UCLA Extension Tax Controversy Institute Tackles ID Theft, Crypto Currencies and Cannabis at 33rd Annual Conference on October 24th at Beverly Hills Hotel

A leading conference dedicated to tax controversy and tax litigation engages with distinguished members of the tax judiciary, government officials and tax practitioners

LOS ANGELES, Oct. 12, 2017 /PRNewswire/ -- UCLA Extension presents the 33rd Annual Tax Controversy Institute Conference on Oct. 24, 2017 at the Beverly Hills Hotel. The Institute's duration and success is attributable to the high-quality practical presentations by government officials and private practitioners who engage in moderated discussions on sensitive tax practice issues.

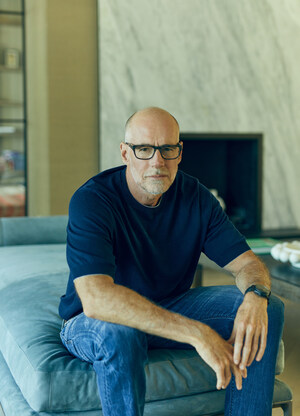

"Many of this year's tax controversy presentations are current and ripped from the headlines - data breach and identity theft, bitcoin and crypto currencies, and the cannabis industry," says Charles Rettig, Institute Chair, and Partner, Hochman, Salkin, Rettig, Toscher & Perez, P.C. "For over 30 years, UCLA Extension's Tax Controversy Institute has been the preeminent conference dedicated to tax controversy and tax litigation." Rettig was recently selected by his peers as the 2016 "Lawyer of the Year" (Litigation and Controversy, Los Angeles) for Best Lawyers.

This year's distinguished luncheon speaker is Selvi Stanislaus, Executive Officer of the Franchise Tax Board. Sandra Brown, Acting Assistant U.S. Attorney (C.D.Cal), receives the Bruce I Hochman Award, presented each year to an individual who demonstrates outstanding proficiency in the field of tax law and best exemplifies the principles that personified Mr. Hochman, a leading attorney for over 40 years, specializing in civil and criminal tax law litigation. Additionally, Phil Edwards, Examination Territory Manager, IRS SB/SE, will be recognized for his work.

Other notable speakers include Mary Beth Murphy, Commissioner, IRS Small Business/Self Employed Division, Lanham, MD; Claudia Hill, EA, Tax Mam, Inc./TMI Tax Services Group, Inc. and Editor-in-Chief, CCH Journal of Tax Practice & Procedure; Steven Toscher, Hochman, Salkin, Rettig, Toscher & Perez, P.C.; Pedram Ben-Cohen, Ben-Cohen Law Firm, PLC, and others. For a complete list of speakers and topics scheduled for discussion and debate, see agenda.

The conference is presented by UCLA Extension Business, Management & Legal Programs. It is designed for attorneys, accountants, business/corporate professionals, and tax practitioners. Continuing education units are offered: 7.5 hours of Minimum Continuing Legal Education credit by the State Bar of California, 8.0 hours Continuing Professional Education (CPE) Credit for Certified Public Accountants (CPAs), and 1.0 hours Minimum Continuing Legal Education (MCLE) Credit - Legal Ethics. Discounts are available for California Society of CPAs (CalCPA), National Association of Enrolled Agents (NAEA), and Financial Planning Association (FPA) members. Additionally, at the Tax Controversy Institute, UCLA Extension will announce a scholarship fund in support of veterans.

The enrollment fee is $525, including materials and lunch. Please register here. The Beverly Hills Hotel is located at 9641 Sunset Blvd, Beverly Hills, 310-276-2251.

For more information about the UCLA Extension Tax Controversy Institute, please contact John Caruso at (310) 206-1708 or [email protected].

For media inquiries, please contact Ruthie Thomas at (213) 341.0171 ext. 752 or [email protected].

SOURCE UCLA Extension

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article