FALLS CHURCH, Va., April 25, 2018 /PRNewswire/ --

- Diluted earnings per share from continuing operations of $2.65, up 6.9%

- Net earnings of $799 million, up 4.7%

- Return on sales of 10.6%

- 1.3% revenue growth with particular strength in our defense businesses

General Dynamics (NYSE: GD) today reported first-quarter 2018 net earnings of $799 million, a 4.7 percent increase over first-quarter 2017, on revenue of $7.5 billion. Diluted earnings per share from continuing operations were $2.65 compared to $2.48 in the year-ago quarter, a 6.9 percent increase.

"General Dynamics delivered solid first-quarter results, with growth in revenue, net earnings and EPS," said Phebe Novakovic, chairman and chief executive officer of General Dynamics. "This is a strong start to 2018 and we remain confident in our outlook."

Margin

Company-wide operating margin for the first quarter of 2018 was 13.4 percent, compared to 14.1 percent in first-quarter 2017. Consolidated operating margin was up 60 basis points, compared to 12.8 percent in fourth-quarter 2017.

Capital Deployment

The company repurchased 1.2 million of its outstanding shares in the first quarter. In addition, in March, the board of directors increased the company's quarterly dividend to $0.93 per share, representing the 21st consecutive annual dividend increase. The 10.7 percent increase is consistent with increases over the past five years.

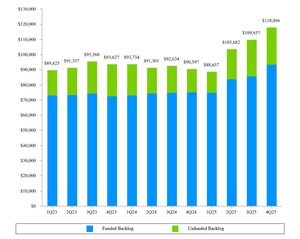

Backlog

General Dynamics' total backlog at the end of first-quarter 2018 was $62.1 billion. The estimated potential contract value, representing management's estimate of value in unfunded indefinite delivery, indefinite quantity (IDIQ) contracts and unexercised options, was $25.5 billion. Total potential contract value, the sum of all backlog components, was $87.6 billion at the end of the quarter.

There was order activity across the Gulfstream product portfolio and strong demand for defense products. Significant awards in the quarter include a contract with a total potential value of $1 billion to deliver Piranha 5 wheeled armored vehicles to the Romanian Armed Forces, $695 million from the U.S. Navy for long-lead materials for Block V Virginia-class submarines, $420 million from the Navy for a second John Lewis-class ship, $355 million from the U.S. Army for continued production and support of Stryker vehicles and $215 million from NASA for the Space Network Ground Segment Sustainment project to modernize NASA's ground infrastructure systems for its satellite network.

About General Dynamics

Headquartered in Falls Church, Virginia, General Dynamics is a global aerospace and defense company that offers a broad portfolio of products and services in business aviation; combat vehicles, weapons systems and munitions; C4ISR and IT solutions; and shipbuilding and ship repair. The company's 2017 revenue was $31 billion. More information is available at www.generaldynamics.com.

Certain statements made in this press release, including any statements as to future results of operations and financial projections, may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are based on management's expectations, estimates, projections and assumptions. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors. Additional information regarding these factors is contained in the company's filings with the Securities and Exchange Commission, including, without limitation, its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. All forward-looking statements speak only as of the date they were made. The company does not undertake any obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date of this press release.

WEBCAST INFORMATION: General Dynamics will webcast its first-quarter 2018 financial results conference call at 9 a.m. EDT on Wednesday, April 25, 2018. The webcast will be a listen-only audio event, available at www.generaldynamics.com. An on-demand replay of the webcast will be available by 12 p.m. on April 25 and will continue for 12 months. To hear a recording of the conference call by telephone, please call 877-344-7529 (international: 1-412-317-0088); passcode 10119160. The phone replay will be available from April 25 through May 2, 2018.

| EXHIBIT A |

||||||||||||||

| CONSOLIDATED STATEMENT OF EARNINGS - (UNAUDITED) |

||||||||||||||

| DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS |

||||||||||||||

| Three Months Ended |

Variance |

|||||||||||||

| April 1, 2018 |

April 2, 2017* |

$ |

% |

|||||||||||

| Revenue |

$ |

7,535 |

$ |

7,441 |

$ |

94 |

1.3 |

% |

||||||

| Operating costs and expenses |

6,527 |

6,395 |

132 |

|||||||||||

| Operating earnings |

1,008 |

1,046 |

(38) |

(3.6) |

% |

|||||||||

| Interest, net |

(27) |

(25) |

(2) |

|||||||||||

| Other, net |

(21) |

(11) |

(10) |

|||||||||||

| Earnings before income tax |

960 |

1,010 |

(50) |

(5.0) |

% |

|||||||||

| Provision for income tax, net |

161 |

247 |

(86) |

|||||||||||

| Net earnings |

$ |

799 |

$ |

763 |

$ |

36 |

4.7 |

% |

||||||

| Earnings per share—basic |

$ |

2.70 |

$ |

2.53 |

$ |

0.17 |

6.7 |

% |

||||||

| Basic weighted average shares outstanding |

296.4 |

301.8 |

||||||||||||

| Earnings per share—diluted |

$ |

2.65 |

$ |

2.48 |

$ |

0.17 |

6.9 |

% |

||||||

| Diluted weighted average shares outstanding |

301.1 |

307.3 |

||||||||||||

| * |

Prior-period information has been restated for the adoption of Accounting Standards Update (ASU) 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, which we adopted on January 1, 2018. |

| EXHIBIT B |

||||||||||||||

| REVENUE AND OPERATING EARNINGS BY SEGMENT - (UNAUDITED) |

||||||||||||||

| DOLLARS IN MILLIONS |

||||||||||||||

| Three Months Ended |

Variance |

|||||||||||||

| April 1, 2018 |

April 2, 2017* |

$ |

% |

|||||||||||

| Revenue: |

||||||||||||||

| Aerospace |

$ |

1,825 |

$ |

2,074 |

$ |

(249) |

(12.0) |

% |

||||||

| Combat Systems |

1,440 |

1,287 |

153 |

11.9 |

% |

|||||||||

| Information Systems and Technology |

2,236 |

2,146 |

90 |

4.2 |

% |

|||||||||

| Marine Systems |

2,034 |

1,934 |

100 |

5.2 |

% |

|||||||||

| Total |

$ |

7,535 |

$ |

7,441 |

$ |

94 |

1.3 |

% |

||||||

| Operating earnings: |

||||||||||||||

| Aerospace |

$ |

346 |

$ |

439 |

$ |

(93) |

(21.2) |

% |

||||||

| Combat Systems |

224 |

205 |

19 |

9.3 |

% |

|||||||||

| Information Systems and Technology |

247 |

236 |

11 |

4.7 |

% |

|||||||||

| Marine Systems |

184 |

161 |

23 |

14.3 |

% |

|||||||||

| Corporate |

7 |

5 |

2 |

40.0 |

% |

|||||||||

| Total |

$ |

1,008 |

$ |

1,046 |

$ |

(38) |

(3.6) |

% |

||||||

| Operating margin: |

||||||||||||||

| Aerospace |

19.0 |

% |

21.2 |

% |

||||||||||

| Combat Systems |

15.6 |

% |

15.9 |

% |

||||||||||

| Information Systems and Technology |

11.0 |

% |

11.0 |

% |

||||||||||

| Marine Systems |

9.0 |

% |

8.3 |

% |

||||||||||

| Total |

13.4 |

% |

14.1 |

% |

||||||||||

| * |

Prior-period information has been restated for the adoption of ASU 2017-07, which we adopted on January 1, 2018. |

| EXHIBIT C |

|||||||

| CONSOLIDATED BALANCE SHEET |

|||||||

| DOLLARS IN MILLIONS |

|||||||

| (Unaudited) |

|||||||

| April 1, 2018 |

December 31, 2017 |

||||||

| ASSETS |

|||||||

| Current assets: |

|||||||

| Cash and equivalents |

$ |

4,332 |

$ |

2,983 |

|||

| Accounts receivable |

3,769 |

3,617 |

|||||

| Unbilled receivables |

5,865 |

5,240 |

|||||

| Inventories |

5,543 |

5,303 |

|||||

| Other current assets |

955 |

1,185 |

|||||

| Total current assets |

20,464 |

18,328 |

|||||

| Noncurrent assets: |

|||||||

| Property, plant and equipment, net |

3,533 |

3,517 |

|||||

| Intangible assets, net |

702 |

702 |

|||||

| Goodwill |

11,955 |

11,914 |

|||||

| Other assets |

565 |

585 |

|||||

| Total noncurrent assets |

16,755 |

16,718 |

|||||

| Total assets |

$ |

37,219 |

$ |

35,046 |

|||

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|||||||

| Current liabilities: |

|||||||

| Short-term debt and current portion of long-term debt |

$ |

2,498 |

$ |

2 |

|||

| Accounts payable |

2,851 |

3,207 |

|||||

| Customer advances and deposits |

7,095 |

6,992 |

|||||

| Other current liabilities |

2,798 |

2,898 |

|||||

| Total current liabilities |

15,242 |

13,099 |

|||||

| Noncurrent liabilities: |

|||||||

| Long-term debt |

3,981 |

3,980 |

|||||

| Other liabilities |

6,222 |

6,532 |

|||||

| Total noncurrent liabilities |

10,203 |

10,512 |

|||||

| Shareholders' equity: |

|||||||

| Common stock |

482 |

482 |

|||||

| Surplus |

2,820 |

2,872 |

|||||

| Retained earnings |

27,605 |

26,444 |

|||||

| Treasury stock |

(15,742) |

(15,543) |

|||||

| Accumulated other comprehensive loss |

(3,391) |

(2,820) |

|||||

| Total shareholders' equity |

11,774 |

11,435 |

|||||

| Total liabilities and shareholders' equity |

$ |

37,219 |

$ |

35,046 |

|||

| EXHIBIT D |

|||||||

| CONSOLIDATED STATEMENT OF CASH FLOWS - (UNAUDITED) |

|||||||

| DOLLARS IN MILLIONS |

|||||||

| Three Months Ended |

|||||||

| April 1, 2018 |

April 2, 2017 |

||||||

| Cash flows from operating activities—continuing operations: |

|||||||

| Net earnings |

$ |

799 |

$ |

763 |

|||

| Adjustments to reconcile net earnings to net cash provided by operating activities: |

|||||||

| Depreciation of property, plant and equipment |

89 |

92 |

|||||

| Amortization of intangible assets |

20 |

19 |

|||||

| Equity-based compensation expense |

29 |

23 |

|||||

| Deferred income tax provision |

4 |

45 |

|||||

| (Increase) decrease in assets, net of effects of business acquisitions: |

|||||||

| Accounts receivable |

(150) |

(84) |

|||||

| Unbilled receivables |

(608) |

(338) |

|||||

| Inventories |

(236) |

2 |

|||||

| Increase (decrease) in liabilities, net of effects of business acquisitions: |

|||||||

| Accounts payable |

(358) |

(72) |

|||||

| Customer advances and deposits |

(149) |

(95) |

|||||

| Income taxes payable |

167 |

202 |

|||||

| Other current liabilities |

(128) |

(76) |

|||||

| Other, net |

25 |

52 |

|||||

| Net cash (used) provided by operating activities |

(496) |

533 |

|||||

| Cash flows from investing activities: |

|||||||

| Capital expenditures |

(104) |

(62) |

|||||

| Other, net |

(1) |

(23) |

|||||

| Net cash used by investing activities |

(105) |

(85) |

|||||

| Cash flows from financing activities: |

|||||||

| Proceeds from commercial paper, net |

2,494 |

— |

|||||

| Purchases of common stock |

(267) |

(354) |

|||||

| Dividends paid |

(250) |

(230) |

|||||

| Other, net |

(25) |

(22) |

|||||

| Net cash provided (used) by financing activities |

1,952 |

(606) |

|||||

| Net cash used by discontinued operations |

(2) |

(8) |

|||||

| Net increase (decrease) in cash and equivalents |

1,349 |

(166) |

|||||

| Cash and equivalents at beginning of period |

2,983 |

2,334 |

|||||

| Cash and equivalents at end of period |

$ |

4,332 |

$ |

2,168 |

|||

| EXHIBIT E |

||||||||

| PRELIMINARY FINANCIAL INFORMATION - (UNAUDITED) |

||||||||

| DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS |

||||||||

| 2018 |

2017 |

|||||||

| First Quarter |

First Quarter |

|||||||

| Other Financial Information: |

||||||||

| Debt-to-equity (a) |

55.0 |

% |

36.7 |

% |

||||

| Debt-to-capital (b) |

35.5 |

% |

26.9 |

% |

||||

| Book value per share (c) |

$ |

39.64 |

$ |

35.08 |

||||

| Income tax refunds, net |

$ |

4 |

$ |

4 |

||||

| Company-sponsored research and development (d) |

$ |

140 |

$ |

113 |

||||

| Shares outstanding |

297,033,427 |

301,685,448 |

||||||

| Non-GAAP Financial Measure: |

||||||||

| Free cash flow from operations: |

||||||||

| Net cash (used) provided by operating activities |

$ |

(496) |

$ |

533 |

||||

| Capital expenditures |

(104) |

(62) |

||||||

| Free cash flow from operations (e) |

$ |

(600) |

$ |

471 |

||||

| (a) |

Debt-to-equity ratio is calculated as total debt divided by total equity as of the end of the period. |

| (b) |

Debt-to-capital ratio is calculated as total debt divided by the sum of total debt plus total equity as of the end of the period. |

| (c) |

Book value per share is calculated as total equity divided by total outstanding shares as of the end of the period. |

| (d) |

Includes independent research and development and Aerospace product-development costs. |

| (e) |

We believe free cash flow from operations is a useful measure for investors because it portrays our ability to generate cash from our businesses for purposes such as repaying maturing debt, funding business acquisitions, repurchasing our common stock and paying dividends. We use free cash flow from operations to assess the quality of our earnings and as a key performance measure in evaluating management. The most directly comparable GAAP measure to free cash flow from operations is net cash provided by operating activities. |

| EXHIBIT F |

||||||||||||||||||||

| BACKLOG - (UNAUDITED) |

||||||||||||||||||||

| DOLLARS IN MILLIONS |

||||||||||||||||||||

| Funded |

Unfunded |

Total |

Estimated |

Total Potential |

||||||||||||||||

| First Quarter 2018: |

||||||||||||||||||||

| Aerospace |

$ |

11,898 |

$ |

158 |

$ |

12,056 |

$ |

1,868 |

$ |

13,924 |

||||||||||

| Combat Systems |

17,126 |

378 |

17,504 |

3,549 |

21,053 |

|||||||||||||||

| Information Systems and Technology |

6,739 |

2,075 |

8,814 |

15,787 |

24,601 |

|||||||||||||||

| Marine Systems |

18,310 |

5,458 |

23,768 |

4,271 |

28,039 |

|||||||||||||||

| Total |

$ |

54,073 |

$ |

8,069 |

$ |

62,142 |

$ |

25,475 |

$ |

87,617 |

||||||||||

| Fourth Quarter 2017: |

||||||||||||||||||||

| Aerospace |

$ |

12,319 |

$ |

147 |

$ |

12,466 |

$ |

1,955 |

$ |

14,421 |

||||||||||

| Combat Systems |

17,158 |

458 |

17,616 |

3,154 |

20,770 |

|||||||||||||||

| Information Systems and Technology |

6,682 |

2,192 |

8,874 |

14,875 |

23,749 |

|||||||||||||||

| Marine Systems |

15,872 |

8,347 |

24,219 |

4,809 |

29,028 |

|||||||||||||||

| Total |

$ |

52,031 |

$ |

11,144 |

$ |

63,175 |

$ |

24,793 |

$ |

87,968 |

||||||||||

| First Quarter 2017: |

||||||||||||||||||||

| Aerospace |

$ |

12,446 |

$ |

133 |

$ |

12,579 |

$ |

1,929 |

$ |

14,508 |

||||||||||

| Combat Systems |

17,058 |

523 |

17,581 |

4,970 |

22,551 |

|||||||||||||||

| Information Systems and Technology |

6,682 |

2,038 |

8,720 |

13,994 |

22,714 |

|||||||||||||||

| Marine Systems |

17,071 |

4,413 |

21,484 |

3,756 |

25,240 |

|||||||||||||||

| Total |

$ |

53,257 |

$ |

7,107 |

$ |

60,364 |

$ |

24,649 |

$ |

85,013 |

||||||||||

| (a) |

The estimated potential contract value includes work awarded on unfunded indefinite delivery, indefinite quantity (IDIQ) contracts and unexercised options associated with existing firm contracts, including options to purchase new aircraft and long-term aircraft services agreements. We recognize options in backlog when the customer exercises the option and establishes a firm order. For IDIQ contracts, we evaluate the amount of funding we expect to receive and include this amount in our estimated potential contract value. The actual amount of funding received in the future may be higher or lower than our estimate of potential contract value. |

EXHIBIT G

FIRST QUARTER 2018 SIGNIFICANT ORDERS - (UNAUDITED)

DOLLARS IN MILLIONS

| We received the following significant contract awards during the first quarter of 2018: |

|

| Combat Systems: |

|

| • |

$445 to produce Piranha 5 wheeled armored vehicles and provide associated support services to the Romanian Armed Forces, part of a larger contract with a total potential value exceeding $1 billion. |

| • |

$285 from the U.S. Army for inventory management and engineering and support services for the Stryker wheeled combat-vehicle fleet. |

| • |

$155 from the Army for various calibers of ammunition. |

| • |

$80 from the Army for technical support and engineering and logistics services for the Abrams main battle tank program. |

| • |

$70 from the Army for the production of Stryker double-V-hull vehicles in the A1 configuration. |

| • |

$65 to produce AGM-114R Hellfire munitions. |

| Information Systems and Technology: |

|

| • |

$215 from the National Aeronautics and Space Administration (NASA) for the Space Network Ground Segment Sustainment (SGSS) program to modernize NASA's ground infrastructure systems for its satellite network. |

| • |

$120 from the U.S. Army for computing and communications equipment under the Common Hardware Systems-4 (CHS-4) program. |

| • |

$95 from the U.S. Air Force for the Battlefield Information Collection and Exploitation System (BICES) program to provide information sharing support to coalition operations. |

| • |

$60 to provide IT network and technical support services for the U.S. Army Intelligence and Security Command. |

| • |

$55 from the U.S. Air Force Central Command for communications equipment and associated technical support services in Asia. |

| • |

$50 from the National Geospatial-Intelligence Agency (NGA) for IT lifecycle management and virtual desktop services. |

| • |

$45 to provide vehicle electronic systems and components for Prophet, the Army's ground-based tactical signals intelligence and electronic warfare system. |

| • |

$45 from the Army for the lightweight mobile tactical network. |

| • |

$40 to continue managing the Army's live training systems. |

| • |

$30 to provide engineering and integration support for the Canadian Army's tactical communications network, the Land Command Support System (LCSS). |

| Marine Systems: |

|

| • |

$695 from the U.S. Navy to procure long-lead materials for four Virginia-class submarines under Block V of the program. |

| • |

$420 from the Navy for construction of the second ship in the John Lewis-class (TAO-205) fleet oiler program. |

| • |

$100 from the Navy for Advanced Nuclear Plant Studies in support of the Columbia-class submarine program. |

| • |

$85 from the Navy for maintenance and modernization work on the USS Montpelier, a Los Angeles-class attack submarine. |

| • |

$40 from the Navy to provide design and development and lead yard services for Virginia-class submarines. |

| EXHIBIT H |

||||||

| AEROSPACE SUPPLEMENTAL DATA - (UNAUDITED) |

||||||

| First Quarter |

||||||

| 2018 |

2017 |

|||||

| Gulfstream Aircraft Deliveries (units): |

||||||

| Large-cabin aircraft |

19 |

23 |

||||

| Mid-cabin aircraft |

7 |

7 |

||||

| Total |

26 |

30 |

||||

| Pre-owned Deliveries (units): |

1 |

1 |

||||

SOURCE General Dynamics

Share this article