Housing affordability for Black California households is half that of whites, illustrating persistent wide homeownership gap and wealth disparities, C.A.R. reports

- Less than one in five Black California households could afford to purchase the $659,380 statewide median-priced home in 2020, compared to two in five white California households who could afford to purchase the same median-priced home.

- At an affordability index of 20 percent, the affordability gap was similarly wide for Latinx households.

- A minimum annual income of $122,800 was needed to make monthly payments of $3,070, including principal, interest, and taxes on a 30-year fixed-rate mortgage at a 3.30 percent interest rate.

LOS ANGELES, Feb. 17, 2021 /PRNewswire/ -- Less than half of Black households earned the minimum income needed to purchase a home as compared to whites, illustrating the homeownership gap and wealth disparity for people of color, women, people with disabilities, indigenous people and members of the LGBTQ community, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) https://www.car.org/ said today.

The percentage of Black home buyers who could afford to purchase a median-priced, existing single-family home in California in 2020 was 19 percent, compared to 38 percent for white households. Housing affordability was similarly low for Latinx households, with 20 percent earning the minimum income needed to purchase a median-priced home. Housing was most affordable for Asians, with 43 percent of homebuyers who could afford the median-priced home in 2020, according to C.A.R.'s Housing Affordability Index.

According to the Census Bureau's American Community Survey, the 2019 homeownership rate in California was 63.2 percent for whites, 60.2 percent for Asians, 44.1 percent for Latinx and 36.8 percent for Blacks.

"The wide affordability gap in California between whites and people of color demonstrates the legacy of systemic racism in housing, which has created inequities in homeownership rates across these communities," said C.A.R. President Dave Walsh. "Closing the homeownership gap is essential to closing the generational wealth gap in our country, and that's why C.A.R. is committed to addressing barriers and disparities to make equity in housing and access to affordable homes a reality for all people."

Among legislative actions C.A.R. is taking to address housing discrimination is introducing several Fair Housing and Equity bills including:

- requiring California real estate professionals to take implicit bias training

- removing discriminatory language in property records

- prohibiting discrimination against people living in affordable housing

- repealing Article 34 of the California Constitution

- boosting housing construction so homeownership is accessible to all

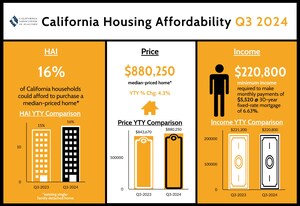

C.A.R.'s Housing Affordability Index (HAI) measures the percentage of households that can afford to purchase a median-priced, single-family home in California. C.A.R. also reports affordability indices for regions and select counties within the state. The index is considered the most fundamental measure of housing well-being for home buyers in the state.

A minimum annual income of $122,800 was needed to qualify for the purchase of a $659,380 statewide median-priced, existing single-family home in 2020. The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, would be $3,070, assuming a 20 percent down payment and an effective composite interest rate of 3.30 percent. The 2020 California median income for whites was $94,390, $107,100 for Asians, $65,510 for Latinx and $56,820 for Blacks.

The affordability gap is especially stark in expensive counties like San Francisco, where a median-priced home of $1,650,000 was only affordable for 8 percent of Black households, 15 percent of Latinx households and 22 percent of Asian households compared to 35 percent of white households.

Compared with California, 42 percent of the nation's Black households could afford to purchase a $299,900 median-priced home in 2020, which required a minimum annual income of $55,600 to make monthly payments of $1,390, while 62 percent of white households could afford the same home.

Multimedia:

- Motiongraphic: https://car.sharefile.com/d-sc042045e452649a6b5b2707d9860aa1b

- Slides: https://car.sharefile.com/d-sec537bfa26ec46639bd7c2fc7b2e0671

Key points from the 2020 Housing Affordability by Ethnicity report include:

- Of the major regions for which C.A.R. tracks affordability by ethnicity, the affordability gap between Black and white households in 2020 was the greatest in San Francisco County with a differential of 27 percent.

- Even in relatively affordable areas such as Fresno and Sacramento counties, the affordability differential between Black and white households was high at 23 percent and 22 percent, respectively.

- For Latinx households, the affordability gap was the greatest in Santa Clara (21 percent gap), San Francisco, San Mateo and Los Angeles counties (all at 20 percent).

- At an affordability index of 8 percent, San Francisco County was the least affordable for Black households, and San Bernardino County was the most affordable at 46 percent.

- The least affordable county in 2020 for Latinx homebuyers was Santa Clara County, and the most affordable was San Bernardino County was the most affordable at 54 percent.

- For white households, Orange County was the least affordable, with 29 percent of households earning the minimum income required, while Fresno was the most affordable at 61 percent.

Leading the way…® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with more than 200,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

CALIFORNIA ASSOCIATION OF REALTORS® |

|||||||

2020 Traditional Housing Affordability Index by Ethnicity |

|||||||

STATE/REGION/COUNTY |

White, Non- Hispanic |

Asian |

Latinx |

Black |

Median Home Price |

Monthly Payment Including Taxes & Insurance |

Minimum Qualifying Income |

Calif. Single-family home |

38 |

43 |

20 |

19 |

$659,380 |

$3,070 |

$122,800 |

Calif. Condo/Townhome |

51 |

56 |

33 |

30 |

$501,000 |

$2,330 |

$93,200 |

United States |

62 |

70 |

51 |

42 |

$299,900 |

$1,390 |

$55,600 |

San Francisco Bay Area |

|||||||

Alameda |

31 |

35 |

14 |

9 |

$1,010,000 |

$4,700 |

$188,000 |

Contra Costa |

42 |

48 |

25 |

24 |

$752,000 |

$3,500 |

$140,000 |

San Francisco |

35 |

22 |

15 |

8 |

$1,650,000 |

$7,680 |

$307,200 |

San Mateo |

33 |

31 |

13 |

15 |

$1,700,000 |

$7,910 |

$316,400 |

Santa Clara |

32 |

37 |

11 |

11 |

$1,385,000 |

$6,450 |

$258,000 |

Southern California |

|||||||

Los Angeles |

38 |

35 |

19 |

17 |

$662,310 |

$3,080 |

$123,200 |

Orange |

29 |

26 |

12 |

13 |

$900,000 |

$4,190 |

$167,600 |

Riverside |

50 |

56 |

40 |

43 |

$460,000 |

$2,140 |

$85,600 |

San Bernardino |

57 |

62 |

54 |

46 |

$348,000 |

$1,620 |

$64,800 |

San Diego |

35 |

38 |

18 |

15 |

$710,000 |

$3,300 |

$132,000 |

Ventura |

36 |

45 |

19 |

28 |

$725,000 |

$3,370 |

$134,800 |

Central Valley |

|||||||

Fresno |

61 |

55 |

46 |

38 |

$314,000 |

$1,460 |

$58,400 |

Kern |

59 |

68 |

42 |

40 |

$280,000 |

$1,300 |

$52,000 |

Sacramento |

52 |

54 |

40 |

30 |

$421,000 |

$1,960 |

$78,400 |

NA = not available |

SOURCE CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.)

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article