SAN FRANCISCO, June 28, 2018 /PRNewswire/ -- In 2015, there were more than 6.3 million car accidents reported that involved property damage1 with insurance fraud accounting for 10 percent of property/casualty claims processed2. While not every accident resulted in an insurance claim, those that did required extensive effort to be verified manually. To help automate the process and to fight against fraud which contributes to rising insurance rates, Metromile, the leader in pay-per-mile car insurance in the U.S., staged the world's slowest car crashes to generate data and used a machine learning technology to help spot fraud more quickly.

Experience the interactive Multichannel News Release here: https://www.multivu.com/players/English/8357351-metromile-artificial-intelligence-machine-learning-insurance-fraud/

"With machine learning technology, our team will be able to better prevent insurance fraud and assist customers with hard-to-prove but common claim types, like hit-and-run collisions, car theft, and rear-ends," said Paul Anzel, a Data Scientist at Metromile.

Crashing cars at roughly five miles per hour, Metromile's Data Science Team recreated a variety of slow speed events like fender benders and hit-and-run collisions. Each test vehicle was equipped with a Pulse device, a small GPS-enabled device that plugs into the OBD-II port, to record sensory data, to generate the digital First Notice of Loss (FNOL) and capture accident details. The team then used the data captured by the Pulse device to teach AVA, Metromile's artificial intelligence (AI) claims system, to detect and analyze crash events.

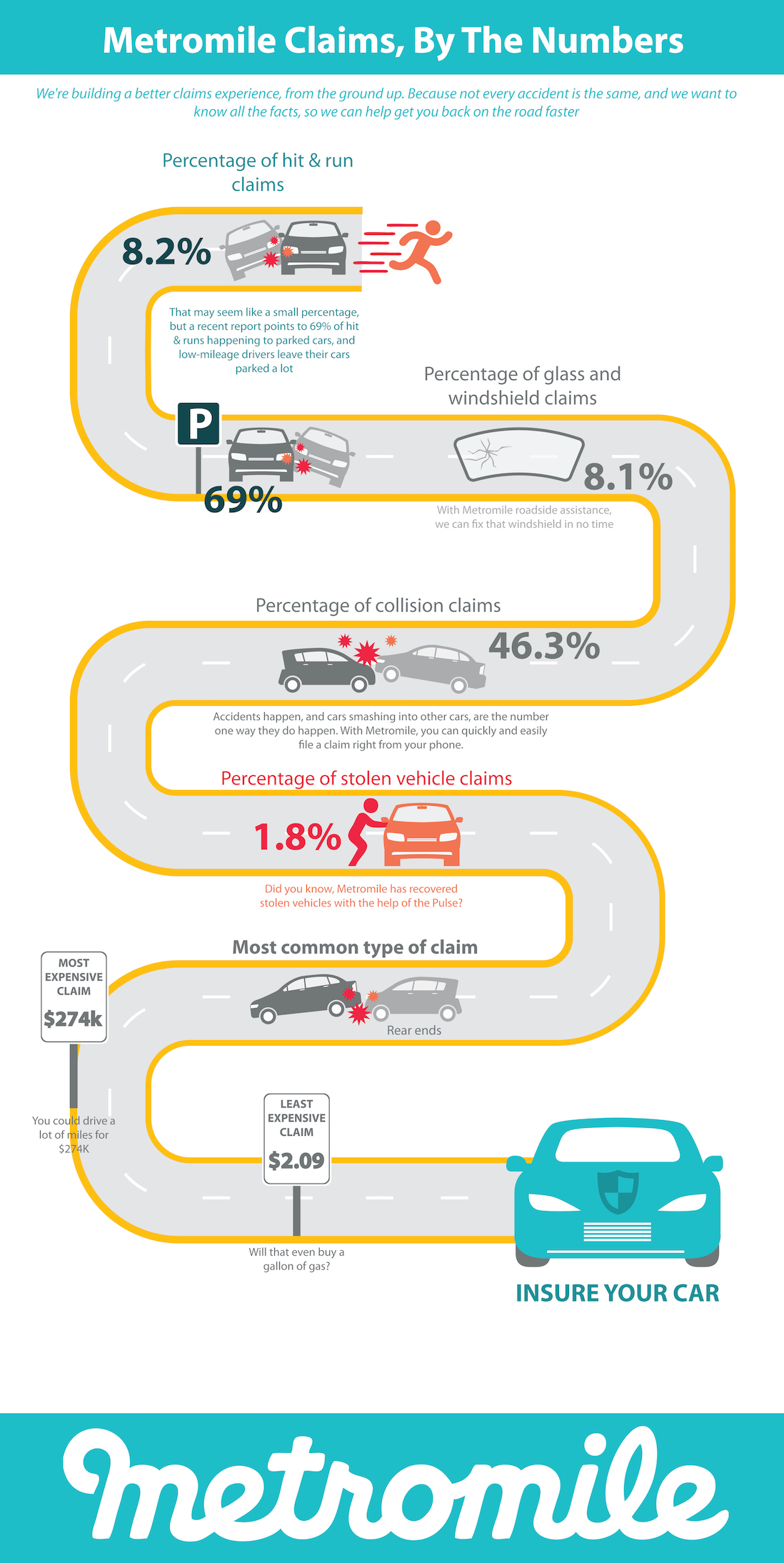

Not wanting to keep the crash test fun and learning all to themselves, Metromile produced two videos highlighting the overall process, data collection, technology and science that went in to testing. The insurer also released "Metromile Claims, By the Numbers" a visual overview of the claims that were resolved by the brand in 2017. The videos include:

- Technology Meets Car Insurance: There were over 4.5 million car accidents involving property damage in the U.S. last year. And while not every accident turns into a claim, and not every claim is handled by Metromile, it's still important to care. Why? Metromile is building a seamless claims process so that even the most minor fender benders can be resolved quickly and customers can get back on the road faster.

- AVA and Data: Metromile is building a better claims experience, from the ground up. Because not every accident is the same, and Metromile wants to know all the facts, so they can help get consumers back on the road faster. The best way to get to the truth of what low-impact and hit-and-run crashes would look like to the Pulse and AVA is to truly measure those collisions in the field. So that's precisely what the pay-per-mile auto insurer did. Metromile found a couple of used cars and put Pulse devices in them. Then they crashed them. Over, and over again.

- Door Dents: Thanks to the work of our Data Scientists, who were able to create a machine learning technique to distinguish between crash types, AVA can now determine what is and what is not a "crash event." So, no matter what life throws at our customer's car, Metromile will have their backs.

Metromile also produced a collection of video shorts to help bust some of the myths surrounding accident claims. The series, titled, "Metromile: Myth v. Fact," can be found on Metromile's YouTube channel and include:

- Solving Hit & Runs: With Metromile, consumers never have to wonder if their insurance company has their back. Thanks to AVA, Metromile can tell where, when, and how hard the impact was.

- My Word Against Theirs: Metromile always has their customer's back with AVA, our AI claims system, who can use sensor data to see what happened.

- Complicated Claims, Solved: With Metromile, customers can file a claim, locate a repair shop, book a rental car, and get paid -- all from the Metromile app.

Metromile's pay-per-mile car insurance saves low mileage drivers $611 on average each year. In addition, Metromile's smart driving app and in-car telematics device give customers visibility into their car's general health and usage, pinpoint their car's exact location via the vehicle locator, and help customers avoid parking tickets via the app's street sweeping alerts (in select cities). Metromile is currently available in eight states, including Ariz., Calif., Ill., N.J., Ore., Pa., Va., and Wash., and the company is focused on offering pay-per-mile insurance nationwide.

For more information about Metromile, visit metromile.com or follow Metromile on Facebook, Twitter, and LinkedIn.

About Metromile

Metromile is revolutionizing car insurance through technology with its pay-per-mile insurance model. By offering affordable car insurance, transparent pricing based on the miles you actually drive, data to optimize how you use your car, and instant access to detailed vehicle diagnostics via the driving app, Metromile is building the future of insurance.

Metromile, Metromile logos, AVA and other service names are the trademarks of Metromile, Inc. and/or its affiliates.

1 National Highway Traffic Safety Administration: "Quick Facts 2016 Report"

2 Insurance Information Institute: "Background on: Insurance Fraud"

SOURCE Metromile

Share this article