Gravitas Education Holdings Inc. Announces Special Cash Dividend in the Range of US$11.256 to US$12.17 per American Depositary Share and Reports Status of Merger

BEIJING, Sept. 21, 2023 /PRNewswire/ -- Gravitas Education Holdings Inc. (the "Company") (NYSE: GEHI), a leading early childhood education service provider in China, today announced that the Company's board of directors (the "Board") approved a special cash dividend in an amount ranging from US$11.256 to US$12.17 per American Depositary Share ("ADS"), or from US$0.5628 to US$0.6085 per ordinary share. The aggregate amount of cash dividends to be paid ranges from US$16 million to US$17.3 million, which will be funded by cash on the Company's balance sheet. The payment of the special dividend is conditional upon the Closing (as defined below), and the exact amount of such special dividend is to be determined and separately announced. Following payment of the special dividend and after the previously announced divestiture of GEHI's PRC education business, the net cash of the Company (excluding the aggregate amount of such special dividend, but including the consideration received for the PRC education business divestiture) will be no less than US$15 million at the Closing (as defined below).

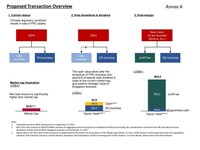

The Company previously announced that it entered into an agreement and plan of merger (the "Merger Agreement"), dated April 18, 2023, with Bright Sunlight Limited, a Cayman Islands exempted company and a direct, wholly owned subsidiary of the Company (the "Merger Sub"), Best Assistant Education Online Limited, a Cayman Islands exempted company ("Best Assistant") and a controlled subsidiary of NetDragon Websoft Holdings Limited (HKEX: 0777, "NetDragon"), a Cayman Islands exempted company, and solely for purposes of certain named sections thereof, NetDragon. It is contemplated that Best Assistant will transfer the education business of NetDragon outside of the PRC to Elmtree Inc., a Cayman Islands exempted company limited by shares wholly owned by Best Assistant ("eLMTree"). Pursuant to the Merger Agreement, Merger Sub will merge with and into eLMTree with eLMTree continuing as the surviving company and becoming a wholly owned subsidiary of the Company (the "Merger"). The overview of the transaction is described in more details in Annex A.

Immediately following closing of the Merger (the "Closing"), the Company will change its name to "Mynd.ai, Inc." and operate in the global market of interactive classroom technology with its headquarter in Seattle, Washington. The share ownership of the Company immediately after the Closing is illustrated in Annex B.

The cash dividend will be paid by the Company on or before the 21st day after the date of the Closing to shareholders of record at the close of business on the date immediately prior the Closing date (the "Record Date"). ADSs will trade with an entitlement to the cash dividend until the ex-dividend date is established by the New York Stock Exchange ("NYSE"). In order to retain the right to the cash dividend, ADS holders of the Company need to hold the ADSs until the ex-dividend date, which shall be the first business day after the Closing.

As conditions to Closing, among other things, approval by the NYSE of the listing application submitted by the Company shall be obtained and Completion of CFIUS Process (as defined under the Merger Agreement) shall have occurred. The Company is actively working with the NYSE in connection with its listing application. Similarly, the Company and NetDragon are working with CFIUS to obtain approval for the Merger as soon as practicable.

In light of the above updates related to the Merger, once the Closing date is fixed, the Company will issue a separate press release announcing the final amount of special cash dividend to be paid by the Company and the Record Date for purpose of the dividend payment. The said press release will be issued at least 10 days prior to the Record Date in compliance with applicable listing rules.

About Gravitas Education Holdings, Inc.

Founded on the core values of "Care" and "Responsibility," "Inspire" and "Innovate," Gravitas Education Holdings, Inc. (formerly known as RYB Education, Inc.) is a leading early childhood education service provider in China. Since opening its first play-and-learn center in 1998, the Company has grown and flourished with the mission to provide high-quality, individualized and age-appropriate care and education to nurture and inspire each child for his or her betterment in life. During its two decades of operating history, the Company has built itself into a well-recognized education brand and helped bring about many new educational practices in China's early childhood education industry. GEHI's comprehensive early childhood education solutions meet the needs of children from infancy to 6 years old through structured courses at kindergartens and play-and-learn centers, as well as at-home educational products and services.

Forward Looking Statements

This press release contains certain "forward-looking statements." These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about the pending transactions described herein, and the parties' perspectives and expectations, are forward-looking statements. Such statements include, but are not limited to, statements regarding the Merger, including the equity values, the benefits of the Merger, expected revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, the expected management and governance of the combined company, and the expected timing of the transactions. The words "will," "expect," "believe," "estimate," "intend," "plan" and similar expressions indicate forward-looking statements.

Such forward-looking statements are inherently uncertain, and shareholders and other potential investors must recognize that actual results may differ materially from the expectations as a result of a variety of factors. Such forward-looking statements are based upon management's current expectations and include known and unknown risks, uncertainties and other factors, many of which are hard to predict or control, that may cause the actual results, performance, or plans to differ materially from any future results, performance or plans expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to: (i) risks related to the expected timing and likelihood of completion of the Merger, including the risk that the transaction may not close due to one or more closing conditions to the transaction not being satisfied or waived, such as regulatory approvals not being obtained, on a timely basis or otherwise, or that a governmental entity prohibited, delayed or refused to grant approval for the consummation of the transaction or required certain conditions, limitations or restrictions in connection with such approvals; (ii) the occurrence of any event, change or other circumstances that could give rise to the termination of the applicable transaction agreements; (iii) the risk that there may be a material adverse change with respect to the financial position, performance, operations or prospects of the Company or eLMTree; (iv) risks related to disruption of management time from ongoing business operations due to the Merger; (v) the risk that any announcements relating to the Merger could have adverse effects on the market price of the Company's securities; (vi) the risk that the Merger and its announcement could have an adverse effect on the ability of eLMTree to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally; (vii) any changes in the business or operating prospects of eLMTree or its businesses; (viii) changes in applicable laws and regulations; and (ix) risks relating to the combined company's ability to enhance its services and products, execute its business strategy, expand its customer base and maintain stable relationship with its business partners. Furthermore, the equity value of eLMTree and the Singapore (SG) business of GEHI provided in Annex A was arrived at by the parties for purposes of the Merger Agreement after arm's length negotiations between the parties with reference to, among other things: (a) the current business operations of the Spin-off Business as defined in the Merger Agreement, and(b) the future development plans of the Spin-off Business as defined in the Merger Agreement. Equity value is the total value of the enterprise as determined by the parties for the purposes of the Merger Agreement. It is not a GAAP measure and instead represents the negotiations valuation of the business based on current business operations and expectations of future earning power of the business. The equity value was not established through an independent valuation and is not a representation on what the actual market capitalization of Mynd.ai will be post-Closing.

A further list and description of risks and uncertainties can be found in the proxy statement that will be filed with the SEC by the Company in connection with the Merger, and other documents that the parties may file with or furnish to the SEC, which you are encouraged to read. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements relate only to the date they were made, and eLMTree, the Company and their subsidiaries and affiliates undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made except as required by law or applicable regulation.

CONTACT

Gravitas Education Holdings, Inc.

Investor Relations

E-mail: [email protected]

SOURCE Gravitas Education Holdings Inc.

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article