CHARLOTTE, N.C., May 29, 2018 /PRNewswire/ -- CompareCards by LendingTree today released the findings of its study on credit card fees that compared the fees of a representative sample of 200 credit cards that are in Americans' wallets. Although every card included in the study had at least one fee, there remains a wide variance among credit cards in the types of fees card issuers impose on customers. The representative sample of 200 cards approximates the card types and issuers of credit cards that Americans carry in 2018, according to data from The Nilson Report.

Credit card fees aren't as widespread as they were a decade ago thanks to the CARD Act of 2009, which limited what credit card lenders can and can't impose fees for, and for how much. However, the CompareCards report found that today's credit cards carry an average of 4.35 types of fees, ranging from as little as one single fee to as many as nine fees.

Highlights from CompareCards 2018 Credit Card Fee Report:

- Two cards — both no-frills credit cards from credit unions — had only a single fee. One card in the survey had as many as nine fees.

- Credit union-issued credit cards have 2.73 fees per card, lower than 4.48 fees for cards issued by banks.

- The most common fee levied by issuers is the late payment fee: 99.5 percent of cards impose this fee, averaging $36.02.

- The average balance transfer fee, among cards that allow them, is 3.46 percent.

- The average cash advance fee is 3.99 percent.

- Foreign transaction fees, overall, average 1.48 percent, including cards that have no fee. But if cards assess the fee, most of the time the fee is 3 percent of the purchase price.

- When compared with smaller credit card issuers, larger credit card issuers assess higher cash advance fees (4.11 percent, versus 3.86 percent) and balance transfers fees (3.49 percent versus 3.42 percent), on average.

- However, average foreign transaction fees are lower at larger credit card issuers (1.22 percent, versus 1.76 percent at smaller issuers).

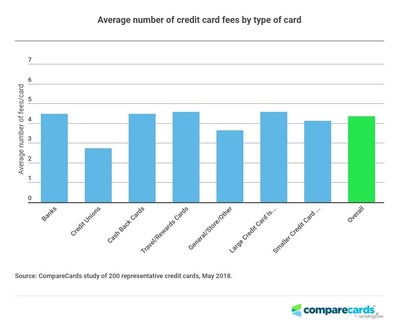

Average number of fees by card category

The average number of fees per card in 2018 was 4.35 fees per card. Credit unions had significantly fewer fees than the other credit card categories examined, with 2.73 fees per card. At the other end of the spectrum, rewards cards and cards from the larger issuers had 4.57 fees per card, on average.

Fee prevalence by type of fee

The most common fee among the 200 cards in the 2018 study was a late payment fee: 99.5 percent of cards imposed this fee. The least common fee found was a credit limit increase fee. Authorized user fees were nearly as scarce: Only nine cards out of 200 charge a fee to add an additional authorized user.

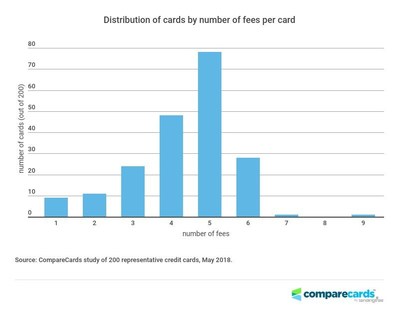

Average number of fees per card

While the cards in the study averaged 4.35 fees per card, fees per individual card varied significantly: Some had as few as one fee to as many as nine fees, as of May 2018. The most common number of fees was five — 39 percent of the cards had that amount. Two cards, both from credit unions, only had one fee, and one card had at least nine fees listed in the terms and conditions.

The credit cards with fewer or less costly fees

Credit unions vs. banks

Fifteen credit cards represented credit unions in the study, and those were compared with the 185 banks.

Credit union credit cards typically had the better fee-related bargains in most categories. The near-universal late payment fees are significantly lower at credit unions, averaging about $23 per occurrence. That's significantly less than the near maximum of $37 banks charge their customers. Fees for certain types of transactions — like balance transfers, foreign transactions and cash advances — were also lower than those charged by banks.

While the relatively low fees on credit union cards are nice, they come with a trade-off. More often than not, credit cards issued by credit unions tend to be no-frills cards that do the basics well, but they don't offer cash back or travel rewards on purchases.

Cashback vs. rewards cards

The comparison between these two popular types of credit cards was a little more interesting. Travel and rewards-based credit cards (which give users points and miles for future flights and purchases based on card use) performed better in areas you might expect, such as offering lower foreign transaction fees.

Rewards cards, somewhat surprisingly, were also a slightly better bargain when it comes to cash advance fees. The average 4.07 percent cash-advance fee is still hefty, but less than those of general purpose credit cards and those from banks in general.

Cashback cards (which typically give users cash rebates or statement credits), offer much more modest annual fees. The average cashback card only charges $8.52, but more than half in our study don't charge an annual fee at all.

"Fees are the second largest cost that cardholders incur, after interest assessed on balances," said Brian Karimzad, VP of Research at CompareCards. "Even one late fee per year can significantly erode any benefit a user might receive from a cashback or travel rewards card."

Karimzad continued, "Although the number of fees that cardholders can potentially face has fallen in recent years, the fee amounts remain elevated, and in some cases are increasing. The average late fee of the 200 cards in our study, $37.06, is close to the $38 maximum currently permitted by the CARD Act, and balance transfer fees average 3.46 percent. By comparing terms among credit cards you may be able to find one with a lower balance transfer fee, or an introductory 0% offer, instead of using an existing card."

To view the full study, visit: http://www.comparecards.com/blog/credit-card-fee-study/.

Methodology

CompareCards examined the terms and conditions pages for 200 credit cards available to U.S. consumers in May 2018. The representative sample of 200 cards approximates the types and issuers of credit cards that Americans carry in 2018, according to data from The Nilson Report.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation's leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

About CompareCards:

CompareCards' mission is to help people make smarter, more informed, healthier financial decisions based on deeper knowledge of financial offers. Each month, over 2.9 million visitors come to CompareCards' website to independently compare credit cards side-by-side and choose a credit card based on interest rate, reward benefit, cost savings, and other factors that are important to each person. CompareCards provides easy-to-use, objective tools and educational resources that help people do everything from making credit card comparisons to managing their credit health. For more information, please visit www.comparecards.com.

MEDIA CONTACT:

Megan Greuling

704-943-8208

[email protected]

SOURCE CompareCards

Share this article