AMARILLO, Texas, July 18, 2017 /PRNewswire/ -- It can be a challenging task attempting to gauge the vitality of the US upstream A&D market by tallying the number and frequency of billion-dollar plus deals announced. For many in the industry, as well as investors watching from the sidelines, extremely large transactions serve as the primary indicators to gauge the mood of the macro A&D climate. That view is not necessarily wrong, but it's not universally right, either.

A robust and vibrant acquisitions and divestiture market is a better indicator of the optimism in the industry. If the majority of market participants have a pessimistic outlook, fewer and fewer deals transact. Fortunately, private equity-sponsored companies and teams deployed significant capital and made a large number of acquisitions during the 2014 to 2016 downturn. The PE teams aggressively acquired assets to build positions that were spun out to the market by larger entities. If private equity had not been there, it would have been a much scarier downturn because there would have been few buyers.

If EnergyNet's marketplace can substitute as a proxy or microcosm for the entire spectrum of deal volume and transaction size, then the US A&D market is vibrant and healthy.

EnergyNet is an upstream oil and gas acquisition and divestment transaction advisory firm that specializes in helping its clients divest oil and gas properties that are valued between <$100K and $100MM+. Thousands of sub-$100MM individual transactions across every US Basin transact annually.

Producing and non-producing assets that are changing hands down the food chain, up the food chain and across the food chain are a sure sign of a healthy industry. Larger E&P companies rationalize their portfolios and trade lower impact assets in their inventory to smaller companies that optimize production, lower operating expenses and unlock value. Smaller E&P companies lease up acreage, prove up the acreage by drilling wells, then sell to larger E&P companies that have the risk-tolerance and financial wherewithal to implement the manufacturing process.

The drivers and motivations for choosing to divest assets has changed considerably since companies stared into the abyss during the most recent downturn. In headier commodity price environments, there was an ongoing debate in E&P board rooms and with A&D management teams on why to divest cash-flow generating assets. Now after the tide went out in 2014-2016, E&P management teams keep an eagle-eye on their operating costs, P&A liabilities, and determining the best use of the capital. The idea that some assets don't fit within the current strategy at $100 oil or $20 oil is taking hold. If it doesn't meet a company's return on investment thresholds, they are selling the assets and using the cash to accelerate their high-impact asset development. Fortunately, there are tons of eager buyers out there ready to acquire the assets. The food chain in our industry is extremely long and nuanced. Not everyone chooses to focus on the Delaware, Midland or Western Anadarko (SCOOP/STACK) basins; smart E&P companies are making it work from East Texas to Kansas to California to conventional Appalachia. Companies today are much less opportunistic when it comes to A&D; they have a unique, laser-focused strategy to execute.

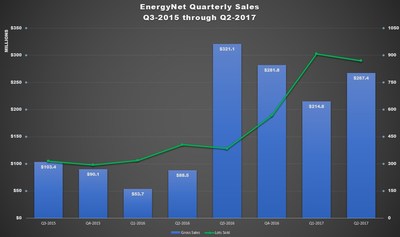

"Sellers are having success closing with EnergyNet buyers, and there is no shortage of acquisitive buyers looking for investment opportunities" stated William Britain, Chairman of EnergyNet. In the first six months of 2017, EnergyNet has facilitated $498 million in property divestments for its clients, approaching a 250% increase over 2016. See Exhibit A.

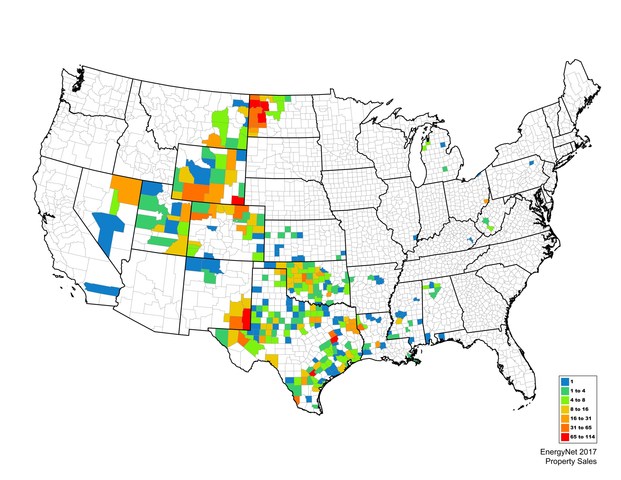

EnergyNet's on-line, continuous marketplace featuring: transparent bid auctions, rapid cycle sealed bids and government lease sales, works well for busy buyers and sellers who would prefer to manage their A&D workflow on their own terms and timetables. EnergyNet has closed 652 deals in nearly every US Basin so far in 2017. See Exhibit B. The upstream A&D market is much more liquid, streamlined and convenient than it was five to ten years ago.

Industry Sellers using EnergyNet's platform and marketing services in the first six months of 2017 include Chevron U.S.A, Inc., Marathon Oil Company, QEP Resources, Shell Offshore, Murphy Oil, Halcon, Jones Energy, Hilcorp Energy, Sandridge, BXP Partners, Apache, Castleton Commodities International, Samson Oil & Gas, Grenadier Energy, ConocoPhillips, Jones Energy, Kaiser-Francis, Staghorn, Monadnock, Merit Energy BP L48, Anadarko Petroleum, EnerVest, EOG Resources, Sabine Oil & Gas, Chaparral and many others.

EnergyNet's sealed bid and online auction marketing allows companies selling assets to expose their offering to a marketplace of 20,000+ qualified buyers and conduct a structured, fair, competitive sales process in a timely and efficient way.

EnergyNet has built a reliable, consistent, proven track record with its clients over the past 18 years and those successful sales have earned them the trust of the industry enabling the firm to facilitate larger and larger asset sales. The firm has successfully closed a dozen individual transactions valued between $25MM and $100MM in the past 12 months. These deals had varying characteristics: unconventional as well as conventional packages, operationally-complex as well as non-ops, primarily PDP as well as primarily acreage with significant PUD value.

"Buyers ranging from Large Publicly Traded E&P's as well as Private Equity Sponsored teams have been active through the EnergyNet marketplace in 2017," said Ryan Dobbs, VP Business Development, Rockies. "Closing 1,000 plus individual transactions annually in every U.S. Basin provides us with unique perspectives, drivers and motivations of the market. We engage the buying community of the marketplace daily from communicating the availability of assets on the market through negotiation and closing. At our fingertips, we have a real-time pulse of the market. We have current, relevant, first-hand knowledge about the market and that is powerful information with regard to aligning Buyers and Sellers expectations and successfully closing deals."

"Government agencies have transitioned to online marketing of their oil and gas leases for the increased exposure and better values received," per John Munroe, V.P. of Govt. Lease Sales. EnergyNet now has contracts with eight government agencies to market their oil and gas leases and other minerals using on-line auctions and sealed bid platforms. These include the Bureau of Land Management, States of North Dakota, Colorado, Wyoming, Utah, New Mexico, Texas General Land Office, and Texas University Lands.

"We intend to relentlessly focus on exceeding the expectations of our buying and selling clients. The EnergyNet divestment platform is widely used by the industry now, but we feel the potential for facilitating larger, more complex, higher-valued deals is just now beginning," states Chris Atherton, President of EnergyNet.com, Inc.

2017 is proving to be a busy year for exploration and production companies divesting oil and gas fields, as well as leasehold and other assets to raise capital and optimize their portfolios. Currently there are 2,103 properties in 17 states available for buyer review, evaluation and screening. New oil and gas properties are arriving daily.

For more information contact:

EnergyNet.com, Inc.

Phone: (832) 654-6612

Email: [email protected]

SOURCE EnergyNet.com

Share this article