Higher housing prices and tight inventory drag down California housing affordability; income required to buy doubles in five years, C.A.R. reports

- Twenty-nine percent of California households could afford to purchase the $553,260 median-priced home in the second quarter of 2017, down from 32 percent in first-quarter 2017 and down from 31 percent in second-quarter 2016.

- A minimum annual income of $110,890 was needed to make monthly payments of $2,770, including principal, interest, and taxes on a 30-year fixed-rate mortgage at a 4.09 percent interest rate.

- Thirty-eight percent of home buyers were able to purchase the $443,400 median-priced condo or townhome. An annual income of $88,870 was required to make a monthly payment of $2,220.

LOS ANGELES, Aug. 9, 2017 /PRNewswire-USNewswire/ -- Higher home prices resulting from a severe lack of homes for sale and high demand during the hot home-buying season eroded California's housing affordability in the second quarter, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

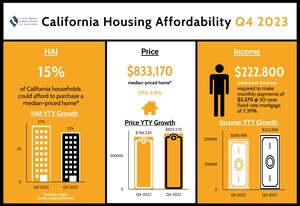

The percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California in second-quarter 2017 fell to 29 percent, down from 32 percent in the first quarter of 2017 and down from 31 percent in the second quarter a year ago, according to C.A.R.'s Traditional Housing Affordability Index (HAI). This is the 17th consecutive quarter that the index has been below 40 percent and the lowest since third-quarter 2015. California's housing affordability index hit a peak of 56 percent in the first quarter of 2012.

C.A.R.'s HAI measures the percentage of all households that can afford to purchase a median-priced, single-family home in California. C.A.R. also reports affordability indices for regions and select counties within the state. The Index is considered the most fundamental measure of housing well-being for home buyers in the state.

A minimum annual income of $110,890 was needed to qualify for the purchase of a $553,260 statewide median-priced, existing single-family home in the second quarter of 2017. The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, would be $2,770, assuming a 20 percent down payment and an effective composite interest rate of 4.09 percent. The effective composite interest rate in first-quarter 2017 was 4.36 percent and 3.85 percent in the second quarter of 2016.

Home prices have nearly doubled since affordability reached its highest level five years ago, and compared to then, home buyers now need twice the income to purchase a median-priced home. In the first quarter of 2012, buyers statewide needed a minimum annual income of $56,320 to purchase a home that was priced $279,190. And in the San Francisco Bay Area, a home buyer needed a minimum annual income of $90,370 to purchase a $447,970 priced home just five years ago. Compare that to the current minimum income of $179,390 needed to purchase an $895,000 priced home now.

Condominiums and townhomes also were less affordable in second-quarter 2017 compared to the previous quarter. Thirty-eight percent of California households earned the minimum income to qualify for the purchase of a $443,400 median-priced condominium/townhome in the second quarter of 2017, and an annual income of $88,870 was required to make monthly payments of $2,220. Forty percent of households could afford to purchase the $414,840 priced condo or townhome in first-quarter 2017.

Key points from the second-quarter 2017 Housing Affordability report include:

- Compared to affordability in first-quarter 2017, only six of 43 counties tracked posted an improvement in housing affordability (Napa, Santa Barbara, San Benito, Mariposa/Tuolumne, Mendocino, and Sutter), 29 experienced a decline (Alameda, Contra Costa, Marin, San Francisco, San Mateo, Santa Clara, Solano, Los Angeles, San Bernardino, San Diego, Ventura, Monterey, Fresno, Kern, Kings, Madera, Merced, Placer, Sacramento, San Joaquin, Stanislaus, Amador, Butte, El Dorado, Lake, Mendocino, Shasta, Yolo, Yuba), and eight were unchanged (Sonoma, Orange, Riverside, San Luis Obispo, Santa Cruz, Tulare, Humboldt, and Sutter).

- During the second quarter of 2017, the most affordable counties in California were Tehama (57 percent), Kern (54 percent), Sutter, (53 percent), Kings and Tulare (both at 52 percent).

- San Francisco (12 percent), San Mateo (14 percent), and Santa Barbara (16 percent), Santa Clara and Santa Cruz (both at 17 percent) counties were the least affordable areas in the state.

- Housing affordability figures are now available for the following counties: Amador, Butte, El Dorado, Humboldt, Lake, Mariposa and Tuolumne (combined), Mendocino, San Benito, Shasta, Siskiyou, Sutter, Tehama, Yolo, and Yuba. See accompanying tables.

Housing Affordability slides (click link to open)

Affordability peak versus current

Annual required income peak vs. current

PITI peak versus current

Median home price peak vs. current

CA housing affordability by quarter (2006-2017)

Housing affordability by county

See C.A.R.'s historical housing affordability data.

See first-time buyer housing affordability data.

Follow us on Twitter @CAR Media and @CAREALTORS®

Like us on Facebook.

Leading the way…® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with more than190,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

| CALIFORNIA ASSOCIATION OF REALTORS® |

||||

| C.A.R. Region |

Housing |

Median Home |

Monthly Payment |

Minimum |

| Calif. Single-family home |

29 |

$ 553,260 |

$ 2,770 |

$ 110,890 |

| Calif. Condo/Townhome |

38 |

$ 443,400 |

$ 2,220 |

$ 88,870 |

| Los Angeles Metro Area |

31 |

$ 491,250 |

$ 2,460 |

$ 98,470 |

| Inland Empire |

43 |

$ 342,050 |

$ 1,710 |

$ 68,560 |

| San Francisco Bay Area |

21 |

$ 895,000 |

$ 4,480 |

$ 179,390 |

| San Francisco Bay Area |

||||

| Alameda |

19 |

$ 880,000 |

$ 4,410 |

$ 176,390 |

| Contra-Costa (Central Cty) |

31 |

$ 655,000 |

$ 3,280 |

$ 131,290 |

| Marin |

17 |

$ 1,302,500 |

$ 6,530 |

$ 261,070 |

| Napa |

25 |

$ 683,000 |

$ 3,420 |

$ 136,900 |

| San Francisco |

12 |

$ 1,450,000 |

$ 7,270 |

$ 290,630 |

| San Mateo |

14 |

$ 1,469,000 |

$ 7,360 |

$ 294,440 |

| Santa Clara |

17 |

$ 1,183,440 |

$ 5,930 |

$ 237,210 |

| Solano |

44 |

$ 412,000 |

$ 2,060 |

$ 82,580 |

| Sonoma |

25 |

$ 625,000 |

$ 3,130 |

$ 125,270 |

| Southern California |

||||

| Los Angeles |

28 |

$ 514,220 |

$ 2,580 |

$ 103,070 |

| Orange County |

21 |

$ 788,000 |

$ 3,950 |

$ 157,950 |

| Riverside County |

39 |

$ 380,000 |

$ 1,900 |

$ 76,170 |

| San Bernardino |

51 |

$ 269,640 |

$ 1,350 |

$ 54,050 |

| San Diego |

26 |

$ 605,000 |

$ 3,030 |

$ 121,260 |

| Ventura |

27 |

$ 635,000 |

$ 3,180 |

$ 127,280 |

| Central Coast |

||||

| Monterey |

21 |

$ 603,000 |

$ 3,020 |

$ 120,860 |

| San Luis Obispo |

26 |

$ 565,000 |

$ 2,830 |

$ 113,250 |

| Santa Barbara |

16 |

$ 750,000 |

$ 3,760 |

$ 150,330 |

| Santa Cruz |

17 |

$ 850,000 |

$ 4,260 |

$ 170,370 |

| Central Valley |

||||

| Fresno |

47 |

$ 250,000 |

$ 1,250 |

$ 50,110 |

| Kern (Bakersfield) |

54 |

$ 232,500 |

$ 1,170 |

$ 46,600 |

| Kings County |

52 |

$ 225,000 |

$ 1,130 |

$ 45,100 |

| Madera |

44 |

$ 259,900 |

$ 1,300 |

$ 52,090 |

| Merced |

48 |

$ 248,000 |

$ 1,240 |

$ 49,710 |

| Placer County |

43 |

$ 465,000 |

$ 2,330 |

$ 93,200 |

| Sacramento |

45 |

$ 340,000 |

$ 1,700 |

$ 68,150 |

| San Benito |

33 |

$ 530,000 |

$ 2,660 |

$ 106,230 |

| San Joaquin |

43 |

$ 336,940 |

$ 1,690 |

$ 67,540 |

| Stanislaus |

47 |

$ 288,500 |

$ 1,450 |

$ 57,830 |

| Tulare |

52 |

$ 220,000 |

$ 1,100 |

$ 44,100 |

| Other Calif. Counties |

||||

| Amador |

42 |

$ 340,000 |

$ 1,700 |

$ 68,150 |

| Butte County |

39 |

$ 305,850 |

$ 1,530 |

$ 61,300 |

| El Dorado County |

40 |

$ 480,000 |

$ 2,410 |

$ 96,210 |

| Humboldt |

36 |

$ 299,000 |

$ 1,500 |

$ 59,930 |

| Lake County |

38 |

$ 250,000 |

$ 1,250 |

$ 50,110 |

| Mariposa And Tuolumne |

46 |

$ 284,390 |

$ 1,430 |

$ 57,000 |

| Mendocino |

27 |

$ 400,000 |

$ 2,000 |

$ 80,180 |

| Shasta |

47 |

$ 259,900 |

$ 1,300 |

$ 52,090 |

| Siskiyou County |

47 |

$ 216,500 |

$ 1,080 |

$ 43,390 |

| Sutter |

53 |

$ 271,000 |

$ 1,360 |

$ 54,320 |

| Tehama |

57 |

$ 202,000 |

$ 1,010 |

$ 40,490 |

| Yolo |

35 |

$ 430,000 |

$ 2,150 |

$ 86,190 |

| Yuba |

43 |

$ 270,000 |

$ 1,350 |

$ 54,120 |

| r = revised |

| CALIFORNIA ASSOCIATION OF REALTORS® |

|||||

| STATE/REGION/COUNTY |

2Qtr 2017 |

1Qtr 2017 |

2Qtr 2016 |

||

| Calif. Single-family home |

29 |

32 |

31 |

||

| Calif. Condo/Townhome |

38 |

40 |

40 |

||

| Los Angeles Metropolitan Area |

31 |

33 |

33 |

||

| Inland Empire |

43 |

43 |

46 |

||

| San Francisco Bay Area |

21 |

25 |

23 |

r |

|

| San Francisco Bay Area |

|||||

| Alameda |

19 |

21 |

23 |

r |

|

| Contra-Costa (Central County) |

31 |

37 |

35 |

r |

|

| Marin |

17 |

18 |

18 |

||

| Napa |

25 |

24 |

26 |

||

| San Francisco |

12 |

13 |

13 |

||

| San Mateo |

14 |

15 |

14 |

||

| Santa Clara |

17 |

19 |

19 |

||

| Solano |

44 |

45 |

45 |

||

| Sonoma |

25 |

25 |

26 |

||

| Southern California |

|||||

| Los Angeles |

28 |

29 |

30 |

||

| Orange County |

21 |

21 |

22 |

||

| Riverside County |

39 |

39 |

41 |

||

| San Bernardino |

51 |

52 |

56 |

||

| San Diego |

26 |

28 |

28 |

r |

|

| Ventura |

27 |

28 |

r |

33 |

r |

| Central Coast |

|||||

| Monterey |

21 |

23 |

25 |

||

| San Luis Obispo |

26 |

26 |

27 |

||

| Santa Barbara |

16 |

14 |

19 |

r |

|

| Santa Cruz |

17 |

17 |

17 |

||

| Central Valley |

|||||

| Fresno |

47 |

48 |

48 |

r |

|

| Kern (Bakersfield) |

54 |

55 |

55 |

r |

|

| Kings County |

52 |

53 |

54 |

r |

|

| Madera |

44 |

47 |

51 |

r |

|

| Merced |

48 |

50 |

51 |

r |

|

| Placer County |

43 |

45 |

47 |

r |

|

| Sacramento |

45 |

46 |

46 |

r |

|

| San Benito |

33 |

32 |

36 |

||

| San Joaquin |

43 |

45 |

45 |

||

| Stanislaus |

47 |

48 |

48 |

||

| Tulare |

52 |

52 |

50 |

||

| Other Counties in California |

|||||

| Amador |

42 |

47 |

50 |

||

| Butte County |

39 |

41 |

43 |

||

| El Dorado County |

40 |

43 |

38 |

||

| Humboldt |

36 |

36 |

42 |

r |

|

| Lake County |

38 |

43 |

44 |

||

| Mariposa And Tuolumne |

46 |

45 |

51 |

||

| Mendocino |

27 |

26 |

34 |

r |

|

| Shasta |

47 |

49 |

48 |

r |

|

| Siskiyou County |

47 |

48 |

54 |

r |

|

| Sutter |

53 |

53 |

55 |

r |

|

| Tehama |

57 |

55 |

60 |

||

| Yolo |

35 |

37 |

36 |

r |

|

| Yuba |

43 |

44 |

47 |

r |

|

| r = revised |

SOURCE CALIFORNIA ASSOCIATION OF REALTORS

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article