Bill Gross Releases Investment Outlook, "In the Parking Lot"

LAGUNA BEACH, Calif., March 11, 2022 /PRNewswire/ -- Legendary bond and fixed income investor William H. (Bill) Gross today released a new Investment Outlook, "In the Parking Lot". In his latest Investment Outlook, Mr. Gross acknowledges turmoil in the markets and offers a few investment ideas that he believes might do well in almost all scenarios. Specifically, buyouts and acquisitions "that offer and have already provided annualized returns of 5-10% that beat cash with reduced risk compared to Tesla and other 'high flyers'. Companies such as Microsoft, Oracle, and Qualcomm have announced acquisitions at fixed prices that provide single digit capital gains opportunities if completed."

Full text of Bill Gross March 11, 2022, Investment Outlook:

In the Parking Lot

A high school reunion can be a revealing thing. At 77 years old and one year away from my 60th and certainly one of my last get togethers, the tontined survivors at the rented lodge will be an accomplished lot – they are still around! As the years roll on, survival indeed can be a significant accomplishment, but during my earlier reunions of 20, 30, and 40 years past the accomplishments and observations were of a different nature. Physical transformations of course dominated first thoughts; the star high school quarterback had gained 50 or perhaps 75 pounds versus his game-time physique. Most of the "girls" were now married with rings on their fingers.

I myself, having had at least some business success prior to my 30th get together, had parked a rented Toyota in the lot with a chance to observe many of these transformations, but my reunion experiences were quite different from the others. My budding reputation, thin waistline, and still-thick, Robert Redford-looking hair could not overcome the insecurity of my earlier high school years. Showing up at the appointed 6:00 PM cocktail hour, I remained frozen and slumped down in the driver's seat as the now-near 50 year olds of the Los Altos High School Class Of 1962 paraded toward the front door. The clock struck 7, then 8, then 9 and still I couldn't muster the courage to announce myself to the many classmates I no longer recognized. It was only in the lingering nighttime moments that I steeled myself enough to walk through the door and say hello to my best -- and perhaps only -- high school friend, Jerry Hearn. Very strange I said to myself later on; yet incredibly, the same scenario played out at my 40th and 50th class rendezvous. Some Bond King! But finally at my 55th, at 72 years old, with a young and beautiful girlfriend Amy (now wife) clinging to my side, I had the courage to smile, and say hello beginning at 6:30. I don't think I deserve a gold star on my life's resume for this observation. Requiring a beautiful woman on my arm to connect to people really deserves a demerit or two. But I've accepted this strange part of me if only late in life and that maybe gets a silver star. Reunions can be a revealing thing.

Investors and their up-to-now hot stocks have recently exited the stock market freeway to rest in a rather strange and confusing parking lot themselves. There are bear markets in many stocks, bull markets in commodities, and hard to recognize trends in bonds – first thoughts of much higher yields due to inflation and the Fed – now safe haven reversals due to Ukraine. Rather than speak to thoughts that evolve or reverse almost daily, I thought I would risk a few investment ideas that might do well in almost all scenarios.

I have been invested for the last six months or so in corporate buyouts/acquisitions that offer and have already provided annualized returns of 5-10% that beat cash with reduced risk compared to Tesla and other "high flyers". Companies such as Microsoft, Oracle, and Qualcomm have announced acquisitions at fixed prices that provide single digit capital gains opportunities if completed. There is risk in that almost all of them require regulatory approval of some sort and a few of my purchases have lost money when approval is denied – but most are completed, the predominant risk being the time it takes for regulators or even countries to get around to applying their stamps of approval. A recent successful example just completed would be Microsoft's purchase of a company called Nuance Communications, a huge deal of $16 billion or so that even after the announcement in April of 2021 provided investors an opportunity to buy stock in NUAN at $52 a share, and sell it to Microsoft just last week at $56. Sort of a long wait I suppose, but an annualized return of 7% or so.

Not riskless, but with Microsoft behind it, it was a good bet. Most investors on the 2021 freeway opted for Facebook or Netflix and did much better for awhile than Nuance in the markets' parking lot, but now? Well, over the same time period Netflix is down 30% and Facebook the same. Can both of these go back up? Of course, but if you're conservative and want to avoid this type of volatility you might consider some current "buyout" opportunities that provide prospective 5-10% returns and that beat yieldless cash. I will list some of them below – they don't go up or down much each day – they sort of creep higher to their promised buyout target. And again as I've mentioned, are not totally riskless due to regulatory approvals and other possibilities, but I own them and expect 5-10% annualized returns in 2022:

- Oracle buys CERN at $95 a share, six months from now. Buy CERN today at 93.50.

- Microsoft buys ATVI at $95 a share. Buy ATVI now at 82. This one is more risky but Microsoft is a good sponsor. Annualized return 15% or so.

- A few others without the details

Apollo buys TGNA at $24

Qualcomm buys VNE at $37

Intel buys TSEM at $53.

Stay off the freeway for now – be content in the parking lot. Like my new book "I'm Still Standing: Bond King Bill Gross and the PIMCO Express" suggests, be more concerned about the return of your money than the return on your money.

About Bill Gross

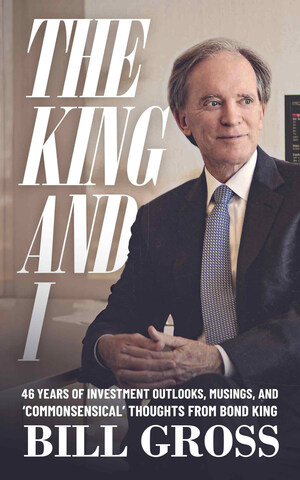

Bill Gross has been a pioneer in fixed income investing for more than 40 years. He co-founded PIMCO in 1971 and served as managing director and chief investment officer until joining Janus Henderson Investors in 2014. He retired in 2019 to focus on managing his personal assets and private charitable foundation. Throughout his career, he has received numerous awards, including Morningstar Fixed Income Manager of the Decade for 2000 to 2009 and Fixed Income Manager of the Year for 1998, 2000 and 2007. Mr. Gross became the first portfolio manager inducted into the Fixed Income Analysts Society's Hall of Fame in 1996 and received the Bond Market Association's Distinguished Service Award in 2000. In 2011, Institutional Investor magazine awarded him the Money Management Lifetime Achievement Award. Mr. Gross oversees the $390 million-asset William, Jeff and Jennifer Gross Family Foundation, which annually donates up to $21 million to non-profits involved in humanitarian causes, health care, and education. For more information or to view Investment Outlook archives, please visit https://williamhgross.com. For information about Mr. Gross's philanthropic activities through the William, Jeff and Jennifer Gross Family Foundation, please visit https://grossfamilyfoundation.com/

Related Links

https://williamhgross.com

https://grossfamilyfoundation.com/

SOURCE Bill Gross

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article