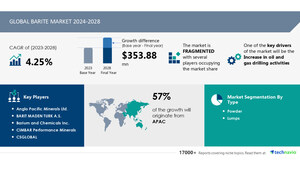

NEW YORK, July 4, 2022 /PRNewswire/ -- The "Tiny Homes Market by Product (Mobile tiny homes and Stationary tiny homes) and Geography (North America, Europe, APAC, South America, and the Middle East and Africa) - Forecast and Analysis 2022-2026" report has been added to Technavio's offering. With ISO 9001:2015 certification, Technavio is proudly partnering with more than 100 Fortune 500 companies for over 16 years. The tiny homes market share is expected to increase by USD 3.57 billion from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 4.45%. Technavio categorizes the tiny homes market as a part of the homebuilding market within the overall global household durables industry. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the tiny homes market during the forecast period.

Tiny Homes Market: Segmentation Analysis

The tiny homes market report is segmented by Product (Mobile tiny homes and Stationary tiny homes) and Geography (North America, Europe, APAC, South America, and the Middle East and Africa).

- Revenue Generating Segment: The tiny homes market share growth in the mobile tiny homes segment will be significant for revenue generation.

- Regional Analysis: 59% of the market's growth will originate from North America during the forecast period. US and Canada are the key markets for tiny homes in North America

For additional insights into the contribution of all the segments - Grab a sample now!

Tiny Homes Market: Key Market Dynamics

- Market Driver - The key factor driving growth in the tiny homes market is its affordability by the mass section of the population. Tiny homes are recognized as the most affordable housing system, preferred especially by millennials. Tiny homes are just a fraction of the price of traditional homes and can be designed based on customers' requirements. These homes can be purchased at a comparatively lower price than conventional site-built homes. The average price of a tiny home ranges from $10,000 to $30,000. Any price variation can be attributed to factors such as design and structure. The high cost of constructing a conventional home exerts financial strains on the buyer.

- Market Challenges - The limited demand from developing economies will be a major challenge for the tiny homes market during the forecast period. Tiny homes have a high demand in developed economies such as the US, while the adoption and purchase of such homes are limited in developing economies. People in developing countries have limited knowledge and awareness about the availability of such homes and prefer to buy conventional homes. The lack of presence of major vendors, coupled with the low preference of consumers to purchase such homes, acts as a major challenge for the market. Vendors find it difficult to penetrate the developing markets of APAC and Eastern Europe due to their limited knowledge about product offerings and technologies.

To learn about additional key drivers, trends, and challenges - Request a Sample Report right now!

Tiny Homes Market: Vendor Analysis

The tiny homes market is fragmented and the vendors are deploying growth strategies such as pricing and marketing strategies to retain their existing market shares and seize new market opportunities to compete in the market.

- American Tiny House

- Aussie Tiny Houses

- BAAHOUSE and BAASTUDIO PTY LTD.

- Berkshire Hathaway Inc.

- Cavco Industries Inc.

- Designer ECO Tiny Homes

- Handcrafted Movement

- Heirloom Inc.

- HONOMOBO

- Humble Hand Craft

- ICON Technology Inc.

- La Tiny House

- Meka Inc.

- Mini Mansions Tiny Home Builders LLC

- Molecule Tiny Homes

- Mustard Seed Tiny Homes LLC

- New Frontier Tiny Homes

- Oregon Cottage Co.

- Skyline Champion Corp.

- Tiny Eco Homes UK Ltd.

- Tiny Home Builders

- Tiny SMART House Inc.

- Tumbleweed Tiny House Co.

- To gain access to more vendor profiles with their key offerings available with Technavio, Click Here

Get ready to achieve excellent business outcomes from this exclusive Tiny Homes Market report by Technavio. The report will include highlights of the overall market which includes frequently asked questions such as -

- What are historical revenue figures and estimated revenue figures as well as CAGR during the forecast timeframe?

- What is the current trend taking place in the market space?

- Which are business tactics that will influence competitive scenarios along with defining the growth potential of the market?

- What are market drivers, restraints, and challenges impacting demand & growth of the market?

- Which regions & segments will garner massive revenue and emerge as market leaders in upcoming years?

The competitive scenario provided in the Tiny Homes Market report analyzes, evaluates, and positions companies based on various performance indicators. Some of the factors considered for this analysis include the financial performance of companies over the past few years, growth strategies, product innovations, new product launches, investments, growth in market share, etc. Don't wait, Make a strategic approach & boost your business goals with our Tiny Homes Market Forecast Report - Buy Now!

Related Reports:

- The predicted growth for the kitchen sinks market share from 2021 to 2026 is USD 533.96 million at a progressing CAGR of 3.37%.

- The smart home speaker market share in US is expected to increase to USD 3.93 billion from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 18.45%

Tiny Homes Market Scope |

|

Report Coverage |

Details |

Page number |

120 |

Base year |

2021 |

Forecast period |

2022-2026 |

Growth momentum & CAGR |

Accelerate at a CAGR of 4.45% |

Market growth 2022-2026 |

USD 3.57 billion |

Market structure |

Fragmented |

YoY growth (%) |

3.88 |

Performing market contribution |

North America at 59% |

Competitive landscape |

Leading companies, competitive strategies, consumer engagement scope |

Companies profiled |

American Tiny House, Aussie Tiny Houses, BAAHOUSE and BAASTUDIO PTY LTD., Berkshire Hathaway Inc., |

Market Dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, |

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized |

Key Topics Covered:

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Product

- Exhibit 06: Executive Summary – Chart on Incremental Growth

- Exhibit 07: Executive Summary – Data Table on Incremental Growth

- Exhibit 08: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 09: Parent market

- Exhibit 10: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 11: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 12: Market segments

- 3.3 Market size 2021

- 3.4 Market outlook: Forecast for 2021-2026

- Exhibit 13: Chart on Global - Market size and forecast 2021-2026 ($ million)

- Exhibit 14: Data Table on Global - Market size and forecast 2021-2026 ($ million)

- Exhibit 15: Chart on Global Market: Year-over-year growth 2021-2026 (%)

- Exhibit 16: Data Table on Global Market: Year-over-year growth 2021-2026 (%)

4 Five Forces Analysis

- 4.1 Five forces summary

- Exhibit 17: Five forces analysis - Comparison between 2021 and 2026

- 4.2 Bargaining power of buyers

- Exhibit 18: Bargaining power of buyers – Impact of key factors in 2021 and 2026

- 4.3 Bargaining power of suppliers

- Exhibit 19: Bargaining power of suppliers – Impact of key factors in 2021 and 2026

- 4.4 Threat of new entrants

- Exhibit 20: Threat of new entrants – Impact of key factors in 2021 and 2026

- 4.5 Threat of substitutes

- Exhibit 21: Threat of substitutes – Impact of key factors in 2021 and 2026

- 4.6 Threat of rivalry

- Exhibit 22: Threat of rivalry – Impact of key factors in 2021 and 2026

- 4.7 Market condition

- Exhibit 23: Chart on Market condition - Five forces 2021 and 2026

5 Market Segmentation by Product

- 5.1 Market segments

- Exhibit 24: Chart on Product - Market share 2021-2026 (%)

- Exhibit 25: Data Table on Product - Market share 2021-2026 (%)

- 5.2 Comparison by Product

- Exhibit 26: Chart on Comparison by Product

- Exhibit 27: Data Table on Comparison by Product

- 5.3 Mobile tiny homes - Market size and forecast 2021-2026

- Exhibit 28: Chart on Mobile tiny homes - Market size and forecast 2021-2026 ($ million)

- Exhibit 29: Data Table on Mobile tiny homes - Market size and forecast 2021-2026 ($ million)

- Exhibit 30: Chart on Mobile tiny homes - Year-over-year growth 2021-2026 (%)

- Exhibit 31: Data Table on Mobile tiny homes - Year-over-year growth 2021-2026 (%)

- 5.4 Stationary tiny homes - Market size and forecast 2021-2026

- Exhibit 32: Chart on Stationary tiny homes - Market size and forecast 2021-2026 ($ million)

- Exhibit 33: Data Table on Stationary tiny homes - Market size and forecast 2021-2026 ($ million)

- Exhibit 34: Chart on Stationary tiny homes - Year-over-year growth 2021-2026 (%)

- Exhibit 35: Data Table on Stationary tiny homes - Year-over-year growth 2021-2026 (%)

- 5.5 Market opportunity by Product

- Exhibit 36: Market opportunity by Product ($ million)

6 Customer Landscape

- 6.1 Customer landscape overview

- Exhibit 37: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

7 Geographic Landscape

- 7.1 Geographic segmentation

- Exhibit 38: Chart on Market share by geography 2021-2026 (%)

- Exhibit 39: Data Table on Market share by geography 2021-2026 (%)

- 7.2 Geographic comparison

- Exhibit 40: Chart on Geographic comparison

- Exhibit 41: Data Table on Geographic comparison

- 7.3 North America - Market size and forecast 2021-2026

- Exhibit 42: Chart on North America - Market size and forecast 2021-2026 ($ million)

- Exhibit 43: Data Table on North America - Market size and forecast 2021-2026 ($ million)

- Exhibit 44: Chart on North America - Year-over-year growth 2021-2026 (%)

- Exhibit 45: Data Table on North America - Year-over-year growth 2021-2026 (%)

- 7.4 Europe - Market size and forecast 2021-2026

- Exhibit 46: Chart on Europe - Market size and forecast 2021-2026 ($ million)

- Exhibit 47: Data Table on Europe - Market size and forecast 2021-2026 ($ million)

- Exhibit 48: Chart on Europe - Year-over-year growth 2021-2026 (%)

- Exhibit 49: Data Table on Europe - Year-over-year growth 2021-2026 (%)

- 7.5 APAC - Market size and forecast 2021-2026

- Exhibit 50: Chart on APAC - Market size and forecast 2021-2026 ($ million)

- Exhibit 51: Data Table on APAC - Market size and forecast 2021-2026 ($ million)

- Exhibit 52: Chart on APAC - Year-over-year growth 2021-2026 (%)

- Exhibit 53: Data Table on APAC - Year-over-year growth 2021-2026 (%)

- 7.6 South America - Market size and forecast 2021-2026

- Exhibit 54: Chart on South America - Market size and forecast 2021-2026 ($ million)

- Exhibit 55: Data Table on South America - Market size and forecast 2021-2026 ($ million)

- Exhibit 56: Chart on South America - Year-over-year growth 2021-2026 (%)

- Exhibit 57: Data Table on South America - Year-over-year growth 2021-2026 (%)

- 7.7 Middle East and Africa - Market size and forecast 2021-2026

- Exhibit 58: Chart on Middle East and Africa - Market size and forecast 2021-2026 ($ million)

- Exhibit 59: Data Table on Middle East and Africa - Market size and forecast 2021-2026 ($ million)

- Exhibit 60: Chart on Middle East and Africa - Year-over-year growth 2021-2026 (%)

- Exhibit 61: Data Table on Middle East and Africa - Year-over-year growth 2021-2026 (%)

- 7.8 US - Market size and forecast 2021-2026

- Exhibit 62: Chart on US - Market size and forecast 2021-2026 ($ million)

- Exhibit 63: Data Table on US - Market size and forecast 2021-2026 ($ million)

- Exhibit 64: Chart on US - Year-over-year growth 2021-2026 (%)

- Exhibit 65: Data Table on US - Year-over-year growth 2021-2026 (%)

- 7.9 Canada - Market size and forecast 2021-2026

- Exhibit 66: Chart on Canada - Market size and forecast 2021-2026 ($ million)

- Exhibit 67: Data Table on Canada - Market size and forecast 2021-2026 ($ million)

- Exhibit 68: Chart on Canada - Year-over-year growth 2021-2026 (%)

- Exhibit 69: Data Table on Canada - Year-over-year growth 2021-2026 (%)

- 7.10 UK - Market size and forecast 2021-2026

- Exhibit 70: Chart on UK - Market size and forecast 2021-2026 ($ million)

- Exhibit 71: Data Table on UK - Market size and forecast 2021-2026 ($ million)

- Exhibit 72: Chart on UK - Year-over-year growth 2021-2026 (%)

- Exhibit 73: Data Table on UK - Year-over-year growth 2021-2026 (%)

- 7.11 Germany - Market size and forecast 2021-2026

- Exhibit 74: Chart on Germany - Market size and forecast 2021-2026 ($ million)

- Exhibit 75: Data Table on Germany - Market size and forecast 2021-2026 ($ million)

- Exhibit 76: Chart on Germany - Year-over-year growth 2021-2026 (%)

- Exhibit 77: Data Table on Germany - Year-over-year growth 2021-2026 (%)

- 7.12 France - Market size and forecast 2021-2026

- Exhibit 78: Chart on France - Market size and forecast 2021-2026 ($ million)

- Exhibit 79: Data Table on France - Market size and forecast 2021-2026 ($ million)

- Exhibit 80: Chart on France - Year-over-year growth 2021-2026 (%)

- Exhibit 81: Data Table on France - Year-over-year growth 2021-2026 (%)

- 7.13 Market opportunity by geography

- Exhibit 82: Market opportunity by geography ($ million)

8 Drivers, Challenges, and Trends

- 8.1 Market drivers

- 8.2 Market challenges

- 8.3 Impact of drivers and challenges

- Exhibit 83: Impact of drivers and challenges in 2021 and 2026

- 8.4 Market trends

9 Vendor Landscape

- 9.1 Overview

- 9.2 Vendor landscape

- Exhibit 84: Overview on Criticality of inputs and Factors of differentiation

- 9.3 Landscape disruption

- Exhibit 85: Overview on factors of disruption

- 9.4 Industry risks

- Exhibit 86: Impact of key risks on business

10 Vendor Analysis

- 10.1 Vendors covered

- Exhibit 87: Vendors covered

- 10.2 Market positioning of vendors

- Exhibit 88: Matrix on vendor position and classification

- 10.3 Berkshire Hathaway Inc.

- Exhibit 89: Berkshire Hathaway Inc. - Overview

- Exhibit 90: Berkshire Hathaway Inc. - Business segments

- Exhibit 91: Berkshire Hathaway Inc. - Key offerings

- Exhibit 92: Berkshire Hathaway Inc. - Segment focus

- 10.4 Cavco Industries Inc.

- Exhibit 93: Cavco Industries Inc. - Overview

- Exhibit 94: Cavco Industries Inc. - Business segments

- Exhibit 95: Cavco Industries Inc. - Key offerings

- Exhibit 96: Cavco Industries Inc. - Segment focus

- 10.5 Handcrafted Movement

- Exhibit 97: Handcrafted Movement - Overview

- Exhibit 98: Handcrafted Movement - Product / Service

- Exhibit 99: Handcrafted Movement - Key offerings

- 10.6 Heirloom Inc.

- Exhibit 100: Heirloom Inc. - Overview

- Exhibit 101: Heirloom Inc. - Product / Service

- Exhibit 102: Heirloom Inc. - Key offerings

- 10.7 Humble Hand Craft

- Exhibit 103: Humble Hand Craft - Overview

- Exhibit 104: Humble Hand Craft - Product / Service

- Exhibit 105: Humble Hand Craft - Key offerings

- 10.8 Oregon Cottage Co.

- Exhibit 106: Oregon Cottage Co. - Overview

- Exhibit 107: Oregon Cottage Co. - Product / Service

- Exhibit 108: Oregon Cottage Co. - Key offerings

- 10.9 Skyline Champion Corp.

- Exhibit 109: Skyline Champion Corp. - Overview

- Exhibit 110: Skyline Champion Corp. - Business segments

- Exhibit 111: Skyline Champion Corp. - Key offerings

- Exhibit 112: Skyline Champion Corp. - Segment focus

- 10.10 Tiny Home Builders

- Exhibit 113: Tiny Home Builders - Overview

- Exhibit 114: Tiny Home Builders - Product / Service

- Exhibit 115: Tiny Home Builders - Key offerings

- 10.11 Tiny SMART House Inc.

- Exhibit 116: Tiny SMART House Inc. - Overview

- Exhibit 117: Tiny SMART House Inc. - Product / Service

- Exhibit 118: Tiny SMART House Inc. - Key offerings

- 10.12 Tumbleweed Tiny House Co.

- Exhibit 119: Tumbleweed Tiny House Co. - Overview

- Exhibit 120: Tumbleweed Tiny House Co. - Product / Service

- Exhibit 121: Tumbleweed Tiny House Co. - Key offerings

11 Appendix

- 11.1 Scope of the report

- 11.2 Inclusions and exclusions checklist

- Exhibit 122: Inclusions checklist

- Exhibit 123: Exclusions checklist

- 11.3 Currency conversion rates for US$

- Exhibit 124: Currency conversion rates for US$

- 11.4 Research methodology

- Exhibit 125: Research methodology

- Exhibit 126: Validation techniques employed for market sizing

- Exhibit 127: Information sources

- 11.5 List of abbreviations

- Exhibit 128: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email:[email protected]

Website: www.technavio.com/

SOURCE Technavio

Share this article