Key Takeaways:

- AT&T remains on track to deliver full-year free cash flow of $16 billion or better based on its long-term sustainable growth strategy. Free cash flow for the second quarter is expected to be in the $3.5 to $4.0 billion range, resulting in higher free cash flow for the first half of 2023 than the first half of 2022.

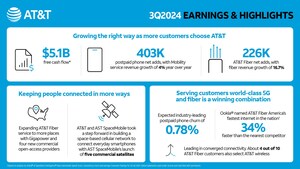

- AT&T expects to deliver profitable 5G and fiber net addition growth in the second quarter highlighted by low customer churn, higher average revenues per user (ARPU), solid year-over-year mobility EBITDA growth and healthy wireless service revenue which it expects to grow about 5% in the first half of the year.

DALLAS, June 20, 2023 /PRNewswire/ -- Pascal Desroches, chief financial officer, AT&T* (NYSE:T) Inc., spoke today at the Bank of America C-Suite Technology, Media and Telecommunications Conference where he provided an update to shareholders. Desroches made the following key points:

2023 full-year free cash flow on target

- Desroches reiterated the company's guidance for full-year free cash flow of $16 billion or better and stated that second quarter free cash flow is expected to be in the $3.5 to $4.0 billion range.

- As the company has previously discussed, the primary factors supporting its annual outlook are expectations for 2023 adjusted EBITDA growth of 3%+, largely in-line capital investment and lower handset payments for full-year 2023 compared to 2022.

Focused on growing high-quality, durable 5G & fiber customers

- AT&T continues to focus on growing its high-value customer base for both 5G and fiber. In wireless, Desroches said the company is tracking to slightly above 300,000 second-quarter postpaid phone net additions. This is largely a result of:

- Continued normalization of industry growth;

- Temporary impacts from competitor product launches; and

- Deliberate decisions to not pursue business with an uneconomic return profile.

- Following a brief, limited impact from these short-term items, the company's subscriber porting trends have normalized. Overall, the company has not seen a material change in its porting ratios, including to cable.

- AT&T expects second-quarter fiber net additions to be in the mid-200,000 range in part due to significantly lower household move activity along with the expected impact from seasonality. The company also continues to feel confident in the return case for AT&T's fiber investments given better-than-expected initial penetration rates and higher average revenues per user (ARPU) levels.

Investing in the future of the country's connectivity

- AT&T is committed to its mission of bringing access to super-fast, reliable, high-capacity fiber service to more Americans and is making strong strides through its continued fiber build, pursuit of government broadband stimulus and via the Gigapower joint venture with BlackRock. The company also remains on track with its 5G and fiber network expansion commitments. It expects to deploy midband 5G spectrum to 200 million people by year-end 2023 and to pass 30 million+ consumer and business locations in its traditional service area with its fiber network by the end of 2025.

- Desroches highlighted that over the long run AT&T is well-positioned to achieve sustainable subscriber and profit growth because of its differentiated position as the largest-scale fiber builder in the country and the strategic advantage of owner's economics on best-in-class 5G and fiber networks.

The webcast of Desroches' conversation is available for replay at AT&T Investor Relations.

*About AT&T

We help more than 100 million U.S. families, friends and neighbors, plus nearly 2.5 million businesses, connect to greater possibility. From the first phone call 140+ years ago to our 5G wireless and multi-gig internet offerings today, we @ATT innovate to improve lives. For more information about AT&T Inc. (NYSE:T), please visit us at about.att.com. Investors can learn more at investors.att.com.

Cautionary Language Concerning Forward-Looking Statements

Information set forth in this news release contains financial estimates and other forward-looking statements that are subject to risks and uncertainties, and actual results might differ materially. A discussion of factors that may affect future results is contained in AT&T's filings with the Securities and Exchange Commission. AT&T disclaims any obligation to update and revise statements contained in this news release based on new information or otherwise.

This news release may contain certain non-GAAP financial measures. Reconciliations between the non-GAAP financial measures and the GAAP financial measures are available on the company's website at https://investors.att.com.

© 2023 AT&T Intellectual Property. All rights reserved. AT&T and the Globe logo are registered trademarks of AT&T Intellectual Property.

SOURCE AT&T

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article