CreditEase Received Top Rankings in Global FinTech Investment by CB Insights and FT Partners

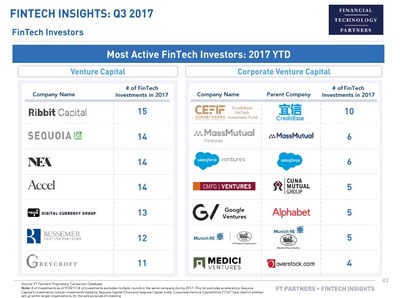

BEIJING, Dec 5, 2017 /PRNewswire/ -- CreditEase, a world-class financial technology conglomerate based in Beijing, China, specializing in inclusive finance and wealth management, announced today that its venture fund, CreditEase FinTech Investment Fund ("CEFIF") has recently been ranked No. 7 by CB Insights as "Top 10 Most Active VC Investors in Global FinTech Companies" and No. 1 by FT Partners as "Most Active FinTech Investors (Corporate VC)".

In addition to CEFIF's achievement, the list includes many well-respected global FinTech venture capital funds. CreditEase Wealth Management's Fund-of-Funds (FOFs) is proud to be a limited partner in four of these funds and has strong relationships with the rest of the funds. This unparalleled achievement demonstrated CreditEase' global investment capabilities and strong expertise in global FinTech innovation.

Founded in early 2016, CreditEase FinTech Investment Fund ("CEFIF") has an equivalent of US$ 1 billion in total committed capital in both RMB fund and US Dollars fund. CEFIF has formed strategic partnerships with global leading venture capital investors to discover investing opportunities in five sub-segments within FinTech: Lending, Payments, Personal Finance/Wealth Management, Enterprise Solutions and Insurance. Since its inception, CEFIF has made more than 20 investments, along with investors such as Goldman Sachs, Soros Fund Management, Visa, American Express and several leading VC firms.

Ms. Anju Patwardhan, Managing Director of CreditEase FinTech Investment Fund, commented, "The rise of FinTech not only addresses some legacy issues within the financial sector, but also enables financial services to improve efficiency and accelerate growth. There have been many emerging opportunities across all segments within FinTech. As CreditEase is at the forefront of technological transformation, we have made a number of investments in consumer finance, insurance tech, online wealth management and enterprise software. We remain bullish in the future adoption of these technologies and look forward to collaborating with these innovative start-ups to contribute to the long-term growth of the FinTech sector."

About CreditEase FinTech Investment Fund:

Founded in February 2016, CreditEase Fintech Investment Fund is a venture fund investing in growth-stage FinTech companies in China and the global markets. CreditEase FinTech Investment Fund has an equivalent of $1 billion in total committed capital. The fund has formed strategic partnerships with global leading venture capital investors to discover opportunities in five sub-segments within the domain of FinTech: Lending, Payment, Personal Finance/Wealth management, Enterprise Solutions and Insurance.

About CreditEase:

CreditEase is a Beijing-based leading FinTech conglomerate in China, specializing in inclusive finance and wealth management, in addition to payment technology, marketplace lending, crowdfunding, robo-advisory, insurance technology and blockchain products and services. CreditEase actively engages with global FinTech innovators through business incubation, commercial co-operation, and investment. Better tech, better finance, better world.

SOURCE CreditEase

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article