Brand growth slows finds Interbrand's Best Global Brands Report 2023

- Total table value grew by 5.7% this year compared to 16% growth in value last year

- Interbrand cites lack of growth mindset, conservative brand leadership and uncertain forecasting behind the slowdown

- Companies that operate across multiple sectors continue to dominate the top of the table – making up 50% of the total value. Data shows a stronger focus on brand enables these companies to unlock rapid growth vs. the competition

- Airbnb (#46) fastest riser in value (+21.8%) despite only entering the table last year

- Apple remains the #1 brand for the 11th year in a row. It is the first brand to rise above half a trillion USD in brand value

- Strongest performing sectors are automotive and luxury with sector value rising 9% and 6.5% respectively. BMW (#10) entered the top 10 for the first time, with Porsche (#47) Hyundai (#32) and Ferrari (#70) also performing well

- Top 10 highest brand value riser is Microsoft (+14%)

- Zara (#43) and Sephora (#97) two retail stars of the table with brand value rising 10% and 15% respectively

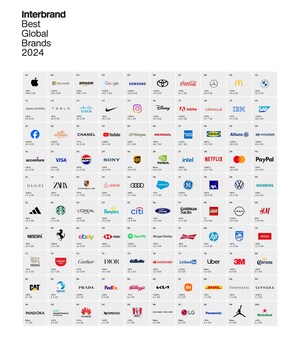

NEW YORK, Nov. 21, 2023 /PRNewswire/ -- Interbrand has launched its Best Global Brands 2023 ranking, revealing many of the world's top 100 brands are in a state of stagnation. The rate of growth in the overall brand value of the table slowed sharply after last year's significant increase - rising 5.7% this year compared to last year's 16% increase, taking the total brand value to $3.3 trillion ($3.1 trillion in 2022).

Interbrand cites lack of growth mindset, weaker brand leadership and poor forecasting were behind the slow down. This follows a longer-term trend in which brands operating exclusively in one sector, taking an incremental approach, have experienced slower brand value growth.

Gonzalo Brujó, Global CEO of Interbrand, said: "After a few years of strong brand growth, we have entered a period of stagnation, with this year's table showing moderate growth in overall brand value.

"Businesses which have witnessed a rise in brand value, including Airbnb (#46), LEGO (#59) and Nike (#9) have all transcended their established category norms and play a more significant and meaningful role in society and consumer's lives.

"As we continue to navigate economic and environmental headwinds, there is a need for improved business cases and better brand management, to drive future investment and sustain growth, within traditional sectors and beyond. Those who can successfully leverage their brand into new consumer pools of potential will reap the rewards of strong brand growth."

More than two decades of analysis shows companies that address a more diverse set of customer needs, often across sectors, continue to dominate the top of the table - making up almost 50% of the total value. Based on the data, these companies operating across several different verticals are more stable[1], achieve higher top line growth[2], are more profitable[3], and benefit from a greater growth of brand value[4]. For these companies, a focus on brand rather than product plays a greater role in driving choice (+12% vs average), meaning they are able to address more customer needs, within and across categories.

Manfredi Ricca, Global Chief Strategy Officer, Interbrand said: "A brand like Apple, can no longer be ascribed to a sector. It competes across different Arenas, helping its customers Connect (the iPhone), but also Thrive (the latest Apple watch was positioned as a health device), Fund (its new savings account drew nearly $1 billion in deposits in the first four days), and much more. Apple's move across Arenas has enabled it to hold the BGB top spot for the 11th year, having overtaken Coca Cola in 2013."

[1] +81.5% Revenue CAGR vs. the average, 2018-2022

[2] +43.8% revenue growth estimates vs. average

[3] +33.7% EBIT growth estimates vs. average

[4] +4.8pp Brand Value growth vs. average

Kathleen Hall, Chief Brand Officer, Microsoft, said: "We are honored to be recognized for continued strong growth in the Best Global Brands ranking this year. The combination of brand perception and financial performance is a great indicator of brand health and relevance and one we value tremendously. With our acquisition of Activision Blizzard, our prominent leadership position in AI, and our continued commitment to make a positive impact on society, we aspire to be a brand people can trust and build a responsible future with."

Other key findings

Top riser

Airbnb is this year's top rising brand with its value increasing +21.8%. It also jumped 8 places in the table (from #54 to #46) despite only entering the ranking last year. The brand's significant increase in value is in part due to its strong investment in brand and solid financial outlook - revenue was up 40% in 2022 vs 2021 and is expected to rise an additional 13% in 2023 vs 2022.

Automotive and luxury witness strongest growth

Automotive brand value rose by 9% in 2023, with BMW (#10) entering the top ten for the first time (#10). Porsche (#47) Hyundai (#32) and Ferrari (#70) all achieved a double-digit rate of growth and accounted for three of the top five fastest-growing brands.

Tesla held its position in the table this year (#12),but its rate of growth was the slowest among the automotive brands with its brand value increasing 4.0% compared to BMW and Mercedes which grew 10.4% and 9.5% respectively.

Luxury is once again a top performing sector with its brand value rising by 6.5% this year. This is due to luxury brands' resilience and ability to transcend categories to create luxury experiences such as restaurants, hotels and retail pop ups.

Hermès (#23) and Dior (#76) are two of the biggest luxury brand risers with 10.2% and 8.4% growth in brand value respectively this year.

For the complete Top 100 ranking and report with industry trends and the full methodology, visit www.bestglobalbrands.com.

For more information, please contact:

Jess Alexander: [email protected]

[email protected]

+44 7795 533229

Infographic - https://mma.prnewswire.com/media/2275522/Interbrand_BGB_2023_Infographic.jpg

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article