National Equity Fund and Silicon Valley Bank Launch $110 Million Opportunity Zone Investment Fund to Create Affordable Housing in High-Rent California Districts

Through use of unique financing strategies, Santa Rosa, Coachella, Los Angeles and San Jose low-income residents will soon have new options for affordable housing

LOS ANGELES and SAN FRANCISCO, Aug. 26, 2021 /PRNewswire/ -- Silicon Valley Bank (SVB) partnered with non-profit, tax credit syndicator, National Equity Fund (NEF), to commit $110,000,000 for affordable housing in Los Angeles and the Bay Area. Leveraging an innovative and deliberate use of Opportunity Zone incentives, the Silicon Valley Bank proprietary fund is committed to place all $110 million in Low-Income Housing Tax Credit deals before the end of 2021, despite having just funded earlier this month.

"Silicon Valley Bank's sizable investment will result in the production of affordable housing that is truly consistent with the original stated intent of the Opportunity Zone legislation - to address racial inequity and invest in the communities where it's needed most," said Matt Reilein, President and CEO of National Equity Fund.

"Silicon Valley Bank's thoughtful approach and willingness to be persistent and work through the complexity of such a high impact fund will result in one of the largest affordable housing investments using Opportunity Zone resources in the industry," Reilein continued.

As defined by the IRS, Opportunity Zone legislation was created to spur economic growth and job creation in low-income communities while providing tax benefits to investors. States nominate communities for the designation, and the U.S. Department of the Treasury certifies that nomination. Today, thousands of low-income communities in all 50 states, the District of Columbia and five U.S. territories are designated as Qualified Opportunity Zones.

"In many of California's most expensive areas, our fund will help create affordable housing where it's needed most and for who needs it the most - including units reserved specifically for people experiencing homelessness and local farm workers," said Fiona Hsu, Head of Community Development Finance at Silicon Valley Bank. "NEF was a fantastic partner in helping us work through all the complexity that comes with Opportunity Zone investments. The process wasn't easy, but it was definitely worth it," Hsu continued.

"At National Equity Fund, our vision is that all individuals and families across the country have access to stable, safe and affordable homes that provide a foundation for them to reach their full potential. Partners like Silicon Valley Bank are helping to make that vision a reality for more communities in need," said Reena Bramblett, Senior Vice President of Equity Placement at NEF.

About NEF

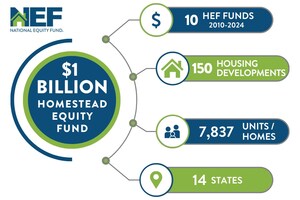

National Equity Fund, Inc., based in Chicago, is a nonprofit affordable housing investor and one of the nation's largest syndicators of federal Low Income Housing Tax Credits. Since 1987, NEF has invested nearly $18.3 billion in more than 2,900 developments, supporting 200,500 affordable homes and fueling nearly 245,000 jobs nationwide. NEF is an affiliate of the nonprofit Local Initiatives Support Corporation (LISC) and has made more than $196 million in grants to support LISC's broad-based community investment efforts throughout the country. For more information, visit www.nefinc.org or https://www.nationalequityfund.org/AnnualReport2020/index.html.

About Silicon Valley Bank

For nearly 40 years, Silicon Valley Bank (SVB) has helped innovative companies and their investors move bold ideas forward, fast. SVB provides targeted financial services and expertise through its offices in innovation centers around the world. With commercial, international and private banking services, SVB helps address the unique needs of innovators. Learn more at svb.com. [SIVB-C]

SOURCE National Equity Fund

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article