New equipment was hard to come by in 2021 and 2022, but factories have since ramped up production, particularly in farm equipment categories. "Over the past year or so, ag equipment dealers have been getting new equipment from OEMs at a faster pace," says TractorHouse Sales Manager Ryan Dolezal. "As a result, late-model inventory is building up on dealers' lots, which can lead to lower retail pricing in the near term."

Sandhills has observed some markets tilting toward newer, high-dollar machines, which increase the overall entry price of equipment. "A typical combine costs 20 to 30 percent more than it did a few years ago," says Dolezal. "However, those units are depreciating much quicker in the current market compared to in past years."

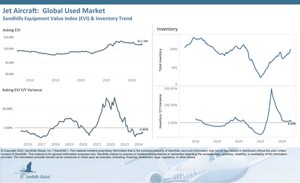

The key metric used in all of Sandhills' market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Effective with the January 2024 EVI, Sandhills introduced version enhancements and weighted adjustments. All historic EVI metrics were amended and recalculated back to 2005, and all calendar year 2024 EVI releases will include these enhancements; as a result, prior numbers will not be comparable to the new, more insightful values.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills' used heavy-duty truck, semitrailer, farm machinery, and construction equipment markets. Key points from the current reports are listed below. Full reports are available upon request.

U.S. Used Farm Equipment

- Used farm equipment inventory levels have been rising for the past few months. Sandhills noted a 2.35% M/M increase and a significant 35.26% YOY jump in January.

- Values have increased slightly compared to the same period last year. Sandhills has observed pronounced growth in late-model farm equipment availability as new equipment enters the market. Newer high-horsepower (300 HP and greater) tractors and combines have inflated the overall farm equipment value metrics over the past few years, but individual assets are experiencing YOY depreciated asking and auction values. For example, 2021 John Deere 8R 370 asking and auction values decreased 8% and 7.1%, respectively, since last year. In the overall used farm market, asking values declined 1.45% M/M, rose 7.24% YOY, and are trending up.

- Auction values declined 1.17% M/M, increased 1.88% YOY, and are trending up.

U.S. Used Combines

- Sandhills observed a mix of trends in the used combine market in January, with rising inventory levels and falling values. However, all three metrics are higher than they were a year ago. Inventory levels were up 4.64% M/M and 14.58% YOY in January and are trending up. Sandhills expects buyers and sellers will see more late-model inventory available in the near future.

- Asking values decreased 2.19% M/M, increased 10.28% YOY, and are trending up. Like high-horsepower tractors, newer combines have boosted overall equipment value metrics and shifted the market within the past few years, while both asking and auction values are depreciating YOY for individual assets. For example, a 2022 John Deere S780's asking and auction values fell 12.1% and 17.2%, respectively, YOY.

- Auction values, meanwhile, were down 1.1% M/M and 3.8% higher YOY and are trending up.

U.S. Used Compact and Utility Tractors

- Inventory levels of used compact and utility trailers remain at historically high levels despite the 3.58% M/M decline in January. Inventory levels were 27.45% higher than last year and are trending up. Sandhills anticipates similar elevated inventory trends in the coming months.

- Asking values decreased 1.05% M/M and 0.91% YOY and are trending down.

- Auction values decreased 0.66% M/M and 3.31% YOY and are also trending down.

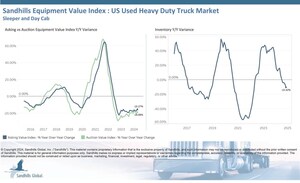

U.S. Used Heavy-Duty Trucks

- Inventory levels of used heavy-duty trucks in Sandhills marketplaces were 14.95% higher year over year in January but dropped 5.54% month over month and are now trending sideways.

- Asking and auction values both declined in January, continuing a 20-month trend currently driven by declines in sleeper truck values. Asking values were down 2.1% M/M and 19.16% YOY.

- Auction values dropped 2.32% M/M and 22.29% YOY. These value trends indicate a weaker demand and an adequate supply of used heavy-duty trucks.

U.S. Used Semitrailers

- Like the used heavy-duty truck market, the used semitrailer market experienced inventory and value drops in January, with dry van semitrailers continuing to show the greatest changes. Inventory was up 54.57% YOY but down 0.65% M/M. Unlike heavy-duty truck inventory, however, used semitrailer inventory levels are trending up.

- Asking values ticked 0.34% lower M/M and dropped 20.81% YOY in January.

- Auction values declined 1.08% M/M and 26.29% YOY. Asking and auction values have both been declining for months.

U.S. Used Medium-Duty Trucks

- Inventory levels of used medium-duty trucks fell 3.44% M/M but were 26.93% higher than last year and are currently trending sideways.

- Sandhills observed a downward trend in values and demand in recent months, with values trending lower since mid-2022. In January, asking values declined 1.36% M/M and 13.82% YOY.

- Auction values dropped 1.66% M/M and 15.17% YOY. The box truck category has been leading the way in both asking and auction value declines.

U.S. Used Heavy-Duty Construction Equipment

- This market showed a small decline in inventory and values in the past month. Inventory levels decreased 2.2% M/M but were up 11.12% YOY, which is exerting pressure on values. Inventory is currently trending sideways.

- Asking and auction values are showing mixed YOY trends, with asking values up 1.43% and auction values down 5.34%. Asking values dipped 0.12% lower M/M after several months of decreases.

- Auction values were down 0.08% M/M after months of decreases. Used excavators have exhibited the greatest inventory and value changes over the past few months, with lower operating weight models showing the highest YOY volatility.

U.S. Used Medium-Duty Construction Equipment

- This market experienced a small M/M increase in inventory levels at 0.38%, but inventory levels are still 65.57% higher than they were a year ago.

- Asking values were lower by 0.89% M/M and 3.3% YOY after several months of decreases.

- Auction values also declined, by 0.26% M/M and 8.25% YOY after months of decreases. Current market trends indicate a downward pressure on prices and an increase in inventory levels. Used track skid steers and mini excavators have shown the largest YOY changes in inventory levels and values.

U.S. Used Lifts

- Inventory levels of used lifts declined 1.28% M/M but were 14.33% higher YOY and are trending sideways. Telehandlers are driving the inventory increases and putting pressure on values.

- Asking values inched up 0.61% M/M, declined 1.27% YOY, and are trending down.

- Auction values were up 1.35% M/M and down 9.31% YOY and are trending down.

Obtain the Full Reports

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About Sandhills Global

Sandhills Global is an information processing company headquartered in Lincoln, Nebraska. Our products and services gather, process, and distribute information in the form of trade publications, websites, and online services that connect buyers and sellers across the construction, agriculture, forestry, oil and gas, heavy equipment, commercial trucking, and aviation industries. Our integrated, industry-specific approach to hosted technologies and services offers solutions that help businesses large and small operate efficiently and grow securely, cost-effectively, and successfully. Sandhills Global—we are the cloud.

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills' proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.

Contact Sandhills

www.sandhills.com/contact-us

402-479-2181

SOURCE Sandhills Global

Share this article