Florida Victims of Hurricanes Helene and Milton at High Risk of Getting Stiffed by Property Insurers

PALM BEACH GARDENS, Fla., Oct. 8, 2024 /PRNewswire/ -- Weiss Ratings, the nation's only independent rating agency covering insurance companies, warned today that homeowners in Florida filing legitimate damage claims in the wake of hurricanes Helene or Milton are at high risk of receiving no payment whatsoever from their insurance company.

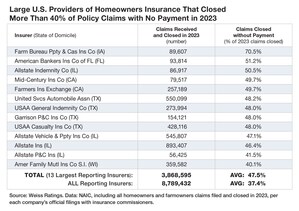

Based on an analysis of the insurance company's official filings, Weiss found that six large Florida carriers flatly denied nearly half of homeowner claims closed in 2023, including Castle Key Indemnity Company (denying 47.1%), State Farm Florida Insurance Company (46.4%), Castle Key Insurance Company (46%), and others.

Weiss Ratings founder, Dr. Martin D. Weiss, commented, "Many Florida insurers are short on reserves because they've diverted funds to shareholders or to parent companies outside the state. Thus, some are abusing their power to deny damage claims as a deliberate tactic to conserve cash and avoid bankruptcy." Over the last two decades, more property insurers have filed for bankruptcy in Florida than in all other states combined.

In 2023, Florida insurers closed 76,428 homeowner claims with no payment to policyholders. And these homeowners, slapped with denials, filed lawsuits against their insurers at a rate that was 18 times higher than the national average outside of Florida, according to data provided by the National Association of Insurance Commissioners.

Weiss explained, "Property insurers who deny legitimate claims are sending the implicit message, 'If you don't like it, sue us.' And that's exactly what thousands of their customers did."

However, that avenue of redress has now been closed for Florida homeowners: After intense lobbying by the insurance companies, the state government passed new legislation, which became effective in 2023, making it far more difficult for policyholders to sue their carriers.

Weiss also warns that a similar crisis is spreading to other states with high property damage. To help prepare, homeowners are advised to take the following steps:

Step 1. Among those who own their home outright and have the means, some may want to self-insure their property, saving the money spent on premiums in secure instruments earning interest.

Step 2. Homeowners who must buy property insurance can go here to see how many claims their carrier denied nationally in 2023. If it's 30% of claims or more, switching to another company may be an option.

Step 3. For additional comfort, homeowners can also check their insurer's Weiss Safety Rating on this page. Weiss recommends favoring companies with a grade of B- or better, while avoiding those with "D+" or lower.

About Weiss Ratings: Weiss issues grades on 53,000 institutions and investments, including safety ratings on insurers, banks and credit unions as well as investment ratings on stocks, ETFs, and mutual funds. Since its founding in 1971, Weiss Ratings has never accepted any form of payment from rated entities for its ratings. The U.S. Government Accountability Office (GAO) reported that the Weiss ratings of U.S. life and health insurers outperformed those of A.M. Best by 3-to-1 in warning of future financial difficulties, while also greatly outperforming those of Moody's and Standard & Poor's.

Weiss Ratings press contact: Nicole Brown

[email protected], (727) 900-5293

SOURCE Weiss Ratings

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article