PAN GLOBAL INTERSECTS 1.04% COPPER OVER 15.9 METERS AT WESTERN EXPANSION OF LA ROMANA COPPER-TIN-SILVER DISCOVERY

TSXV: PGZ | OTCQX: PGZFF

- Highest grades intersected to-date in the current 25-hole drill program

- New drilling confirms continuation of high-grade near-surface copper-tin-silver (Cu-Sn-Ag) mineralization

- Mineralization remains wide open, with grades increasing to the west and down-dip to the north

VANCOUVER, BC, Nov. 7, 2023 /PRNewswire/ - Pan Global Resources Inc. ("Pan Global" or the "Company") (TSXV: PGZ) (OTCQX: PGZFF) is pleased to announce the intersection of additional high-grade near-surface copper mineralization at the Company's 100% owned Escacena Project in the Iberian Pyrite Belt in southern Spain.

Assay results for five new drill holes from the western extension of the La Romana copper-tin-silver discovery confirm the mineralization extends over more than 1.35 kilometers of strike and remains open. These drill results include the highest grades intersected to-date in the current 25-hole drill program aimed at testing the western extension of the La Romana mineralization.

- LRD171: 15.9m at 1.15% CuEq1 (1.04% Cu, 0.03% Sn, 2.4 g/t Ag) from 79m, including 9.9m at 1.70% CuEq1 (1.57% Cu, 0.04% Sn, 3.6 g/t Ag);

- LRD170: 12m at 1.04 % CuEq1 (0.80% Cu, 0.09% Sn, 2.1 g/t Ag) from 61m, including 7m at 1.47% CuEq1 (1.16% Cu, 0.11% Sn, 2.9 g/t Ag);

- LRD168: 13m at 1.02% CuEq1 (0.67 % Cu, 0.13% Sn, 1.6 g/t Ag) from 52m, including 7m at 1.43% CuEq1 (0.96% Cu, 0.17% Sn, 2.2 g/t Ag)

- A down-hole electromagnetic (DHEM) conductor anomaly from LRD171 provides a strong indication the higher-grade mineralization continues down-dip and will be targeted for future drilling

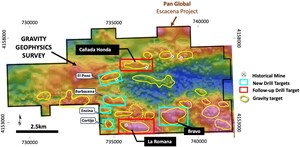

Drill hole locations are shown in Figure 1 below. Drill hole assay results are summarized in Table 1 and collar details are presented in Table 2 below.

"It is very encouraging that our ongoing drill program at La Romana confirms extensions to the high-grade copper-tin mineralization. The potential to expand the high-grade mineralization further along-strike to the west and down-dip is exciting. The east-west strike length of La Romana is now more than 1.35 kilometers and remains open, with step-out drilling ongoing," said Tim Moody, President and CEO of Pan Global.

"The combination of continuous near-surface copper-tin mineralization, simple and predictable geometry, and favourable metallurgy are significant advantages for potential open-pit development at La Romana," said Mr. Moody. "The C$6 million non-brokered private placement financing that closed earlier this week puts us in a strong position to fund a multi-target exploration program and maiden Resource for La Romana."

The main La Romana copper mineralization occurs in two highly continuous layers, Zone B and Zone C, commencing from surface or directly below a thin cover of post-mineral sediments. The new results show the copper mineralization in Zone B is increasing in grade and thickness in the west. A deeper high-grade copper layer, Zone D, is also present in several recent drill holes, and represents an additional prospective target horizon.

Copper mineralization intersected in drill holes includes primary chalcopyrite, overprinted at shallow depths by secondary/supergene copper sulphide (chalcocite) and an overlying oxide zone with local native copper and copper oxides. Chalcocite is a high copper content mineral, indicating upgrading of the copper mineralization at the base of the oxide zone. This represents an additional target for higher grade copper. The tin mineralization is cassiterite, the preferred mineral for commercial extraction.

Additional results are pending for eight completed drill holes at La Romana and preparations are underway for follow-up drilling at the recent Cañada Honda copper-gold discovery approximately 4km to the north.

Table 1 – La Romana new drill results summary

Hole ID |

From |

To |

Interval |

CuEq1 |

Cu |

Sn |

Ag |

Au |

Pb |

Zn |

True |

|

m |

m |

m |

% |

% |

% |

g/t |

g/t |

ppm |

ppm |

(m) |

||

LRD167 |

20.00 |

33.05 |

15.05 |

0.49 |

0.32 |

0.06 |

1.2 |

0.01 |

25 |

81 |

12.43 |

|

and |

73.00 |

80.00 |

7.00 |

0.64 |

0.50 |

0.05 |

1.4 |

0.02 |

14 |

59 |

5.78 |

|

and |

117.95 |

118.50 |

0.55 |

1.70 |

1.57 |

0.05 |

0.5 |

0.02 |

13 |

95 |

0.45 |

|

LRD168 |

43.00 |

57.55 |

14.55 |

0.93 |

0.61 |

0.12 |

1.4 |

0.02 |

15 |

109 |

14.27 |

|

including |

43.00 |

56.00 |

13.00 |

1.02 |

0.67 |

0.13 |

1.6 |

0.02 |

17 |

108 |

12.75 |

|

including |

47.00 |

56.00 |

7.00 |

1.43 |

0.96 |

0.17 |

2.2 |

0.03 |

29 |

138 |

6.87 |

|

LRD169 |

52.00 |

59.00 |

7.00 |

1.05 |

0.97 |

0.03 |

2.0 |

0.01 |

16 |

96 |

5.34 |

|

including |

56.00 |

59.00 |

3.00 |

2.26 |

2.11 |

0.05 |

4.3 |

0.02 |

13 |

105 |

2.29 |

|

and |

101.00 |

111.00 |

10.00 |

0.53 |

0.33 |

0.07 |

0.7 |

0.03 |

10 |

59 |

7.63 |

|

and |

140.00 |

141.00 |

1.00 |

1.68 |

1.64 |

0.01 |

4.7 |

0.02 |

25 |

176 |

0.76 |

|

LRD170 |

61.00 |

73.00 |

12.00 |

1.04 |

0.80 |

0.09 |

2.1 |

0.01 |

5 |

77 |

11.82 |

|

including |

66.00 |

73.00 |

7.00 |

1.47 |

1.16 |

0.11 |

2.9 |

0.02 |

5 |

89 |

6.90 |

|

including |

69.00 |

71.40 |

2.40 |

3.20 |

2.64 |

0.20 |

6.2 |

0.04 |

8 |

137 |

2.36 |

|

and |

93.00 |

100.00 |

7.00 |

0.44 |

0.36 |

0.03 |

0.7 |

0.02 |

7 |

49 |

6.90 |

|

and |

148.00 |

150.00 |

2.00 |

1.21 |

1.18 |

0.01 |

2.0 |

0.01 |

76 |

93 |

1.97 |

|

LRD171 |

79.00 |

97.00 |

18.00 |

1.03 |

0.94 |

0.03 |

2.2 |

0.01 |

5 |

83 |

14.74 |

|

including |

79.00 |

94.90 |

15.90 |

1.15 |

1.04 |

0.03 |

2.4 |

0.01 |

6 |

88 |

13.02 |

|

including |

85.00 |

94.90 |

9.90 |

1.70 |

1.57 |

0.04 |

3.6 |

0.02 |

6 |

104 |

8.11 |

|

including |

92.00 |

94.90 |

2.90 |

4.28 |

4.08 |

0.06 |

8.9 |

0.05 |

12 |

209 |

2.38 |

|

and |

123.00 |

130.00 |

7.00 |

0.56 |

0.40 |

0.06 |

0.9 |

0.01 |

45 |

51 |

5.73 |

|

and |

183.25 |

184.15 |

0.90 |

3.64 |

3.59 |

0.01 |

2.7 |

0.02 |

18 |

103 |

0.74 |

1 Copper Equivalent = CuEq. CuEq is calculated using Cu, Sn, and Ag grades. Metallurgical recoveries include 86% for Cu, 68% for Sn and 56% for Ag, based on preliminary studies performed by Wardell Armstrong International and MinePro. The CuEq calculation uses US$ 8,693/tonne Cu, US$ 29,069/tonne Sn and US$ 23.72/oz Ag, corresponding to the three-year monthly price averages to July 2023. The effective formula is [CuEq %] = [Cu %] + 2.6440 * [Sn %] + 0.0057 * [Ag ppm] |

Table 2 – La Romana drill hole collar information (5 holes, total 792.10m)

Hole ID |

Easting 2 |

Northing 2 |

Azimuth (o) |

Dip (o) |

Depth (m) |

LRD167 |

735976 |

4152716 |

156 |

-50 |

122.15 |

LRD168 |

735954 |

4152761 |

180 |

-50 |

125.55 |

LRD169 |

735865 |

4152803 |

240 |

-60 |

191.65 |

LRD170 |

735866 |

4152806 |

180 |

-55 |

155.65 |

LRD171 |

735866 |

4152807 |

0 |

-90 |

197.1 |

2 Coordinate system: UTM29N ERTS89 |

The Escacena Project comprises a large, contiguous, 5,760-hectare land package controlled 100% by Pan Global in the east of the Iberian Pyrite Belt. Escacena is located near operating mines at Las Cruces and Riotinto and is immediately adjacent to the former Aznalcóllar and Los Frailes mines where Minera Los Frailes/Grupo Mexico is in the final permitting stage with construction anticipated to start in 2024. The Escacena Project hosts the La Romana copper-tin-silver discovery and a number of other prospective targets, including Cañada Honda, Romana North, Bravo, Barbacena, El Pozo, San Pablo, Zarcita, Hornitos, La Jarosa, and Romana Deep.

Pan Global Resources Inc. is actively targeting copper-rich mineral deposits, given copper's compelling supply-demand fundamentals and outlook for strong long-term prices as a critical metal for global electrification and energy transition. The Company's flagship Escacena Project is located in the prolific Iberian Pyrite Belt in southern Spain, where infrastructure, mining and professional expertise, and support for copper as a Strategic Raw Material by the European Commission collectively define a tier-one jurisdiction for mining investment. The Pan Global team comprises proven talent in exploration, development, and mine operations - all of which are committed to operating safely and with utmost respect for the environment and our partnered communities.

Core size was HQ (63mm) and all samples were ½ core. Nominal sample size was 1m core length and ranged from 0.5 to 2m. Sample intervals were defined using geological contacts with the start and end of each sample physically marked on the core. Diamond blade core cutting and sampling was supervised at all times by Company staff. Duplicate samples of ¼ core were taken approximately every 30 samples and Certified Reference materials inserted every 25 samples in each batch.

Samples were delivered to ALS laboratory in Seville, Spain and assayed at the ALS laboratory in Ireland. All samples were crushed and split (method CRU-31, SPL22Y), and pulverized using (method PUL-31). Gold analysis was by 50gm fire assay with ICP finish (method Au-ICP22) and multi element analysis was undertaken using a 4-acid digest with ICP AES finish (method ME-ICP61). Over grade base metal results were assayed using a 4-acid digest ICP AES (method OG-62). Over grade tin was determined using peroxide fusion with ICP finish (method Sn-ICP81x).

James Royall, Vice President Exploration for Pan Global Resources and a qualified person as defined by National Instrument 43-101, has reviewed the scientific and technical information for this media release. Mr. Royall is not independent of the Company.

On behalf of the Board of Directors

Statements which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations or intentions regarding the future. It is important to note that actual outcomes and the Company's actual results could differ materially from those in such forward-looking statements. The Company believes that the expectations reflected in the forward-looking information included in this media release are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking information should not be unduly relied upon. Risks and uncertainties include, but are not limited to, economic, competitive, governmental, environmental and technological factors that may affect the Company's operations, markets, products and prices. Readers should refer to the risk disclosures outlined in the Company's Management Discussion and Analysis of its audited financial statements filed with the British Columbia Securities Commission.

The forward-looking information contained in this media release is based on information available to the Company as of the date of this media release. Except as required under applicable securities legislation, the Company does not intend, and does not assume any obligation, to update this forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

SOURCE Pan Global Resources Inc.

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article