China Labor Market Continued to Improve in the Second Quarter of 2017

BEIJING, July 20, 2017 /PRNewswire/ -- Zhaopin Limited (NYSE: ZPIN) ("Zhaopin" or the "Company"), a leading career platform[1] in China focused on connecting users with relevant job opportunities throughout their career lifecycle, and the China Institute for Employment Research ("CIER") at Renmin University released the CIER Employment Index Report for the second quarter of 2017.

As the overall economy grew steadily in the second quarter of 2017, the labor market in China became more favorable for job seekers with increasing labor demand, and a decline in job applicants.

China's Second-Quarter 2017 Labor Market Highlights:

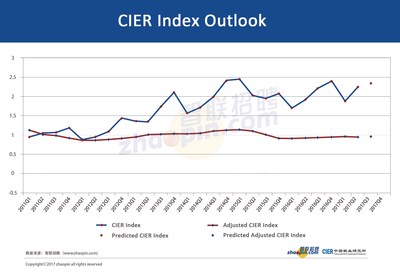

- The CIER index in the second quarter of 2017 rose to 2.26, from 1.93 during the same period of 2016 and 1.91 in the first quarter of 2017. The labor market improved in the second quarter with increasing labor demand, and a decline in job seekers.

- Internet and e-commerce continued to be the best-performing sector, while printing/packaging/papermaking was the worst.

- Eastern China continued to enjoy the highest CIER index score of 2.03, followed by 1.76 for Central China and 1.67 for Western China.

- The CIER index for micro-sized companies declined by 0.4 in the second quarter of 2017 year-over-year. With declining investment this year, some start-ups were struggling to survive.

- The CIER index is very likely to increase significantly in the third quarter of 2017 due to strong seasonal factors.

Methodology and how to interpret the data

Based on data from Zhaopin's online recruitment platform, the CIER index tracks the ratio changes between job vacancies and job seekers in a variety of industries and cities across the country, and identifies the overall trend in China's employment market. Jointly published by Zhaopin and the CIER at Renmin University every quarter, the CIER index has become a leading barometer of China's labor market and macro-economic environment.

The CIER index score is calculated by dividing the number of job vacancies during a specified period by the number of unique job seekers during the same period. A CIER index score of more than 1 indicates that the labor market is booming, with more vacancies than job seekers. A CIER index score of less than 1 indicates that the labor market competition is intensifying, with more job seekers than available vacancies.

CIER index rising with growing economy

In the second quarter of 2017, the economy in China continued to grow with the GDP increasing by 6.9% year-over-year. The CIER index for the labor market rose to 2.26 in the second quarter of 2017, up from 1.93 during the same period of 2016 and 1.91 in the first quarter of 2017. The rising CIER index was caused by increasing labor demand, and a decline in job seekers in the second quarter.

The improving economy had created more job demand in the second quarter this year, especially in the booming new economy driven by internet and e-commerce. After the peak season for job hopping in the first quarter, many job seekers already found new jobs, which led to the decline in job applicants in the second quarter of 2017. The rising CIER index indicated that the labor market in China became more favorable for job seekers.

While the combination of stronger labor demand and fewer applicants may mean more opportunities for those on the hunt for a job, it's not translating into higher pay at the moment. On July 17, 2017, Zhaopin reported that the average monthly salary for white-collar workers was RMB7,376, in the second quarter of 2017, down by 3.8% over the first quarter, based on online job postings in 37 key cities in China. This was the first time that the average monthly salary declined quarter-over-quarter since the second quarter of 2015. The falling average salary for white-collar workers was mainly caused by a 31% decrease in average salaries at micro-sized companies. With investment waning, many small start-ups became more rational and could no longer offer higher salaries to attract talents. An additional factor contributing to the overall decline in salaries in the second quarter of 2017 was that more jobs were located in lower-tier cities, where pay is normally lower.

In addition, while online recruitment demand continued to gain, the pace of growth is slowing. According to Zhaopin's data, total online recruitment demand in China rose 36% year-over-year in the second quarter of 2017, compared with a 52% year-over-year growth in the first quarter of 2017.

CIER index by sectors

The internet/e-commerce sector continued to be the best-performing sector in the second quarter of 2017, with recruitment demand far exceeding the number of job seekers. The real estate/construction/building materials/engineering sector was also booming in lower-tier cities, pushing the CIER index for the sector to 3.83 in the second quarter of 2017, from 2.78 in the first quarter this year.

| Ten best-performing sectors in the second quarter of 2017 |

||

| Ranking |

Sector |

CIER index |

| 1 |

Internet/e-commerce |

9.06 |

| 2 |

Traffic/transportation |

7.64 |

| 3 |

Insurance |

5.85 |

| 4 |

Intermediary service |

5.74 |

| 5 |

Funds/securities/futures/investment |

5.26 |

| 6 |

Logistics/warehousing |

4.10 |

| 7 |

Real estate/construction/building materials/engineering |

3.83 |

| 8 |

Farming/forestry/animal husbandry/fishery |

3.78 |

| 9 |

Education/training/college |

3.64 |

| 10 |

Computer software |

3.57 |

The gap between the best-performing sectors and the worst-performing sectors actually narrowed in the second quarter of 2017 as the restructuring of the economy began to show some results. The CIER index of the energy/mineral/mining/smelting sector rose to 0.60 in the second quarter of 2017 from 0.32 in the first quarter this year.

| Ten worst-performing sectors in the second quarter of 2017 |

||

| Ranking |

Sector |

CIER index |

| 1 |

Printing/packaging/papermaking |

0.35 |

| 2 |

Petroleum/petrochemical/chemical |

0.52 |

| 3 |

Environmental protection |

0.54 |

| 4 |

Energy/mineral/mining/smelting |

0.60 |

| 5 |

Instruments/apparatuses/industrial automation |

0.65 |

| 6 |

Property management/business center |

0.71 |

| 7 |

Inspection/testing/authentication |

0.75 |

| 8 |

Aerospace research and manufacturing |

0.78 |

| 9 |

Electricity/power/water conservancy |

0.82 |

| 10 |

Office supplies and equipment |

0.86 |

The traffic/transportation sector enjoyed the highest increase in job demand among all sectors, with 55% growth in the second quarter of 2017 year-over-year, as the government gave priority to the sector and invested heavily to build transportation infrastructure across the country.

| Year-over-year change in recruitment demand for |

|

| Nationwide |

55% |

| First-tier cities |

30% |

| Emerging first-tier cities |

81% |

| Second-tier cities |

86% |

| Third-tier cities |

64% |

The IT and internet sector saw growth in job demand slow in the second quarter of 2017. The job demand from this sector increased by 36% year-over-year in the second quarter of 2017, compared with a 56% growth year-over-year in the first quarter this year. As investors became more rational, many start-ups in the sector could no longer "burn money" for fast expansion.

| Year-over-year change in recruitment demand for |

|

| Nationwide |

36% |

| First-tier cities |

19% |

| Emerging first-tier cities |

57% |

| Second-tier cities |

52% |

| Third-tier cities |

40% |

The financial sector was far below the national average in job demand, with only 6% growth year-over-year in the second quarter of 2017. The job demand in the first-tier cities fell by 4% in the second quarter. To ensure financial stability, the central bank and regulatory departments took measures to bring financial risks under control.

| Year-over-year change in recruitment demand for |

|

| Nationwide |

6% |

| First-tier cities |

- 4% |

| Emerging first-tier cities |

21% |

| Second-tier cities |

9% |

| Third-tier cities |

26% |

The real estate sector continued its fast growth in job demand, with a 55% increase year-over-year in the second quarter of 2017. While big cities imposed restrictions on the real estate market to curb bubbles, second-tier and third-tier cities encouraged sales to reduce stocks.

CIER index by regions and cities

In the second quarter of 2017, Eastern China continued to enjoy the highest CIER index score of 2.03, followed by 1.76 for Central China and 1.67 for Western China. Among all regions, Central China had the fastest growth in job demand at 61% year-over-year in the second quarter of 2017. With the recovery of steel and coal industries, Northeast China saw its CIER index rise to 1.33 in the second quarter of 2017, from 1.17 in the first quarter this year.

| CIER index by regions |

|||

| Region |

2Q 2017 CIER |

Change year- |

1Q 2017 CIER |

| Eastern China |

2.03 |

0.82 |

1.60 |

| Central China |

1.76 |

0.59 |

1.35 |

| Western China |

1.67 |

0.50 |

1.33 |

| Northeast China |

1.33 |

0.34 |

1.17 |

The CIER index increased for cities of all tiers[2] in the second quarter of 2017. Emerging first-tier cities were creating more job demand with fast growth and becoming more attractive to talents. The job growth of first-tier cities were slowing down with saturated labor markets.

| CIER index by cities |

|||

| City |

2Q 2017 CIER |

Change year- |

1Q 2017 CIER |

| First-tier cities |

0.97 |

0.36 |

0.68 |

| Emerging first-tier cities |

1.30 |

0.46 |

0.98 |

| Second-tier cities |

2.08 |

0.77 |

1.64 |

| Third-tier cities |

2.53 |

0.95 |

2.12 |

CIER index by size of companies

In the second quarter of 2017, the CIER index grew for companies of all sizes year-over-year, except for micro-sized companies. Many of these micro-sized companies were start-ups. With a decline in investment this year, some start-ups were struggling to survive.

| CIER index by size of companies |

|||

| Company size |

2Q 2017 CIER |

Change year- |

1Q 2017 CIER |

| Large-sized (more than 10,000 employees) |

2.46 |

1.66 |

1.65 |

| Medium-sized (500 to 9,999 employees) |

1.25 |

0.58 |

0.92 |

| Small-sized (20 to 499 employees) |

1.10 |

0.80 |

0.85 |

| Micro-sized (fewer than 20 employees) |

2.15 |

-0.4 |

2.09 |

Labor Market Outlook

The CIER index is very likely to increase significantly in the third quarter of 2017 due to strong seasonal factors.

About Zhaopin Limited

Zhaopin is a leading career platform in China, focusing on connecting users with relevant job opportunities throughout their career lifecycle. The Company's zhaopin.com website is the most popular career platform in China as measured by average daily unique visitors in each of the 12 months ended March 31, 2017, number of registered users as of March 31, 2017 and number of unique customers[3] for the three months ended March 31, 2017. The Company's over 135.0 million registered users include diverse and educated job seekers who are at various stages of their careers and are in demand by employers as a result of the general shortage of skilled and educated workers in China. In the fiscal year ended June 30, 2016, approximately 36.9 million job postings[4] were placed on Zhaopin's platform by 509,813 unique customers including multinational corporations, small and medium-sized enterprises and state-owned entities. The quality and quantity of Zhaopin's users and the resumes in the Company's database attract an increasing number of customers. This in turn leads to more users turning to Zhaopin as their primary recruitment and career- related services provider, creating strong network effects and significant entry barriers for potential competitors. For more information, please visit http://www.zhaopin.com.

Safe Harbor Statements

This press release contains forward-looking statements made under the "safe harbor" provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "confident" and similar statements. Zhaopin may also make written or oral forward-looking statements in its reports filed with or furnished to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Any statements that are not historical facts, including statements about Zhaopin's beliefs and expectations, are forward-looking statements that involve factors, risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Such factors and risks include, but not limited to the following: Zhaopin's goals and strategies; its future business development, financial condition and results of operations; its ability to retain and grow its user and customer base for its online career platform; the growth of, and trends in, the markets for its services in China; the demand for and market acceptance of its brand and services; competition in its industry in China; its ability to maintain the network infrastructure necessary to operate its website and mobile applications; relevant government policies and regulations relating to the corporate structure, business and industry; and its ability to protect its users' information and adequately address privacy concerns. Further information regarding these and other risks, uncertainties or factors is included in the Company's filings with the U.S. Securities and Exchange Commission. All information provided in this press release is current as of the date of the press release, and Zhaopin does not undertake any obligation to update such information, except as required under applicable law.

| [1] Zhaopin's website is the most popular career platform in China as measured by average daily unique visitors in each of the 12 months ended March 31, 2017, the number of registered users as of March 31, 2017 and the number of unique customers for the three months ended March 31, 2017. |

| [2] Cities are categorized to tiers based on standard of CBN Weekly. First-tier cities include Beijing, Shanghai, Guangzhou and Shenzhen. Emerging first-tier cities include Chengdu, Dalian, Dongguan, Hangzhou, Nanjing, Ningbo, Qingdao, Shenyang, Suzhou, Tianjin, Wuhan, Xi'an, Changsha, Zhengzhou, and Chongqing. Second-tier cities include Changzhou, Foshan, Fuzhou, Guiyang, Harbin, Hefei, Huizhou, Jinan, Jiaxing, Kunming, Nanchang, Nanning, Nantong, Quanzhou, Shijiazhuang, Taiyuan, Weifang, Wenzhou, Wuxi, Xuzhou, Yantai, Yangzhou, Changchun, Zhongshan, Zhuhai. Third-tier cities include Baotou, Daqing, Hohhot, Huai'an, Linyi, Luoyang, Qinhuangdao, Weihai, Xianyang and Zhenjiang. |

| [3] A "unique customer" refers to a customer that purchases the Company's online recruitment services during a specified period. Zhaopin makes adjustments for multiple purchases by the same customer to avoid double counting. Each customer is assigned a unique identification number in the Company's information management system. Affiliates and branches of a given customer may, under certain circumstances, be counted as separate unique customers. |

| [4] Zhaopin calculates the number of job postings by counting the number of newly placed job postings during each respective period. Job postings that were placed prior to a specified period - even if available during such period - are not counted as job postings for such period. Any particular job posting placed on the Company's website may include more than one job opening or position. |

For more information, please contact:

Zhaopin Limited

Ms. Daisy Wang

Investor Relations

[email protected]

ICR Beijing

Mr. Edmond Lococo

Phone: +86 10 6583-7510

[email protected]

SOURCE Zhaopin Limited

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article