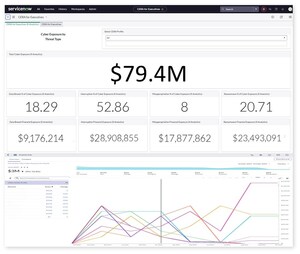

Crowe is a public accounting, consulting and technology firm with offices around the world. The Crowe RCA solution monitors every patient transaction every day from more than 1,700 hospitals and more than 200,000 physicians for purposes of automating hindsight, providing accounts receivable valuations and analyzing net revenue. Crowe is currently partnering with clients to leverage the data gathered by Crowe RCA to monitor payor behaviors both within specific markets and nationally. The Crowe Payor Market Insights aims to arm providers with actionable insights to support targeted performance discussions with their payors.

According to the report, the rate of medical claims being denied by payors rose from 10.2% in 2021 to 11% in 2022, which translates into 110,000 unpaid claims for an average-size health system. Prior-authorization denials on inpatient accounts were a key driver behind the dollar value of denials increasing to 2.5% of gross revenue in August 2022 from 1.5% of gross revenue in January 2021. As a result, healthcare providers are dedicating more time and resources to resolving denials, which directly affects their revenue cycle performance.

"Even if a medical claim isn't denied by payors, hospitals are struggling to collect expected revenue months after a service is provided," said Colleen Hall, managing principal of the healthcare services group at Crowe. "Between increasing pressures and mounting expenses, including rising employee costs brought about by inflation and staffing shortages, hospitals' finances are taking a hit."

Healthcare organizations' cash is still at risk, even after the administrative burden of resolving a denial is completed. Takebacks – when payors retract previous payments made to providers after an audit is completed – are becoming increasingly more prevalent. Payor takebacks averaged 1.4% of debit accounts receivable per month from January 2021 to June 2022. In July and August of 2022, that percentage jumped to 1.8%, the highest percentage on record, equating to more than $1.6 billion in takebacks per month for providers on the Crowe RCA platform.

The research also revealed:

- In the summer of 2022, hospitals on average collected 94% of their expected cash within six months, down from 97% the previous summer.

- The three-percentage-point decrease in cash coupled with a more than 9% increase in expenses creates a minimum of a 12% negative impact on a health system's finances.

- Accounts receivable that aged over 90 days went from 32% in January 2021 to 37% in August 2022. The five-percentage-point jump directly affects the cost of care.

"With so much economic uncertainty, it is important for healthcare financial leaders to take immediate action and implement innovative solutions," said Hall. "Utilizing proven automation solutions to help alleviate the administrative burden and creating more data-driven payor conversations to monitor shared key performance indicators can be effective strategies to help mitigate these revenue cycle challenges."

To download a copy of the report, please visit "Hospital Double Whammy: Less Cash In, More Cash Out."

About Crowe Revenue Cycle Analytics (Crowe RCA) benchmarking data

Over 1,700 hospitals and more than 200,000 physicians use the Crowe RCA solution to capture every patient transaction for purposes of automating hindsight, providing accounts receivable valuations and analyzing net revenue. Crowe developed a proprietary benchmarking solution that monitors revenue cycle performance through normalized key performance indicators at healthcare organizations across 47 states and accounts for over $800 billion in annual gross revenue.

About Crowe

Crowe LLP is a public accounting, consulting and technology firm with offices around the world. Crowe uses its deep industry expertise to provide audit services to public and private entities. The firm and its subsidiaries also help clients make smart decisions that lead to lasting value with its tax, advisory and consulting services, helping businesses uncover hidden opportunities in the market – no matter what challenges the markets present. Crowe is recognized by many organizations as one of the best places to work in the U.S. As an independent member of Crowe Global, one of the largest global accounting networks in the world, Crowe serves clients worldwide. The network consists of more than 200 independent accounting and advisory services firms in more than 130 countries around the world.

Twitter: @CroweUSA

LinkedIn: Crowe

SOURCE Crowe LLP

Share this article