To understand more about Market Dynamics, Download our Sample Report

Key Hiking and Trail Footwear Market Report Highlights:

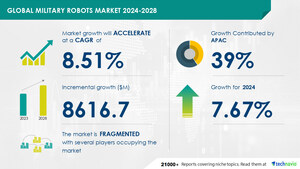

- YoY growth (%): 4.25%

- Performing market contribution: APAC at 59%

- Key consumer countries: China, Japan, and South Korea (Republic of Korea)

Regional Market Analysis

APAC will have the highest market growth contribution during the forecast period, with 59% of the growth originating from this region. The region is a major hub for manufacturing cylindrical lithium-ion batteries. The manufacturing units of many end-users, including manufacturers of EVs, consumer electronics, and other products, are located in this region. Among these end-users, automotive is a major end-user industry. These factors are driving the growth of the market in the region.

For additional information about the regional market, Request a Sample Report.

Key Vendors and Vendor Strategies

DLG (Shanghai) Electronic Technology Co. Ltd., Hitachi Ltd., LG Chem Ltd., Murata Manufacturing Co. Ltd., OptimumNano Energy Co. Ltd., Padre Electronics Co. Ltd., Panasonic Corp., PowerTech Systems, Samsung SDI Co. Ltd., and Shenzhen Cham Battery Technology Co. Ltd. among others. are few of the key vendors in the cylindrical lithium-ion battery market.

There are various players in the global cylindrical lithium-ion battery market. The major players mainly focus on manufacturing products and are constantly increasing their R&D investments. The market is competitive, and the established vendors are acquiring smaller and regional players to enhance their global reach. Moreover, several new players are also expected to enter the market, which will intensify the level of competition among the existing players.

Download our Sample Report to get a brief understanding of various vendors and their strategies.

Key Market Driver and Trend

Our analysts have extensively outlined the information on the key market drivers and their impact on the cylindrical lithium-ion battery market.

- Shift in the automotive industry to EVs:

- Growing concerns over environmental pollution and a shift toward a sustainable ecosystem are leading to the adoption of EVs. Many countries have framed policies to reduce air pollution and vehicle emissions. Li-ion batteries are mainly used to power EVs. EV manufacturers use these batteries to deliver higher levels of performance. For instance, Tesla uses cylindrical Li-ion batteries manufactured by Panasonic in its Model S and Model X cars. Thus, the growing adoption of EVs owing to sustainability factors will increase the sales volume of cylindrical Li-ion batteries, which will drive the growth of the market.

- Advances in cylindrical Li-ion battery capacity:

- Many new cylindrical Li-ion batteries have been introduced in the market. Such batteries can provide the required output with fewer thus. Hence, the adoption of these batteries is expected to rise, which will boost the production of cylindrical Li-ion batteries and, in turn, contribute to the growth of the market during the forecast period.

To know about a few other market drivers, trends, and challenges.

Download our sample report

Related Reports

Lead Acid Battery Market in US by Application and Type - Forecast and Analysis 2022-2026

Flat Lithium-ion (Li-ion) Battery Market by Application and Geography - Forecast and Analysis 2022-2026

Cylindrical Lithium-Ion Battery Market Scope |

Report Coverage |

Details |

Page number |

120 |

Base year |

2020 |

Forecast period |

2021-2025 |

Growth momentum & CAGR |

Accelerate at a CAGR of 6.79% |

Market growth 2021-2025 |

USD 9.81 billion |

Market structure |

Fragmented |

YoY growth (%) |

4.25 |

Regional analysis |

APAC, North America, Europe, South America, and MEA |

Performing market contribution |

APAC at 59% |

Key consumer countries |

China, US, Japan, South Korea (Republic of Korea), and Germany |

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

Key companies profiled |

DLG (Shanghai) Electronic Technology Co. Ltd., Hitachi Ltd., LG Chem Ltd., Murata Manufacturing Co. Ltd., OptimumNano Energy Co. Ltd., Padre Electronics Co. Ltd., Panasonic Corp., PowerTech Systems, Samsung SDI Co. Ltd., and Shenzhen Cham Battery Technology Co. Ltd. |

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table of Contents

1 Executive Summary

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 01: Parent market

- Exhibit 02: Market characteristics

- 2.2 Value chain analysis

- Exhibit 03: Value chain analysis: Renewable electricity

3 Market Sizing

- 3.1 Market definition

- Exhibit 04: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 05: Market segments

- 3.4 Market outlook: Forecast for 2020 - 2025

- Exhibit 06: Global - Market size and forecast 2020 - 2025 ($ million)

- Exhibit 07: Global market: Year-over-year growth 2020 - 2025 (%)

4 Five Forces Analysis

- 4.1 Five forces summary

- Exhibit 08: Five forces analysis 2020 & 2025

- 4.2 Bargaining power of buyers

- Exhibit 09: Bargaining power of buyers

- 4.3 Bargaining power of suppliers

- Exhibit 10: Bargaining power of suppliers

- 4.4 Threat of new entrants

- Exhibit 11: Threat of new entrants

- 4.5 Threat of substitutes

- Exhibit 12: Threat of substitutes

- 4.6 Threat of rivalry

- Exhibit 13: Threat of rivalry

- 4.7 Market condition

- Exhibit 14: Market condition - Five forces 2020

5 Market Segmentation by Application

- 5.1 Market segments

- Exhibit 15: Application - Market share 2020-2025 (%)

- 5.2 Comparison by Application

- Exhibit 16: Comparison by Application

- 5.3 Automotive - Market size and forecast 2020-2025

- Exhibit 17: Automotive - Market size and forecast 2020-2025 ($ million)

- Exhibit 18: Automotive - Year-over-year growth 2020-2025 (%)

- 5.4 Industrial - Market size and forecast 2020-2025

- Exhibit 19: Industrial - Market size and forecast 2020-2025 ($ million)

- Exhibit 20: Industrial - Year-over-year growth 2020-2025 (%)

- 5.5 Others - Market size and forecast 2020-2025

- Exhibit 21: Others - Market size and forecast 2020-2025 ($ million)

- Exhibit 22: Others - Year-over-year growth 2020-2025 (%)

- 5.6 Market opportunity by Application

- Exhibit 23: Market opportunity by Application

6 Customer landscape

7 Geographic Landscape

- 7.1 Geographic segmentation

- Exhibit 25: Market share by geography 2020-2025 (%)

- 7.2 Geographic comparison

- Exhibit 26: Geographic comparison

- 7.3 APAC - Market size and forecast 2020-2025

- Exhibit 27: APAC - Market size and forecast 2020-2025 ($ million)

- Exhibit 28: APAC - Year-over-year growth 2020-2025 (%)

- 7.4 North America - Market size and forecast 2020-2025

- Exhibit 29: North America - Market size and forecast 2020-2025 ($ million)

- Exhibit 30: North America - Year-over-year growth 2020-2025 (%)

- 7.5 Europe - Market size and forecast 2020-2025

- Exhibit 31: Europe - Market size and forecast 2020-2025 ($ million)

- Exhibit 32: Europe - Year-over-year growth 2020-2025 (%)

- 7.6 South America - Market size and forecast 2020-2025

- Exhibit 33: South America - Market size and forecast 2020-2025 ($ million)

- Exhibit 34: South America - Year-over-year growth 2020-2025 (%)

- 7.7 MEA - Market size and forecast 2020-2025

- Exhibit 35: MEA - Market size and forecast 2020-2025 ($ million)

- Exhibit 36: MEA - Year-over-year growth 2020-2025 (%)

- 7.8 Key leading countries

- Exhibit 37: Key leading countries

- 7.9 Market opportunity by geography

- Exhibit 38: Market opportunity by geography

8 Drivers, Challenges, and Trends

- 8.2 Market challenges

- Exhibit 39: Impact of drivers and challenges

9 Vendor Landscape

- 9.2 Vendor landscape

- Exhibit 40: Vendor landscape

- 9.3 Landscape disruption

- Exhibit 41: Landscape disruption

- Exhibit 42: Industry risks

10 Vendor Analysis

- 10.1 Vendors covered

- Exhibit 43: Vendors covered

- 10.2 Market positioning of vendors

- 10.3 DLG (Shanghai) Electronic Technology Co. Ltd.

- Exhibit 45: DLG (Shanghai) Electronic Technology Co. Ltd. - Overview

- Exhibit 46: DLG (Shanghai) Electronic Technology Co. Ltd. - Product and service

- Exhibit 47: DLG (Shanghai) Electronic Technology Co. Ltd. - Key offerings

- 10.4 Hitachi Ltd.

- Exhibit 48: Hitachi Ltd. - Overview

- Exhibit 49: Hitachi Ltd. - Business segments

- Exhibit 50: Hitachi Ltd. - Key news

- Exhibit 51: Hitachi Ltd. - Key offerings

- Exhibit 52: Hitachi Ltd. - Segment focus

- 10.5 LG Chem Ltd.

- Exhibit 53: LG Chem Ltd. - Overview

- Exhibit 54: LG Chem Ltd. - Business segments

- Exhibit 55: LG Chem Ltd. - Key offerings

- Exhibit 56: LG Chem Ltd. - Segment focus

- 10.6 Murata Manufacturing Co. Ltd.

- Exhibit 57: Murata Manufacturing Co. Ltd. - Overview

- Exhibit 58: Murata Manufacturing Co. Ltd. - Business segments

- Exhibit 59: Murata Manufacturing Co. Ltd. - Key news

- Exhibit 60: Murata Manufacturing Co. Ltd. - Key offerings

- Exhibit 61: Murata Manufacturing Co. Ltd. - Segment focus

- 10.7 OptimumNano Energy Co. Ltd.

- Exhibit 62: OptimumNano Energy Co. Ltd. - Overview

- Exhibit 63: OptimumNano Energy Co. Ltd. - Product and service

- Exhibit 64: OptimumNano Energy Co. Ltd. - Key offerings

- 10.8 Padre Electronics Co. Ltd.

- Exhibit 65: Padre Electronics Co. Ltd. - Overview

- Exhibit 66: Padre Electronics Co. Ltd. - Product and service

- Exhibit 67: Padre Electronics Co. Ltd. - Key offerings

- 10.9 Panasonic Corp.

- Exhibit 68: Panasonic Corp. - Overview

- Exhibit 69: Panasonic Corp. - Business segments

- Exhibit 70: Panasonic Corp. -Key news

- Exhibit 71: Panasonic Corp. - Key offerings

- Exhibit 72: Panasonic Corp. - Segment focus

- 10.10 PowerTech Systems

- Exhibit 73: PowerTech Systems - Overview

- Exhibit 74: PowerTech Systems - Product and service

- Exhibit 75: PowerTech Systems - Key offerings

- 10.11 Samsung SDI Co. Ltd.

- Exhibit 76: Samsung SDI Co. Ltd. - Overview

- Exhibit 77: Samsung SDI Co. Ltd. - Business segments

- Exhibit 78: Samsung SDI Co. Ltd. -Key news

- Exhibit 79: Samsung SDI Co. Ltd. - Key offerings

- Exhibit 80: Samsung SDI Co. Ltd. - Segment focus

- 10.12 Shenzhen Cham Battery Technology Co. Ltd.

- Exhibit 81: Shenzhen Cham Battery Technology Co. Ltd. - Overview

- Exhibit 82: Shenzhen Cham Battery Technology Co. Ltd. - Product and service

- Exhibit 83: Shenzhen Cham Battery Technology Co. Ltd. - Key offerings

11 Appendix

- 11.2 Currency conversion rates for US$

- Exhibit 84: Currency conversion rates for US$

- 11.3 Research methodology

- Exhibit 85: Research Methodology

- Exhibit 86: Validation techniques employed for market sizing

- Exhibit 87: Information sources

- 11.4 List of abbreviations

- Exhibit 88: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

SOURCE Technavio

Share this article