General Dynamics Reports First-Quarter 2016 Results

- Diluted earnings per share from continuing operations up 9.3% to $2.34

- Operating margin of 13.6%, a 40 basis-point improvement

- Operating earnings up 2.5% to $1.05 billion

- Earnings from continuing operations up 2% to $730 million

FALLS CHURCH, Va., April 27, 2016 /PRNewswire/ --General Dynamics (NYSE: GD) today reported first-quarter 2016 earnings from continuing operations of $730 million, a 2 percent increase over first-quarter 2015, on revenue of $7.7 billion. Diluted earnings per share from continuing operations were $2.34 compared to $2.14 in the year-ago quarter, a 9.3 percent increase.

"General Dynamics delivered a strong first quarter, with all four groups contributing to our outstanding operating performance," said Phebe N. Novakovic, chairman and chief executive officer of General Dynamics. "We generated positive operating leverage and achieved the sixth straight quarter with operating earnings of more than one billion dollars."

Margin

Company-wide operating margin for the first quarter of 2016 was 13.6 percent, a 40 basis-point increase when compared to 13.2 percent in first-quarter 2015. Three of the company's four business groups expanded margins over the year-ago period.

Cash

Net cash provided by operating activities in the quarter totaled $439 million. Free cash flow from operations, defined as net cash provided by operating activities less capital expenditures, was $374 million.

Capital Deployment

The company repurchased 7.8 million of its outstanding shares in the first quarter. In addition, in March, the board of directors increased the company's quarterly dividend by 10.1 percent to $0.76 per share, representing the company's 19th consecutive annual dividend increase.

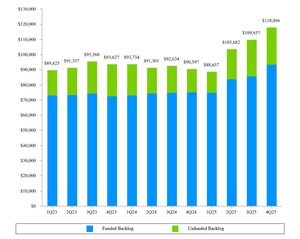

Backlog

General Dynamics' total backlog at the end of first-quarter 2016 was $64.7 billion. There was order activity across the Gulfstream product portfolio and strong demand for defense products, which resulted in a book-to-bill ratio (orders divided by revenue) of one-to-one in the Combat Systems group and greater than one-to-one in the Information Systems and Technology group. The estimated potential contract value, representing management's estimate of value in unfunded indefinite delivery, indefinite quantity (IDIQ) contracts and unexercised options, was $24.5 billion. Total potential contract value, the sum of all backlog components, was $89.2 billion at the end of the quarter.

About General Dynamics

Headquartered in Falls Church, Virginia, General Dynamics is a global aerospace and defense company that offers a broad portfolio of products and services in business aviation; combat vehicles, weapons systems and munitions; C4ISR and IT solutions; and shipbuilding. The company's revenues in 2015 were $31.5 billion. More information is available at www.generaldynamics.com.

Certain statements made in this press release, including any statements as to future results of operations and financial projections, may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are based on management's expectations, estimates, projections and assumptions. These statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors. Additional information regarding these factors is contained in the company's filings with the Securities and Exchange Commission, including, without limitation, its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q.

All forward-looking statements speak only as of the date they were made. The company does not undertake any obligation to update or publicly release any revisions to any forward-looking statements to reflect events, circumstances or changes in expectations after the date of this press release.

WEBCAST INFORMATION: General Dynamics will webcast its first-quarter securities analyst conference call at 9 a.m. EDT on Wednesday, April 27, 2016. The webcast will be a listen-only audio event, available at www.generaldynamics.com. An on-demand replay of the webcast will be available by 12 p.m. on April 27 and will continue for 12 months. To hear a recording of the conference call by telephone, please call 855-859-2056 (international: 404-537-3406); passcode 89290991. The phone replay will be available from 3 p.m. April 27 through May 3, 2016.

| EXHIBIT A

CONSOLIDATED STATEMENTS OF EARNINGS - (UNAUDITED) DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS |

|||||||||||||||

| First Quarter |

Variance |

||||||||||||||

| 2016 |

2015 |

$ |

% |

||||||||||||

| Revenue |

$ |

7,724 |

$ |

7,784 |

$ |

(60) |

(0.8) |

% |

|||||||

| Operating costs and expenses |

6,671 |

6,757 |

86 |

||||||||||||

| Operating earnings |

1,053 |

1,027 |

26 |

2.5 |

% |

||||||||||

| Interest, net |

(22) |

(21) |

(1) |

||||||||||||

| Other, net |

10 |

3 |

7 |

||||||||||||

| Earnings from continuing operations before income tax |

1,041 |

1,009 |

$ |

32 |

3.2 |

% |

|||||||||

| Provision for income tax, net |

311 |

293 |

(18) |

||||||||||||

| Earnings from continuing operations |

$ |

730 |

$ |

716 |

$ |

14 |

2.0 |

% |

|||||||

| Discontinued operations |

(13) |

* |

— |

(13) |

|||||||||||

| Net earnings |

$ |

717 |

$ |

716 |

$ |

1 |

0.1 |

% |

|||||||

| Earnings per share—basic |

|||||||||||||||

| Continuing operations |

$ |

2.37 |

$ |

2.18 |

$ |

0.19 |

8.7 |

% |

|||||||

| Discontinued operations |

$ |

(0.04) |

* |

$ |

— |

$ |

(0.04) |

||||||||

| Net earnings |

$ |

2.33 |

$ |

2.18 |

$ |

0.15 |

6.9 |

% |

|||||||

| Basic weighted average shares outstanding |

307.9 |

329.2 |

|||||||||||||

| Earnings per share—diluted |

|||||||||||||||

| Continuing operations |

$ |

2.34 |

$ |

2.14 |

$ |

0.20 |

9.3 |

% |

|||||||

| Discontinued operations |

$ |

(0.04) |

* |

$ |

— |

$ |

(0.04) |

||||||||

| Net earnings |

$ |

2.30 |

$ |

2.14 |

$ |

0.16 |

7.5 |

% |

|||||||

| Diluted weighted average shares outstanding |

312.3 |

334.7 |

|||||||||||||

| * |

In the first quarter of 2016, we recognized a final adjustment to the loss on the sale of our axle business in the Combat Systems group. The business was sold in 2015. |

|||||||||||||||

| EXHIBIT B

REVENUE AND OPERATING EARNINGS BY SEGMENT - (UNAUDITED) DOLLARS IN MILLIONS |

||||||||||||||

| First Quarter |

Variance |

|||||||||||||

| 2016 |

2015 |

$ |

% |

|||||||||||

| Revenue: |

||||||||||||||

| Aerospace |

$ |

1,987 |

$ |

2,108 |

$ |

(121) |

(5.7) |

% |

||||||

| Combat Systems |

1,273 |

1,363 |

(90) |

(6.6) |

% |

|||||||||

| Information Systems and Technology |

2,333 |

2,370 |

(37) |

(1.6) |

% |

|||||||||

| Marine Systems |

2,131 |

1,943 |

188 |

9.7 |

% |

|||||||||

| Total |

$ |

7,724 |

$ |

7,784 |

$ |

(60) |

(0.8) |

% |

||||||

| Operating earnings: |

||||||||||||||

| Aerospace |

$ |

411 |

$ |

431 |

$ |

(20) |

(4.6) |

% |

||||||

| Combat Systems |

217 |

204 |

13 |

6.4 |

% |

|||||||||

| Information Systems and Technology |

248 |

217 |

31 |

14.3 |

% |

|||||||||

| Marine Systems |

192 |

188 |

4 |

2.1 |

% |

|||||||||

| Corporate |

(15) |

(13) |

(2) |

(15.4) |

% |

|||||||||

| Total |

$ |

1,053 |

$ |

1,027 |

$ |

26 |

2.5 |

% |

||||||

| Operating margin: |

||||||||||||||

| Aerospace |

20.7 |

% |

20.4 |

% |

||||||||||

| Combat Systems |

17.0 |

% |

15.0 |

% |

||||||||||

| Information Systems and Technology |

10.6 |

% |

9.2 |

% |

||||||||||

| Marine Systems |

9.0 |

% |

9.7 |

% |

||||||||||

| Total |

13.6 |

% |

13.2 |

% |

||||||||||

| EXHIBIT C

CONSOLIDATED BALANCE SHEETS DOLLARS IN MILLIONS |

|||||||

| (Unaudited) |

|||||||

| April 3, 2016 |

December 31, 2015 |

||||||

| ASSETS |

|||||||

| Current assets: |

|||||||

| Cash and equivalents |

$ |

1,907 |

$ |

2,785 |

|||

| Accounts receivable |

3,654 |

3,446 |

|||||

| Contracts in process |

4,705 |

4,357 |

|||||

| Inventories |

3,504 |

3,366 |

|||||

| Other current assets |

418 |

617 |

|||||

| Total current assets |

14,188 |

14,571 |

|||||

| Noncurrent assets: |

|||||||

| Property, plant and equipment, net |

3,477 |

3,466 |

|||||

| Intangible assets, net |

759 |

763 |

|||||

| Goodwill |

11,595 |

11,443 |

|||||

| Other assets |

1,683 |

1,754 |

|||||

| Total noncurrent assets |

17,514 |

17,426 |

|||||

| Total assets |

$ |

31,702 |

$ |

31,997 |

|||

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|||||||

| Current liabilities: |

|||||||

| Short-term debt and current portion of long-term debt |

$ |

501 |

$ |

501 |

|||

| Accounts payable |

2,150 |

1,964 |

|||||

| Customer advances and deposits |

5,560 |

5,674 |

|||||

| Other current liabilities |

4,212 |

4,306 |

|||||

| Total current liabilities |

12,423 |

12,445 |

|||||

| Noncurrent liabilities: |

|||||||

| Long-term debt |

2,899 |

2,898 |

|||||

| Other liabilities |

5,798 |

5,916 |

|||||

| Total noncurrent liabilities |

8,697 |

8,814 |

|||||

| Shareholders' equity: |

|||||||

| Common stock |

482 |

482 |

|||||

| Surplus |

2,740 |

2,730 |

|||||

| Retained earnings |

23,687 |

23,204 |

|||||

| Treasury stock |

(13,386) |

(12,392) |

|||||

| Accumulated other comprehensive loss |

(2,941) |

(3,286) |

|||||

| Total shareholders' equity |

10,582 |

10,738 |

|||||

| Total liabilities and shareholders' equity |

$ |

31,702 |

$ |

31,997 |

|||

| EXHIBIT D

CONSOLIDATED STATEMENTS OF CASH FLOWS - (UNAUDITED) DOLLARS IN MILLIONS |

||||||||

| Three Months Ended |

||||||||

| April 3, 2016 |

April 5, 2015 |

|||||||

| Cash flows from operating activities—continuing operations: |

||||||||

| Net earnings |

$ |

717 |

$ |

716 |

||||

| Adjustments to reconcile net earnings to net cash provided by operating activities: |

||||||||

| Depreciation of property, plant and equipment |

90 |

94 |

||||||

| Amortization of intangible assets |

27 |

30 |

||||||

| Equity-based compensation expense |

27 |

40 |

||||||

| Excess tax benefit from equity-based compensation |

(15) |

(30) |

||||||

| Deferred income tax provision |

20 |

(8) |

||||||

| Discontinued operations |

13 |

— |

||||||

| (Increase) decrease in assets, net of effects of business acquisitions: |

||||||||

| Accounts receivable |

(195) |

388 |

||||||

| Contracts in process |

(337) |

152 |

||||||

| Inventories |

(133) |

(183) |

||||||

| Increase (decrease) in liabilities, net of effects of business acquisitions: |

||||||||

| Accounts payable |

179 |

210 |

||||||

| Customer advances and deposits |

(209) |

(871) |

||||||

| Income taxes payable |

268 |

251 |

||||||

| Other current liabilities |

(70) |

(38) |

||||||

| Other, net |

57 |

(6) |

||||||

| Net cash provided by operating activities |

439 |

745 |

||||||

| Cash flows from investing activities: |

||||||||

| Capital expenditures |

(65) |

(98) |

||||||

| Maturities of held-to-maturity securities |

— |

500 |

||||||

| Other, net |

(53) |

94 |

||||||

| Net cash (used) provided by investing activities |

(118) |

496 |

||||||

| Cash flows from financing activities: |

||||||||

| Purchases of common stock |

(1,026) |

(620) |

||||||

| Dividends paid |

(215) |

(206) |

||||||

| Proceeds from stock options exercises |

33 |

87 |

||||||

| Repayment of fixed-rate notes |

— |

(500) |

||||||

| Other, net |

15 |

30 |

||||||

| Net cash used by financing activities |

(1,193) |

(1,209) |

||||||

| Net cash used by discontinued operations |

(6) |

(8) |

||||||

| Net (decrease) increase in cash and equivalents |

(878) |

24 |

||||||

| Cash and equivalents at beginning of period |

2,785 |

4,388 |

||||||

| Cash and equivalents at end of period |

$ |

1,907 |

$ |

4,412 |

||||

| EXHIBIT E

PRELIMINARY FINANCIAL INFORMATION - (UNAUDITED) DOLLARS IN MILLIONS EXCEPT PER SHARE AMOUNTS |

||||||||

| First Quarter 2016 |

First Quarter 2015 |

|||||||

| Other Financial Information (a): |

||||||||

| Debt-to-equity (b) |

32.1 |

% |

29.5 |

% |

||||

| Debt-to-capital (c) |

24.3 |

% |

22.8 |

% |

||||

| Book value per share (d) |

$ |

34.62 |

$ |

35.04 |

||||

| Total taxes paid |

$ |

21 |

$ |

53 |

||||

| Company-sponsored research and development (e) |

$ |

104 |

$ |

96 |

||||

| Shares outstanding |

305,646,967 |

328,732,777 |

||||||

| Non-GAAP Financial Measures: |

||||||||

| Free cash flow from operations: |

||||||||

| Net cash provided by operating activities |

$ |

439 |

$ |

745 |

||||

| Capital expenditures |

(65) |

(98) |

||||||

| Free cash flow from operations (f) |

$ |

374 |

$ |

647 |

||||

| (a) |

Prior period information has been restated to reflect the reclassification of debt issuance costs from other assets to debt in accordance with ASU 2015-03, Interest - Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs, which we adopted in the fourth quarter of 2015. |

| (b) |

Debt-to-equity ratio is calculated as total debt divided by total equity as of the end of the period. |

| (c) |

Debt-to-capital ratio is calculated as total debt divided by the sum of total debt plus total equity as of the end of the period. |

| (d) |

Book value per share is calculated as total equity divided by total outstanding shares as of the end of the period. |

| (e) |

Includes independent research and development and Aerospace product-development costs. |

| (f) |

We believe free cash flow from operations is a useful measure for investors because it portrays our ability to generate cash from our businesses for purposes such as repaying maturing debt, funding business acquisitions, repurchasing our common stock and paying dividends. We use free cash flow from operations to assess the quality of our earnings and as a performance measure in evaluating management. The most directly comparable GAAP measure to free cash flow from operations is net cash provided by operating activities. |

| EXHIBIT F

BACKLOG - (UNAUDITED) DOLLARS IN MILLIONS |

||||||||||||||||||||

| Funded |

Unfunded |

Total Backlog |

Estimated Potential Contract Value* |

Total Potential Contract Value |

||||||||||||||||

| First Quarter 2016 |

||||||||||||||||||||

| Aerospace |

$ |

12,465 |

$ |

147 |

$ |

12,612 |

$ |

2,368 |

$ |

14,980 |

||||||||||

| Combat Systems |

18,260 |

565 |

18,825 |

4,959 |

23,784 |

|||||||||||||||

| Information Systems and Technology |

7,442 |

1,991 |

9,433 |

15,146 |

24,579 |

|||||||||||||||

| Marine Systems |

16,547 |

7,317 |

23,864 |

1,999 |

25,863 |

|||||||||||||||

| Total |

$ |

54,714 |

$ |

10,020 |

$ |

64,734 |

$ |

24,472 |

$ |

89,206 |

||||||||||

| Fourth Quarter 2015 |

||||||||||||||||||||

| Aerospace |

$ |

13,292 |

$ |

106 |

$ |

13,398 |

$ |

2,437 |

$ |

15,835 |

||||||||||

| Combat Systems |

18,398 |

597 |

18,995 |

5,059 |

24,054 |

|||||||||||||||

| Information Systems and Technology |

6,827 |

1,755 |

8,582 |

14,702 |

23,284 |

|||||||||||||||

| Marine Systems |

13,266 |

11,879 |

25,145 |

2,263 |

27,408 |

|||||||||||||||

| Total |

$ |

51,783 |

$ |

14,337 |

$ |

66,120 |

$ |

24,461 |

$ |

90,581 |

||||||||||

| First Quarter 2015 |

||||||||||||||||||||

| Aerospace |

$ |

12,947 |

$ |

147 |

$ |

13,094 |

$ |

2,699 |

$ |

15,793 |

||||||||||

| Combat Systems |

18,942 |

462 |

19,404 |

5,459 |

24,863 |

|||||||||||||||

| Information Systems and Technology |

6,842 |

1,815 |

8,657 |

15,296 |

23,953 |

|||||||||||||||

| Marine Systems |

17,248 |

12,138 |

29,386 |

2,143 |

31,529 |

|||||||||||||||

| Total |

$ |

55,979 |

$ |

14,562 |

$ |

70,541 |

$ |

25,597 |

$ |

96,138 |

||||||||||

| * |

The estimated potential contract value represents management's estimate of our future contract value under unfunded indefinite delivery, indefinite quantity (IDIQ) contracts and unexercised options associated with existing firm contracts, including options to purchase new aircraft and long-term agreements with fleet customers, as applicable. Because the value in the unfunded IDIQ arrangements is subject to the customer's future exercise of an indeterminate quantity of orders, we recognize these contracts in backlog only when they are funded. Unexercised options are recognized in backlog when the customer exercises the option and establishes a firm order. |

|||||||||||||||||||

| EXHIBIT G

FIRST QUARTER 2016 SIGNIFICANT ORDERS (UNAUDITED) DOLLARS IN MILLIONS |

We received the following significant orders during the first quarter of 2016:

Combat Systems

- $405 from the Swiss government to upgrade Duro tactical vehicles through 2022.

- $180 from the U.S. Army for spare parts and inventory management and support services for the Stryker family of vehicles.

- $60 from the Army to design, develop and produce eight prototype Stryker vehicles with an integrated 30-millimeter gun system.

Information Systems and Technology

- $310 for several space payloads.

- $170 for new hardware, software and equipment to upgrade the United Kingdom Ministry of Defence's Bowman tactical communication system.

- $160 from the Army for additional equipment for the Warfighter Information Network-Tactical (WIN-T) Increment 2 program.

- $155 from the National Geospatial-Intelligence Agency (NGA) to consolidate NGA's operations from six locations to one stand-alone location at New Campus East (NCE).

- $140 from the Army for ruggedized computing equipment under the CHS-4 program.

- $95 for combat and seaframe control systems on an Independence-variant Littoral Combat Ship (LCS) for the U.S. Navy.

Marine Systems

- $155 from the Navy for the planning and execution of depot-level maintenance, alterations and modifications to the USS Essex (LHD-2).

- $140 from the Navy for lead yard and design services for the Virginia-class submarine program.

- $80 from the Navy for Advanced Nuclear Plant Studies (ANPS) in support of the Ohio-class submarine replacement program.

| EXHIBIT H

AEROSPACE SUPPLEMENTAL DATA - (UNAUDITED) |

||||||

| First Quarter |

||||||

| 2016 |

2015 |

|||||

| Gulfstream Green Deliveries (units): |

||||||

| Large-cabin aircraft |

25 |

27 |

||||

| Mid-cabin aircraft |

6 |

7 |

||||

| Total |

31 |

34 |

||||

| Gulfstream Outfitted Deliveries (units): |

||||||

| Large-cabin aircraft |

19 |

25 |

||||

| Mid-cabin aircraft |

8 |

7 |

||||

| Total |

27 |

32 |

||||

| Pre-owned Deliveries (units): |

1 |

1 |

||||

Logo - http://photos.prnewswire.com/prnh/20140428/81320

SOURCE General Dynamics

Share this article