NEW YORK, Oct. 21, 2020 /PRNewswire/ -- International Tax Review (ITR) has named Deloitte as the leading "Americas Tax Technology Firm of the Year," "Americas Transfer Pricing Firm of the Year," and "Tax Compliance and Reporting Firm of the Year" for the organization's work driving pioneering solutions and enhancing efficiency for numerous client engagements in the Americas region.

This is the third consecutive year Deloitte has won "Americas Tax Technology Firm of the Year" and "2020 North America Transfer Pricing Firm of the Year." Deloitte also won "Americas Transfer Pricing Firm of the Year" for the fourth consecutive year.

"Accelerating globalization, growing regulatory and business complexity, and the evolution of tax technology is creating ever-increasing expectations for tax executives," said Steve Kimble, chairman and chief executive officer, Deloitte Tax LLP. "At Deloitte, we serve some of the most prestigious clients in the world as trusted business advisors. They rely on us to incorporate best-in-class technology while efficiently managing increased workload and complexity. Winning the title of 'Americas Tax Technology Firm of the Year' delivers on Deloitte's commitment to be at the forefront of driving digital transformation in tax, as we help our clients shift from doing digital to 'being' digital."

Over the past three years, Deloitte Tax LLP has doubled its investment in innovation, deepening its commitment to evolve with clients, and anticipating the next generation of solutions and capabilities to meet the ever-changing set of challenges its clients face.

This recognition from ITR affirms Deloitte's dedication to challenge the status quo, enhance clients' operations, and create lasting value through digital transformation. The technological advancements highlighted this year include:

- Integrated International Tax Reform (IITR) model – After the U.S. Congress passed the Tax Cuts and Jobs Act in December 2017, U.S. multinationals needed assistance with planning to help them adjust to the sweeping changes to international tax law. In response, Deloitte Tax LLP developed the IITR model, which Deloitte Tax LLP professionals use in providing services to help companies compute their global intangible low-tax income inclusion, Subpart F inclusion, foreign-derived intangible income benefit, section 163(j) interest expense limitation, foreign tax credit limitation, and BASE erosion anti-avoidance tax liability.

IITR is widely used for tax compliance, but it can also run calculations under different scenarios, helping clients quantify the impact of these provisions and make well-informed international tax planning decisions.

- FATCA and CRS Compliance Services Using AEOI Reporter – Global financial institutions ("FIs") – including banks, custodians, and investment managers – are required to comply with information reporting obligations under the U.S. Foreign Account Tax Compliance Act (FATCA) and the OECD Common Reporting Standard (CRS), collectively referred to as Automatic Exchange of Information ("AEOI") regimes. Under these regimes, FIs must report certain demographic and financial information of their underlying account holders that are determined to be reportable to the relevant U.S. or local country taxing authorities. Noncompliance with these rules can give rise to financial and reputational risks.

AEOI Reporter is an enterprise level technology solution used by Deloitte Tax LLP professionals to assist FI's in complying with the FATCA and CRS compliance services regimes. AEOI Reporter enables data gathering and analysis of the account holder reportability to provide a streamlined end-to-end reporting service and allows FIs to have visibility in the platforms' collaborative workspace, providing transparency to their AEOI reporting obligations.

The 15th annual Americas Tax Awards recognize remarkable achievements and developments that demonstrate innovative, complex and impactful transactions. The awards acknowledge work that broke new ground in the tax marketplace and was completed between March 2019 and April 2020.

About Deloitte

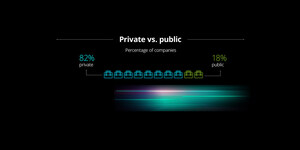

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world's most admired brands, including nearly 90% of the Fortune 500® and more than 7,000 private companies. Our people work across the industry sectors that drive and shape today's marketplace — delivering measurable and lasting results that help reinforce public trust in our capital markets, inspire clients to see challenges as opportunities to transform and thrive, and help lead the way toward a stronger economy and a healthy society. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Now celebrating 175 years of service, our network of member firms spans more than 150 countries and territories. Learn how Deloitte's more than 312,000 people worldwide make an impact that matters at www.deloitte.com.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as "Deloitte Global") does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the "Deloitte" name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

Copyright © 2020 Deloitte Development LLC. All rights reserved.

SOURCE Deloitte

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article