HOUSTON, Oct. 11, 2017 /PRNewswire/ -- Oil and gas executives' confidence in a quick industry recovery seems to have materially shifted this year from a return to optimism to more caution, according to Deloitte's "2017 Oil and Gas Industry Executive" survey. With lower expectations of a rapid price recovery, the need by many to find new efficiency gains and reduce costs could push the digital revolution to its tipping point.

These findings contrast with prior executives' views that the moderate-growth global macroeconomic outlook of the past two years remains unchanged. Whereas respondents were increasingly hopeful for a strong recovery in 2016, this year's survey results indicate the oil and gas sector seems to have been hit disproportionately harder when compared to the broader economic outlook. In fact, respondents across the oil and gas value chain expressed more caution about the state of the industry and indicated business strategies would need to adapt accordingly.

"The slow road back has gotten longer," said John England, vice chairman, Deloitte LLP and U.S. energy and resources leader. "The protracted holding pattern we've been in for the last two years seems to have shaken executives' confidence in every sector — upstream, midstream and downstream. As the industry hunkers down to focus on cost reduction and productivity, one silver lining may be a drive to the next wave of digital technology adoption to uncover new efficiencies important to success."

Key findings include:

- The majority (64 percent) of respondents expect the price of West Texas Intermediate crude to remain between $40–$50 per barrel in 2017, slightly rising to $50–$60 in 2018, and then only increasing to up to $70 per barrel by 2020. In contrast, last year executives were markedly more optimistic about a more rapid price recovery.

- The pessimism was more pronounced in oil prices, with the outlook for natural gas slightly more stable. Almost half expect Henry Hub natural gas to be between $2.50–$3 per million British thermal units (mmbtu) in 2017, with price increases expected for 2018, and into 2020 (up to $3.50 per mmbtu).

- Half of upstream oil and gas executives expect up to a 10-percent decrease in capital expenditures in 2018 versus 2016, including 4 in 10 expecting exploration expenditures to decrease; and 58 percent of executives expect a net decrease in rig deployment in 2018 versus 2016.

- Oil field services is seen as the sector with the greatest potential for increased mergers and acquisition (M&A) activity, followed closely by upstream exploration and production (E&P), integrated oil and midstream.

Upstream: Recalibrating to new rebound realities

Given the more cautious price outlook, most respondents noted maintaining or increasing current production levels as their foremost priority for strategic focus for upstream companies in 2017–2018, followed by reducing general and administrative expenses (G&A) and total expenditures.

- About half of respondents see service and supply cost changes as the biggest factors impacting cost structures in 2017 and 2018, followed by increased well productivity (42 percent) and digital technology (31 percent).

- Slightly more respondents (41 percent) anticipate a decline in headcount reductions in 2018 versus remaining the same. That noted, fewer expect direct headcount changes to have as much of an impact on costs in 2018 versus 2017.

Midstream: Can infrastructure needs overcome buildout obstacles?

More than half (56 percent) of midstream executives expect a decrease in capital expenditures in 2018 versus 2016. Only 1 in 8 expect an increase over the next year.

- Pipelines are seen as the best opportunity for growth in 2018, with the majority continuing to view the Gulf coast as the most productive (49 percent), followed by U.S. Midwest and Appalachia (42 percent).

- Of greatest concern were environmental issues (47 percent), controlling costs (46 percent) and regulations (41 percent). However, nearly half (49 percent) of respondents see future top opportunities in catching up with infrastructure needs and expanding into new markets such as liquefied natural gas (LNG) or new industrial sites (43 percent).

Downstream: Outlook less dour but far from rosy

Downstream executives are slightly less likely to expect reductions in capital expenditures (45 percent) compared with those in upstream and midstream sectors. Increased exports (58 percent) and low oil prices stimulating the economy (53 percent) top the list of downstream opportunities.

- Expectations for refinery margins by the end of 2018 are largely in line with current margins, with a majority (52 percent) expecting margins between $15-$25 per barrel.

- The biggest downstream challenges are costs (46 percent), environmental issues (38 percent) and regulations (38 percent).

- Increased fuel efficiency (53 percent), followed by use of compressed natural gas (CNG)/LNG in trucking and shipping industries (47 percent) and broader adoption of electric vehicles (41 percent) are viewed as having the biggest impact on downstream product demand over the next five years.

Can digital bridge the price divide?

Fifty-five percent of upstream executives see improving operational efficiencies as the best path forward for sustained cost reductions. Additional Deloitte research indicates that although many companies are seeing value in digitizing operations to find new opportunities and drive efficiencies, cut costs and increase safety and productivity — especially when they have exhausted other means — they are still immature on the adoption curve, compared to other industries.

Even a 1 percent gain in capital productivity would mean a savings of about $40 billion. For perspective, listed pure-play upstream, integrated and oil field services companies worldwide reported a cumulative net loss of about $35 billion in 2016. The digital leap toward advanced analytics alone could potentially deliver annualized well-cost savings of about $30 billion to upstream players, while oil field service players can potentially create multibillion-dollar, high-margin revenue streams.

"The new reality seems to have set in — waiting for a significant price recovery may be a long haul," said Andrew Slaughter, executive director, Deloitte Center for Energy Solutions, Deloitte Services LP. "It possibly has never been truer now that the low-cost producers are the winners. The bottom line is that companies should focus on cost discipline and operational efficiency. Digitization is likely the next frontier in this new normal, offering a lifeline for new efficiencies, cost reductions and productivity."

Connect with us on Twitter: @Deloitte4Energy, @JohnWEngland.

About Deloitte

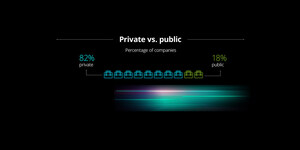

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world's most admired brands, including 80 percent of the Fortune 500 and more than 6,000 private and middle market companies. Our people work across more than 20 industry sectors to deliver measurable and lasting results that help reinforce public trust in our capital markets, inspire clients to make their most challenging business decisions with confidence, and help lead the way toward a stronger economy and a healthy society.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as "Deloitte Global") does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the "Deloitte" name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

SOURCE Deloitte

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article