Bill Gross Releases Investment Outlook, "What's Your Opinion?"

LAGUNA BEACH, Calif., Aug. 30, 2021 /PRNewswire/ -- Legendary bond and fixed income investor, William H. (Bill) Gross today released a new Investment Outlook, "What's Your Opinion?" In his latest Investment Outlook of 2021, Mr. Gross writes about interest rates: "At 1.25% for the 10-year Treasury, they have nowhere to go but up." He sees 10-year Treasury yields increasing to 2% over the next 12 months: "Through the benefit of my aging mathematical gymnastics, that equates to a 4%-5% price loss and a negative total return of 2.5%-3%. Cash has been trash for a long time but there are now new contenders for the investment garbage can."

Full text of Bill Gross August 30, 2021, Investment Outlook:

What's Your Opinion?

I'm finding that expressing an opinion or telling a joke in public company these days is most dangerous to one's reputation, not that my past dustup with a Laguna Beach neighbor over Gilligan's Island or planting a stink bomb going out the door in my ex-wife's toilet haven't sealed the deal for me already. But I now have a solution that allows me to vent opinions without consequences although I have to credit a Mr. Salvatore Garau for the brainstorm and the actual trailblazing creation of what he calls his "Invisible Sculpture" that takes NFTs and "live art" one step further.

This little-known artist (whoops I expressed an opinion) decided to create an existent but non-visible sculpture in a box with nothing but space in it, yet full as he claims "of energy" that the observer can feel. There is literally nothing in it. The artist, however, claims that if so, it is a metaphor of our times, and good for him, because he managed to sell it online for $15,000. Well, I'm not sure what to charge for my new box but I (and you) can now express opinions on sex, religion and politics without anyone being able to criticize. Just create an empty box with personal energy and opinions that can be felt but not heard. And sell it for $15,000 if possible!

But not so fast Bill! The fact that I even have an opinion, that there really is something in my empty box (brain) is probably subject to a wokeness misdemeanor, so better to first say I agree with your opinion, or someone else's on critical race theory, abortion, or whether Simone Biles was brave or just a quitter. And then just drift way into conformity. Safe until the next witch hunt (Oops I did it again).

How about an opinion on interest rates? I'll come right out and say it: At 1.25% for the 10-year Treasury, they have nowhere to go but up. How quickly is the real question because even if they go up by 10 basis points a year over the next decade, a bond investor could still break even with an indexed bond fund. But they'll go up quicker than that and probably much quicker.

With quantitative easing about to reverse, it's more than obvious that the $120 billion-a-month Federal Reserve deluge will probably end sometime in mid-2022 given inflation at greater than 2% and economic growth prospects remaining optimistic. Granted, that still leaves $600 or $700 billion of Treasury and mortgage debt yet to buy, but foreign central banks and investors have been selling in the past few years and $1.5 trillion fiscal deficits are perhaps a minimum of what we can expect in the U.S.

The Institute of International Finance in a recent advisory hit the nail on the head – not that they're any better at forecasting than any other trade association. In an August 12th note the IIF's Robin Brooks questioned ballooning debt levels and how much debt governments could sell to markets at current low yields. In the U.S., the IIF paper found that in the past year the Fed absorbed 60% of net issuance through quantitative easing with the balance purchased elsewhere. How willing, therefore, will private markets be to absorb this future 60% in mid-2022 and beyond? Perhaps if inflation comes back to the 2%+ target by then, a "tantrum" can be avoided, but how many more fiscal spending programs can we afford without paying for it with higher interest rates?

I'm thinking 2% 10-year Treasuries over the next 12 months. Through the benefit of my aging mathematical gymnastics, that equates to a 4%-5% price loss and a negative total return of 2.5%-3%. Cash has been trash for a long time but there are now new contenders for the investment garbage can. Intermediate to long-term bond funds are in that trash receptacle for sure, but will stocks follow? Earnings growth had better be double-digit-plus or else they could join the garbage truck. And then there's the now recent Afghanistan fallout, and the incessant push of global warming that few investors seem to care about unless there's a new solar IPO to run up on the first day. There are other problems but I best keep it simple.

Only a Honus Wagner baseball card and of course Salvatore Garau's NFT may be safe. Oops – I've expressed another opinion.

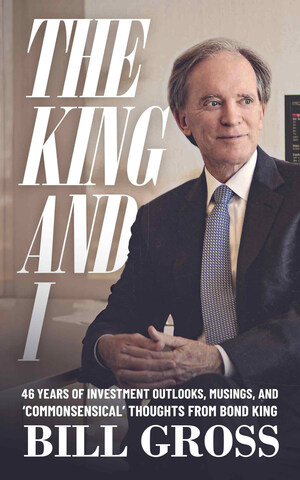

About Bill Gross

Bill Gross has been a pioneer in fixed income investing for more than 40 years. He co-founded PIMCO in 1971 and served as managing director and chief investment officer until joining Janus Henderson Investors in 2014. He retired in 2019 to focus on managing his personal assets and private charitable foundation. Throughout his career, he has received numerous awards, including Morningstar Fixed Income Manager of the Decade for 2000 to 2009 and Fixed Income Manager of the Year for 1998, 2000 and 2007. Mr. Gross became the first portfolio manager inducted into the Fixed Income Analysts Society's Hall of Fame in 1996 and received the Bond Market Association's Distinguished Service Award in 2000. In 2011, Institutional Investor magazine awarded him the Money Management Lifetime Achievement Award. Mr. Gross oversees the $390 million-asset William, Jeff and Jennifer Gross Family Foundation, which annually donates more than $21 million to non-profits involved in humanitarian causes, health care, and education. For more information or to view Investment Outlook archives, please visit https://williamhgross.com. For information about Mr. Gross's philanthropic activities through the William, Jeff and Jennifer Gross Family Foundation, please visit https://grossfamilyfoundation.com/

SOURCE Bill Gross

Related Links

https://williamhgross.com

https://grossfamilyfoundation.com/

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article