SAN FRANCISCO, Feb. 13, 2017 /PRNewswire/ --

-- Company announces 2017 guidance, including delivering 110,000-120,000 billable reports and generating revenue between $55 million and $65 million --

-- Management hosting conference call at 4:45 pm ET / 1:45 pm PT --

Invitae Corporation (NYSE: NVTA), one of the fastest growing genetic information companies, today announced financial and operating results for the fourth quarter and full year ended December 31, 2016 and set guidance for 2017.

Following are the company's financial results in 2016:

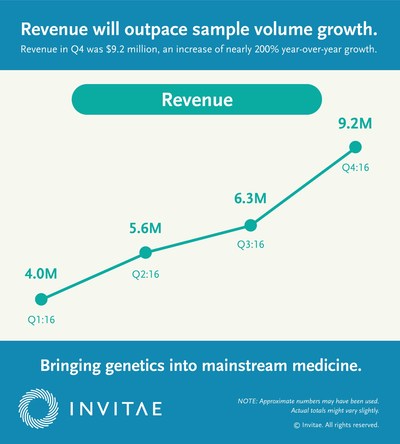

- Generated revenue of $9.2 million in the fourth quarter of 2016 and a total of $25.0 million for the year

- Reduced cost of goods sold (COGS) per sample accessioned from approximately $700 in the fourth quarter of 2015 to approximately $400 in the fourth quarter of 2016. This represents a 43% decrease in COGS per sample accessioned compared to the fourth quarter of 2015

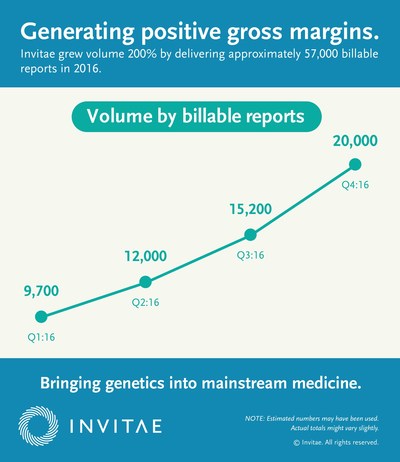

- Delivered approximately 57,000 billable reports for the full year 2016, roughly tripling the approximately 19,000 billable reports delivered in 2015. Additionally, the company reported that it accessioned approximately 59,000 samples in 2016, a nearly 200% increase compared to 2015

- Delivered approximately 20,000 billable reports in the fourth quarter of 2016, representing a 186% increase over the fourth quarter of 2015, and accessioned more than 20,500 samples in the quarter

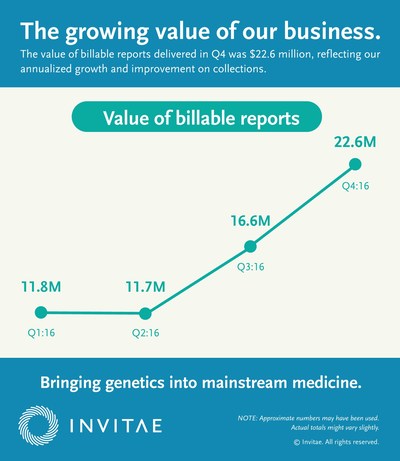

- Achieved positive gross margin of approximately $900,000 in the fourth quarter, or approximately $47 per report delivered, compared to a negative gross margin of $2.3 million, or $293 per report delivered in the fourth quarter of 2015

Total operating expenses for the fourth quarter of 2016 were $26.0 million, excluding the cost of goods sold, compared to $21.9 million for the fourth quarter of 2015. Fourth quarter operating expenses included approximately $6.7 million in non-cash expenses, including approximately $4.3 million in equity compensation expense. For the full year, operating expenses were $125.2 million, compared to $97.9 million in 2015. Net loss was $24.8 million in the fourth quarter of 2016, or a $0.69 loss per share compared to a net loss of $24.4 million and a $0.76 loss per share in the fourth quarter of 2015. Net loss for the full year 2016 was $100.3 million, or a $3.02 loss per share compared to a net loss of $89.8 million, or a $3.18 loss per share in the full year of 2015.

At December 31, 2016, cash, cash equivalents, restricted cash, and marketable securities totaled approximately $97.3 million. Cash used in operating activities in 2016 amounted to $76.3 million, as compared to $80.7 million in 2015.

2017 Business Objectives:

The company announced business objectives for 2017, including plans to:

- double volume to 110,000-120,000 samples accessioned

- grow revenue to $55-65 million for the full year

- commercially launch its 20,000-gene medical exome by the end of the first quarter

- secure additional biopharma partnerships to expand the Invitae Genome Network

- continue to expand the Invitae Genome Network to accelerate the understanding, diagnosis, and treatment of hereditary disease through permission-based sharing of genetic and clinical information

"Invitae is no longer a concept story – but a company with what we believe is the fastest growing market share in the genetic testing industry. With the progress we made with payers in 2016, the last question marks on our business model have been removed, and we are on track to generate positive cash flow by end of 2018," said Sean George, chief executive officer of Invitae. "Our value proposition to our customers, patients, providers, and payers is working, and now with the AltaVoice acquisition accelerating our Genome Network, we can get the right diagnosis for more patients, connecting them faster with our biopharma partners, and speeding up the time to market for potential therapies."

Additional Highlights:

- Approximately doubled the size of its genetic testing platform compared to the end of 2015 to include more than 1,100 genes in production and released dozens of new test panels for hereditary cancer, cardiovascular, neuromuscular, pediatric, and other rare disorders

- Introduced and expanded its Breast Cancer STAT Panel for patients with breast cancer who need rapid test results to guide surgical decisions

- Signed contracts with the nation's largest payers, securing coverage for more than 175 million lives

- Established the Invitae Genome Network:

- Acquired patient-centered data company AltaVoice to expand the Invitae Genome Network to include both genetic information and patient-centered data

- Announced Invitae's growing network of biopharma partnerships, including with BioMarin, MyoKardia, and Parion, among others

- Announced a collaboration with Helix to build some of the first proactive health apps in the Helix marketplace for common, actionable inherited disorders for which there are preventive measures available

- Initiated landmark new collaborations with TME Research, Tulane University, and University of Texas Southwestern Medical Center, among others

- Submitted information on more than 10,000 clinically observed genetic variants to the ClinVar project, an effort by the National Center for Biotechnology Information (NCBI) to aggregate all of the world's known relationships between genetic variants and disease, bringing our total submissions to more than 22,000

- Launched CancerCHECK , a tool designed to guide and support community oncologists to more easily follow clinical guidelines on the use of hereditary cancer genetic testing.

- Received approval from New York State Department of Health to offer comprehensive, high-quality, affordable genetic testing in New York for our entire test menu

- Announced a new leadership structure to drive global growth, including the appointment of Sean George as chief executive officer and Randy Scott as executive chairman

- Presented more than 65 posters, talks, and session speeches at various medical meetings, demonstrating Invitae's commitment to providing high-quality testing backed by peer reviewed studies, guidelines-based panels, and ongoing contributions to data sharing

- Announced that the Centers for Medicare and Medicaid Services (CMS) are now paying for Invitae's multi-gene tests under expanded guidelines for hereditary cancer panel testing at a price that is consistent with Invitae's institutional pricing model

Webinar and Conference Call Details:

Management will host a webinar and conference call today at 4:45 p.m. Eastern / 1:45 p.m. Pacific to discuss financial results and recent developments. The dial-in numbers for the conference call are (877) 201-0168 for domestic callers and (647) 788-4901 for international callers, and the reservation number for both is 60742797.

The live webinar and conference call may be accessed by visiting the investors section of the company's website at ir.invitae.com. A replay of the webcast will be available shortly after the conclusion of the call and will be archived on the company's website.

About Invitae

Invitae Corporation's (NYSE: NVTA) mission is to bring comprehensive genetic information into mainstream medical practice to improve the quality of healthcare for billions of people. Invitae's goal is to aggregate most of the world's genetic tests into a single service with higher quality, faster turnaround time, and lower price than many single-gene and panel tests today. The company currently provides a diagnostic service comprising hundreds of genes for a variety of genetic disorders associated with oncology, cardiology, neurology, pediatrics, and other rare disease areas. Additionally, the company has created a Genome Network to connect patients, clinicians, advocacy organizations, researchers, and drug developers to accelerate the understanding, diagnosis, and treatment of hereditary disease. For more information, visit our website at invitae.com.

Safe Harbor Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the company's belief that it has the fastest growing market share in the genetic testing industry; that it is on track to generate positive cash flow by the end of 2018; that it can get the right diagnosis for more patients and connect them faster with its biopharma partners speeding up the time to market for potential therapies; the company's announced guidance and business objectives for 2017, including plans to double volume, grow revenue, commercially launch its medical exome by the end of the first quarter of 2017, secure additional biopharma partnerships, and continue to expand its Genome Network to accelerate the understanding, diagnosis, and treatment of hereditary disease through permission-based sharing of genetic and clinical information. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially, and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: the company's history of losses; the company's ability to compete; the company's failure to manage growth effectively; the company's need to scale its infrastructure in advance of demand for its tests and to increase demand for its tests; the company's ability to develop and commercialize new tests and expand into new markets; the risk that the company may not obtain or maintain sufficient levels of reimbursement for its tests; the company's inability to raise additional capital on acceptable terms; risks associated with the company's ability to use rapidly changing genetic data to interpret test results accurately, consistently, and quickly; risks associated with the company's limited experience with respect to acquisitions; security breaches, loss of data and other disruptions; laws and regulations applicable to the company's business; and the other risks set forth in the company's filings with the Securities and Exchange Commission, including the risks set forth in the company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2016. These forward-looking statements speak only as of the date hereof, and Invitae Corporation disclaims any obligation to update these forward-looking statements.

NOTE: Invitae and the Invitae logo are trademarks of Invitae Corporation. All other trademarks and service marks are the property of their respective owners.

| Invitae Corporation |

||||||||||||||||

| Three months ended |

Year ended |

|||||||||||||||

| December 31, |

December 31, |

|||||||||||||||

| 2016 |

2015 |

2016 |

2015 |

|||||||||||||

| (unaudited) |

||||||||||||||||

| Revenue |

$ |

9,236 |

$ |

3,161 |

$ |

25,048 |

$ |

8,378 |

||||||||

| Costs and operating expenses: |

||||||||||||||||

| Cost of revenue |

8,173 |

5,506 |

27,878 |

16,523 |

||||||||||||

| Research and development |

11,775 |

11,380 |

44,630 |

42,806 |

||||||||||||

| Selling and marketing |

7,949 |

6,111 |

28,638 |

22,479 |

||||||||||||

| General and administrative |

6,291 |

4,455 |

24,085 |

16,047 |

||||||||||||

| Total costs and operating expenses |

34,188 |

27,452 |

125,231 |

97,855 |

||||||||||||

| Loss from operations |

(24,952) |

(24,291) |

(100,183) |

(89,477) |

||||||||||||

| Other income (expense), net |

226 |

17 |

348 |

(94) |

||||||||||||

| Interest expense |

(122) |

(86) |

(421) |

(211) |

||||||||||||

| Net loss |

$ |

(24,848) |

$ |

(24,360) |

$ |

(100,256) |

$ |

(89,782) |

||||||||

| Net loss per share, basic and diluted |

$ |

(0.69) |

$ |

(0.76) |

$ |

(3.02) |

$ |

(3.18) |

||||||||

| Shares used in computing net loss per share, basic and diluted |

36,245,400 |

31,929,869 |

33,176,305 |

28,213,324 |

||||||||||||

The condensed, consolidated statement of operations for the year ended December 31, 2015 has been derived from the audited consolidated financial statements included in the company's Annual Report on Form 10-K for the year ended December 31, 2015.

| Invitae Corporation |

||||||||

| December 31, |

December 31, |

|||||||

| 2016 |

2015 |

|||||||

| (Unaudited) |

||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ |

66,825 |

$ |

73,238 |

||||

| Marketable securities |

25,798 |

53,780 |

||||||

| Prepaid expenses and other current assets |

9,177 |

4,292 |

||||||

| Total current assets |

101,800 |

131,310 |

||||||

| Property and equipment, net |

23,793 |

18,709 |

||||||

| Restricted cash |

4,697 |

4,831 |

||||||

| Other assets |

361 |

1,826 |

||||||

| Total assets |

$ |

130,651 |

$ |

156,676 |

||||

| Liabilities and stockholders' equity |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ |

3,352 |

$ |

3,500 |

||||

| Accrued liabilities |

6,711 |

4,253 |

||||||

| Capital lease obligation, current portion |

1,309 |

1,588 |

||||||

| Debt, current portion |

3,381 |

1,536 |

||||||

| Total current liabilities |

14,753 |

10,877 |

||||||

| Capital lease obligation, net of current portion |

266 |

1,576 |

||||||

| Debt, net of current portion |

8,721 |

5,504 |

||||||

| Other long-term liabilities |

7,837 |

343 |

||||||

| Total liabilities |

31,577 |

18,300 |

||||||

| Stockholders' equity: |

||||||||

| Common stock |

4 |

4 |

||||||

| Accumulated other comprehensive income (loss) |

- |

(15) |

||||||

| Additional paid-in capital |

374,288 |

313,349 |

||||||

| Accumulated deficit |

(275,218) |

(174,962) |

||||||

| Total stockholders' equity |

99,074 |

138,376 |

||||||

| Total liabilities and stockholders' equity |

$ |

130,651 |

$ |

156,676 |

||||

The condensed, consolidated balance sheet at December 31, 2015 has been derived from the audited consolidated financial statements at that date included in the company's Annual Report on Form 10-K for the year ended December 31, 2015.

Contact:

Laura D'Angelo

[email protected]

314-920-0617

SOURCE Invitae Corporation

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article