NEW YORK, Oct. 31, 2019 /PRNewswire/ -- Deloitte Digital and Finxact, an emerging leader in Core-as-a-Service banking, today announced a strategic alliance to help banks imagine, deliver and run the next generation of digital banking products and experiences.

The alliance will combine Deloitte Digital's financial services experience and systems integration capabilities with Finxact's next-generation core banking platform. The Finxact and Deloitte enabled platform will allow banks to co-create goal-oriented, behavioral banking products that deliver modern banking experiences to digital native customers and compete with the nimblest of digital banking players.

Established banks are being fundamentally challenged to respond to the digital transformation wave that has taken the industry by storm, in part due to a growing contingent of global consumers who prefer personalized digital banking experiences, including 28% who exclusively use online and mobile channels. Yet many banks do not have the operational flexibility to rapidly and consistently deliver products to the market, placing them at a disadvantage to challenger banks (digital native entrants) and neo banks (digital, or mobile-only banks) that operate unencumbered by the constraints of legacy business models and core systems.

"The weight of legacy business models and core systems have banks stuck in a competitive rut, and CXOs are eager for a transformative way out," said Gys Hyman, U.S. digital banking lead and principal, Deloitte Consulting LLP. "Addressing these issues is at the heart of Deloitte's alliance with Finxact. We are combining our innovation, digital design and systems integration capabilities with Finxact's next generation core banking platform in order to help banks differentiate at product and cost levels. It also enables banks to reimagine their operating models to compete nimbly and enter new markets."

Deloitte's practice includes several early stage clients and 30 trained professionals across a range of disciplines within its Finxact's Center of Excellence, which launches alongside the alliance. The Deloitte Digital team has spent the past few years working with leading fintechs such as Finxact to design and power Deloitte's DigiBank Platform. The platform enables behavioral banking products and features by adopting an event-based, real-time architecture powered by Finxact's next-generation cloud native core platform and a robust fintech ecosystem. The alliance will help banks to shed the product-as-a-commodity model by enabling them to differentiate on price and experience, modernize their cores to increase efficiencies and reduce costs. It can also help banks to accelerate M&A transactions by building an agile core ready for post-merger integrations, and rapidly prototype and launch new products in-market alongside existing operations.

"Much of the innovation happening in the industry to date has focused on customer experiences, not the production systems," said Frank Sanchez, Finxact's CEO. "If banks don't address the core platforms on the backend, it will be very difficult for them to innovate, adapt quickly to increasing customer expectations, and shape the future of the industry. Together with Deloitte Digital, we hope to solve this dilemma by working with banks as a co-creator — not a vendor — to help them ideate, innovate and transform at a pace that hasn't been possible before now."

The Deloitte Digital team has an award-winning record of building solutions for the world's leading banks and will continue to incubate and launch other new product possibilities through the Finxact alliance that will help place its financial institution clients at the leading edge of the industry.

Visit Deloitte Digital's website for more information on the Finxact alliance.

About Deloitte

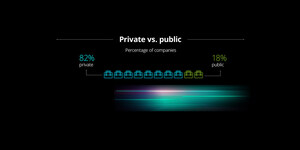

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world's most admired brands, including nearly 90% of the Fortune 500® and more than 5,000 private and middle market companies. Our people work across the industry sectors that drive and shape today's marketplace — delivering measurable and lasting results that help reinforce public trust in our capital markets, inspire clients to see challenges as opportunities to transform and thrive, and help lead the way toward a stronger economy and a healthy society. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Our network of member firms spans more than 150 countries and territories. Learn how Deloitte's more than 312,000 people worldwide make an impact that matters at www.deloitte.com.

About Finxact

Finxact is innovating the first enterprise class cloud-native Core-as-a-Service platform with a 100 percent accessible open banking API. Finxact's modern architecture enables banks to rapidly deliver new experiences by creating products on demand and integrating new services as needed. The Finxact team has been at the forefront of banking software for 35+ years, and together with its best of breed partners is disrupting core banking so financial institutions can truly transform on their terms. Learn more at www.Finxact.com.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as "Deloitte Global") does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the "Deloitte" name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

SOURCE Deloitte

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article