CHARLOTTE, N.C., Oct. 3, 2017 /PRNewswire/ -- LendingTree®, the nation's leading online loan marketplace, has released the findings of its study on how well residents in the top 50 U.S. metropolitan areas are spending within their means – or aren't.

LendingTree looked at the average number of credit inquiries, use of revolving credit, non-housing debt balances as a percentage of income and mortgage balances (also as a percentage of income). The study then combined these factors to create a "Spending Within Your Means Score" of 0 to 100, with a higher score designating the cities where residents are more likely to be living within their means.

Among the 50 ranked metro areas, residents are, on average, using 30 percent of their revolving credit lines — such as credit cards and home equity lines of credit, or HELOCs. They also have mortgage balances averaging 79 percent of their annual income and non-housing debt balances averaging 44 percent of annual income, and have had five credit inquiries in the last two years

| Rank |

Metro |

Spending Within Their Means Score |

Inquiries (last 2 years) |

Revolving Credit Utilization |

Non-Housing Debt % of Income |

Mortgage Debt % of Income |

| 1 |

Greenville, SC |

71 |

4.0 |

27.6% |

47.3% |

61.6% |

| 2 |

Greensboro, NC |

65 |

3.8 |

28.9% |

48.5% |

63.9% |

| 3 |

Kansas City, MO |

64 |

5.9 |

28.4% |

42.8% |

65.0% |

| 4 |

Buffalo, NY |

64 |

4.0 |

29.0% |

50.5% |

55.2% |

| 5 |

Charlotte, NC |

64 |

3.8 |

28.2% |

43.2% |

84.9% |

| 6 |

Milwaukee, WI |

64 |

7.1 |

28.4% |

39.7% |

65.8% |

| 7 |

San Francisco, CA |

63 |

3.9 |

28.9% |

28.4% |

109.1% |

| 8 |

Boston, MA |

62 |

4.6 |

29.0% |

35.7% |

86.9% |

| 9 |

New York, NY |

62 |

4.4 |

30.5% |

34.7% |

77.6% |

| 10 |

Raleigh, NC |

61 |

3.8 |

27.6% |

45.2% |

85.6% |

| 11 |

Pittsburgh, PA |

60 |

5.1 |

28.0% |

51.2% |

49.3% |

| 12 |

Nashville, TN |

59 |

4.4 |

27.8% |

43.9% |

80.4% |

| 13 |

Hartford, CT |

58 |

5.5 |

30.0% |

38.1% |

76.8% |

| 14 |

Oklahoma City, OK |

58 |

6.0 |

28.3% |

47.8% |

60.7% |

| 15 |

Portland |

56 |

3.5 |

30.0% |

40.2% |

90.8% |

| 16 |

Grand Rapids, MI |

56 |

6.8 |

29.4% |

43.3% |

59.8% |

| 17 |

Detroit, MI |

56 |

5.9 |

30.1% |

41.0% |

65.0% |

| 18 |

Louisville, KY |

56 |

6.8 |

28.3% |

43.0% |

68.4% |

| 19 |

Washington, DC |

55 |

4.0 |

30.1% |

37.1% |

102.8% |

| 20 |

Richmond, VA |

55 |

4.0 |

29.8% |

41.2% |

87.5% |

| 21 |

Denver, CO |

55 |

3.1 |

29.2% |

39.9% |

108.0% |

| 22 |

St. Louis, MO |

53 |

7.7 |

29.0% |

42.8% |

67.0% |

| 23 |

Philadelphia, PA |

53 |

5.6 |

28.9% |

43.0% |

79.4% |

| 24 |

Minneapolis, MN |

53 |

4.3 |

30.5% |

39.5% |

83.6% |

| 25 |

Birmingham, AL |

53 |

5.6 |

29.2% |

47.3% |

62.5% |

| 26 |

Cincinnati, OH |

53 |

5.7 |

29.1% |

44.9% |

68.0% |

| 27 |

Cleveland, OH |

52 |

6.6 |

28.9% |

49.4% |

58.9% |

| 28 |

Austin, TX |

52 |

4.9 |

30.0% |

42.5% |

78.2% |

| 29 |

Dallas - Fort Worth, TX |

52 |

5.1 |

29.5% |

44.3% |

69.9% |

| 30 |

Indianapolis, IN |

51 |

6.6 |

28.4% |

46.1% |

68.3% |

| 31 |

Atlanta, GA |

51 |

4.3 |

29.2% |

45.0% |

81.2% |

| 32 |

Columbus, OH |

49 |

6.2 |

30.6% |

45.9% |

57.4% |

| 33 |

Salt Lake City, UT |

48 |

4.2 |

30.2% |

39.7% |

98.2% |

| 34 |

Chicago, IL |

46 |

7.2 |

30.1% |

39.5% |

80.1% |

| 35 |

Seattle, WA |

46 |

4.6 |

30.6% |

37.6% |

98.7% |

| 36 |

Memphis, TN |

45 |

5.1 |

29.7% |

51.2% |

64.9% |

| 37 |

New Orleans, LA |

43 |

4.2 |

30.8% |

50.8% |

66.9% |

| 38 |

Miami, FL |

43 |

4.1 |

29.0% |

48.7% |

89.5% |

| 39 |

Harrisburg, PA |

42 |

6.2 |

29.1% |

47.8% |

70.1% |

| 40 |

Sacramento, CA |

42 |

4.4 |

32.0% |

38.5% |

103.2% |

| 41 |

San Diego, CA |

41 |

4.3 |

32.8% |

37.2% |

118.2% |

| 42 |

Los Angeles, CA |

39 |

4.6 |

32.0% |

38.6% |

108.3% |

| 43 |

Houston, TX |

39 |

5.3 |

31.4% |

46.8% |

70.3% |

| 44 |

Tampa, FL |

38 |

4.2 |

29.9% |

51.6% |

80.7% |

| 45 |

Virginia Beach, VA |

36 |

3.8 |

33.2% |

46.8% |

95.4% |

| 46 |

Orlando, FL |

31 |

4.3 |

30.7% |

51.0% |

82.1% |

| 47 |

Jacksonville, FL |

25 |

4.1 |

32.3% |

51.8% |

87.9% |

| 48 |

Phoenix, AZ |

25 |

5.1 |

30.4% |

48.1% |

102.7% |

| 49 |

Las Vegas, NV |

20 |

5.1 |

31.8% |

50.6% |

96.6% |

| 50 |

San Antonio, TX |

19 |

7.3 |

32.1% |

54.7% |

72.2% |

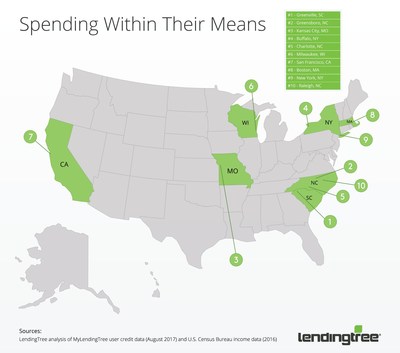

Greenville, SC takes the top score, despite having the second-lowest average income among the 50 cities ranked at $65,503 per household. Boosting the city's score are factors like low use of revolving credit lines, low levels of housing debt, and a low average balance on installment loans (including auto, student and personal loans).

Not too far from Greenville, SC is Greensboro, NC, which comes in at the No. 2 spot and benefits from low housing costs and relatively fewer credit inquiries compared to residents in other cities on the list. Kansas City, MO has the third highest "Spending Within Their Means" score, although residents in this city carry more housing debt than Greenville and Greensboro. Higher incomes and lower non-housing debt percentages are key factors boosting the city's score.

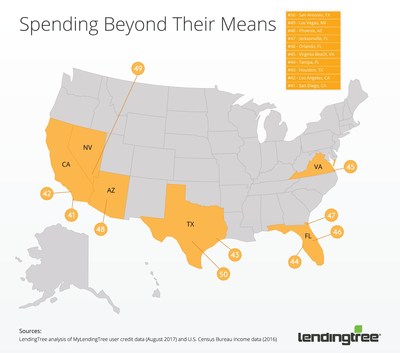

On the opposite end of the spectrum is San Antonio, TX, with a high amount of credit inquiries combined with relatively high levels of revolving credit utilization and higher-than-average non-housing related debt as a percentage of income. San Antonio residents have an average outstanding balance on installment loans that is 26 percent above the national average, and have an average of seven credit inquiries per resident in the past two years, suggesting that income may not be enough to support their Texas-sized lifestyles.

Local residents in Las Vegas, NV are taking on financial risk by stretching further than most with their finances. They score in the bottom 20 metros for non-housing debt balances (50.6 percent of income), mortgage balance burdens (97 percent of income), and utilization of revolving credit lines. And in Phoenix, AZ, mortgage balances average 103 percent of income, which are comparable to those in many Western cities, like San Diego and Los Angeles, but well above the 50-metro average of 79 percent. Where Phoenix residents stretch even further than mortgage-burdened Western peers is in non-housing debt, with balances accounting for nearly 50 percent of household income.

To gain more insight on your personal credit profile, get updates on your tradelines and get alerts when LendingTree identifies an opportunity to save, visit www.mylendingtree.com to sign up for savings notifications and free monthly credit scores.

For more information on the study visit https://www.lendingtree.com/finance/cities-spending-within-their-means/

Methodology

LendingTree used a statistically relevant sampling (more than 1,000,000) of anonymized My LendingTree user data in August of 2017 along with U.S. Census Bureau data on average household income and population for the 50 largest metropolitan areas in the U.S.

My LendingTree user credit information is provided by TransUnion.

The ranking used three metrics to score each metro:

Number of credit inquiries in the last two years (20%): A hard credit inquiry is reported on a consumer credit report when a consumer applies for a credit product or seeks specific rate quotes for some products. This is a measure that shows which metros have residents more actively seeking new credit, which could be a sign households are stretching beyond what their income can support.

Revolving credit utilization (20%): This is current outstanding balances as a percentage of available credit lines, typically on credit cards.

Debt balances vs household income (mortgage and non-housing, 30% each): This gives a measure of how stretched overall residents are with debt. While mortgage debt penalizes homeowners vs renters, we look separately at non-housing debt. Cities that rank high on both non-housing and mortgage debt as a percentage of income are more stretched overall than those who rank high on just one metric.

Each metro was assigned a percentile ranking among the 50 metros analyzed for each of the three metrics, and the three metrics were equally weighted to create a 'Living Within Your Means Score' that ranges from 0 to 100.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation's leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

MEDIA CONTACT:

Megan Greuling

704-943-8208

[email protected]

SOURCE LendingTree

Share this article