BELLEVUE, Wash., Sept. 6, 2017 /PRNewswire/ -- Center, a financial technology company tackling business spend challenges through a unique combination of budgeting software and a digital, connected corporate card, today released insights from its recent study, The State of Corporate Budget 2017. The survey, which polled nearly 250 US-based business owners and managers, looked to gain deeper insights on attitudes and practices related to the budget process today. Findings prove that budgets, the cornerstone of corporate planning, remain mired in manual processes, with many companies still using outdated, time-intensive tools like Excel spreadsheets and paper receipt collecting to track spend. As a result, 64 percent of respondents cite that their companies go over budget at least sometimes. Survey results signal not only a lack of insight but demonstrate a large-scale opportunity for businesses to improve the budgeting process, actively involve employees in the conversation, and positively impact their own bottom lines.

The Challenges of Successful Budgeting

When used properly and updated regularly, budgets provide the strategic insights and operational focus needed to streamline and optimize business dynamics. However, 55 percent of respondents say their companies set budgets only once a year, despite best practices that recommend a rolling approach to budget planning. Budgets set annually fail to respond to the agile nature of today's businesses and are often out of date within a few months. Of the surveyed executives, a staggering 86 percent do not set and adjust budget periodically. Of the 14 percent who do set and adjust budgets throughout the year, businesses employing 50 people or less were more likely than larger companies to use a rolling budget, indicating greater flexibility around budget management within smaller organizations.

Since company budgets often function as the gold standard in measuring corporate success, the absence of timely insights into corporate spending paired with outdated budgets makes it difficult to hit financial projections. The survey found that a majority (64 percent) of executives admit to going over budget at least some of the time, pointing to how easily companies can get off track when budgets aren't regularly evaluated and adapted to reflect shifting strategic priorities.

Antiquated Tools Overcomplicate Budgeting Processes

In a typical small to medium-sized business, discretionary spend – spending that falls outside of fixed costs like payroll and rent – accounts for up to 25 percent of a company's budget and offers the biggest opportunity to impact the bottom line when businesses look to cut expenses, manage cash flow or track to P&L targets. But accurately managing, tracking and controlling discretionary spend is innately complex. In fact, one in four executives polled have no idea what percentage of their corporate budget goes toward discretionary spend.

Most executives point to current tools in place as the biggest barrier to better visibility within the organization. In fact, 88 percent of respondents don't use budgeting software at all, and another 43 percent still use passive documents that require manual updating, like Excel spreadsheets, as their primary budget tracking system. Small companies (under 50 employees) are even more likely than mid-size to large organizations to rely on Excel for budget tracking over more advanced software. While manual, time-consuming processes are widely used, the findings point to a major opportunity to adopt more agile business solutions and processes that promote strategic, flexible spending and meet the changing business needs of small to medium-sized businesses.

"Our survey findings prove that today's commonly used but outdated budgeting processes can't meet the ever-changing needs of the organizations they serve," said Naveen Singh, co-founder and CEO at Center. "Without real-time visibility into spend, budgets are merely static documents, instead of the dynamic plans needed to manage cash flow and support an organization as it evolves. As the data clearly shows, the market is ripe for new solutions to help budget managers and employees meet their goals and ultimately strengthen a company's bottom line."

To view the CenterCard infographic highlighting these and other key findings from the survey, visit: https://centercard.com/how-well-do-you-know-your-companys-budget-infographic.

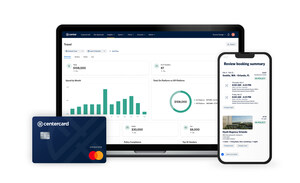

Center's corporate card program, CenterCard, combines a cloud and mobile budgeting solution with a digitally connected payment card that allows businesses to dynamically and strategically link their budgets to spend. This real-time visibility enables card spend to be planned, managed and controlled on a rolling basis, which helps businesses track, adjust and communicate spending information across departments and cost centers, all the way down to individual employees at the point of purchase. CenterCard will be available to US-based businesses in the fall of 2017. For more information on Center or to receive updates on CenterCard's availability, please visit www.centercard.com.

About Center

Center ID Corp., doing business as Center, focuses on making business spending strategic, intelligent and connected. Its CenterCard corporate card program helps businesses achieve more by dynamically linking budget to strategy and spending. Through the powerful combination of its mobile and cloud-based software and the digitally connected payment card, CenterCard will help businesses budget, track, adjust and communicate spending information across departments and cost centers, down to individual employees at the point of purchase. Designed by a team with deep expertise in payments, hardware, cloud computing, travel & expense management and supply chain & operations, CenterCard builds intelligence into all aspects of the plan-manage-spend cycle to help everyone within the organization make more strategic decisions. Founded in 2014, Center has offices in Bellevue, Washington and Kitchener, Ontario. For more information on Center, please visit www.centercard.com.

Media Contact: Jennifer Lyle, [email protected]

SOURCE Center

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article