||

| Total shareholders' equity |

11,390 |

14,501 |

|||

| Total liabilities and shareholders' equity |

$ 34,309 |

$ 35,448 |

|||

| EXHIBIT F |

||||

| PRELIMINARY CONSOLIDATED STATEMENTS OF CASH FLOWS - (UNAUDITED) |

||||

| DOLLARS IN MILLIONS |

||||

| Twelve Months Ended |

||||

| December 31, 2012 |

December 31, 2013 |

|||

| Cash flows from operating activities: |

||||

| Net earnings (loss) |

$ (332) |

$ 2,357 |

||

| Adjustments to reconcile net earnings to net cash provided by |

||||

| operating activities: |

||||

| Depreciation of property, plant and equipment |

386 |

393 |

||

| Amortization of intangible assets |

234 |

163 |

||

| Goodwill and intangible asset impairments |

2,295 |

- |

||

| Stock-based compensation expense |

114 |

120 |

||

| Excess tax benefit from stock-based compensation |

(29) |

(23) |

||

| Deferred income tax (benefit) provision |

(148) |

104 |

||

| Discontinued operations, net of tax |

- |

129 |

||

| (Increase) decrease in assets, net of effects of business acquisitions: |

||||

| Accounts receivable |

240 |

(205) |

||

| Contracts in process |

149 |

177 |

||

| Inventories |

(478) |

(200) |

||

| Increase (decrease) in liabilities, net of effects of business acquisitions: |

||||

| Accounts payable |

(441) |

(223) |

||

| Customer advances and deposits |

730 |

330 |

||

| Other current liabilities |

22 |

(126) |

||

| Other, net |

(55) |

110 |

||

| Net cash provided by operating activities |

2,687 |

3,106 |

||

| Cash flows from investing activities: |

||||

| Capital expenditures |

(450) |

(440) |

||

| Purchases of available-for-sale securities |

(252) |

(135) |

||

| Sales of available-for-sale securities |

186 |

99 |

||

| Maturities of available-for-sale securities |

110 |

14 |

||

| Business acquisitions, net of cash acquired |

(444) |

(1) |

||

| Purchases of held-to-maturity securities |

(260) |

- |

||

| Maturities of held-to-maturity securities |

224 |

- |

||

| Sales of held-to-maturity securities |

211 |

- |

||

| Other, net |

19 |

96 |

||

| Net cash used by investing activities |

(656) |

(367) |

||

| Cash flows from financing activities: |

||||

| Purchases of common stock |

(602) |

(740) |

||

| Dividends paid |

(893) |

(591) |

||

| Proceeds from option exercises |

146 |

583 |

||

| Other, net |

(33) |

23 |

||

| Net cash used by financing activities |

(1,382) |

(725) |

||

| Net cash used by discontinued operations |

(2) |

(9) |

||

| Net increase in cash and equivalents |

647 |

2,005 |

||

| Cash and equivalents at beginning of period |

2,649 |

3,296 |

||

| Cash and equivalents at end of period |

$ 3,296 |

$ 5,301 |

||

| EXHIBIT G |

|||||||||||

| PRELIMINARY FINANCIAL INFORMATION - (UNAUDITED) |

|||||||||||

| DOLLARS IN MILLIONS EXCEPT PER SHARE AND EMPLOYEE AMOUNTS |

|||||||||||

| Fourth Quarter |

Fourth Quarter |

||||||||||

| 2012 |

2013 |

||||||||||

| Other Financial Information: |

|||||||||||

| Return on equity (a) |

(2.5)% |

20.1% |

|||||||||

| Debt-to-equity (b) |

34.3% |

27.0% |

|||||||||

| Debt-to-capital (c) |

25.6% |

21.2% |

|||||||||

| Book value per share (d) |

$ 32.20 |

$ 41.03 |

|||||||||

| Total taxes paid |

$ 350 |

$ 175 |

|||||||||

| Company-sponsored research and development (e) |

$ 79 |

$ 68 |

|||||||||

| Employment |

92,200 |

96,000 |

|||||||||

| Sales per employee (f) |

$ 337,300 |

$ 337,600 |

|||||||||

| Shares outstanding |

353,674,248 |

353,402,794 |

|||||||||

| Non-GAAP Financial Measures: |

|||||||||||

| Free cash flow from operations: |

Quarter |

Year-to-date |

Quarter |

Year-to-date |

|||||||

| Net cash provided by operating activities |

$ 780 |

$ 2,687 |

$ 1,556 |

$ 3,106 |

|||||||

| Capital expenditures |

(164) |

(450) |

(169) |

(440) |

|||||||

| Free cash flow from operations (g) |

$ 616 |

$ 2,237 |

$ 1,387 |

$ 2,666 |

|||||||

| Return on invested capital: |

|||||||||||

| Earnings (loss) from continuing operations |

$ (332) |

$ 2,486 |

|||||||||

| After-tax interest expense |

109 |

67 |

|||||||||

| After-tax amortization expense |

152 |

106 |

|||||||||

| Net operating profit (loss) after taxes |

(71) |

2,659 |

|||||||||

| Average invested capital |

17,223 |

15,989 |

|||||||||

| Return on invested capital (h) |

(0.4)% |

16.6% |

|||||||||

| Notes describing the calculation of the other financial information and a reconciliation of non-GAAP financial measures are on the following page. |

|||||||||||

| EXHIBIT G (cont.) |

| PRELIMINARY FINANCIAL INFORMATION - (UNAUDITED) |

| DOLLARS IN MILLIONS EXCEPT PER SHARE AND EMPLOYEE AMOUNTS |

| (a) Return on equity is calculated by dividing earnings from continuing operations for the latest 12-month period by our average equity during that period. |

| (b) Debt-to-equity ratio is calculated as total debt divided by total equity as of the end of the period. |

| (c) Debt-to-capital ratio is calculated as total debt divided by the sum of total debt plus total equity as of the end of the period. |

| (d) Book value per share is calculated as total equity divided by total outstanding shares as of the end of the period. |

| (e) Includes independent research and development costs and Gulfstream product-development costs. |

| (f) Sales per employee is calculated by dividing revenues for the latest 12-month period by our average number of employees during that period. |

| (g) We believe free cash flow from operations is a measurement that is useful to investors because it portrays our ability to generate cash from our core businesses for such purposes as repaying maturing debt, funding business acquisitions and paying dividends. We use free cash flow from operations to assess the quality of our earnings and as a performance measure in evaluating management. The most directly comparable GAAP measure to free cash flow from operations is net cash provided by operating activities. |

| (h) We believe return on invested capital (ROIC) is a measurement that is useful to investors because it reflects our ability to generate returns from the capital we have deployed in our operations. We use ROIC to evaluate investment decisions and as a performance measure in evaluating management. We define ROIC as net operating profit after taxes for the latest 12-month period divided by the sum of the average debt and shareholders' equity for the same period excluding any change in AOCL. Net operating profit after taxes is defined as earnings from continuing operations plus after-tax interest and amortization expense. The most directly comparable GAAP measure to net operating profit after taxes is earnings from continuing operations. After-tax interest and amortization expense is calculated using the statutory tax rate of 35 percent. |

| EXHIBIT H |

|||||||||||

| BACKLOG - (UNAUDITED) |

|||||||||||

| DOLLARS IN MILLIONS |

|||||||||||

| Estimated |

|||||||||||

| Total |

Potential |

Total Potential |

|||||||||

| Fourth Quarter 2013 |

Funded |

Unfunded |

Backlog |

Contract Value* |

Contract Value |

||||||

| Aerospace |

$ 13,785 |

$ 158 |

$ 13,943 |

$ 1,679 |

$ 15,622 |

||||||

| Combat Systems |

5,571 |

1,113 |

6,684 |

3,664 |

10,348 |

||||||

| Marine Systems |

11,795 |

5,063 |

16,858 |

3,098 |

19,956 |

||||||

| Information Systems and Technology |

7,253 |

1,267 |

8,520 |

19,127 |

27,647 |

||||||

| Total |

$ 38,404 |

$ 7,601 |

$ 46,005 |

$ 27,568 |

$ 73,573 |

||||||

| Third Quarter 2013 |

|||||||||||

| Aerospace |

$ 13,653 |

$ 170 |

$ 13,823 |

$ - |

$ 13,823 |

||||||

| Combat Systems |

6,164 |

954 |

7,118 |

3,622 |

10,740 |

||||||

| Marine Systems |

12,228 |

5,337 |

17,565 |

3,389 |

20,954 |

||||||

| Information Systems and Technology |

7,950 |

1,485 |

9,435 |

20,433 |

29,868 |

||||||

| Total |

$ 39,995 |

$ 7,946 |

$ 47,941 |

$ 27,444 |

$ 75,385 |

||||||

| Fourth Quarter 2012 |

|||||||||||

| Aerospace |

$ 15,458 |

$ 209 |

$ 15,667 |

$ - |

$ 15,667 |

||||||

| Combat Systems |

7,442 |

1,298 |

8,740 |

2,794 |

11,534 |

||||||

| Marine Systems |

13,495 |

3,606 |

17,101 |

3,047 |

20,148 |

||||||

| Information Systems and Technology |

8,130 |

1,643 |

9,773 |

21,009 |

30,782 |

||||||

| Total |

$ 44,525 |

$ 6,756 |

$ 51,281 |

$ 26,850 |

$ 78,131 |

||||||

| * The estimated potential contract value represents management's estimate of our future contract value under unfunded indefinite delivery, indefinite quantity (IDIQ) contracts and unexercised options associated with existing firm contracts, including options to purchase new aircraft and long-term agreements with fleet customers, as applicable. Because the value in the unfunded IDIQ arrangements is subject to the customer's future exercise of an indeterminate quantity of orders, we recognize these contracts in backlog only when they are funded. Unexercised options are recognized in backlog when the customer exercises the option and establishes a firm order. |

|||||||||||

| EXHIBIT I |

| FOURTH QUARTER 2013 SIGNIFICANT ORDERS (UNAUDITED) |

| DOLLARS IN MILLIONS |

We received the following significant orders during the fourth quarter of 2013:

Combat Systems

- $230 from the U.S. Army for research, development and testing in preparation for the Stryker Engineering Change Proposal (ECP) upgrade program.

- $125 from the Army under the Stryker wheeled armored vehicle program for the production of 30 double-V-hulled vehicles and for contractor logistics support.

- $85 from the Canadian government to supply various caliber of ammunition.

- $75 from the Army under a foreign military sales contract to provide contractor logistics support (CLS) services in Iraq.

- The production of 130 Duro vehicles for Switzerland.

Marine Systems

- $150 from the U.S. Navy for design work, including advanced nuclear studies, for the next-generation ballistic-missile submarine.

- $120 from the Navy for long-lead material for three Virginia-class submarines under Block IV of the program.

- $60 from the Navy to repair USS Carter Hall (LSD 50).

- The design and construction of one product carrier from Seabulk Tankers, Inc., with an option to build an additional ship.

Information Systems and Technology

- $140 from the Navy for production and support of the U.S. and U.K. Trident II submarine weapons systems.

- $130 from the National Geospatial-Intelligence Agency (NGA) to consolidate NGA's operations from six locations to one stand-alone location at New Campus East (NCE).

- $105 from the Army for production of 1,500 Manpack radios and over 500 accessory kits.

- $105 from the Centers for Medicare & Medicaid Services for contact-center services, including the 1-800-MEDICARE program.

- $95 from the Army under the Warfighter Information Network-Tactical (WIN-T) program for Increment 3 engineering and development.

- $55 from the U.S. Department of State to provide supply chain management services.

| EXHIBIT J |

||||||||

| AEROSPACE SUPPLEMENTAL DATA - (UNAUDITED) |

||||||||

| Fourth Quarter |

Twelve Months |

|||||||

| 2012 |

2013 |

2012 |

2013 |

|||||

| Gulfstream Green Deliveries (units): |

||||||||

| Large aircraft |

26 |

27 |

104 |

110 |

||||

| Mid-size aircraft |

7 |

13 |

17 |

29 |

||||

| Total |

33 |

40 |

121 |

139 |

||||

| Gulfstream Outfitted Deliveries (units): |

||||||||

| Large aircraft |

31 |

34 |

83 |

121 |

||||

| Mid-size aircraft |

6 |

7 |

11 |

23 |

||||

| Total |

37 |

41 |

94 |

144 |

||||

| Pre-owned Deliveries (units): |

3 |

2 |

4 |

11 |

||||

| APPENDIX |

||||||||||

| Exhibits K through M on the following pages were included in the 4Q12 earnings release and are provided herein to |

||||||||||

| EXHIBIT K |

||||||||||

| CALCULATION OF ADJUSTED NON-GAAP EARNINGS FROM CONTINUING OPERATIONS AND |

||||||||||

| ADJUSTED NON-GAAP DILUTED EARNINGS PER SHARE - (UNAUDITED) |

||||||||||

| DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS |

||||||||||

| Fourth Quarter |

Twelve Months |

|||||||||

| 2012 |

2012 |

|||||||||

| Calculation of adjusted non-GAAP earnings from continuing operations: |

||||||||||

| Loss from continuing operations (from Exhibits A and B, respectively) |

$ (2,130) |

$ (332) |

||||||||

| Non-GAAP adjustments: |

||||||||||

| Goodwill impairment (a) |

1,994 |

1,994 |

||||||||

| Intangible asset impairments (a) |

301 |

301 |

||||||||

| Contract disputes accruals (b) |

292 |

292 |

||||||||

| Restructuring-related charges (c) |

98 |

98 |

||||||||

| Inventory-related charges (d) |

53 |

78 |

||||||||

| Debt retirement charge (e) |

123 |

123 |

||||||||

| Tax effects (f) |

(240) |

(249) |

||||||||

| Adjusted non-GAAP earnings from continuing operations |

$ 491 |

$ 2,305 |

||||||||

| Calculation of diluted (loss) earnings per share from continuing operations: |

||||||||||

| Loss from continuing operations |

$ (2,130) |

$ (332) |

||||||||

| Basic weighted average shares outstanding |

350.9 |

353.3 |

||||||||

| Diluted loss per share from continuing operations |

$ (6.07) |

(g) |

$ (0.94) |

(g) |

||||||

| Adjusted non-GAAP earnings from continuing operations |

$ 491 |

$ 2,305 |

||||||||

| Diluted weighted average shares outstanding |

353.2 |

355.7 |

||||||||

| Adjusted non-GAAP diluted earnings per share from continuing operations |

$ 1.39 |

$ 6.48 |

||||||||

| This Exhibit includes the following financial measures which are not calculated in accordance with generally accepted accounting principles (GAAP) in the United States – adjusted earnings from continuing operations and adjusted diluted earnings per share from continuing operations. Each of these calculations excludes the impact of certain items and therefore, is considered a non-GAAP financial measure. The items excluded were considered by management to be unusual and not reflective of the underlying performance of the company as explained in the notes for each item. The GAAP financial measure most directly comparable to adjusted earnings from continuing operations is loss from continuing operations and the GAAP financial measure most directly comparable to adjusted diluted earnings per share is diluted loss per share. Reconciliations of each of these non-GAAP financial measures to the corresponding GAAP financial measure are included above. Management uses these measures to evaluate the operating performance of the company and analyze trends. For this reason, management believes the measures are useful supplemental information for investors to understand the company's operating results. Notes describing each non-GAAP adjustment are on the following page. |

||||||||||

| EXHIBIT K (cont.) |

|||||||||

| CALCULATION OF ADJUSTED NON-GAAP EARNINGS FROM CONTINUING OPERATIONS AND |

|||||||||

| ADJUSTED NON-GAAP DILUTED EARNINGS PER SHARE - (UNAUDITED) |

|||||||||

| DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS |

|||||||||

| (a) Impairments- Represents goodwill impairment charge of $1,994 in the Information Systems and Technology group and intangible asset impairments of $191 in the Aerospace group and $110 in the Information Systems and Technology group. Management believes that the exclusion of these items is useful because management does not consider impairment charges in evaluating the operating performance of its ongoing operations. The exclusions permit investors to evaluate the company's performance and analyze trends in a similar manner as management. |

|||||||||

| (b) Contract disputes accruals- Represents accruals of $292 for contract disputes related to the Combat System group's European Land Systems business, primarily with the government of Portugal. While the company has contract disputes from time to time, management believes this item is unique due to the nature of the disputes and not reflective of the operating performance of its underlying operations. The exclusion permits investors to evaluate the company's performance in a similar manner as management and facilitates a comparison of its operating performance to the company's past operating performance. |

|||||||||

| (c) Restructuring-related charges- Represents restructuring-related charges of $98, primarily severance costs, related to the Combat System group's European Land Systems business. Management believes that the exclusion of this item is useful because management does not consider this item as reflective of its operating performance of its underlying operations. The exclusion permits investors to evaluate the company's performance in a similar manner as management and facilitates a comparison of its operating performance to the company's past operating performance. |

|||||||||

| (d) Inventory-related charges- Represents increases to inventory reserves for obsolete inventory in the Information Systems and Technology group of $38 and in the Combat Systems group of $15 for the quarter ended December 31, 2012. Represents increases to inventory reserves for obsolete inventory in the Information Systems and Technology group of $63 and in the Combat Systems group of $15 for the twelve months ended December 31, 2012. The Information System and Technology charge was primarily for ruggedized hardware products that ceased production in 2012. Management has adjusted for this item because it does not believe that it is indicative of its on-going operations or the on-going operating costs of its products since it does not generally build products to inventory within its defense groups. The exclusion permits investors to evaluate the company's performance in a similar manner as management and facilitates a comparison of its operating performance to the company's past operating performance. |

|||||||||

| (e) Debt retirement charges- Represents the premium associated with the early redemption of debt completed in December 2012. Management has excluded this item for comparative purposes and views this charge as uniquely related to its debt refinancing completed in 2012. By excluding this item, investors can evaluate the company's performance in a similar manner as management. |

|||||||||

| (f) Tax effects- Represents the limited tax benefit on the charges in (a) - (e) due to the non-deductible nature of a substantial portion of the charges. The tax effects of these changes have been reflected because management evaluates performance on an after-tax basis. This permits investors to evaluate the company's performance in a similar manner as management and compare the operating performance of the company to prior periods. |

|||||||||

| (g) Calculated based on basic weighted average shares outstanding as the inclusion of dilutive securities (stock options and restricted stock) would have an antidilutive effect. |

|||||||||

| EXHIBIT L |

|||||||

| CALCULATION OF ADJUSTED NON-GAAP REVENUES |

|||||||

| AND ADJUSTED NON-GAAP OPERATING EARNINGS BY SEGMENT - (UNAUDITED) |

|||||||

| DOLLARS IN MILLIONS |

|||||||

| GAAP |

Adjusted |

||||||

| Fourth Quarter |

Non-GAAP |

||||||

| 2012 |

Non-GAAP |

Fourth Quarter |

|||||

| (from Exhibit C) |

Adjustments |

2012 |

|||||

| Revenues: |

|||||||

| Aerospace |

$ 1,861 |

$ - |

$ 1,861 |

||||

| Combat Systems |

1,976 |

169 |

(a) |

2,145 |

|||

| Marine Systems |

1,664 |

- |

1,664 |

||||

| Information Systems and Technology |

2,577 |

- |

2,577 |

||||

| Total |

$ 8,078 |

$ 169 |

$ 8,247 |

||||

| Operating earnings (loss): |

|||||||

| Aerospace |

$ 69 |

$ 191 |

(b) |

$ 260 |

|||

| Combat Systems |

(136) |

405 |

(c) |

269 |

|||

| Marine Systems |

196 |

- |

196 |

||||

| Information Systems and Technology |

(2,014) |

2,142 |

(d) |

128 |

|||

| Corporate |

(17) |

- |

(17) |

||||

| Total |

$ (1,902) |

$ 2,738 |

$ 836 |

||||

| Operating margins: |

|||||||

| Aerospace |

3.7 % |

14.0 % |

|||||

| Combat Systems |

(6.9)% |

12.5 % |

|||||

| Marine Systems |

11.8 % |

11.8 % |

|||||

| Information Systems and Technology |

(78.2)% |

5.0 % |

|||||

| Total |

(23.5)% |

10.1 % |

|||||

| This Exhibit includes the following financial measures which are not calculated in accordance with generally accepted accounting principles (GAAP) in the United States – adjusted revenues and operating earnings by segment. Each of these calculations excludes the impact of certain items and therefore, is considered a non-GAAP financial measure. The items excluded were considered by management to be unusual and not reflective of the underlying performance of the company. The GAAP financial measure most directly comparable to adjusted revenues by segment is revenues by segment and the GAAP financial measure most directly comparable to adjusted operating earnings by segment is operating earnings by segment. Reconciliations of each of these non-GAAP financial measures to the corresponding GAAP financial measure are included above. Management uses these measures to evaluate the operating performance of the company and analyze trends. For this reason, management believes the measures are useful supplemental information for investors to understand the company's operating results. Notes describing each non-GAAP adjustment are on the following page. |

|||||||

| EXHIBIT L (cont.) |

|||||||

| CALCULATION OF ADJUSTED NON-GAAP REVENUES |

|||||||

| AND ADJUSTED NON-GAAP OPERATING EARNINGS BY SEGMENT - (UNAUDITED) |

|||||||

| DOLLARS IN MILLIONS |

|||||||

| (a) Represents the portion of the $292 of contract disputes accruals related to the contract with the government of Portugal in the Combat Systems group from Exhibit K that was recorded as a reduction of revenue. |

|||||||

| (b) Represents intangible asset impairment of $191 in the Aerospace group from Exhibit K. |

|||||||

| (c) Represents contract disputes accruals of $292, restructuring-related charges of $98 and inventory-related charges of $15 in the Combat Systems group from Exhibit K. |

|||||||

| (d) Represents goodwill impairment of $1,994, intangible asset impairment of $110 and inventory-related charges of $38 in the Information Systems and Technology group from Exhibit K. |

|||||||

| EXHIBIT M |

|||||||

| CALCULATION OF ADJUSTED NON-GAAP REVENUES |

|||||||

| AND ADJUSTED NON-GAAP OPERATING EARNINGS BY SEGMENT - (UNAUDITED) |

|||||||

| DOLLARS IN MILLIONS |

|||||||

| GAAP |

Adjusted |

||||||

| Twelve Months |

Non-GAAP |

||||||

| 2012 |

Non-GAAP |

Twelve Months |

|||||

| (from Exhibit D) |

Adjustments |

2012 |

|||||

| Revenues: |

|||||||

| Aerospace |

$ 6,912 |

$ - |

$ 6,912 |

||||

| Combat Systems |

7,992 |

169 |

(a) |

8,161 |

|||

| Marine Systems |

6,592 |

- |

6,592 |

||||

| Information Systems and Technology |

10,017 |

- |

10,017 |

||||

| Total |

$ 31,513 |

$ 169 |

$ 31,682 |

||||

| Operating earnings (loss): |

|||||||

| Aerospace |

$ 858 |

$ 191 |

(b) |

$ 1,049 |

|||

| Combat Systems |

663 |

405 |

(c) |

1,068 |

|||

| Marine Systems |

750 |

- |

750 |

||||

| Information Systems and Technology |

(1,369) |

2,167 |

(d) |

798 |

|||

| Corporate |

(69) |

- |

(69) |

||||

| Total |

$ 833 |

$ 2,763 |

$ 3,596 |

||||

| Operating margins: |

|||||||

| Aerospace |

12.4 % |

15.2 % |

|||||

| Combat Systems |

8.3 % |

13.1 % |

|||||

| Marine Systems |

11.4 % |

11.4 % |

|||||

| Information Systems and Technology |

(13.7)% |

8.0 % |

|||||

| Total |

2.6 % |

11.4 % |

|||||

| This Exhibit includes the following financial measures which are not calculated in accordance with generally accepted accounting principles (GAAP) in the United States – adjusted revenues and operating earnings by segment. Each of these calculations excludes the impact of certain items and therefore, is considered a non-GAAP financial measure. The items excluded were considered by management to be unusual and not reflective of the underlying performance of the company. The GAAP financial measure most directly comparable to adjusted revenues by segment is revenues by segment and the GAAP financial measure most directly comparable to adjusted operating earnings by segment is operating earnings by segment. Reconciliations of each of these non-GAAP financial measures to the corresponding GAAP financial measure are included above. Management uses these measures to evaluate the operating performance of the company and analyze trends. For this reason, management believes the measures are useful supplemental information for investors to understand the company's operating results. Notes describing each non-GAAP adjustment are on the following page. |

|||||||

| EXHIBIT M (cont.) |

|||||||

| CALCULATION OF ADJUSTED NON-GAAP REVENUES |

|||||||

| AND ADJUSTED NON-GAAP OPERATING EARNINGS BY SEGMENT - (UNAUDITED) |

|||||||

| DOLLARS IN MILLIONS |

|||||||

| (a) Represents the portion of the $292 of contract disputes accruals related to the contract with the government of Portugal in the Combat Systems group from Exhibit K that was recorded as a reduction of revenue. |

|||||||

| (b) Represents intangible asset impairment of $191 in the Aerospace group from Exhibit K. |

|||||||

| (c) Represents contract disputes accruals of $292, restructuring-related charges of $98 and inventory-related charges of $15 in the Combat Systems group from Exhibit K. |

|||||||

| (d) Represents goodwill impairment of $1,994, intangible asset impairment of $110 and inventory-related charges of $63 in the Information Systems and Technology group from Exhibit K. |

|||||||

SOURCE General Dynamics

Share this article