China's electronics manufacturers expect 26 percent jump in component purchase value in 2014 and 41 percent prefer to buy from local components distributors

Leading industry publication also announces the top components distributors as voted by China's electronics manufacturers, and Frederick Fu of Avnet as Outstanding Executive of the Year

DONGGUAN, China, May 30, 2014 /PRNewswire/ -- China's electronics manufacturers are expected to purchase US$34 million worth of components on average in 2014, representing a substantial increase of 26 percent from US$27 million in 2013. Manufacturers purchased 60 percent of components from distributors last year, and 51 percent of them planned to raise the proportion of components from distributors. Local distributors are gaining popularity, with 41 percent of manufacturers saying they preferred China distributors (2013: 25 percent), while 22 percent had no preference by distributors' headquarters location (2013: 12 percent). Proportions of respondents preferring international, Hong Kong and Taiwan distributors have dropped.

These are among the findings of the 14th Annual Electronic Components Distributor Survey announced today by Electronics Supply & Manufacturing-China (ESM-China), China's leading electronics management title published by Global Sources' (NASDAQ: GSOL) joint venture, eMedia Asia Limited.

Components distributors seem bullish about the China and Hong Kong markets and anticipate revenue growth of 22 percent in 2014 on average as the global economy slowly recovers. They put their 2013 revenue growth at 19 percent (2012: 17 percent) on average, with the top three markets remaining the same as the previous year: consumer electronics, industrial electronics, and network and communications systems. The average profit margin was 18 percent, which was 5 percentage points higher than that indicated in last year's survey, although 31 percent of distributors stated shrinking profit margin as one of the top three challenges they faced.

"By revamping business operations and strategies, some surveyed distributors have successfully differentiated themselves from the competition as well as expanded into new markets. As many as 8 percent of distributors surveyed this year had profit margins of 40 percent or higher," said eMedia Asia President Brandon Smith. "ESM-China's annual Survey aims to identify distributors' business challenges and manufacturers' difficulties when sourcing for components, as well as ways they can overcome these, in order to help both parties fine-tune their strategies for greater success."

Price is the main consideration for manufacturers

Price is by far the top consideration (more than 70 percent) for manufacturers when purchasing components, a possible contributing factor in the growing popularity of local distributors and component brands. This year, 28 percent of distributors indicated that they would carry more China brands (2013: 21 percent), although the majority (59 percent) still said they would carry more international brands (2013: 68 percent). Complementing existing product lines (52 percent, 2013: 43 percent) has overtaken brand awareness (49 percent, 2013: 53 percent) as the major consideration when choosing new brands to carry.

Product quality, price and delivery lead time are manufacturers' top concerns when choosing franchise distributors, while distributors themselves consider product supply capability, technical support and competitive pricing the main qualities as a good distributor.

Manufacturers surveyed said that the main challenges in components sourcing were inaccurate demand forecast (61 percent), product quality (35 percent) and delayed delivery (34 percent). In response, they are strengthening partnerships with suppliers (58 percent), building safety stock (32 percent), and working with strong and all-round distributors (30 percent).

The two main challenges distributors face have been the same over the past few years: softening market demand (40 percent) and disorderly competition (34 percent). To address these, they are developing new application markets, expanding customer base as well as adding product lines.

The challenges that have intensified most are fluctuating market demand (8 percentage points higher in 2013 than 2012), difficulty in securing franchise brands (7 percentage points higher) and high logistics costs (3 percentage points higher).

Online transactions increasing, albeit slowly

The proportion of online transactions in distributors' total revenues, at 13 percent on average in 2013, has been increasing for three years (2012: 11 percent). Online transactions are still mainly for small-volume purchases. As many as 49 percent of manufacturers used online platforms for sourcing, mostly for component models search, inventory search and product inquiries.

A total of 179 senior managers working for leading components distributors in China and 2,260 managers and engineers from China's electronics manufacturers participated in the Survey.

Top distributors in China unveiled

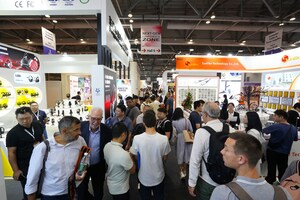

The Survey results were unveiled today at ESM-China's annual Supply Chain Forum and Distributor Survey Awards held in the Songshan Lake Hi-tech Park in Dongguan, Guangdong Province. More than 200 executives from components distributors, IC vendors, electronics manufacturers and independent design houses participated in the event and witnessed the awarding of the top components distributors who were selected through online voting by managers of China's electronics manufacturers.

Winners of each category (in alphabetical order) are:

- Top 10 International Distributors: Arrow Electronics, Avnet, Cytech Technology, Digi-Key Electronics, Excelpoint Systems (HK), Future Electronics, HK Baite (Group), Jetronic Technology, Mouser Electronics, Willas-Array Electronics, and WPG Holdings.

- Top 10 Local Distributors: Asiacom Technology, Burnon International, CEAC, Comtech Group, Fengbao Electronic, Fortune Techgroup, Honestar Electronics, Mornsun Electronics, Powertek Group, and Sekorm.

- Top 5 Most Promising Distributors: Ample Solutions, Hi-Hone, Mission Electronics, Sigma Technology, and Vadas International.

- Top 3 Best e-Commerce Distributors: Shanghai Galaxy Electronics, Shenzhen Shenmei Technology, and RightIC.

- Top 3 Best Technical Support Distributors: EDOM Technology, Lierda Science and Technology, and WT Microelectronics.

- Top 3 Best Logistics Service Distributors: Advanced MP, America II, and RS Components.

- Top 3 Rising Star Distributors: Heilind Asia Pacific (Hong Kong), Succeed International Trade, and Yang Cheng Electronics International.

- Analyst's Choice - Outstanding Executive of the Year: Frederick Fu, Regional President, China, Avnet Electronics Marketing.

For more information on the 14th Annual Electronic Components Distributor Survey, please contact Cindy Hu, Chief Analyst of ESM-China at [email protected] or read the detailed Survey reports at www.emrgresearch.com.

More information about Global Sources is available on the company's corporate site (http://www.corporate.globalsources.com), Facebook and Twitter (/globalsources).

About Global Sources

Global Sources is a leading business-to-business media company and a primary facilitator of trade with Greater China.

The core business facilitates trade between Asia and the world using English-language media such as online marketplaces (GlobalSources.com), print and digital magazines, sourcing research reports, private sourcing events, trade shows, and online sourcing fairs.

More than 1 million international buyers, including 95 of the world's top 100 retailers, use these services to obtain product and company information to help them source more profitably from overseas supply markets. These services also provide suppliers with integrated marketing solutions to build corporate image, generate sales leads and win orders from buyers in more than 240 countries and territories.

Global Sources' other businesses provide Chinese-language media to companies selling to and within Greater China. These services include online web sites, print and digital magazines, seminars and trade shows. In mainland China, Global Sources has a network of more than 30 office locations and a community of more than 4 million registered online users and magazine readers of its Chinese-language media.

Now in its fifth decade, Global Sources has been publicly listed on the NASDAQ since 2000.

About eMedia Asia Limited

eMedia Asia Limited is a joint venture between Global Sources (60.1%) and United Business Media's EETimes Group (39.9%).

eMedia Asia provides 500,000-plus technology decision-makers throughout Asia and China with access to a multichannel media network. Through its technical events, publications and online network, eMedia Asia leads in providing the region's electronics community with the business and technical information they need to remain competitive.

| Press Contact in Asia |

Investor Contact in Asia |

| Camellia So |

Connie Lai |

| Tel: (852) 2555-5021 |

Tel: (852) 2555-4747 |

| e-mail: [email protected] |

e-mail: [email protected] |

| Press Contact in U.S. |

Investor Contact in U.S. |

| Brendon Ouimette |

Cathy Mattison |

| Tel: (1-480) 664-8309 |

LHA |

| e-mail: [email protected] |

Tel: (1-415) 433-3777 |

| e-mail: [email protected] |

Logo - http://photos.prnewswire.com/prnh/20030303/LNM011LOGO-b

SOURCE Global Sources

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article