Twenty-four percent of the current generation of leadership and just 13% of next generation family members surveyed strongly agree that their family-owned business would continue to run smoothly and without interruption if an important family employee moved on, retired, or passed away

NEW YORK, May 14, 2024 /PRNewswire/ -- Today, Deloitte Private released "The Enduring Family Business," a survey of 500 current and next generation members of U.S.-based family businesses. The report reveals how different generations of family businesses approach leadership, risks and decision-making. Notably, 63% of respondents cited "interest in succession" as a high or very high risk to their organization's succession planning, exemplifying how this crucial aspect of family businesses is not rising to the top of leaders' agendas.

"Family businesses face an added complexity that comes with finding common ground across generations. Our survey findings show the challenges and opportunities in this area," said Wendy Diamond, Deloitte Private U.S. family enterprise leader and partner, Deloitte Tax LLP. "Exploring both the disconnect and alignment between the current and next generation can not only help strengthen family enterprises moving forward, but also establish a foundation for trust to accomplish short and long-term goals."

Generational perceptions of succession, risk and participation

The survey revealed diverging perspectives on key elements of family enterprises. Findings include:

- The current generation is more confident with succession planning: When asked whether their family business could withstand the departure of an important family employee, 24% of the current generation surveyed strongly agreed their succession plan would allow the business to continue running smoothly. However, only 13% of next generation respondents strongly agreed, revealing a gap for companies to focus on closing.

- Risks to the business are a greater concern among the current generation: Current generation respondents reported higher concerns around the ability to hire and retain employees (23% vs. 11%), the impact of climate change on business organizations (20% vs. 12%), and capital structure (24% vs. 16%). This may be attributed to differences in experiences, as half of the current generation employees (48%) have only ever worked in the family business, compared to just 29% of the next generation.

- The next generation perceives it has a lower level of participation in the overall direction of the business: Members of the current generation were almost twice as likely as the next generation to say the successive generation has a very high level of participation in decision-making and direction of the enterprise (28% vs. 15%). The disconnect grows more pronounced when examining plans for the business. When asked about plans to retain or divest ownership in the company, just 8% of the current generation expect successors to sell part or all their interest in the business, while 18% of next-generation respondents say they expect to do the same.

"Understanding the gaps in perception between generations is critical to a family business' success in the long-term," continued Diamond. "Their governance structures can be valuable as they work to prioritize transparent communications, education for the next generation, succession planning, and innovation to keep their organizations competitive and thriving."

Despite their divergent views, both generations surveyed recognize the importance of technology as a core competency for potential successors. When asked which competencies were important for a successor to possess, 46% of the current generation and 46% of the next generation chose technology and digital transformation.

About the survey

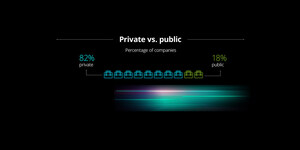

From Jan. 16 to Jan. 26, 2024, an independent research company conducted an online survey of 500 U.S. respondents comprising leaders and next generation members of family enterprises to understand their perceptions, plans and attitudes across a number of dimensions, including influence and involvement in the business; ongoing ownership; risk; opportunities related to data and technology; trust; and their confidence to move forward. Respondents included leaders and employees from the following industries: consumer goods; consumer services; energy, resources and industrials; financial services; life sciences and health care; and technology, media and telecommunications. Responses were evenly split between the current generation of business leadership, and the next generation. All responses came from family-owned, private companies with revenues between $250 million and over $1 billion.

Deloitte Private brings together a network of ideas, knowledge, and experience to serve the unique needs of the private enterprises and their owners. Leveraging Deloitte's vast resources and deep industry insights, we tailor services to help more than 8,500 private enterprises, family-owned businesses, private equity firms and their portfolio companies, and emerging growth companies. Visit us at https://www2.deloitte.com/us/private or follow us on LinkedIn.

About Deloitte

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world's most admired brands, including nearly 90% of the Fortune 500® and more than 8,500 U.S.-based private companies. At Deloitte, we strive to live our purpose of making an impact that matters by creating trust and confidence in a more equitable society. We leverage our unique blend of business acumen, command of technology, and strategic technology alliances to advise our clients across industries as they build their future. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Bringing more than 175 years of service, our network of member firms spans more than 150 countries and territories. Learn how Deloitte's approximately 457,000 people worldwide connect for impact at www.deloitte.com.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as "Deloitte Global") does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the "Deloitte" name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

SOURCE Deloitte

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article