LOS ANGELES, Jan. 4, 2022 /PRNewswire/ -- DJM, a California-based private equity real estate and development firm, today announced its acquisition of Long Beach Exchange (LBX) in partnership with PGIM Real Estate from Burnham-Ward Properties. Eastdil is credited with brokering the deal. As experts in retail, DJM will increase LBX's value through best-in-class management, leasing, marketing and placemaking. PGIM Real Estate is the real estate investment and financing business of PGIM, the $1.5 trillion global investment management business of Prudential Financial, Inc.

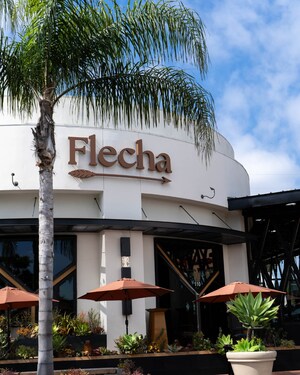

Built in 2018, Long Beach Exchange is a 246,500 square-foot, open-air lifestyle property located in Long Beach, California. Grocery-anchored LBX features a mix of best-in-class retail, fitness, daily needs and dining including Whole Foods, Handel's, Orange Theory, Ra Yoga, Silverlake Ramen, Ulta, Nordstrom Rack, and more. LBX also boasts The Hangar, a 17,000 square-foot food hall fashioned in the style of a vintage aviation hangar that offers a range of small, artisanal food vendors and boutique retailers to Long Beach's dense office and residential population.

The purchase of 26-acre LBX marks the latest acquisition from DJM, who is placing a heavy emphasis on growth and portfolio expansion of open-air retail coming out of the COVID-19 pandemic. "Over the next year, we plan to double the square footage of our assets under management and focus on aggressive growth within our company," said Lindsay Parton, President at DJM. "We have positioned ourselves for the future with our team, and are currently working through a number of deals that will reflect the true ethos of DJM's mission to create places where people and communities thrive."

"Although COVID undoubtedly impacted retail across all sectors, we're now experiencing a tremendous return to growth across our entire portfolio, with foot traffic and sales numbers surpassing even pre-pandemic figures" said Chad Cress, Chief Creative Officer at DJM. "This rebound, which reinforces the ever-changing nature of retail, is due largely in part to the outdoor nature of our properties as well as thoughtful community programming and relevant, region-specific merchandising. Long Beach Exchange is a fantastic addition to the DJM portfolio and we look forward to shaping the property into the best version of itself."

With today's announcement, Long Beach Exchange joins DJM's portfolio that also includes, among other destinations, Hollywood & Highland (soon to be Ovation Hollywood) in Los Angeles, Lido Marina Village in Newport Beach, and Bella Terra in Huntington Beach. PGIM Real Estate, DJM's partner at the 853,000 square-foot outdoor shopping center Bella Terra, will join DJM as a partner at LBX.

"We have seen firsthand the transformation DJM has created at Bella Terra," said Tim Hennessey, Managing Director at PGIM Real Estate. "We are extremely pleased with the value that DJM and PGIM Real Estate were able to add to the portfolio and deliver an excellent outcome for our investors even during these unprecedented times. We are excited to continue our work together at Long Beach Exchange."

"Long Beach Exchange is a perfect example of what retail should look like in the future," said Scott Burnham, CEO and Partner at Burnham-Ward Properties. "This iconic property promotes an experiential environment that encourages shopping through community and experiences by innovative property development. The continued success of LBX during these unprecedented times is a true testament of its consumer appeal, which has ensured that the center will continue to grow and thrive. DJM and its partners will be great stewards for this asset going forward."

About DJM

DJM is a private real estate equity and development firm based in Southern California. With a core strength in retail combined with mixed use asset classes, DJM creates long-term value by transforming real estate to meet the 21st century demands of consumers, retailers, and office users. DJM's focus is on placemaking- leveraging design, development, and best-in-class management to create places where people thrive. DJM is represented by a current portfolio of approximately four million square feet with an estimated total portfolio value of $2 billion. For more information, please visit www.djmcapital.com.

About PGIM Real Estate

As one of the largest real estate managers in the world with $201.3 billion in gross assets under management and administration,1 PGIM Real Estate strives to deliver exceptional outcomes for investors and borrowers through a range of real estate equity and debt solutions across the risk-return spectrum. PGIM Real Estate is a business of PGIM, the $1.5 trillion global asset management business of Prudential Financial, Inc.

PGIM Real Estate's rigorous risk management, seamless execution, and extensive industry insights are backed by a 50-year legacy of investing in commercial real estate, a 140-year history of real estate financing,2 and the deep local expertise of professionals in 32 cities globally. Through its investment, financing, asset management, and talent management approach, PGIM Real Estate engages in practices that ignite positive environmental and social impact, while pursuing activities that strengthen communities around the world. For more information visit pgimrealestate.com.

Press Contact:

Casey McDonald

[email protected]

212.584.5668

SOURCE DJM

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article