Automotive Inventory Data and Sales Forecasts January 2022

GRAND RAPIDS, Mich., Jan. 26, 2022 /PRNewswire/ -- The ZeroSum Market First Report is the automotive industry's first source to predict month-end vehicle movement, providing vital supply and demand trend data to automotive marketers and dealers. ZeroSum uses predictive modeling to accurately estimate new vehicle inventory, pricing trends, and market share.

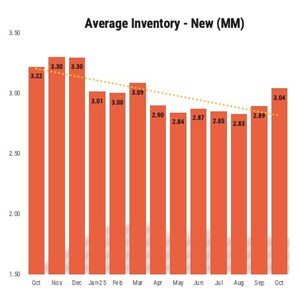

New Vehicle Inventory

Dealers started 2022 in a stronger inventory position than December, however, new inventory is not being added to lots fast enough to replace current demand, and inventory shortages may remain a factor in 2022 (See Figure 1). January began with 13% more new vehicles on the ground than December, representing the third consecutive month of inventory growth, an increase of 116,978 units available for sale. Toyota showed the strongest gains in available inventory, up 24% month over month, with Jeep, Hyundai and Nissan showing strong month over month gains. Inventory levels remain significantly lower than last year, with year over year inventory in January down 62% compared to 2021, a decrease of over 1.6 million units. Additionally, week-over-week inventory trends show January inventory levels declining since the start of month.

Inventory Movement

ZeroSum's MarketAI platform tracks inventory as it leaves dealers' lots in order to predict monthly sales outcomes. January is forecasted to finish 8% below December in total new units sold. Toyota and Jeep are poised to make the biggest month-over-month sales gains, aligning with their inventory position, while Ford and Chevrolet are poised for month-over-month decreases. Additionally, MarketAI tracks vehicles added to dealers' inventory, to predict manufacturer production and overall inventory supply. 17% fewer vehicles were added to dealers' inventory in January than December, with every major OEM showing month-over-month decreases in inventory added to dealers' lots. This overall decrease suggests that manufacturers will struggle to provide enough inventory to keep pace with demand in 2022, continuing trends from 2021(See Figure 2). By combining inventory moved and inventory added, MarketAI also tracks turn rates of new inventory across the industry. The average turn rate of new inventory was 88% in January, a decrease from December's record high.

Automotive Pricing Trends

New vehicle prices have steadily risen as inventory levels have decreased. The average MSRP of a new vehicle is down 1% in January compared to last month, likely due to seasonal trends and increased inventory at start of month. MSRP remains up 16% over last year. The gap between MSRP and retail list prices has disappeared, whereas the average retail price was over 6% less than MSRP a year ago. Prices on used inventory continue to increase, up 2% month over month and up 38% year-over-year, as constraints on new inventory drive used prices upwards. (See Figure 3).

About ZeroSum Market First Report

ZeroSum's Market First Report is based on ZeroSum's retail vehicle movement and pricing indices, powered by real-time data gathered using ZeroSum's data-driven marketing platform MarketAI. The platform brings together vast amount of data, including all available light vehicle inventory in the U.S., to help improve marketing performance. MarketAI allows dealers to analyze their market in real-time, using sales conversion rates, market turn rates, days' supply, and competitive inventory.

About ZeroSum

ZeroSum is a leader in software, marketing, and data. Powered by its SaaS platform, MarketAI, ZeroSum is simplifying and modernizing automotive marketing by leveraging artificial intelligence, data, and scaling ability to acquire new customers. ZeroSum is the first and only company that matches consumer demand with automotive data in real time. For more information, visit zerosum.ai.

CONTACT: Leslie Dagg, [email protected], 313-300-0782

SOURCE ZeroSum

Share this article