Alliance Data Launches IntelApply(SM), A Customer-Initiated Prequalification Capability for Retail Private Label Credit Cards

-Signet Jewelers first to launch IntelApply this October

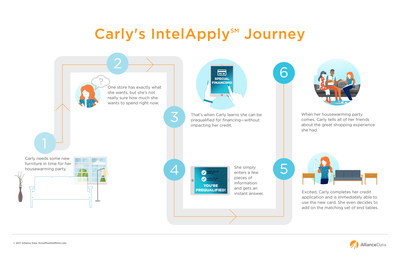

-New capability for retailers provides customers a way to learn if they qualify for credit before applying

-For retailers, easy-to-implement capability extends brands' reach to credit-worthy customers by approximately 20 percent and allows for incremental large purchases

COLUMBUS, Ohio, Nov. 2, 2017 /PRNewswire/ -- Alliance Data's card services business today announced the launch of its new credit card prequalification capability, IntelApplySM. Ideal for major consumer purchases like jewelry, furniture, and bridal wear, IntelApply gives shoppers confidence to apply for store credit. IntelApply allows brands to increase the purchase power for up to 20 percent more customers by reaching more credit applicants, including those who have previously opted out of credit pre-screens. IntelApply is a leader in offering prequalification for retailers' private label credit programs.

Alliance Data has partnered with Signet Jewelers (NYSE: SIG), the largest specialty jewelry retailer in the U.S., to launch IntelApply.

Easy for Brands, Easy for Shoppers

IntelApply allows shoppers to know if they will be approved for a store-branded credit card, without impacting their credit score. The customer simply provides minimal information to learn if they are qualified. If the customer chooses to apply, upon final approval, the new account is immediately available to use for purchases.

"Major consumer purchases typically have a longer shopping path to purchase. When customers are confident in their financing options, they accelerate their buying decision. IntelApply is simple and helps brands give their customers a seamless way to pursue a store-branded credit solution as they shop for the things they love most," said Sheryl McKenzie, vice president of product and capabilities for Alliance Data's card services business. "IntelApply demonstrates Alliance Data's commitment to providing the capabilities our brand partners need to reach their customers with the right solutions in the moments that matter."

IntelApply is easy for retailers to implement for immediate results. Brands can quickly launch the capability in-store through sales associate tablets. They can also opt for integration into their point-of-sale systems and e-commerce sites. IntelApply allows brands the option to not only show if a customer prequalifies for credit, but also their expected credit limit before applying. When customers have a preview of their projected credit line, they not only accelerate their buying decision, they are likely to spend more.

About Alliance Data's card services business

Alliance Data's card services business is a leading provider of tailored marketing and loyalty solutions, delivered through branded credit programs that drive more profitable relationships between our brand partners and their cardmembers. We offer private label, co-brand, and business card products to many of the world's most recognizable brands across a multitude of channels.

We uphold our Know more. Sell more.® promise by leveraging unmatched customer insights, advanced analytics, and broad-reaching innovative capabilities. It's how we deliver increased sales to our partners, build enduring loyalty to their brands, and provide more value to our cardmembers. Alliance Data's card services business is a proud part of the Alliance Data enterprise. To learn more, visit www.knowmoresellmore.com or follow us on Twitter @Know_SellMore.

SOURCE Alliance Data Card Services

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article