LINCOLN, Neb., Jan. 20, 2022 /PRNewswire/ -- Recent equipment value movement across heavy-duty sleeper trucks show just how volatile values can be from month to month. A new Sandhills Global Market Report details that, from November to December 2021, heavy-duty sleeper truck values in Sandhills marketplaces rose 19.2% at auction, while asking values were up 18.3% M/M. The report also examines the short-term value trends in crawler excavators and high-horsepower (300-HP and greater) tractors.

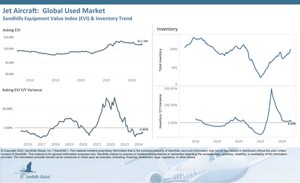

The key metric used in this reporting is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills' used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The short-term value changes featured in this report also detail which age groups are driving the highest increases in each equipment category.

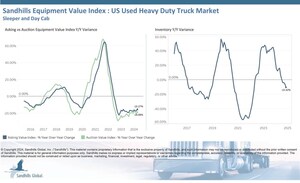

U.S. Used Heavy-Duty Sleeper Trucks

- Low inventory for heavy-duty sleeper trucks continues to impact used values.

- From November to December 2021, average asking values and auction values both increased $12,000.

- Asking values for late-model sleeper trucks (those in the 0- to 5-year age group) were up 19% M/M. Asking values for older models (over 5 years), by comparison, increased only 3.5% to 4% M/M.

U.S. Used Excavators

- The Sandhills EVI finds that crawler excavator auction values were up 2.62% M/M, and asking values increased 0.84% M/M.

- Crawler excavators in the 10- to 25-year age group displayed the highest asking value increase, up 2.34% M/M.

- Asking values for the less-than-10-year age group increased between only 0.5% and 1.0% M/M.

U.S. Used Tractors 300 Horsepower and Greater

- Compared to other major used equipment categories, high-horsepower tractors remained flat with a 0.17% M/M auction value increase and a 0.77% M/M decrease in asking value.

- The slight downward trajectory is a departure from the upward increases in high-horsepower tractors seen throughout Q4 2021.

- The 10- to 25-year age group produced the highest asking value increase, up 1.45% M/M. The less-than-10-year age group was flat from November to December 2021.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About Sandhills Global

Sandhills Global is an information processing company headquartered in Lincoln, Nebraska. Our products and services gather, process, and distribute information in the form of trade publications, websites, and online services that connect buyers and sellers across the construction, agriculture, forestry, oil and gas, heavy equipment, commercial trucking, and aviation industries. Our integrated, industry-specific approach to hosted technologies and services offers solutions that help businesses large and small operate efficiently and grow securely, cost-effectively, and successfully. Sandhills Global—we are the cloud.

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills' proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.

Contact Sandhills

www.sandhills.com/contact-us

402-479-2181

SOURCE Sandhills Global

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article