The company's latest offering is a low-risk way to maximize interest with more tax efficiency than a savings account or CD.

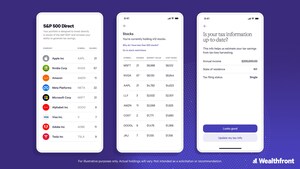

PALO ALTO, Calif., May 7, 2024 /PRNewswire/ -- Wealthfront, a leading consumer fintech and pioneer of the robo-advisor industry, today announced a first-of-its-kind Automated Bond Ladder that revolutionizes how investors use US Treasuries to maximize interest on their extra cash. This new addition to Wealthfront's product suite is a liquid, low-risk way to earn a steady yield, with more tax efficiency than a savings account or CD.

Because US Treasuries are exempt from state and local income tax, investors can keep up to 13.3% more of their earned interest from the Automated Bond Ladder when compared to a high-yield savings account or CD (depending on state of residence and tax bracket). This tax efficiency plus the product's focus on preserving principal makes the Automated Bond Ladder an ideal way to balance out higher risk investments, protect and grow a windfall, or save for large expenses without risking loss of funds.

A ladder is an intelligent way to invest in low-risk Treasuries, but accessing the strategy previously required considerable manual work, high minimums, or expensive fees. With today's launch, investors can open an Automated Bond Ladder with just $500, then Wealthfront's software instantly compares rates across hundreds of state income-tax exempt US Treasury bills and notes to build a ladder that helps investors reduce interest rate risk and lock in rates for six months to six years. The Automated Bond Ladder conveniently handles researching and managing multiple maturity dates, adding more funds in increments as low as $100, and automatically reinvesting proceeds from interest and maturing bonds to keep money growing effortlessly.

"Bonds are begging for modernization with the help of software. Today's launch of the Automated Bond Ladder continues to redefine what is possible when it comes to saving and growing your money by bringing the same automated, set-it-and-forget-it approach to US Treasuries that we brought to ETFs when we pioneered the robo-advisor industry," said Dave Myszewski, Vice President of Product at Wealthfront. "We're proud to add another innovative way for investors to make the most of fixed income, and we will continue expanding our product suite to help our clients build long-term wealth."

Excitement about US Treasuries is at an all-time high, driven by their unique combination of extremely low risk, stable yield (if held to maturity), and exemption from state and local income tax. In 2023, Treasury Bill purchases totaled $175 billion, making it the highest year on record, and the trend has continued into 2024 with purchases totaling $47 billion in Q1 alone. Interest in laddering strategies is similarly strong among Wealthfront clients: more than 50 percent of clients' external Treasury holdings are held as part of a ladder.

Despite this growing demand, most of the current fixed income offerings are decades behind what today's investors expect from their financial products, leaving bond ladders reserved for retirement planning or gated behind expensive financial advisors or clunky interfaces. Thanks to Wealthfront's expertise in automating sophisticated investing strategies, the capital preserving power of a Treasury ladder is now available to the many investors eager to lock in rates before potential cuts.

As Geoff Cleary, a Wealthfront client who beta-tested the Automated Bond Ladder, said: "Faced with the spectre of falling interest rates, I wanted to use a bond ladder to grow my emergency fund, but I was immediately overwhelmed by how much work and research it would take to build and manage one myself. Wealthfront made the process so accessible with their bond ladder, and it was perfect timing for me to start taking advantage of US Treasuries to earn a higher after-tax yield."

Today's launch adds to Wealthfront's growing suite of innovative saving and investing products designed to help clients build long-term wealth in all market conditions. The company also offers an award-winning Cash Account with a 5.00% APY via partner banks and free same-day transfers through the RTP network, plus automated index investing, retirement accounts, and adviser-managed, zero-commission stock investing.

Wealthfront's focus on delivering innovation and value through software is why clients continue to adopt new products rapidly and why the business remains profitable and able to thrive in a variety of market conditions. This is evidenced by the company recently surpassing $60 billion in total client assets across all product offerings and continuing to maintain EBITDA margins over 40 percent.

For more information and to sign up for Wealthfront's Automated Bond Ladder, please visit: https://www.wealthfront.com/automated-bond-ladder

About Wealthfront

Wealthfront integrates investing and saving products to help young professionals build long-term wealth in any market condition. Through software, the company delivers cash management, diversified ETF and bond investing, zero-commission stock investing, and low-cost loans to help sophisticated and new investors learn, lower costs, and grow wealth. Wealthfront is one of the highest-rated financial apps in the Apple App Store and has been named Best Automated Investment App, Best Overall Robo-Advisor, and Best Robo-Advisor in the Portfolio Construction, Portfolio Management, and Goal Planning categories by Investopedia (2024), Best Cash Management Account and Best Investing App by Bankrate (2024), Best Robo-Advisor for Portfolio Options by NerdWallet (2024), and Best Robo-Advisor for DIY Financial Planning by Forbes (2024). The company currently oversees more than $60 billion for over 800,000 clients in the US. To learn more please visit www.wealthfront.com or download the app on the App Store or Google Play.

Contact: Elly Stolnitz, [email protected]

Disclosures

Treasury Bill purchase data from Treasury.gov: Sales, retrieved from Fiscal Data

https://fiscaldata.treasury.gov/datasets/electronic-securities-transactions/, Apr 22, 2024

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation or offer, or recommendation, to buy or sell any security.

Investment management and advisory services--which are not FDIC insured--are provided by Wealthfront Advisers LLC ("Wealthfront Advisers"), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC ("Wealthfront").

Investing in US Treasuries involves risks, including but not limited to interest rate risk, credit risk, and market risk. While US Treasuries are considered to be among the safest investments, they are not entirely risk-free, and there is a potential for loss of principal. Returns on US Treasuries can also be affected by changes in the credit rating of the US government, although such occurrences are rare. Investors should consider their tolerance for these risks and their overall investment objectives before investing in US Treasuries. Past performance does not guarantee future results.

The yield earned from US Treasuries is exempt from state and local income taxes. However, interest income from Treasuries is subject to federal income tax. Tax treatment may vary depending on your individual circumstances and state of residence. Wealthfront Advisers and its affiliates do not provide legal or tax advice and do not assume any liability for the tax consequences of any client transaction. To understand implications for your specific financial situation, consult with a tax professional.

The unpaid testimonial featured above was made by a current Wealthfront Advisers client. This party has no other affiliation with or relationship to Wealthfront Corporation or its subsidiaries.

Investopedia receives cash compensation for referring potential clients to Wealthfront Advisers, LLC ("Wealthfront Advisers") via advertisements placed on their website which could create an incentive creating a material conflict of interest. While they receive compensation for referring potential clients, the statements and rankings provided above represent independent endorsements by Investopedia, which are not directly tied to such compensation. Investopedia and Wealthfront Advisers are not associated with one another and have no formal relationship outside of this arrangement. Investopedia's opinions are their own. Their ratings are determined by their editorial team. Investopedia is not a client of Wealthfront Advisers. Investopedia designed a system that rates robo-advisors based on nine key categories and 59 variables. Each category covers critical elements users need to thoroughly evaluate a robo-advisor. The ratings reflect data and evaluations for the 12-month period ending in February 2024. Learn more about their methodology and review process. Investopedia ranking as of March 2024.

Bankrate receives cash compensation for referring potential clients to Wealthfront Advisers, LLC ("Wealthfront Advisers") and Wealthfront Brokerage, LLC ("Wealthfront Brokerage") via advertisements placed on their website which could create an incentive creating a material conflict of interest. While they receive compensation for referring potential clients, the statements and rankings provided above represent independent endorsements by Bankrate, which are not directly tied to such compensation. Bankrate and Wealthfront are not associated with one another and have no formal relationship outside of this arrangement. Bankrate's opinions are their own. Their ratings are determined by their editorial team. Bankrate is not a client of Wealthfront Advisers. Bankrate designed a methodology that evaluates app-based financial services—including robo-advisors, brokerages, and mobile-only platforms, assessing overall experience, features offered and total value proposition to the investor. Best Investing App 2023 was awarded on January 10, 2023 based on data and evaluations over the 12-month period ending in December 2022. Bankrate also designed a methodology that evaluates non-bank cash accounts, evaluating APYs, checking features, service fees, minimum deposit and balance requirements and other factors. Best Cash Management Account 2024 was awarded on December 12, 2023 covering the 2023 calendar year. Wealthfront pays an annual license fee to use Bankrate's awards in marketing materials. Learn more about their methodology and review process.

Nerdwallet receives cash compensation for referring potential clients to Wealthfront Advisers, LLC ("Wealthfront Advisers") via advertisements placed on their website. Nerdwallet and Wealthfront Advisers are not associated with one another and have no formal relationship outside of this arrangement. Nerdwallet's opinions are their own. Their ratings are determined by their editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. Nerdwallet ranking as of June 2024.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2024 Wealthfront Corporation. All rights reserved.

SOURCE Wealthfront

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article