NEW YORK, Dec. 7, 2016 /PRNewswire/ -- Against a backdrop of uncertainty, the M&A market dipped in 2016. But, the "Deloitte M&A Trends Report 2016, Year-end edition" shows an anticipated rebound in the year ahead with 86 percent of surveyed private equity and 71 percent of surveyed corporate dealmakers expecting to close more deals in the next 12 months. Many say deal size will increase in the next year as well (64 percent), according to a pre-election survey.

When asked if M&A will change during the first 90 days after the 2016 elections, 53 percent of respondents (65 percent of private equity respondents and 48 percent of corporate respondents) expected an increase in deal activity.

"Market optimism expected after the US elections was apparent amongst our survey respondents, who anticipate more M&A—both major transformational and smaller strategic deals—between now and early 2017. Notably, 46 percent of surveyed corporate dealmakers intend to use their growing cash reserves for M&A—a 16-point jump from our Spring M&A Trends survey when cash deployments were most earmarked for organic investments," said Russell Thomson, managing partner of Deloitte's U.S. merger and acquisitions services practice. "As US political transitions and Brexit discussions unfold, we'll continue to keep a close eye on their evolving implications for transactions."

Brexit may present an opportunity for M&A

While Britain's exit from the European Union remains unresolved, survey respondents were undaunted by Brexit proceedings. Many said that Brexit's impact on their organizations' M&A strategies will translate into more deals in the UK (52 percent of private equity respondents; 44 percent of corporate respondents) and more deals in the European Union (56 percent of private equity respondents; 45 percent of corporate respondents).

The UK continues to rank highly (31 percent)—second only to Canada (40 percent) and ahead of third-place China (25 percent)—among markets in which respondents plan to pursue deals.

Divestitures continue an upward trend

Interest in divestitures has risen significantly in recent months with 73 percent of respondents planning to pursue a divestiture in the next year – up from 48 percent in Spring 2016 and 31 percent in Spring 2015. Financing needs and a change in strategy are noted as the most important reasons for divesting a business.

Technology fuels M&A strategy and gives rise to industry convergence

Acquiring technology assets has surged to tie for the No. 2 spot as the main strategic driver for M&A, more than tripling in importance since Deloitte's Spring 2016 M&A survey. Further, technology is seen as the sector most likely to converge with others (26 percent) at about twice the rate of convergences expected in financial services, construction, energy, telecommunications and professional services, respectively.

"Nearly all of our respondents acknowledge that industry convergence will continue to occur through transactions in the next few years," said Thomson. "Gaining technology or niche advantages via acquisition can really help create business value when strong targets are identified and deals are well executed."

Confidence in M&A success is rising

When reporting on deals completed in the preceding two years, just 10 percent of respondents said value was not generated from more than half of their organizations' deals -- a significant improvement from 40 percent in Spring 2016.

Unsurprisingly, the top factor in deal success for corporate respondents was effective integration (23 percent) and for private equity respondents it was proper target identification (21 percent).

"There's no substitution for strong fundamentals in M&A strategy," Thomson added, "Whether it's effective due diligence, proper target identification and valuation or post-deal integration, success is most typically realized when the strategy preceding all of it is well researched and executed."

About the survey

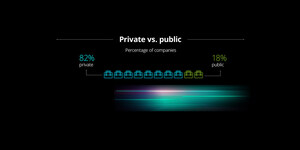

The "Deloitte M&A Trends Report, Year-end 2016 edition" was fielded online from Sept. 12-20, 2016 by market research firm OnResearch. It polled 1,000 executives involved in M&A at U.S. corporations (75 percent) and private equity firms (25 percent). Corporate respondents' organizations were public (37 percent) and privately held (63 percent). Earlier iterations of the survey were released in Spring 2014, Spring 2015 and Spring 2016.

About Deloitte M&A Practice

Deloitte advises corporate buyers and private equity investors throughout the entire M&A deal lifecycle from strategy development to selecting the right partner and from conducting thorough due diligence to closing the deal. Throughout the integration process or through a divestiture, we align our services to help clients address transactional and integration needs, all with the goal of building value for our clients.

As used in this document, "Deloitte" means Deloitte LLP and its subsidiaries. Please see http://www.deloitte.com/us/about for a detailed description of the legal structure of Deloitte LLP and its subsidiaries. Certain services may not be available to attest clients under the rules and regulations of public accounting.

Contact

| Shelley Pfaendler |

Amber Arnold |

| Public Relations Deloitte |

Public Relations MWWPR |

| +1 212 492 4484 |

+1 646 640 3611 |

Logo - http://photos.prnewswire.com/prnh/20160614/379251LOGO

SOURCE Deloitte

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article