COSTA MESA, Calif., Nov. 8, 2017 /PRNewswire/ -- Happy Money, the leading financial company innovating at the intersection of psychology and money to help people live happier lives, today announced the launch of Joy – a new iOS app that changes the way people think about, spend and save money through a personalized experience shaped by an individual's psychology and financial behaviors.

Joy and its team of clinical psychologists and neuroscientists recognized a person's psychological makeup and personality directly affect how they spend and save money. They also found a void in the market — no one had created a product to address this. "Through our research, we've heard countless times that talking about money is overwhelming to a lot of people and financial apps out there are one-size-fits-all and naturally judgmental. Joy is the first app that doesn't judge you, but instead embraces you for who you are and what makes YOU happy," says Scott Saunders, founder and CEO of Happy Money.

With this new psychology-based approach to money, Joy features bespoke elements specifically designed to drive awareness of how spending is connected to happiness, and to encourage people to build savings with daily savings recommendations. "Joy puts happiness at the epicenter of spending, and for millennials, happiness is the bottom line," says professor Elizabeth Dunn, Ph.D., Joy's Scientific Advisor and author of Happy Money: The Science of Happier Spending. "Joy provides an alternative approach to looking at how you spend. It's not about how much money is in your account, it's about how much happiness there is in your life."

Joy's key features include:

Personalized Money Coach: Joy delivers a person-centric experience with an undeniably approachable and non-judgmental tone. To achieve this, Joy's scientists have developed in-app assessments that identify the user's financial personality and assign one of four money coaches tailored to fit the specific needs of that individual. Each coach has been designed to support a growing awareness of happiness, spending and saving behavior with the goal of beneficial habit formation.

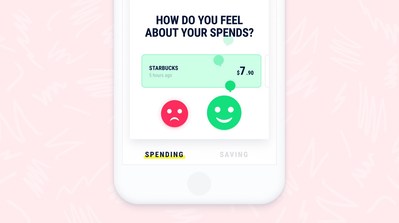

Buying More Happiness: With Joy, there is a new way to think about spending: spend more on what makes you happy and less on what makes you sad – what Joy calls, "happy spends" and "sad spends." The app prompts users to rate purchases, helping them recognize spending habits and focus more on what brings long-term happiness.

Free Savings Account and Daily Saves: Joy helps people save more money by providing behavior-based daily savings recommendations as well as a free FDIC-insured savings account. The app identifies a daily savings amount based on income data and spending habits, then prompts the user to make that save via their Joy Savings Account. This actively enables the person to recognize daily savings opportunities and build savings, helping to decrease overall stress, increase happiness, and promote a sense of ownership over their financial future.

The Joy app is free to download for iOS. For more information, please visit www.findjoy.com.

About Happy Money

Happy Money is the only financial company that combines psychology and money to help people live happier lives. Happy Money believes in long-term relationships with people, meeting them at every stage of their financial life, and maximizing their happiness along the way. Happy Money is composed of financial services professionals, research and clinical psychologists, data scientists, neuroscientists, designers, and technology experts, all working together to provide three primary experiences: Joy, Payoff and the Happy Money Score.

Press Contact: ALISON BROD MARKETING + COMMUNICATIONS / 212-230-1800 / Emily Kjesbo / [email protected]

SOURCE Joy

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article