Cheetah Mobile Responds to Recent Allegations

Cheetah Mobile Reiterates its Third Quarter 2017 Total Revenue Guidance

BEIJING, Oct. 27, 2017 /PRNewswire/ -- Cheetah Mobile Inc. (NYSE: CMCM) ("Cheetah Mobile" or the "Company"), a leading mobile internet company that aims to provide leading apps for mobile users worldwide and connect users with personalized content on the mobile platform, today responded to the allegations raised in a short seller's report dated October 26, 2017.

Cheetah Mobile believes these allegations are unfounded and contain numerous errors, unsupported speculation, and a general misunderstanding of the industry and the Company's business model. The Company stands by its publicly reported financial results and its public disclosures regarding the Company's business. The Company has informed its board of directors and its independent auditors of the report, and will conduct a review of the allegations as appropriate. Today the Company would like to clarify certain key errors in the report.

Allegations Regarding Live.me:

i) Comparison with YouNow

The allegations question Live.me's revenue based on comparison with YouNow. As Live.me is well ahead of YouNow on metrics such as user downloads and total grossing ranking according to publicly available data. It is not meaningful to compare the revenue of Live.me and YouNow.

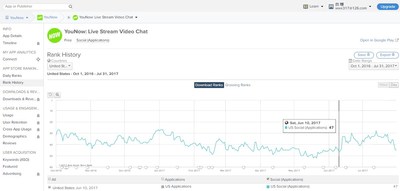

Live.me and YouNow's Download Rankings on Google Play

Live.me was among the top 10 social apps in the U.S. on Google Play in terms of user downloads V.S. YouNow among the top 50.

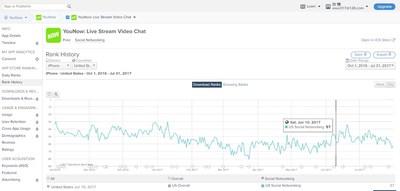

Live.me and YouNow's Download Rankings on Apple's App Store

Live.me was among the top 35 social apps in the U.S. on Apple's App Store in terms of user downloads V.S. YouNow among the top 66.

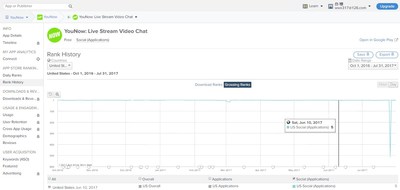

Live.me and YouNow's Gross Rankings on Google Play

Live.me remained the No. 1 grossing social app in the U.S. on Google Play V.S. YouNow among the top 25.

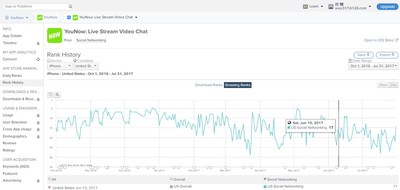

Live.me and YouNow's Gross Rankings on Apple's App Store

Live.me was among the top 5 grossing social apps in the U.S. on Apple's App Store V.S. YouNow among the top 30.

In addition, Live.me is materially different from YouNow in several key aspects of its business model. For example, Live.me has significantly more mobile users than YouNow, who exhibit fundamentally different behaviors than PC users. Also, through a so-called "Back to Coin" feature, a broadcaster can convert virtual gifts he or she receives into coins and give them to his or her followers and other broadcasters and users. It is an effective mechanism to transform virtual gifts into a social currency to foster a vibrant and healthy social environment on the platform.

ii) Users and broadcasters' spending pattern

The allegations used incorrect methods to estimate the cost of coins and so arrived at the wrong conclusion that top broadcasters gave away more than they received. They also questioned the spending patterns of viewers and broadcasters, which shows a fundamental lack of understanding of the live broadcasting industry and Live.me in particular. Live broadcasting with virtual gifting is a relatively new phenomenon, which first became very popular in Asia only in the last couple of years. Many users are willing to spend significant amount of time and money to enjoy these types of interactions they otherwise may never be able to experience. Live.me is one of the pioneers that started this business model in the U.S. and has enriched the lives of many people.

In addition, many broadcasters are themselves viewers of other broadcasters and thus are willing to send virtual gifts to others. Based on the Company's data, about 80% of users on the Live.me platform shared virtual gifts they received with other users on the platform.

iii) Broadcasters' followers

The allegations suggest that top earning broadcasters are fake because they don't have many followers on mainstream social platforms. This actually is a unique feature of Live.me because it has cultivated a significant number of home-grown online celebrities who were not online celebrities already popular on other social platforms. Many unknown ordinary people have become extraordinary online stars on Live.me and their experiences are quite inspirational. For example, one of the Company's broadcasters in the U.S. was a solider. After returning to the U.S. from overseas deployment, he lost an arm in a traffic accident. Yet, he didn't give up on life. He became a live broadcaster on Live.me and gained significant popularity. His life story inspires many fans to take on life's challenges with a positive attitude.

iv) User account

The allegations also suggest that many of the company's users are fake because their user names are similar. This can be a mixed result. On the one hand, it is common for many online users to have user names similar to well-known figures or certain popular phrases. For example, there are about 60 accounts having name similar to singer Taylor Swift on Twitter based on a quick search. On the other hand, there might be "fake accounts" on the platform created by illegitimate users. Fake accounts are a problem across social networks (e.g. Facebook, Twitter), and Live.me is committed to fighting account fraud. The Live.me team is actively building machine learning content moderation tools to detect and combat fraud.

Allegations Regarding Utility Products:

i) User Data

The Company stands by its previously disclosed user MAUs. While there has been certain decline in the MAUs of Clean Master and Security Master since early 2015, the Company has launched a series of new casual games since late 2015, and these casual games reached around 100 million MAUs in the end of the second quarter of 2017. The Company's other utility products such as CM Launcher and Cheetah Keyboard also have gained significant growth in user base. For example, CM Launcher has remained one of the top 3 personalized apps in the U.S. on Google Play since May 2017 according to App Annie. The allegations estimate of the Company's total MAUs based on incomplete information relating to just a subset of the Company's many products is entirely misleading. In addition, users often have multiple Cheetah Mobile products installed in a single phone and such users will be counted only once in deriving the Company's overall MAUs. Thus, the loss of a user in one product may not reduce the MAUs accordingly.

ii) Facebook effect

It is true that in 2015, Facebook was the main third-party advertising platform which contributed to most of the Company's overseas revenues for utility products. While revenue contribution from Facebook decreased over the last two years, the Company remains a significant business partner of Facebook and is one of the largest distributors of Facebook in the China market. In addition, the Company has diversified its revenues sources and it is working with multiple advertising networks including Google Admob, Twitter, Yahoo and other Ad exchanges. Facebook only contributed to 22% of the Company's mobile utility revenues in the second quarter of 2017.

iii) Sales team

The allegations question the revenues of the Company's utility products and services because of the departure of certain sales people. This also reflects a fundamental misunderstanding of the Company's business. The Company's direct sales team that sources advertisers only contributed a small portion of the revenues for utilities products, while the majority of such revenues are directly from third party advertising networks such as Facebook and Google Admob, which do not require the significant involvement of a sales team.

iv) Utility products' usefulness

The allegations claimed that the Company's utility products are "useless". On the contrary, the Company's core utility products Clean Master and Security Master received 4.7 scores in Google Play with more than 40 million and 24 million users respectively participating in the review. In addition, the Company's junk file cleaning functions have been embedded in mainstream mobile phones such as Samsung and Xiaomi models to provide file cleaning services. Cheetah Mobile Security Master (4.2) received the best antivirus software for Android award according to an AV-TEST Product Review and Certification Report – Sep/2017. That report can be accessed at https://www.av-test.org/en/antivirus/mobile-devices/android/september-2017/cheetah-mobile-security-master-4.2-173506.

Allegations Regarding Cheetah Mobile's Other Financial Matters

i) Cash Balance

The Company stands by its previous disclosure that as of June 30, 2017, the Company had cash and cash equivalents, restricted cash and short-term investments of RMB2,383.3 million (US$351.5 million). The Company maintained strict internal control procedures. The Company regularly reconciles cash and cash equivalents and time deposits with its bank statements and documented the bank statements and reconciliation reports every month. The Company received unqualified opinions regarding its internal control over its financial reporting as of the years ended December 31, 2015 and 2016, respectively, from its independent auditor. Further information regarding the Company's interest income and expenses are provided below.

Interest Income, net

Interest income and interest expense are netted and disclosed as "Interest income, net" in the Company's financial statements.

| Year Ended December 31, |

|||||||||

| 2014 |

2015 |

2016 |

|||||||

| RMB |

RMB |

RMB |

US$ |

||||||

| Interest income |

28,221 |

15,097 |

15,675 |

2,258 |

|||||

| Interest expense |

- |

(547) |

(7,892) |

(1,137) |

|||||

| Interest income, net |

28,221 |

14,550 |

7,783 |

1,121 |

|||||

Interest income fluctuation

The interest income for the second quarter of 2017 was RMB6.89 million, and decreased by 29% compared to the interest income of RMB9.68 million for the fourth quarter of 2014, which mainly reflects the combination of an increased amount of cash bank balances and the significant decrease in deposit interest rates for RMB and USD accounts.

| CMCM Reported Cash Balance vs Interest Income |

|||

| As of |

|||

| 31-Dec-14 |

30-Jun-17 |

||

| RMB |

RMB |

||

| (in thousands) |

|||

| Cash and cash equivalents |

1,115,738 |

1,848,638 |

|

| Time deposits recorded in short-term investments |

428,330 |

440,472 |

|

| Total cash and bank balance |

1,544,068 |

2,289,110 |

|

| % inc/(dec) |

48% |

||

| For The Three Months Ended |

|||

| 31-Dec-14 |

30-Jun-17 |

||

| RMB |

RMB |

||

| (in thousands) |

|||

| Interest income, net |

9,678 |

3,380 |

|

| - Interest expense |

- |

(3,517) |

|

| - Interest income |

9,678 |

6,897 |

|

| % inc/(dec) |

-29% |

||

ii) Capital Expenditure

The Company is an asset light company. It has moved away from buying and utilizing its own servers and almost all of the Company's apps are deployed in cloud systems such as Amazon Web Services. The Company incurred significant costs for these cloud services, bandwidth and internet data center expenses. All of these expenses are included in the cost of revenues, which amounted to RMB1,543.8 million (US$222.4 million) in 2016.

iii) Share-based compensation expenses

A number of factors contributed to a decrease in share-based compensation in recent quarters. The Company granted a significant number of equity awards in 2014 and 2015. It has elected to recognize share-based compensation using the accelerated method for all equity awards granted with graded vesting. The Company has not granted similar equity awards in subsequent years, and the Company's share prices have been in a downward trend. As a result, the Company's share-based compensation expenses are more front loaded during the previous several years.

iv) Debt

The allegations question why the Company still has about $70 million debt while its cash balance is growing. There is nothing unusual about this, as the Company has multiple units operating across several countries. It is common practice to maintain a banking relationship with multiple financial institutions for better liquidity management.

Allegations Regarding OrionStar Investment:

The allegations claim that the OrionStar investment is a vehicle for the misappropriation of shareholder capital. Because the transaction is considered a related-party transaction, the Company has followed strict procedures to ensure the fairness of the investment. Each of the Company and Kingsoft Corporation, the parent company of Cheetah Mobile, engaged an independent appraiser to evaluate the transaction and the audit committee of the Company has approved the transaction as well. Several external investors also invested in OrionStar at the same valuation.

Allegations Regarding Management Departure and Selling Shares:

The allegations cast the departure of Mr. Ka Wai Andy Yeung, the Company's former CFO, as a red flag indicating the Company is in difficulty. Mr. Yeung is a well-respected U.S. trained professional. Before his departure in March 2017 for another business opportunity, he has been with the Company for nearly three years. The current CFO, Mr. Vincent Zhenyu Jiang, joined the Company in April 2017, he is a CFA charter holder and also an attorney registered in the State of New York, and previously worked at the prestigious Wall Street law firm Skadden, Arps, Slate, Meagher & Flom LLP.

Cheetah Mobile reiterates its third quarter financial forecast of total revenues to be between RMB1,150 million (US$170 million) and RMB1,210 million (US$178 million), representing a year-over-year increase of 2% to 7%.

About Cheetah Mobile Inc.

Cheetah Mobile is a leading mobile internet company. It aims to provide leading apps for mobile users worldwide and connect users with personalized content on the mobile platform. Cheetah Mobile's products, including its popular utility applications Clean Master, Security Master and Battery Doctor, help make users' mobile internet experience smarter, speedier, and safer. Leveraging the success of its utility applications, Cheetah Mobile has launched its line of mobile content-driven applications, including News Republic and Live.me.

Cheetah Mobile provides its advertising customers, which include direct advertisers and mobile advertising networks through which advertisers place their advertisements, with direct access to highly targeted mobile users and global promotional channels, which are capable of delivering targeted content to hundreds of millions of users.

Safe Harbor Statement

This press release contains forward-looking statements. These statements, including management quotes and business outlook, constitute forward-looking statements under the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Such statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in the forward-looking statements, including but are not limited to the following: Cheetah Mobile's growth strategies; Cheetah Mobile's ability to retain and increase its user base and expand its product and service offerings; Cheetah Mobile's ability to monetize its platform; Cheetah Mobile's future business development, financial condition and results of operations; competition with companies in a number of industries including internet companies that provide online marketing services and internet value-added services; expected changes in Cheetah Mobile's revenues and certain cost or expense items; and general economic and business condition globally and in China. Further information regarding these and other risks is included in Cheetah Mobile's filings with the U.S. Securities and Exchange Commission. Cheetah Mobile does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under applicable law.

Investor Relations Contact

Cheetah Mobile Inc.

Helen Jing Zhu

Tel: +86 10 6292 7779 ext. 1600

Email: [email protected]

ICR, Inc.

Xueli Song

Tel: +1 (646) 417-5395

Email: [email protected]

SOURCE Cheetah Mobile

Share this article