NEW YORK, March 27, 2018 /PRNewswire/ -- Pareteum Corporation (NYSE American: TEUM), ("Pareteum" or the "Company"), the rapidly growing Cloud Communications Platform company, announced today operating and financial results for the fourth quarter and year ended December 31, 2017.

"We achieved record revenue growth for the fourth quarter and full year 2017. Our key performance indicators of connections, backlog conversion, connection values, revenue per employee and churn are all favorable and trending in the right directions. This past year's focus of strengthening our management and operational teams to create and close sales opportunities based on our robust and proprietary technology has been highly successful. The hires and resulting build-up of our 36-month contractual revenue backlog sets us up for 2018 and beyond. Our balance sheet is dramatically improved as we successfully executed on capital raises in the fourth quarter that allowed us to pay off our debt and enter 2018 with a strong cash balance to fuel our future growth. We are well positioned for growth and profitability having structured our technology and operational platform to scale our business and are now focused in converting backlog to revenue, servicing our clients, selling into new geographical markets and industries and creating shareholder value," said Hal Turner, Pareteum's Founder, Executive Chairman and Principal Executive Officer.

| Strong 2017 Sequential Quarterly Improvements Across All Key Metrics |

||||||

| (000's) |

2016 |

Q1 2017 |

Q2 2017 |

Q3 2017 |

Q4 2017 |

|

| REVENUE |

$ 12,856 |

$ 2,795 |

$ 3,239 |

$ 3,499 |

$ 4,015 |

|

| COST OF SALES |

$ 3,659 |

$ 842 |

$ 946 |

$ 792 |

$ 1,105 |

|

| GROSS MARGIN |

$ 9,197 |

$ 1,953 |

$ 2,293 |

$ 2,707 |

$ 2,910 |

|

| ADJUSTED EBITDA |

$ (3,798) |

$ (198) |

$ 463 |

$ 603 |

$ 708 |

|

Key Business Highlights for Full Year 2017:

- Awarded 26 contracts totaling $118 million covering 45 countries

- Increased 36-month contractual revenue backlog from $50 million to $147 million at 12/31/17

- Ended 2017 with 1,711,000 connections

- Pareteum Global Cloud Received IoT Evolution's 2017 IoT Excellence Award

- Added Blockchain Settlement for Cryptocurrency to its Global Cloud Platform

- Formed strategic alliance with Artilium to create and sell global solutions

- Partnered with AirFox whose AirToken is an Ethereum-based digital utility token that facilitates the transfer of mobile airtime, data and currency

- Subsequently appointed Denis McCarthy as Senior VP Corporate Development

- Appointed Ali Davachi as Chief Technology Officer and Chief Operating Officer

- Appointed and Promoted Rob Mumby as Chief Revenue Officer

- Appointed Ted O'Donnell as Chief Financial Officer

Key Financial Highlights for Full Year 2017:

- Revenues increased by 5% to $13.5 million

- Gross margins increased 130 basis points to 72.8%

- Operating loss decreased by $10.1 million, or 54%, to $8.8 million

- EBITDA loss decreased by $4.8 million, or 53%, to $4.3 million

- Adjusted EBITDA profit of $1.6 million, from a loss of $3.9 million

- Raised $20 million in equity

- Subsequently paid off and eliminated all $10.1 million senior debt

- Increase in stockholders' equity from a deficit of ($9.4 million) to $15.4 million

- Increase in total assets from $13.0 million to $25.3 million

- Cash balance of $13.5 million

- Anticipated removal of the going concern language as of 12/31/17

2018 Outlook:

Based on our 36-month contractual revenue backlog of $147 million, as of December 31, 2017, and connections, we expect 2018 revenue to increase by at least 50% over 2017. As we convert backlog to connections, our revenue will increase and for every incremental dollar of revenue, we expect contribution to our bottom line. Our target gross margins are 70-75% and operating margins of 15-20%.

Highlight Key Performance Indicators and Trends (as of December 31, 2017):

36-month contractual revenue backlog of $147 million

Connections of 1,711,000, up from 1,273,000 at the end of the third quarter 2017 and 1,140,000 at the end of 2016.

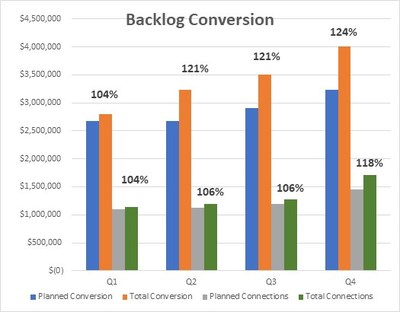

Backlog conversion of 104 – 124% throughout the year.

Lifetime connection value of $224, up from $191 at the end of the third quarter 2017 and $157 at the end of the first quarter 2017.

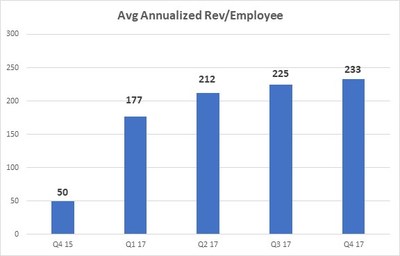

Average annualized revenue per employee of $233,000, up from $225,000 at the end of the third quarter 2017 and $177,000 at the end of the first quarter 2017.

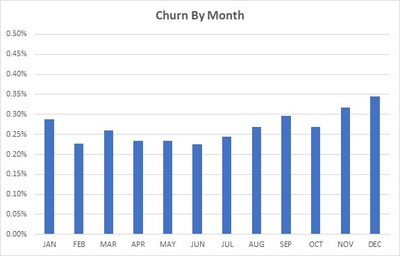

Churn by month remaining in the 0.20 – 0.30%.

Financial Results for the Year Ended December 31, 2017:

Revenue for the year ended December 31, 2017 was $13,547,507, an increase of $691,696 or 5%, compared to $12,855,811 for the year ended December 31, 2016. This increase was mainly due to the company's focus on growing the mobile bundled services portion of the business, which accounted for $886,856 of revenue, which is 7% of the total revenue for the year.

Gross profit for the twelve month period ended December 31, 2017 was $9,863,898, resulting in a gross margin of 72.8%, compared to $9,197,144 and 71.5% for the twelve-month period ended December 31, 2016. Cost of revenues includes origination, termination, network and billing charges from telecommunications operators, costs of telecommunications service providers, network costs, data center costs, facility cost of hosting network and equipment and cost in providing resale arrangements with long distance service providers, cost of leasing transmission facilities, international gateway switches for voice, data transmission services, and the cost of professional services of staff directly related to the generation of revenues, consisting primarily of employee-related costs associated with these services, including share-based compensation and the cost of subcontractors. Cost of revenues excludes depreciation and amortization.

Product development expenses for the twelve months ended December 31, 2017 and 2016 were $1,479,587 and $3,543,590, a decrease of $2,064,003 or 58%, as a result of restructuring costs and closing down outsourced Asian product development. This was driven by a reduction in headcount. Product Development costs consist primarily of salaries and related expenses, including share-based expenses, of employees involved in the development of the Company's services, which are expensed as incurred. Costs such as database architecture, and Pareteum BOSS & IN platform development and testing are included in this function.

Sales and Marketing expenses for the twelve months ended December 31, 2017 and 2016 were $1,575,069 and $1,340,959, respectively, an increase of $234,110 or 17%. The increase is due to additions to the sales force. Sales and Marketing expenses consist primarily of salaries and related expenses, including share-based expenses, for our sales and marketing staff, including commissions, payments to partners and marketing programs. Marketing programs consist of advertising, events, corporate communications and brand building.

General and Administrative expenses for the twelve months ended December 31, 2017 and 2016 were $10,097,026 and $11,708,151, respectively, a decrease of $1,611,125 or 14%. This was primarily due to a $1,716,070 decrease, or 24%, in staff related payroll of $5,494,499 in 2017 as compared to $7,210,569 for 2016. General and administrative expenses are our largest cost and consist primarily of salaries and related expenses, including share-based compensation, for non-employee directors, finance and accounting, legal, internal audit and human resources personnel, legal costs, professional fees and other corporate expenses.

Operating loss for the twelve months ended December 31, 2017, was $8,787,186, a decrease in loss of $10,115,681 or 54%, compared to the loss of $18,902,681 for the same period in 2016 was mainly due to restructuring efforts and the sale of Validsoft in the third quarter of 2016.

EBITDA loss for the twelve months ended December 31, 2017, was $4,254,075, a decrease in loss of $4,778,819 or 53%, compared to the loss of $9,032,894 for the same period in 2016.

Adjusted EBITDA profit for the twelve months ended December 31, 2017, was $1,576,807, an improvement of $5,500,150, compared to the loss of $3,923,343 for the same period in 2016.

Of note, $966,292 of annual expense incurred was related to restructuring and severance and will no longer be effective by June 30, 2018.

At December 31, 2017, Pareteum had $13.5 million of cash, $0 senior secured debt, 50.5 million shares issued and outstanding and 18.1 million warrants outstanding. Thus far into the first quarter of 2018, over $2 million has been received from cash exercises of 1.9 million warrants. Additionally, 2.4 million warrants have been exercised in a cashless manner.

Financial Results for the Three Months Ended December 31, 2017:

Revenue for the three months ended December 31, 2017 was $4,014,700, an increase of $870,177 or 28%, compared to $3,144,523 for the three months ended December 31, 2016.

Gross profit for the three months ended December 31, 2017 was $2,910,016, resulting in a gross margin of 72.5%, compared to $2,482,352 and 78.9% for the three-month period ended December 31, 2016.

Product development expenses for the three months ended December 31, 2017 and 2016 were $424,301 and $776,900, a decrease of $352,599 or 45%, as a result of restructuring costs and closing down outsourced Asian product development. This was driven by a reduction in headcount.

Sales and Marketing expenses for the three months ended December 31, 2017 and 2016 were $471,906 and $246,654, respectively, an increase of $225,252 or 91%. The increase is due to additions to the sales force.

General and Administrative expenses for the three months ended December 31, 2017 and 2016 were $4,661,839 and $2,723,415, respectively, an increase of $1,938,424 or 71%.

Operating loss for the three months ended December 31, 2017, was $4,157,124, an increase in loss of $532,306 or 15%, compared to the loss of $3,624,818 for the same period in 2016.

EBITDA loss for the three months ended December 31, 2017, was $2,773,203, an improvement in loss of $129,932 or 4%, compared to the loss of $2,903,135 for the same period in 2016.

Adjusted EBITDA profit for the three months ended December 31, 2017, was $708,024, an improvement of $598,159 or 544%, compared to the profit of $109,865 for the same period in 2016.

| Conference Call Information: |

|

| Date: |

Tuesday, March 27, 2018 |

| Time: |

4:30 p.m. ET |

| Conference ID: |

7293025 |

| Domestic Dial-in Number: |

1-888-394-8218 |

| International Dial-in Number: |

1-323-701-0225 |

| U.K. Toll Free: |

0800 358 6377 |

| Live webcast: |

|

All interested participants should dial in approximately 5 to 10 minutes prior to the 4:30 p.m. ET conference call and an operator will register your name and organization.

A replay of the call will be available approximately one hour after the end of the call through March 27, 2019, and can be accessed at: http://public.viavid.com/index.php?id=128833

About Pareteum Corporation

The mission of Pareteum Corporation (NYSE American: TEUM) is to connect "every person and everything". Organizations use Pareteum to energize their growth and profitability through cloud communication services and complete turnkey solutions featuring relevant content, applications, and connectivity worldwide. Our platform services partners (technologies integrated into our Cloud) include: HPE, IBM, Sonus, Oracle, Microsoft, and other world class technology providers. All of the relevant customer acquired value is derived from Pareteum's award winning software, developed and enhanced for many years. By harnessing the value of communications, Pareteum serves retail, enterprise and IoT customers. Pareteum currently has offices in New York, Madrid, Barcelona, Bahrain and the Netherlands. For more information please visit: www.pareteum.com.

Forward Looking Statements:

Certain statements contained herein constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may include, without limitation, statements with respect to Pareteum's plans and objectives, projections, expectations and intentions. These forward-looking statements are based on current expectations, estimates and projections about Pareteum's industry, management's beliefs and certain assumptions made by management. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Because such statements involve risks and uncertainties, the actual results and performance of Pareteum may differ materially from the results expressed or implied by such forward-looking statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Unless otherwise required by law, Pareteum also disclaims any obligation to update its view of any such risks or uncertainties or to announce publicly the result of any revisions to the forward-looking statements made here. Additional information concerning certain risks and uncertainties that could cause actual results to differ materially from those projected or suggested in Pareteum's filings with the Securities and Exchange Commission, copies of which are available from the SEC or may be obtained upon request from Pareteum Corporation.

Contractual Revenue Backlog Definition:

Contractual revenue backlog is measured on a forward looking 36 month snapshot view monthly, and, is generated by each of the Company's Managed Services, Global Mobility Cloud, and Application Exchange & Developer's Platform customers. The Pareteum multi-year Software-as-a-Service agreements include service establishment and implementation fees, guaranteed minimum monthly recurring fees, as well as contractually scheduled subscribers, in some cases including subscriber usage, during the term of the agreement, and, their resulting monthly recurring revenue.

Discussion of Non-GAAP Financial Measures:

Pareteum's management believes that the non-GAAP measures of (1) "EBITDA" and (2) "Adjusted EBITDA" enhance an investor's understanding of Pareteum's financial and operating performance by presenting (i) a focus on core operating performance and (ii) comparable financial results over various periods. Pareteum 's management uses these financial measures for strategic decision making, forecasting future financial results and operating performance. The presentation of non-GAAP ("Generally Accepted Accounting Principles") financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

EBITDA and Adjusted EBITDA Definition:

"EBITDA" is a non-GAAP measure defined as earnings before interest, taxes, depreciation and amortization. "Adjusted EBITDA" is a non-GAAP measure defined by Pareteum as "EBITDA" excluding stock based compensation, restructuring charges, nonrecurring expenditures and certain software and non-cash adjustments made during the 2016 restructuring that are not applicable in 2017.

Pareteum Investor Relations Contacts:

Ted O'Donnell

Chief Financial Officer

(212) 984-1096

[email protected]

Hayden IR

(917) 658-7878

| PARETEUM CORPORATION AND SUBSIDIARIES |

|||||||

| AUDITED CONDENSED CONSOLIDATED |

|||||||

| (In thousands except for per share amounts) |

|||||||

| Three Month Period Ended |

Twelve Month Period Ended |

||||||

| December 31, |

December 31, |

December 31, |

December 31, |

||||

| 2017 |

2016 |

2017 |

2016 |

||||

| REVENUES |

$ 4,015 |

$ 3,145 |

$ 13,548 |

$ 12,856 |

|||

| COST AND OPERATING EXPENSES |

|||||||

| Cost of service |

1,105 |

662 |

3,684 |

3,659 |

|||

| Product development |

424 |

777 |

1,480 |

3,544 |

|||

| Sales and marketing |

472 |

247 |

1,575 |

1,341 |

|||

| General and administrative |

4,662 |

2,723 |

10,097 |

11,708 |

|||

| Restructuring charges |

125 |

1,638 |

966 |

1,638 |

|||

| Depreciation and amortization of intangibles assets |

1,384 |

927 |

4,533 |

4,247 |

|||

| Impairment for assets held and used |

- |

- |

- |

851 |

|||

| Impairment of goodwill |

- |

- |

- |

3,229 |

|||

| Loss on sale of assets |

- |

(205) |

- |

1,542 |

|||

| Total cost and operating expenses |

8,172 |

6,769 |

22,335 |

31,758 |

|||

| LOSS FROM OPERATIONS |

(4,157) |

(3,625) |

(8,787) |

(18,903) |

|||

| Total other income (expense) |

(3,335) |

(7,634) |

(3,569) |

(12,504) |

|||

| LOSS BEFORE PROVISION FOR INCOME TAXES |

(7,492) |

(11,259) |

(12,356) |

(31,406) |

|||

| Provision for income taxes |

26 |

11 |

107 |

38 |

|||

| NET LOSS |

(7,518) |

(11,269) |

(12,463) |

(31,445) |

|||

| OTHER COMPREHENSIVE LOSS |

|||||||

| Foreign currency translation (loss) gain |

(1,211) |

282 |

(1,220) |

703 |

|||

| COMPREHENSIVE LOSS |

$ (8,729) |

$ (10,987) |

$ (13,683) |

$ (30,742) |

|||

| Net loss per common share |

$ (0.31) |

$ (1.66) |

$ (0.84) |

$ (4.68) |

|||

| Weighted average shares - basic |

28,613,376 |

6,627,708 |

16,338,156 |

6,563,148 |

|||

| Non-GAAP Reconciliation |

Three Month Period Ended |

Twelve Month Period Ended |

|||||

| December 31, |

December 31, |

December 31, |

December 31, |

||||

| 2017 |

2016 |

2017 |

2016 |

||||

| NET LOSS |

$ (7,518) |

$ (11,269) |

$ (12,463) |

$ (31,445) |

|||

| Total interest and other income (expense) |

3,335 |

7,429 |

3,569 |

18,127 |

|||

| Depreciation and amortization |

1,384 |

927 |

4,533 |

4,247 |

|||

| Provision for income taxes |

26 |

11 |

107 |

38 |

|||

| EBITDA |

(2,773) |

(2,903) |

(4,254) |

(9,033) |

|||

| Nonrecurring and restructuring costs |

701 |

1,218 |

1,542 |

1,638 |

|||

| Stock based compensation |

2,780 |

1,795 |

4,289 |

3,472 |

|||

| Adjusted EBITDA |

$ 708 |

$ 110 |

$ 1,577 |

$ (3,923) |

|||

| PARETEUM CORPORATION AND SUBSIDIARIES |

||||

| AUDITED CONDENSED CONSOLIDATED BALANCE SHEET INFORMATION |

||||

| (In thousands) |

||||

| December 31, |

December 31, |

|||

| 2017 |

2016 |

|||

| Cash and cash equivalents |

$ 13,538 |

$ 931 |

||

| Restricted cash |

200 |

564 |

||

| Accounts receivable |

2,058 |

615 |

||

| Prepaid expenses and other current assets |

900 |

1,085 |

||

| Total current assets |

16,696 |

3,195 |

||

| Total assets |

25,326 |

13,045 |

||

| Total current liabilities |

7,538 |

13,293 |

||

| Total liabilities |

9,905 |

22,410 |

||

| Total stockholders' equity |

15,422 |

(9,365) |

||

| PARETEUM CORPORATION AND SUBSIDIARIES |

||||

| AUDITED CONDENSED CONSOLIDATED CASH FLOW INFORMATION |

||||

| (In thousands) |

||||

| For the Twelve Months Ended |

||||

| December 31, |

December 30, |

|||

| 2017 |

2016 |

|||

| CASH FLOWS FROM OPERATING ACTIVITIES: |

$ (3,864) |

$ (3,658) |

||

| CASH FLOWS FROM INVESTING ACTIVITIES: |

(722) |

1,037 |

||

| CASH FLOWS FROM FINANCING ACTIVITIES: |

15,859 |

3,162 |

||

| EFFECT OF EXCHANGE RATES |

970 |

21 |

||

| NET INCREASE (DECREASE) IN CASH & CASH EQUIVALENTS |

12,242 |

562 |

||

SOURCE Pareteum Corporation

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article