NEW YORK, May 1, 2017 /PRNewswire/ -- Global chemical mergers and acquisitions (M&A) activity is expected to increase in 2017, but geopolitical factors, such as protectionism, could pose a challenge to achieving the levels of record activity the industry experienced in 2015 and 2016, according to Deloitte's "2017 Global chemical industry mergers and acquisitions outlook."

Higher levels of cash on corporate balance sheets, low levels of innovation, and a low growth macroeconomic outlook are expected to help drive M&A volumes. Depressed natural gas and oil prices should also help drive activity in the petrochemical M&A space. Meanwhile, the fertilizer and agriculture chemicals, industrial gases, and diversified chemical segments are expected to experience strong M&A activity in pursuit of scale and to gain access to different technologies.

Mega deals valued at over $1 billion have become more common with 41 deals taking place over the past three years, compared to 30 deals between 2011 and 2013. It is expected that 2017 M&A activity will be focused around innovation and digitization. As valuations have soared, companies may rely on sales growth and synergy capture to help mitigate the higher cost of deals.

"Companies are increasingly focused on gaining access to technological capabilities and are creating corporate venture capital divisions to help support new investments," said Duane Dickson, vice chairman, Deloitte LLP and U.S. chemicals and specialty materials sector leader. "Increased digitization around the world is also expected to encourage M&A activity. We expect to see these global trends lead to increased growth and deal flow in the chemicals industry."

"We are also observing that some deal and integration teams have been exceeding internally forecast synergies by up to 150 to 200 percent," added Dickson. "This is potentially due to an artificially low perspective of the total potential synergies. As a result, companies are missing out on growth opportunities for their shareholders, due to an unrealistic perspective on the return on investment and cost savings a merger could create."

"Despite geopolitical uncertainty, which normally dampens M&A activity, there is a very positive outlook for 2017," said Dan Schweller, partner, Deloitte & Touche LLP and U.S. and global M&A leader for the chemicals and specialty materials sector. "As deal flow remains strong and mega deals become the norm, it will be important to watch how competition regulators impact consolidation and whether or not increasing interest rates will stifle deal activity in the year to come."

About Deloitte

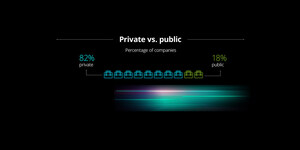

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world's most admired brands, including 80 percent of the Fortune 500 and more than 6,000 private and middle market companies. Our people work across more than 20 industry sectors to deliver measurable and lasting results that help reinforce public trust in our capital markets, inspire clients to make their most challenging business decisions with confidence, and help lead the way toward a stronger economy and a healthy society.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as "Deloitte Global") does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the "Deloitte" name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

SOURCE Deloitte

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article