FORT LAUDERDALE, Fla., Oct. 18, 2016 /PRNewswire/ -- U.S. business travelers can breathe a bit easier with the new travel-tracking app TaxDay™. TaxDay is a game-changer for people who juggle multi-state residency, or for those who conduct business in multiple states, and must track and record taxable travel days and total time spent in various locations.

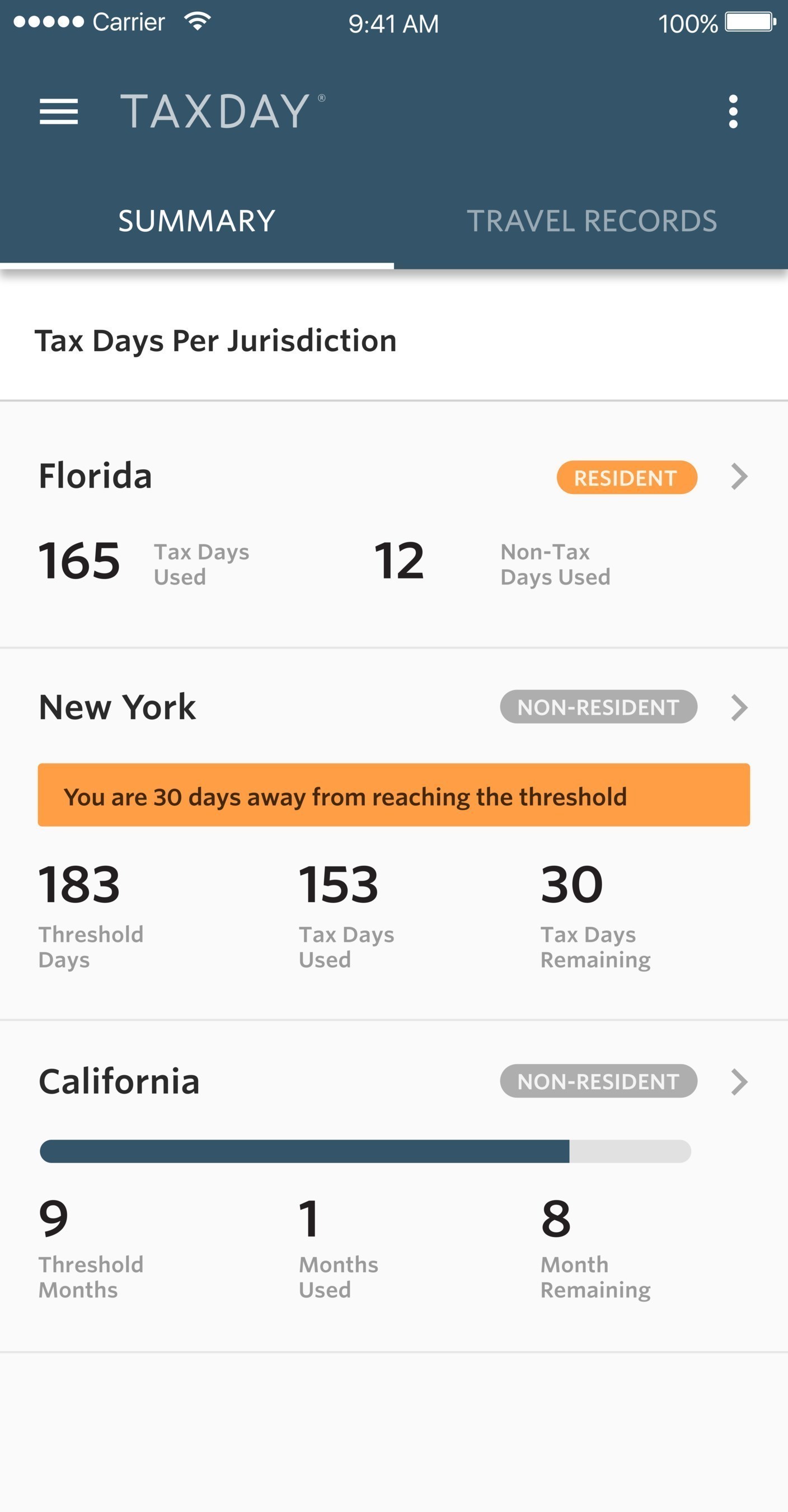

Each U.S. state has separate rules and regulations that define tax residency, and many travelers don't know the rules, or the tax consequences associated with multi-state travel. To address this, TaxDay runs silently in the background, syncing to a user's smartphone GPS to securely track interstate travel after location settings are enabled on the device. Smart notifications, an intuitive reporting interface, and a comprehensive database of all 50 states' tax-residency rules make it easy to track tax-residency thresholds in different states. With a few clicks in the app users can manage interstate travel records, attach receipts and generate an accurate, securely stored report of multi-state travel, which can protect people from unexpected tax consequences.

The TaxDay app is available for download in the Apple App Store as a subscription service of $9.99/month: http://apple.co/2e3z8Ox

"I own residences in different states, and traveled frequently for business when I worked for Major League Baseball—and I was personally audited twice when New York State challenged my Florida residency," said Jonathan Mariner, Founder and President of TaxDay. "Those experiences inspired me to develop the TaxDay app to make it simple to maintain accurate travel records, and keep track of tax-residency thresholds, while commuting between multiple tax jurisdictions."

TaxDay recognizes the importance of privacy, and only records the state where the traveler is located—not specific locations within each state.

The TaxDay app utilizes secure cloud storage to protect travel data and makes it easily accessible at any time, even years later. Its key features and capabilities include:

- Customizable setting options to allow automatic notifications to be sent when tax-residency thresholds are approaching or have been exceeded.

- Configurable permission settings to enable additional individuals, such as accountants, financial advisors or personal assistants, to access the app.

- Built-in portal for uploading additional documentation, such as receipts or boarding passes, to establish proof of travel as well as physical presence in jurisdictions.

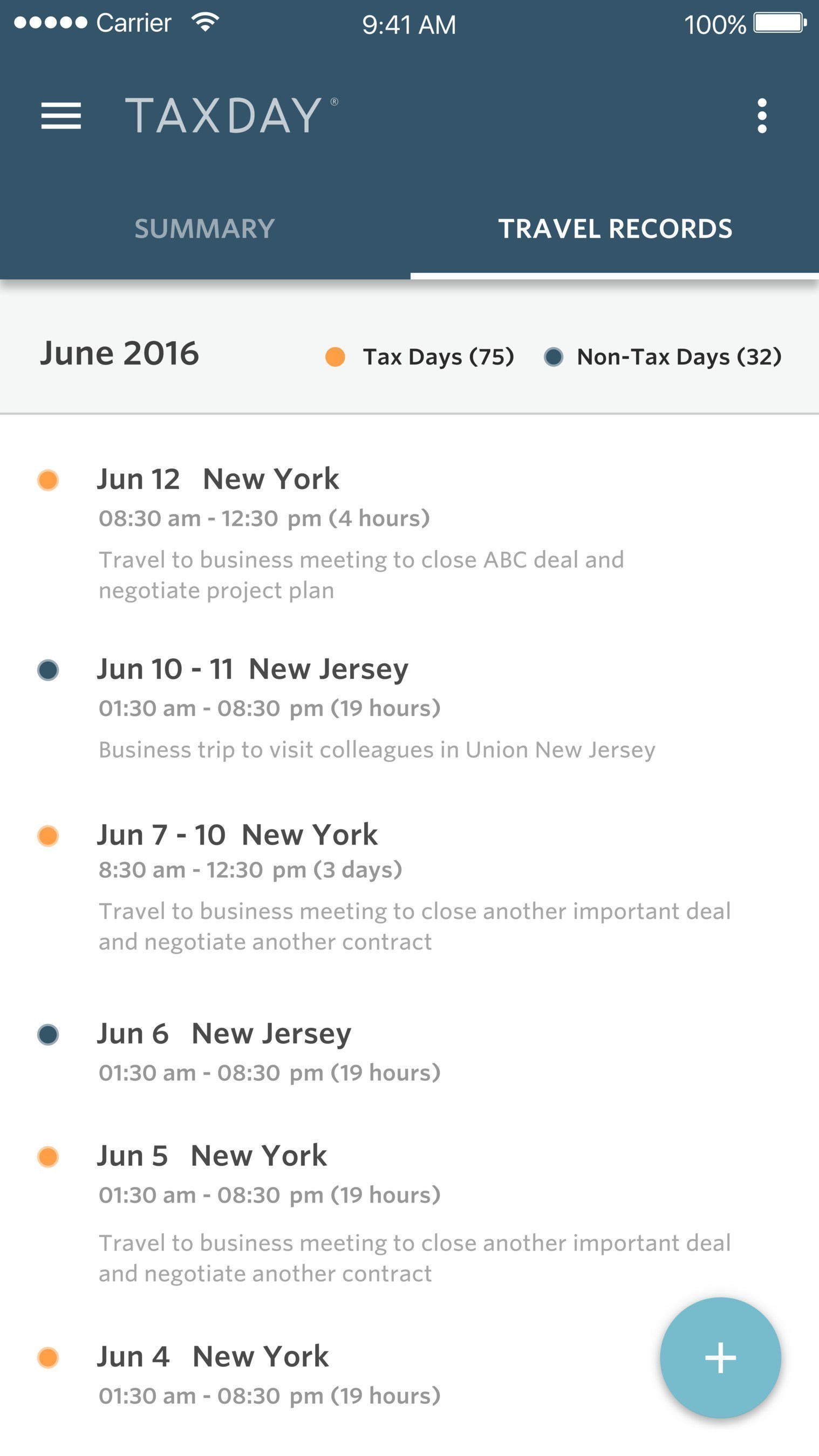

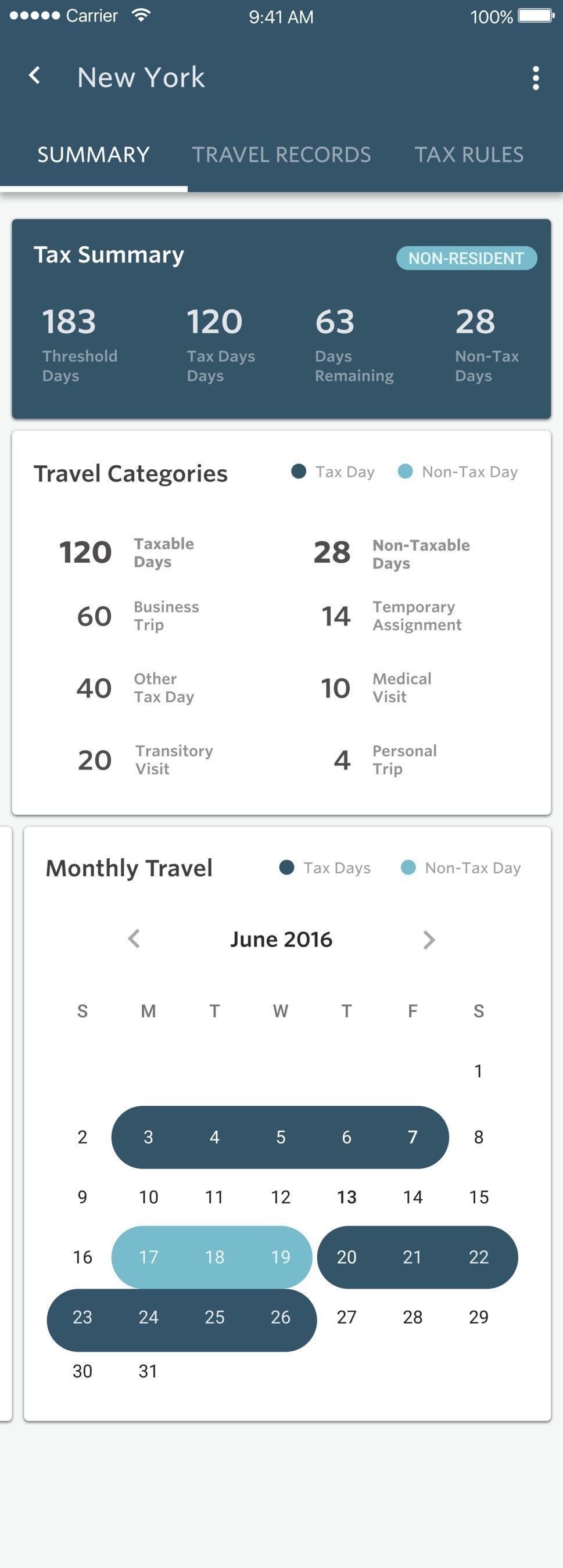

- Exportable reports that clearly document where an individual was, the length of their stay, and the type of travel (business, vacation, medical or transient), which can be sent to the user's accountants, financial advisors or personal assistants.

- The ability to add notes or trip descriptions to help document travel, plus the option to manually enter travel information in the event that the mobile device has been forgotten on a particular trip.

"TaxDay reliably and effortlessly equips individuals with the information they need to remain tax-compliant and simplify tax-filing preparation," said Mr. Mariner. "Preparing records of travel days can be time-consuming and burdensome, especially if an individual relies on archaic means of storing data, such as travel diaries, multiple calendars and shoe boxes filled with receipts. TaxDay simplifies the entire process, and protects individuals and their assets against tax-residency penalties."

About TaxDay™

TaxDay™ is a travel-tracking app that enables individuals who maintain residences in more than one U.S. state, or travel frequently and do business in multiple states, to record their travel and track their tax-residency status requirements in a reliable, effortless way. By syncing TaxDay to GPS tracking on their mobile devices, users are able to reliably track their travel days and receive residency threshold notifications to avoid unintended consequences at tax time.

The app can be synched across multiple devices and logins, so accountants, personal assistants and other parties can help busy travelers maintain accurate travel records. TaxDay can provide notifications as certain preset state tax-residency thresholds are met, enabling users to make travel adjustments as needed. TaxDay's comprehensive dashboard utilizes secure data features to simplify the tax-preparation process, allowing users to safely secure and access information—even years later—and generate reports that can be shared with financial professionals.

TaxDay is available for purchase in Apple's App Store, and is compatible with iPhone and iPad (requires iOS 8.4 or later). For more information about TaxDay—offering peace of mind, for the state you're in™—please visit www.taxdayapp.com.

| Media Contact: |

Dana Taormina |

| JConnelly |

|

| (973) 850-7305 |

|

Video - http://www.youtube.com/watch?v=W8bp00Hq6GU&feature=youtu.be

Photo - http://photos.prnewswire.com/prnh/20161017/429419

Photo - http://photos.prnewswire.com/prnh/20161017/429421

Photo - http://photos.prnewswire.com/prnh/20161017/429417

Logo - http://photos.prnewswire.com/prnh/20161017/429418LOGO

SOURCE TaxDay

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article